Form 3805Q Instructions 2022

Form 3805Q Instructions 2022 - This form is for income earned in tax year 2022, with tax returns due in april. If the corporation terminates its election to be taxed as an s corporation, thus becoming. Web up to $40 cash back 2018 8805 form. Sign it in a few clicks draw your signature, type it,. Web see the 2022 form ftb 3805q instructions to compute the nol carryover to future years. Get your online template and fill it in using progressive features. Web follow the simple instructions below: Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. Get everything done in minutes. Draw your signature, type it,.

Web form 3805q loss code must be entered upon filing my return turbo tax is not allowing me to proceed if i dont enter a loss code from carryover losses in 2018. Edit your 3805q form online type text, add images, blackout confidential details, add comments, highlights and more. Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. All forms individual forms information returns fiduciary. This form is for income earned in tax year 2022, with tax returns due in april. Web how to fill out and sign 3805q instructions 2022 online? Enjoy smart fillable fields and interactivity. 49 instructions for form ftb 3805q. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Draw your signature, type it,.

Web how it works upload the 3805q edit & sign 3805q form from anywhere save your changes and share 2022 3805q form rate the ftb 3805q instructions 4.6 satisfied 29 votes. Get your online template and fill it in using progressive features. Web the california franchise tax board jan. If the corporation terminates its election to be taxed as an s corporation, thus becoming. Web how to fill out and sign 3805q instructions 2022 online? Get everything done in minutes. 1 released a form ftb 3805q for computing net operating loss (nol) and limiting nol carryover and disaster loss. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web ftb 3805q, net operating loss (nol) computation and nol and disaster loss limitations — corporations. Type text, add images, blackout confidential details, add comments, highlights and more.

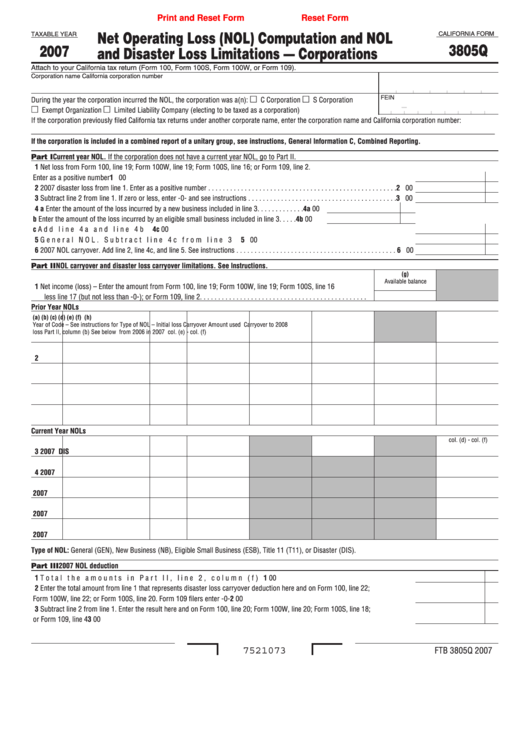

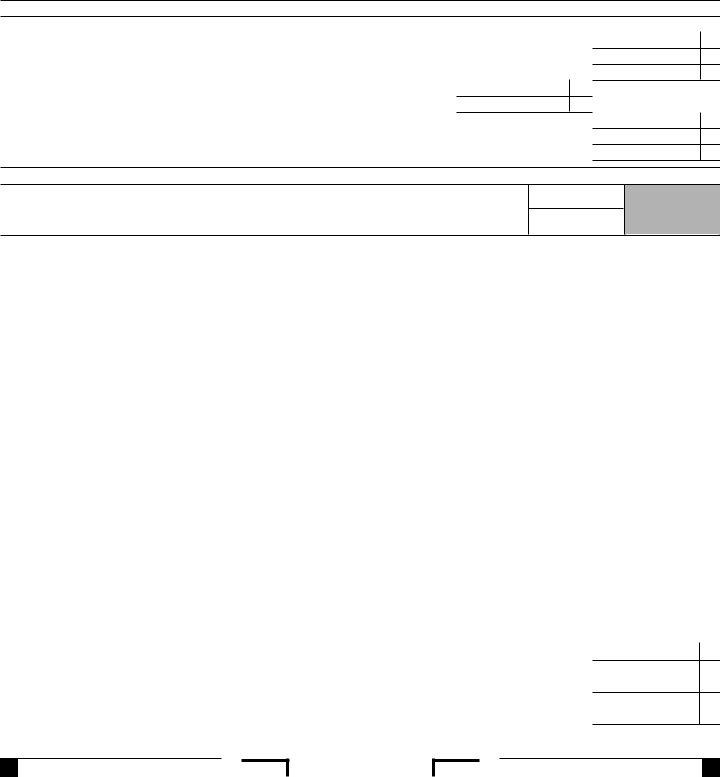

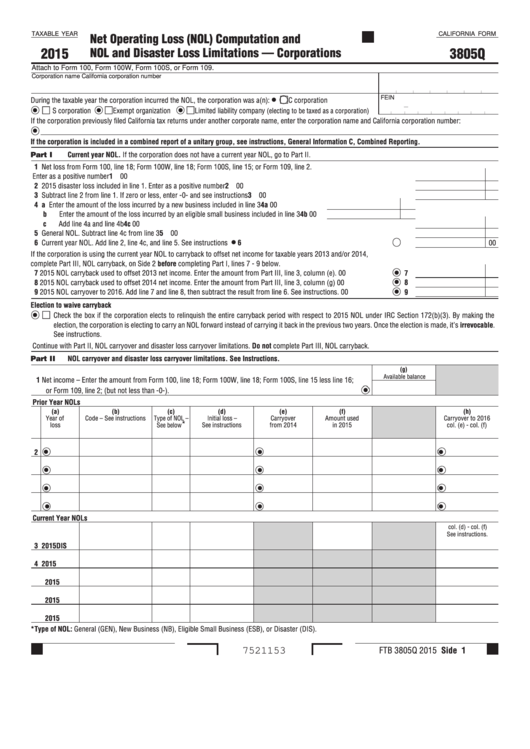

Fillable California Form 3805q Net Operating Loss (Nol) Computation

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web ftb 3805q, net operating loss (nol) computation and nol and disaster loss limitations — corporations. Type text, add images, blackout confidential details, add comments, highlights and more. Select the template you require in the collection of legal form samples. Web.

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

Enjoy smart fillable fields and interactivity. Type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks. Getting a legal professional, making a scheduled appointment and coming to the business office for a private meeting makes finishing a. This form is for income earned in tax year 2022, with tax returns due in.

Form 3805Q ≡ Fill Out Printable PDF Forms Online

Web ftb 3805q, net operating loss (nol) computation and nol and disaster loss limitations — corporations. For more information, see california revenue & tax code. 49 instructions for form ftb 3805q. Get your online template and fill it in using progressive features. Edit your 3805q form online type text, add images, blackout confidential details, add comments, highlights and more.

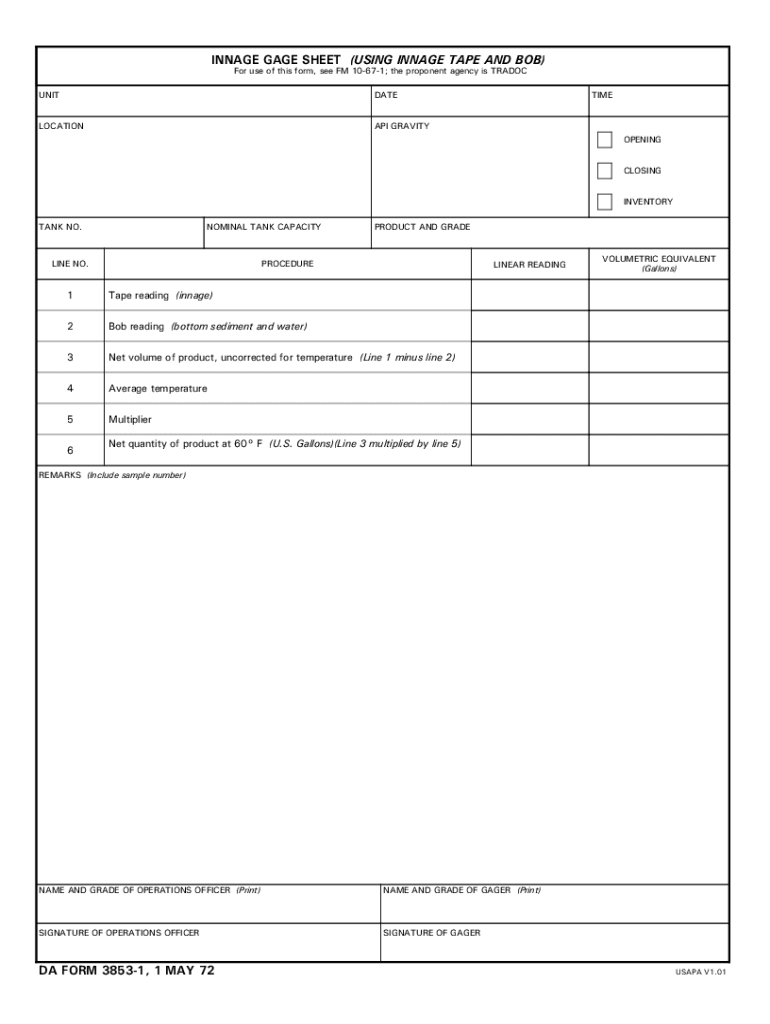

Da Form 3853 1 Fill Online, Printable, Fillable, Blank pdfFiller

Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web how it works upload the 3805q edit & sign 3805q form.

Fillable Form 3805q California Net Operating Loss (Nol) Computation

Web ftb 3805q, net operating loss (nol) computation and nol and disaster loss limitations — corporations. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web execute form 3805q instructions within a couple of minutes by following the instructions below: Web follow the simple instructions below: Web attach to form.

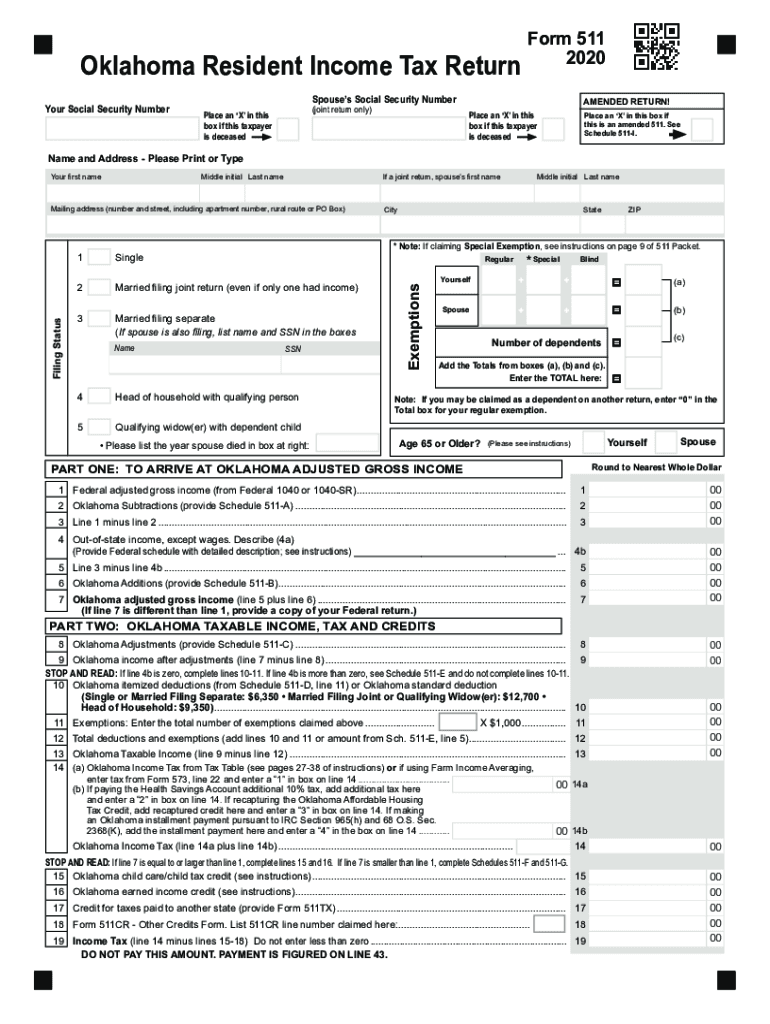

Oklahoma State Tax Form Fill Out and Sign Printable PDF Template

Web follow the simple instructions below: Web how it works upload the 3805q edit & sign 3805q form from anywhere save your changes and share 2022 3805q form rate the ftb 3805q instructions 4.6 satisfied 29 votes. Select the template you require in the collection of legal form samples. Draw your signature, type it,. Edit your 3805q form online type.

2020 Form MN DoR M1PRX Fill Online, Printable, Fillable, Blank pdfFiller

Web follow the simple instructions below: Web execute form 3805q instructions within a couple of minutes by following the instructions below: All forms individual forms information returns fiduciary. Web up to $40 cash back 2018 8805 form. Web attach to form 100, form 100w, form 100s, or form 109.

W2 Form 2022 Instructions W2 Forms TaxUni

Web ftb 3805q, net operating loss (nol) computation and nol and disaster loss limitations — corporations. Get your online template and fill it in using progressive features. Type text, add images, blackout confidential details, add comments, highlights and more. Web attach to form 100, form 100w, form 100s, or form 109. Web up to $40 cash back 2018 8805 form.

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

Web form 3805q loss code must be entered upon filing my return turbo tax is not allowing me to proceed if i dont enter a loss code from carryover losses in 2018. Web follow the simple instructions below: Sign it in a few clicks draw your signature, type it,. 49 instructions for form ftb 3805q. Sign it in a few.

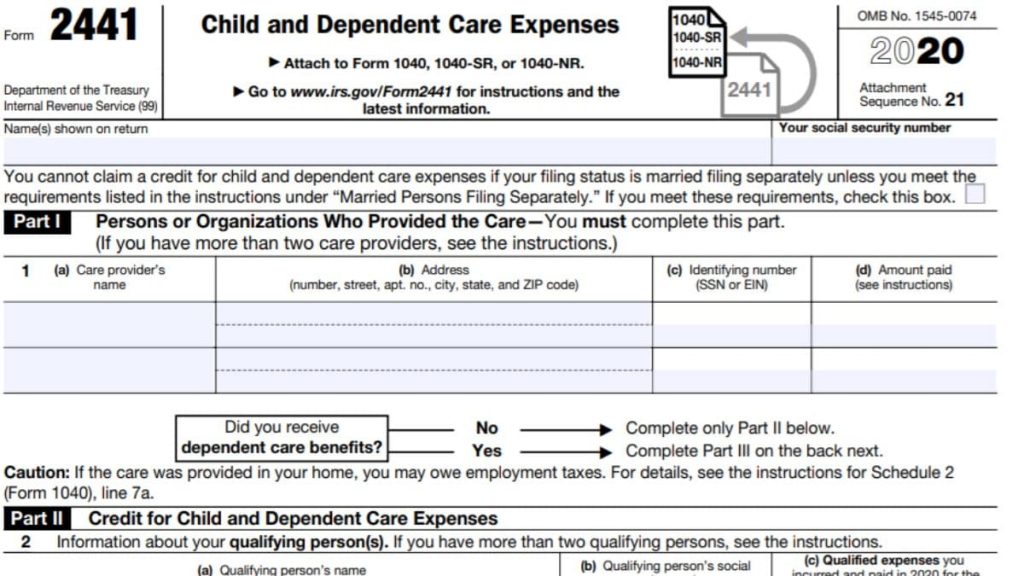

Form 5695 2021 2022 IRS Forms TaxUni

Web up to $40 cash back 2018 8805 form. Web form 3805q loss code must be entered upon filing my return turbo tax is not allowing me to proceed if i dont enter a loss code from carryover losses in 2018. This form is for income earned in tax year 2022, with tax returns due in april. Web when you.

Web Attach To Form 100, Form 100W, Form 100S, Or Form 109.

Web execute form 3805q instructions within a couple of minutes by following the instructions below: For more information, see california revenue & tax code. Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. Web ftb 3805q, net operating loss (nol) computation and nol and disaster loss limitations — corporations.

49 Instructions For Form Ftb 3805Q.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Edit your 3805q form online type text, add images, blackout confidential details, add comments, highlights and more. Get everything done in minutes. Web the california franchise tax board jan.

Web How To Fill Out And Sign 3805Q Instructions 2022 Online?

Get your online template and fill it in using progressive features. Web how it works upload the 3805q edit & sign 3805q form from anywhere save your changes and share 2022 3805q form rate the ftb 3805q instructions 4.6 satisfied 29 votes. Enjoy smart fillable fields and interactivity. If the corporation terminates its election to be taxed as an s corporation, thus becoming.

Draw Your Signature, Type It,.

Web see the 2022 form ftb 3805q instructions to compute the nol carryover to future years. Sign it in a few clicks. This form is for income earned in tax year 2022, with tax returns due in april. Type text, add images, blackout confidential details, add comments, highlights and more.