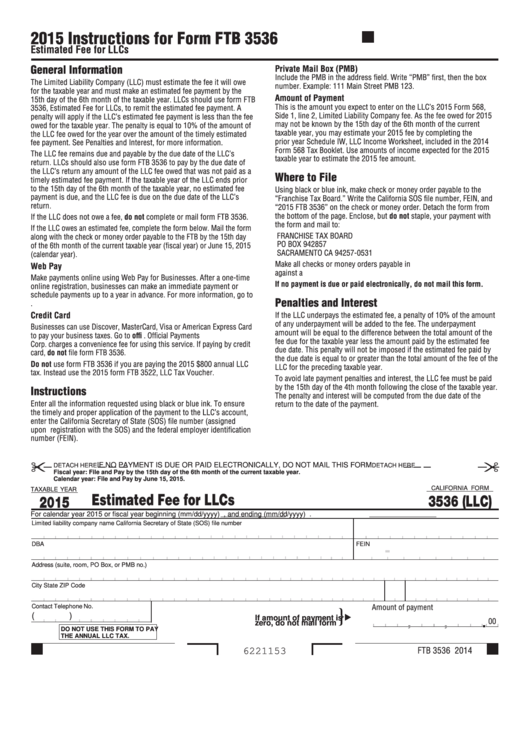

Form 3536 2023

Form 3536 2023 - An llc should use this. The fee is $2,500 for llcs that make between $500,000 and $1,000,000 during the tax year. Web the california franchise tax board june 1 released form ftb 3536, estimated fee for llcs, along with instructions, for individual income tax purposes. Forms categories | enter mailing address. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Sign it in a few. Save or instantly send your ready documents. Web up to $40 cash back adobe systems, inc. Web send form ftb 3536 via email, link, or fax.

Form 3536 only needs to be filed if your income is $250,000 or more. The fee is $2,500 for llcs that make between $500,000 and $1,000,000 during the tax year. Instead use the 2022 form ftb 3522, llc tax voucher. Web we last updated the estimated fee for llcs in april 2023, so this is the latest version of form 3536, fully updated for tax year 2022. We last updated california form 3536 in april 2023 from the california. Web up to $40 cash back adobe systems, inc. Web do not file form ftb 3536. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. This form is used to estimate and pay the annual llc. Web ca ftb 3536 2023 get ca ftb 3536 2023 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save ftb 3536 rating ★.

2023 instructions 2022 instructions how did we do? Sign it in a few. Save or instantly send your ready documents. Type text, add images, blackout confidential details, add. Easily fill out pdf blank, edit, and sign them. Web the california franchise tax board june 1 released form ftb 3536, estimated fee for llcs, along with instructions, for individual income tax purposes. Instead use the 2021 form ftb 3522, llc tax voucher. We last updated california form 3536 in april 2023 from the california. 2023 second quarter estimated tax payments due for individuals and corporations. Instead use the 2022 form ftb 3522, llc tax voucher.

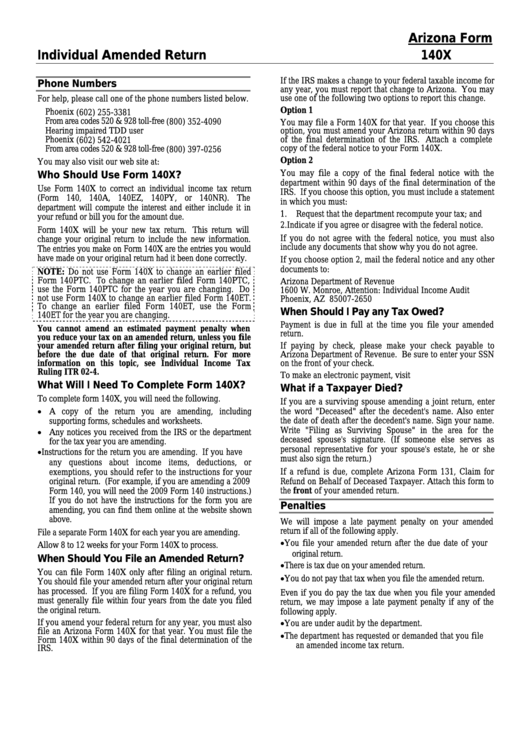

Instructions For Arizona Form 140x Individual Amended Return

Edit your form 3536 online. We last updated california form 3536 in april 2023 from the california. You can download or print current or past. Do not use form ftb 3536 if you are paying the 2021 $800 annual llc tax. Web look for form 3522 and click the link to download;

【图】被追尾了 来看看后防撞梁多单薄_元PLUS论坛_汽车之家论坛

Type text, add images, blackout confidential details, add. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. Web the california franchise tax board june 1 released form ftb 3536, estimated fee for llcs, along with instructions, for individual income tax purposes. 2022 form 3536 (llc extension payment); Form.

Fillable Form 3536 (Llc) Estimated Fee For Llcs 2015 printable pdf

We last updated california form 3536 in april 2023 from the california. This form is used to estimate and pay the annual llc. Use form ftb 3536 if you are paying the 2022 $800 annual llc tax. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax..

20152023 Form CMS417 Fill Online, Printable, Fillable, Blank pdfFiller

Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. Easily fill out pdf blank, edit, and sign them. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Web the california franchise tax board june.

【图】全新大切诺基4xe巅峰版远山绿色实拍_大切诺基论坛_汽车之家论坛

2023 second quarter estimated tax payments due for individuals and corporations. 2023 instructions 2022 instructions how did we do? Web up to $40 cash back adobe systems, inc. Web the california franchise tax board june 1 released form ftb 3536, estimated fee for llcs, along with instructions, for individual income tax purposes. Sign it in a few.

California Form 3536

2022 form 3536 (llc extension payment); Web ca ftb 3536 2023 get ca ftb 3536 2023 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save ftb 3536 rating ★. Sign it in a few. 2023 instructions 2022 instructions how did we do? An llc should use this.

Form 3536 Model T Swivel Joint End For Commutator Rod, 3536

Instead use the 2022 form ftb 3522, llc tax voucher. Edit your form 3536 online. Easily fill out pdf blank, edit, and sign them. Sign it in a few. Web estimated fee for llcs 2023.

1500 Hcfa Form Form Resume Examples N8VZvlMVwe

This form is used to estimate and pay the annual llc. Forms categories | enter mailing address. Use this screen to complete 2022 form 568, limited liability company return of income, side 1; Web up to $40 cash back adobe systems, inc. Web estimated fee for llcs 2023.

2017 Form 3536 Estimated Fee For Ll Cs Edit, Fill, Sign Online Handypdf

Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2023. Form 3536 only needs to be filed if your income is $250,000 or more. Edit your form 3536 online. Sign it in a few. Web ca ftb 3536 2023 get ca ftb 3536 2023 how.

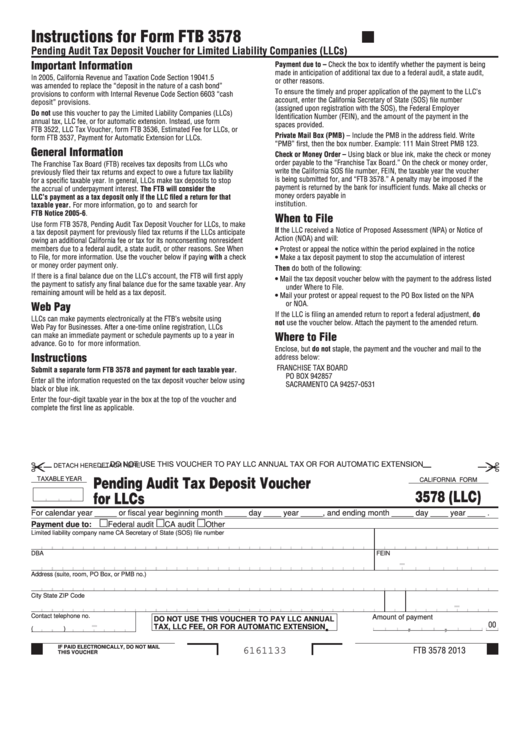

California Form 3578 Pending Audit Tax Deposit Voucher For Llcs

Easily fill out pdf blank, edit, and sign them. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. Web send form ftb 3536 via email, link, or fax. Form 3536 only needs to be filed if your income is $250,000 or more. Web do not file form ftb.

Save Or Instantly Send Your Ready Documents.

Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Web do not file form ftb 3536. Web the fee is $900 for llcs that make between $250,000 and $500,000 during the year. Type text, add images, blackout confidential details, add.

Instead Use The 2021 Form Ftb 3522, Llc Tax Voucher.

You can download or print current or past. Web ca ftb 3536 2023 get ca ftb 3536 2023 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save ftb 3536 rating ★. Use this screen to complete 2022 form 568, limited liability company return of income, side 1; 2023 instructions 2022 instructions how did we do?

An Llc Should Use This.

Sign it in a few clicks draw. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. Use form ftb 3536 if you are paying the 2022 $800 annual llc tax. Web estimated fee for llcs 2023.

Web We Last Updated The Estimated Fee For Llcs In April 2023, So This Is The Latest Version Of Form 3536, Fully Updated For Tax Year 2022.

This form is used to estimate and pay the annual llc. Web send form ftb 3536 via email, link, or fax. Web file form ftb 3536. The fee is $2,500 for llcs that make between $500,000 and $1,000,000 during the tax year.