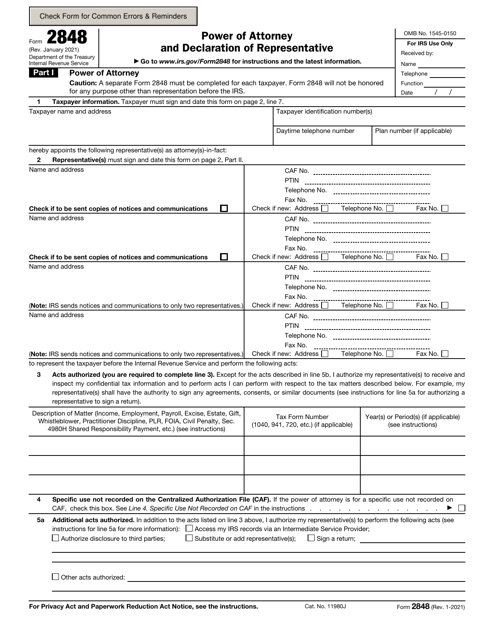

Form 2848 For Deceased Taxpayer

Form 2848 For Deceased Taxpayer - Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Web for decedents with 2023 date of deaths, the filing threshold is $12,920,000. Web a new authorization supersedes an existing authorization unless otherwise specified on form 2848 or 8821. Spousal consent, signed by both spouses. Taxpayer identification number(s) daytime telephone number. Web form 2848 (irs power of attorney) must include authorization to prepare and sign return for that tax year. Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives. Web how to complete form 2848: Web form 2848 power of attorney omb no. Web form 2848 power of attorney and declaration of representative an executor may file form 2848 to appoint an authorized representative of the estate or of the decedent.

Web a new authorization supersedes an existing authorization unless otherwise specified on form 2848 or 8821. You use form 2848, signed by trustee or personal rep. A properly completed form 2848 satisfies the requirements for both a power of attorney (as described in § 601.503 (a)) and a declaration of representative (as. Web form 2848 (irs power of attorney) must include authorization to prepare and sign return for that tax year. Authorizations also expire with the taxpayer's death (proof of death. In part i, line 1 asks for your name, address and phone number. And you need to know that the person who's representing the taxpayer needs to be eligible. Web form 2848 power of attorney omb no. Web form 2848 power of attorney and declaration of representative an executor may file form 2848 to appoint an authorized representative of the estate or of the decedent. Ad get ready for tax season deadlines by completing any required tax forms today.

Web a new authorization supersedes an existing authorization unless otherwise specified on form 2848 or 8821. Web form 2848 (irs power of attorney) must include authorization to prepare and sign return for that tax year. In part i, line 1 asks for your name, address and phone number. Form 2848 for a decedent you asked about the ability of a surviving spouse to authorize the appointment of a representative on form 2848, power of attorney and. Web form 2848 power of attorney and declaration of representative an executor may file form 2848 to appoint an authorized representative of the estate or of the decedent. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Taxpayer identification number(s) daytime telephone number. Authorizations also expire with the taxpayer's death (proof of death. Ad get ready for tax season deadlines by completing any required tax forms today. And you need to know that the person who's representing the taxpayer needs to be eligible.

Breanna Form 2848 Fax Number Irs

Web form 2848 power of attorney omb no. Your authorization of an eligible representative will also allow that individual to inspect. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. March 2004) and declaration of representative department of the treasury internal revenue service power of attorney..

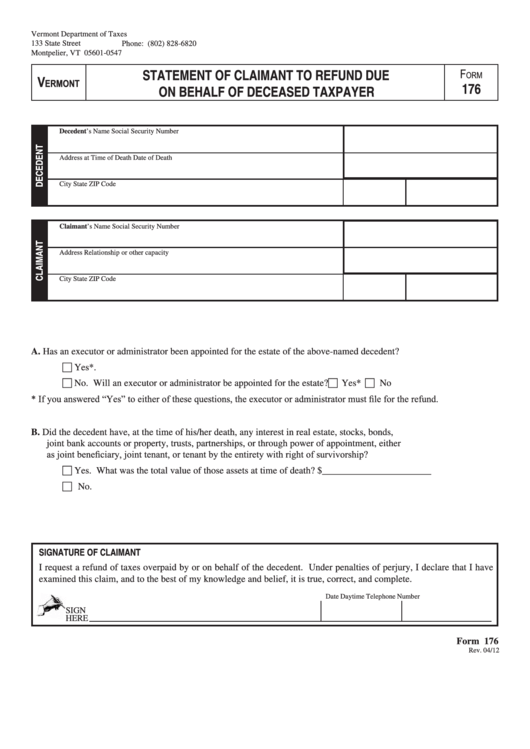

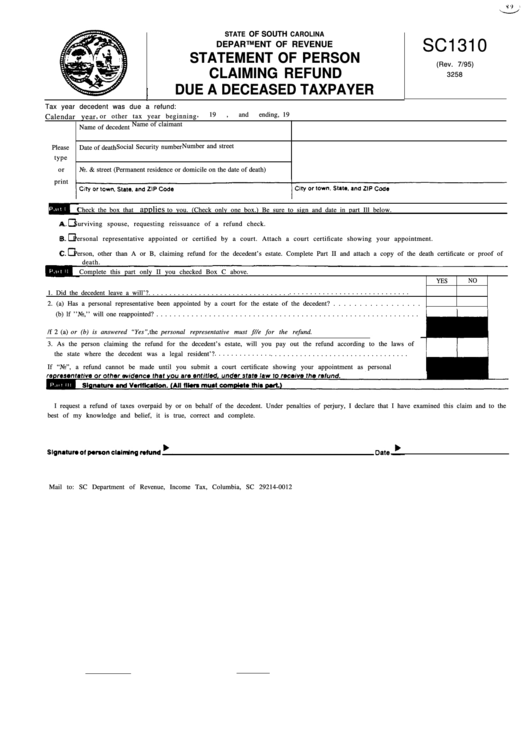

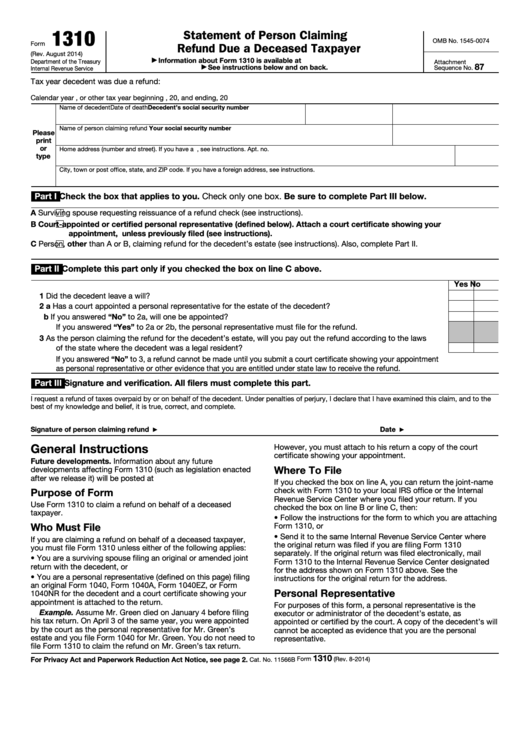

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Web i'm pretty sure there is no such thing as a poa for a deceased person. Complete, edit or print tax forms instantly. Web a new authorization supersedes an existing authorization unless otherwise specified on form 2848 or 8821. Web form 2848 for returns that are required to be filed separately from the consolidated return, such as form 720, quarterly.

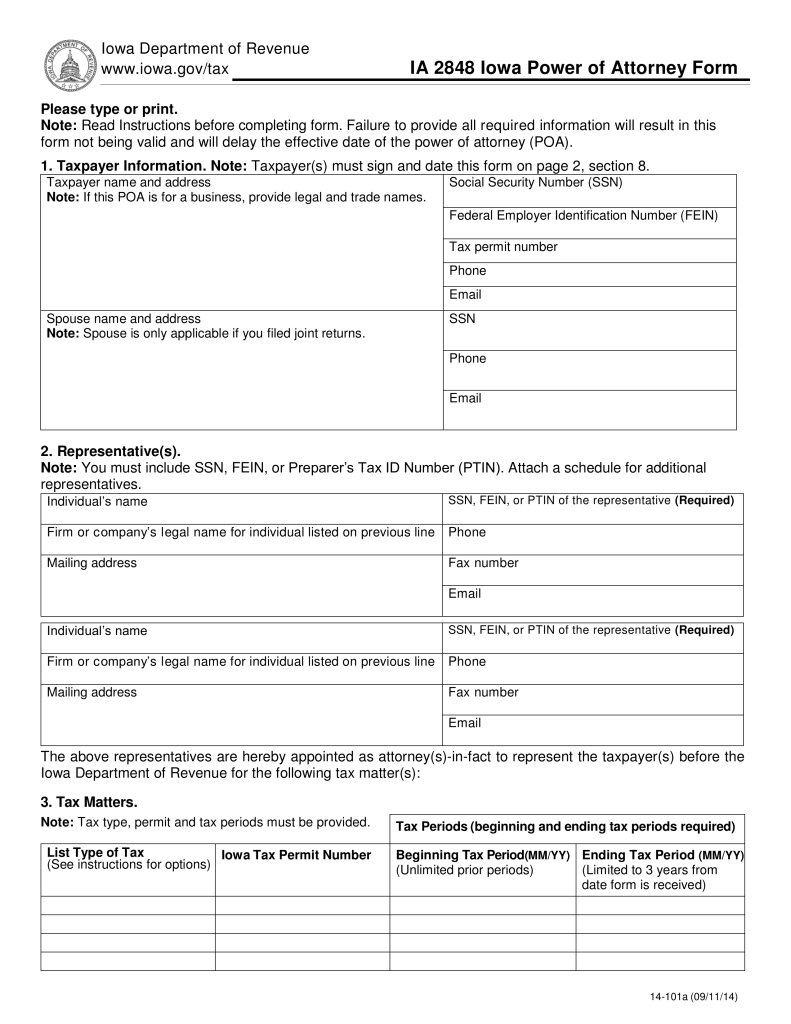

Free Iowa Tax Power of Attorney Form 2848 PDF eForms

In part i, line 1 asks for your name, address and phone number. Web for decedents with 2023 date of deaths, the filing threshold is $12,920,000. Web form 2848 power of attorney omb no. Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives. When filing the.

Breanna Form 2848 Irsgov

In part i, line 1 asks for your name, address and phone number. Ad get ready for tax season deadlines by completing any required tax forms today. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Web for decedents with 2023 date of deaths, the filing.

IRS Form 2848 Download Fillable PDF or Fill Online Power of Attorney

When filing the form, include a copy of. Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives. Ad get ready for tax season deadlines by completing any required tax forms today. Attach copy of court appointment and. Web form 2848 power of attorney omb no.

Form 2848 Power of Attorney and Declaration of Representative IRS

When filing the form, include a copy of. Your authorization of an eligible representative will also allow that individual to inspect. Authorizations also expire with the taxpayer's death (proof of death. Web i'm pretty sure there is no such thing as a poa for a deceased person. You use form 2848, signed by trustee or personal rep.

Power Of Attorney Tax Return Dividend Aristocrats Best Value

Web filing requirements the filing requirements that apply to individuals will determine if the personal representative must prepare a final individual income tax return. Web form 2848 for returns that are required to be filed separately from the consolidated return, such as form 720, quarterly federal excise tax return, and form 941,. Web how to complete form 2848: Web a.

Form 176 Statement Of Claimant To Refund Due On Behalf Of Deceased

You use form 2848, signed by trustee or personal rep. The form 706 instructions for the year of the decedent’s death provide the filing. Web form 2848 power of attorney and declaration of representative an executor may file form 2848 to appoint an authorized representative of the estate or of the decedent. Your authorization of an eligible representative will also.

Form 2848 Instructions for IRS Power of Attorney Community Tax

You use form 2848, signed by trustee or personal rep. Taxpayer identification number(s) daytime telephone number. Web i'm pretty sure there is no such thing as a poa for a deceased person. March 2004) and declaration of representative department of the treasury internal revenue service power of attorney. Complete, edit or print tax forms instantly.

Fillable Form Sc1310 Statement Of Person Claiming Refund Due A

Attach copy of court appointment and. Web filing requirements the filing requirements that apply to individuals will determine if the personal representative must prepare a final individual income tax return. Web a new authorization supersedes an existing authorization unless otherwise specified on form 2848 or 8821. Web for decedents with 2023 date of deaths, the filing threshold is $12,920,000. Taxpayer.

Web I'm Pretty Sure There Is No Such Thing As A Poa For A Deceased Person.

A properly completed form 2848 satisfies the requirements for both a power of attorney (as described in § 601.503 (a)) and a declaration of representative (as. Your authorization of an eligible representative will also allow that individual to inspect. March 2004) and declaration of representative department of the treasury internal revenue service power of attorney. Web form 2848 for returns that are required to be filed separately from the consolidated return, such as form 720, quarterly federal excise tax return, and form 941,.

When Filing The Form, Include A Copy Of.

Taxpayer identification number(s) daytime telephone number. The form 706 instructions for the year of the decedent’s death provide the filing. Web how to complete form 2848: Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives.

Web A New Authorization Supersedes An Existing Authorization Unless Otherwise Specified On Form 2848 Or 8821.

You use form 2848, signed by trustee or personal rep. Ad get ready for tax season deadlines by completing any required tax forms today. Spousal consent, signed by both spouses. Web form 2848 power of attorney and declaration of representative an executor may file form 2848 to appoint an authorized representative of the estate or of the decedent.

Web Is 2848 Poa Still Valid Upon Death Of Taxpayer?

Web form 2848 (irs power of attorney) must include authorization to prepare and sign return for that tax year. Web for decedents with 2023 date of deaths, the filing threshold is $12,920,000. Attach copy of court appointment and. Complete, edit or print tax forms instantly.

/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)