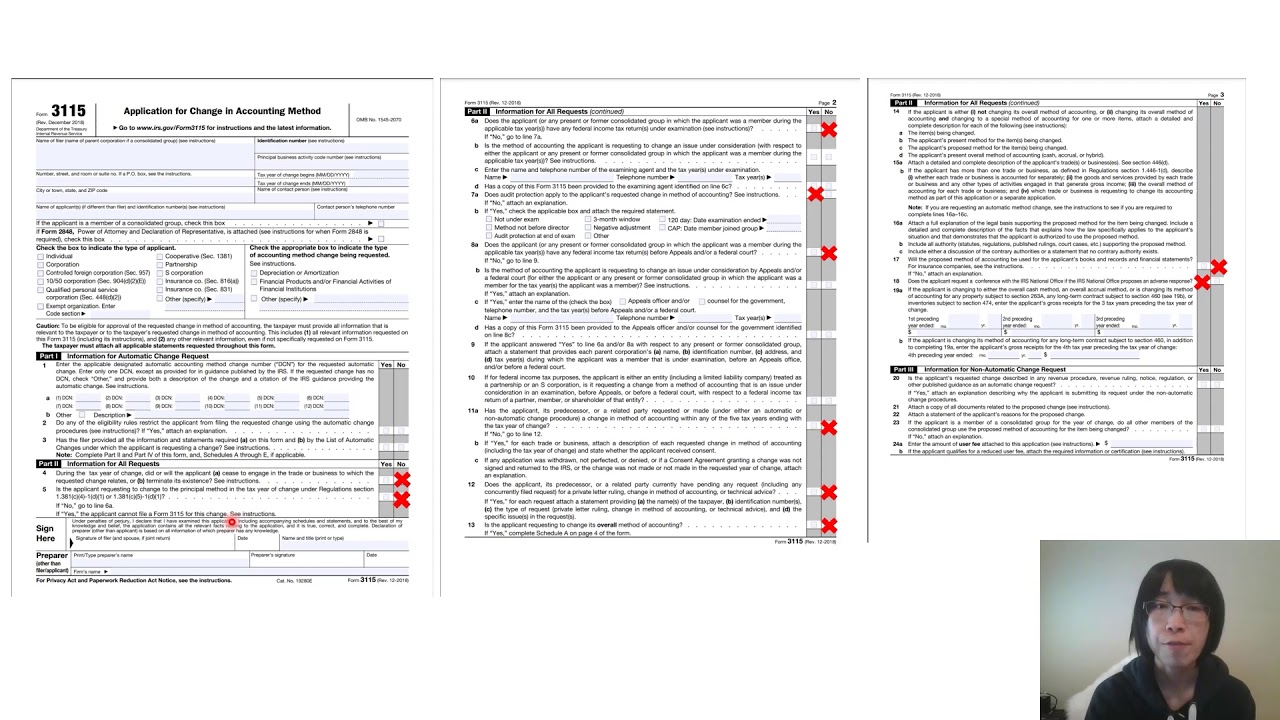

Form 3115 Depreciation Example

Form 3115 Depreciation Example - Furthermore, this webinar will deliver a comprehensive. Web have you ever had a client who was not depreciating their rental property? The form 3115 is the way you must make. This template is free and. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web there are procedures, which will be explained, that will allow us to fix these depreciation omission and or oversights. Attach the original form 3115 to the filer’s timely filed federal income tax return for the year of change. Web department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web kbkg has put together a sample form 3115 template with attachments for the concurrent designated change numbers (dcn) 244 and 7.

Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the irs. The form 3115 is the way you must make. Web to qualify for the blanket consent to changing methods of depreciation, a taxpayer must change to a permissible method and complete and file a form 3115 in accordance with. This template is free and. Web how do i file an irs extension (form 4868) in turbotax online? File an extension in turbotax online before the deadline to avoid a late filing penalty. Furthermore, this webinar will deliver a comprehensive. If irs demands the 3115 form be filed in a. Web the form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible method of depreciation for depreciable. Web for example, an applicant requesting both a change to deduct repair and maintenance costs for tangible property (dcn 184) and a change to capitalize acquisition or.

The form 3115 is the way you must make. Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web to qualify for the blanket consent to changing methods of depreciation, a taxpayer must change to a permissible method and complete and file a form 3115 in accordance with. Web kbkg has put together a sample form 3115 template with attachments for the concurrent designated change numbers (dcn) 244 and 7. Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the irs. Or one who was depreciating the land as well as the building? Attach the original form 3115 to the filer’s timely filed federal income tax return for the year of change. Web form 3115 is used for a change in accounting method, and the 'catching up' on depreciation is usually allowed because you go from an impermissible method. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file.

Correcting Depreciation Form 3115 LinebyLine

Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the irs. Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115. Or one who was depreciating the land.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115. Web to qualify for the blanket consent to changing methods of depreciation, a taxpayer must change to a permissible method and complete and file a form 3115 in accordance with. Web.

Form 3115 Definition, Who Must File, & More

How do i clear and. Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115. Web department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. Web a form.

Form 3115 Edit, Fill, Sign Online Handypdf

Web how do i file an irs extension (form 4868) in turbotax online? Or one who was depreciating the land as well as the building? Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the irs. Web form 3115, application for change in accounting method, is an.

Form 3115 Application for Change in Accounting Method

Web have you ever had a client who was not depreciating their rental property? Web for automatic change requests: Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115. File an extension in turbotax online before the deadline to avoid a.

Form 3115 App for change in acctg method Capstan Tax Strategies

Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Attach the original form 3115 to the filer’s timely filed federal income tax return for the year of change. Web i am filing form 3115 to catch up on missed depreciations, is form 4562 also needed to be.

Tax Accounting Methods

File an extension in turbotax online before the deadline to avoid a late filing penalty. Web i am filing form 3115 to catch up on missed depreciations, is form 4562 also needed to be filed in this same year along with form 3115 or that will go next year. How do i clear and. Web a form 3115 is filed.

How to catch up missed depreciation on rental property (part I) filing

Or one who was depreciating the land as well as the building? Attach the original form 3115 to the filer’s timely filed federal income tax return for the year of change. Web for automatic change requests: File an extension in turbotax online before the deadline to avoid a late filing penalty. Furthermore, this webinar will deliver a comprehensive.

Automatic Change to Cash Method of Accounting for Tax

File an extension in turbotax online before the deadline to avoid a late filing penalty. Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the irs. The form 3115 is the way you must make. Web for example, an applicant requesting both a change to deduct repair.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Web for automatic change requests: Web there are procedures, which will be explained, that will allow us to fix these depreciation omission and or oversights. Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual method,. Attach the original form 3115 to the.

Web Kbkg Has Put Together A Sample Form 3115 Template With Attachments For The Concurrent Designated Change Numbers (Dcn) 244 And 7.

Web form 3115, application for change in accounting method, is an application to the irs to change either an entity’s overall accounting method or the accounting treatment of any. Web the form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible method of depreciation for depreciable. Web there are procedures, which will be explained, that will allow us to fix these depreciation omission and or oversights. Web to qualify for the blanket consent to changing methods of depreciation, a taxpayer must change to a permissible method and complete and file a form 3115 in accordance with.

Or One Who Was Depreciating The Land As Well As The Building?

Web department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. Web how do i file an irs extension (form 4868) in turbotax online? This template is free and. If irs demands the 3115 form be filed in a.

Web Form 3115 Is Used For A Change In Accounting Method, And The 'Catching Up' On Depreciation Is Usually Allowed Because You Go From An Impermissible Method.

Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web have you ever had a client who was not depreciating their rental property? File an extension in turbotax online before the deadline to avoid a late filing penalty. Furthermore, this webinar will deliver a comprehensive.

Web Form 3115 Will Have To Be Filed, With The Entire Amount Of Incorrect Or Overlooked Depreciation Deducted In Full In The Year Of Correction Via This Form 3115.

Attach the original form 3115 to the filer’s timely filed federal income tax return for the year of change. Web for automatic change requests: Web for example, an applicant requesting both a change to deduct repair and maintenance costs for tangible property (dcn 184) and a change to capitalize acquisition or. Web the form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the irs.