Form 301 Arizona

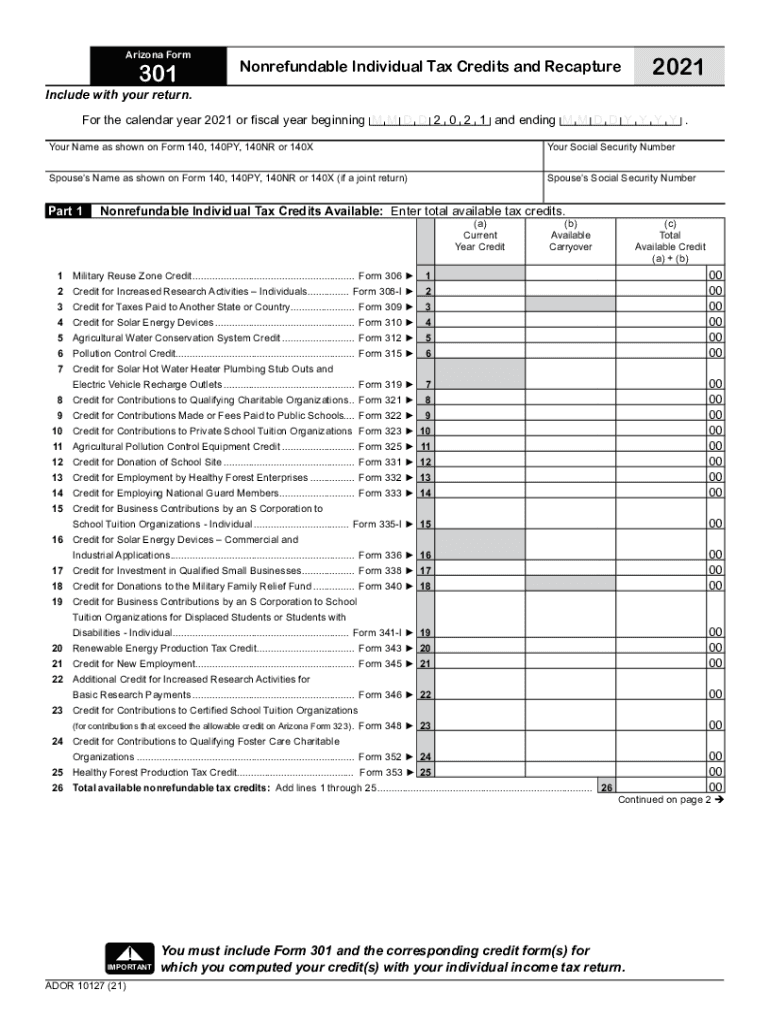

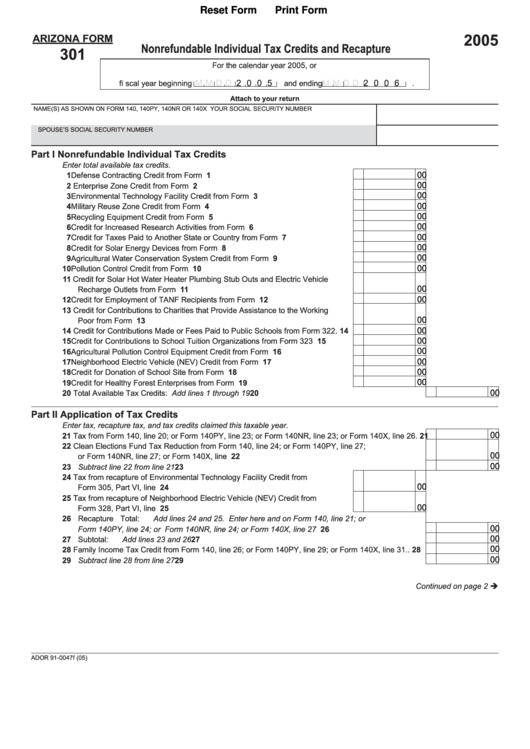

Form 301 Arizona - Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Upload, modify or create forms. Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Open the template in the online. This form is for income earned in tax year 2022, with tax returns due in april. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web 24 rows nonrefundable individual tax credits and recapture. Select the document you will need in the collection of legal forms. Form 335 is used in claiming the corporate tax.

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web 26 rows tax credits forms : Nonrefundable corporate tax credits and. Form 335 is used in claiming the corporate tax. Web 24 rows nonrefundable individual tax credits and recapture. Web also, enter this amount on arizona form 301, part 1, line 20, column (c). Select the document you will need in the collection of legal forms. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Ador 10127 (19) a orm 301 2019 page 2 of 2 your name (as shown on page 1) your social security. Summarization of taxpayer's application of nonrefundable tax credits and credit.

Web 24 rows nonrefundable individual tax credits and recapture. Web we last updated the nonrefundable individual tax credits and recapture in february 2023, so this is the latest version of form 301, fully updated for tax year 2022. Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Ad register and edit, fill, sign now your az dor form 301 & more fillable forms. Open the template in the online. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Nonrefundable corporate tax credits and. Web what is arizona form 301? Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the.

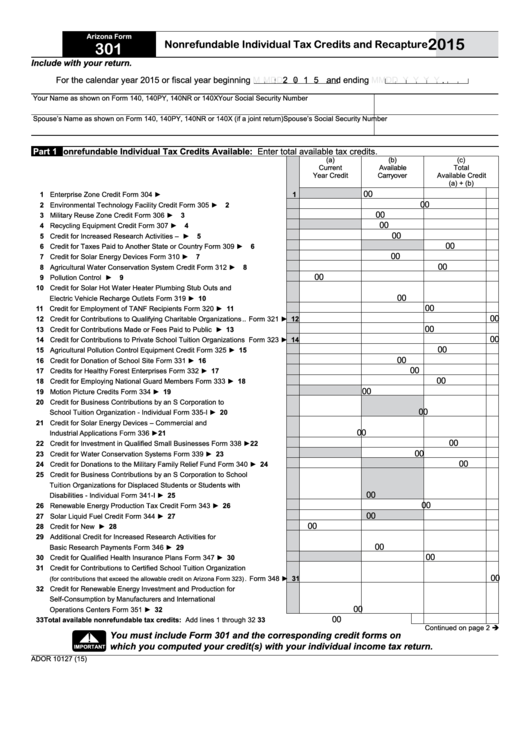

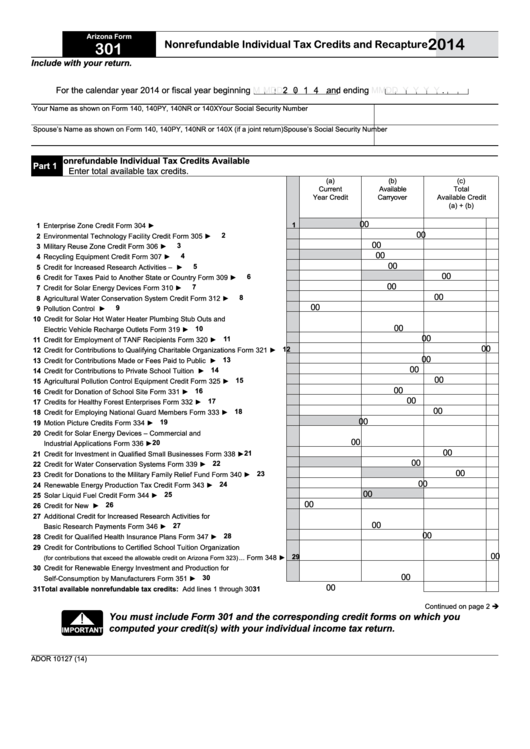

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Web also, enter this amount on arizona form 301, part 1, line 20, column (c). Web arizona form 301 included with form 309. Web stick to these simple instructions to get az dor form 301 prepared for sending: Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Summarization of taxpayer's application of nonrefundable.

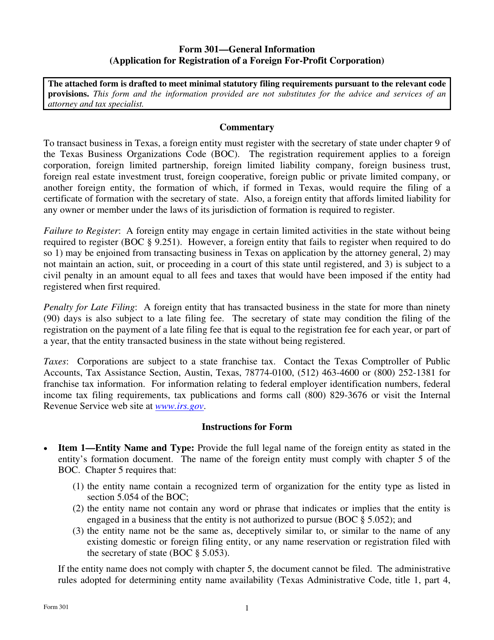

Form 301 Download Fillable PDF or Fill Online Application for

Web ador 10127 (20) a orm 301 2020 page 2 of 2 your name (as shown on page 1) your social security number part 2 application of tax credits and recapture: Ador 10127 (19) a orm 301 2019 page 2 of 2 your name (as shown on page 1) your social security. Form 335 is used in claiming the corporate.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Upload, modify or create forms. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Summarization of taxpayer's application of nonrefundable tax credits and credit. Web arizona state income tax forms 301, 323, and 348 are used for claiming the.

AZ Form 301, Nonrefundable Individual Tax Credits and Recapture

Arizona department of revenue subject: Web what is arizona form 301? Nonrefundable corporate tax credits and. Select the document you will need in the collection of legal forms. Web we last updated arizona form 301 in february 2023 from the arizona department of revenue.

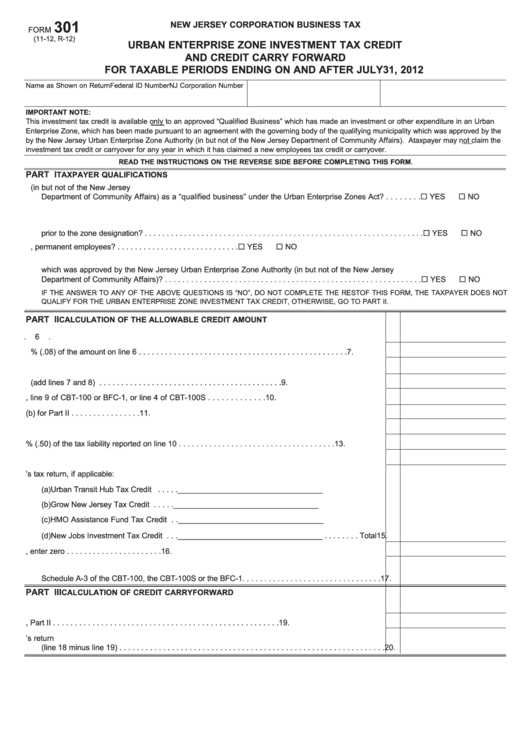

Form 301 Nebraska Enterprise Zone Investment Tax Credit And Credit

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Form 335 is used in claiming the corporate tax. Web stick to these simple instructions to get az dor form 301 prepared for sending: Web you must complete and include.

2021 AZ DoR Form 301 Fill Online, Printable, Fillable, Blank pdfFiller

Web we last updated the nonrefundable individual tax credits and recapture in february 2023, so this is the latest version of form 301, fully updated for tax year 2022. Web what is arizona form 301? Web 24 rows nonrefundable individual tax credits and recapture. Web arizona form 301 nonrefundable individual tax credits and recapture 2019. Form 335 is used in.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web arizona form 301 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax. Ador 10127.

OSHA 301 Mobile Form Aptora AllInOne Field Service Management

If your client receives a “tax correction notice” from the az department of revenue (dor) that limits a claimed credit. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Az allows carryover of unused credits. Arizona department of revenue.

Form COM301 Download Fillable PDF or Fill Online Compliance

Upload, modify or create forms. Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. If your client receives a “tax correction notice” from the az department of revenue (dor) that limits a claimed credit. Ador 10127 (19) a orm 301 2019 page 2 of 2 your name (as shown on page 1) your.

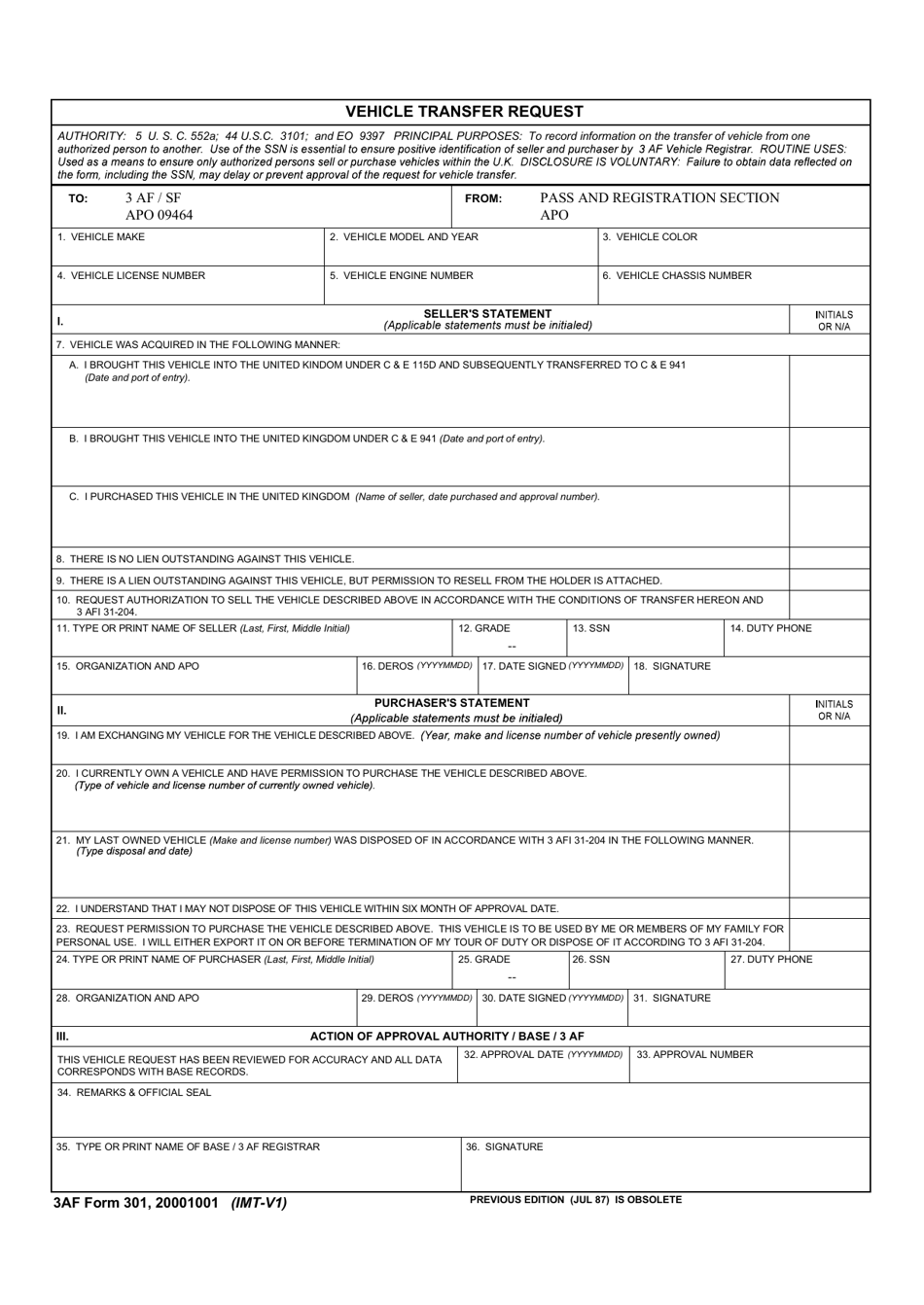

3 AF Form 301 Download Fillable PDF or Fill Online Vehicle Transfer

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web we last updated the nonrefundable individual tax credits and recapture in february 2023, so this is the latest version of form 301, fully updated for tax year 2022. Az.

Nonrefundable Corporate Tax Credits And.

Web arizona form 301 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax. Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits. Form 335 is used in claiming the corporate tax. Web 26 rows tax credits forms :

Upload, Modify Or Create Forms.

Summarization of taxpayer's application of nonrefundable tax credits and credit. Web arizona form 301 nonrefundable individual tax credits and recapture 2019. Web stick to these simple instructions to get az dor form 301 prepared for sending: Web we last updated arizona form 301 in february 2023 from the arizona department of revenue.

Web You Must Complete And Include Arizona Form 301 And The Credit Form(S) With Your Arizona Income Tax Return To Claim Nonrefundable Tax Credits Unless You Meet One Of The.

Web what is arizona form 301? Ador 10127 (19) a orm 301 2019 page 2 of 2 your name (as shown on page 1) your social security. Open the template in the online. Arizona department of revenue subject:

Web Also, Enter This Amount On Arizona Form 301, Part 1, Line 20, Column (C).

Az allows carryover of unused credits. Web we last updated the nonrefundable individual tax credits and recapture in february 2023, so this is the latest version of form 301, fully updated for tax year 2022. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web arizona form 301 included with form 309.