Form 4506-C Instructions

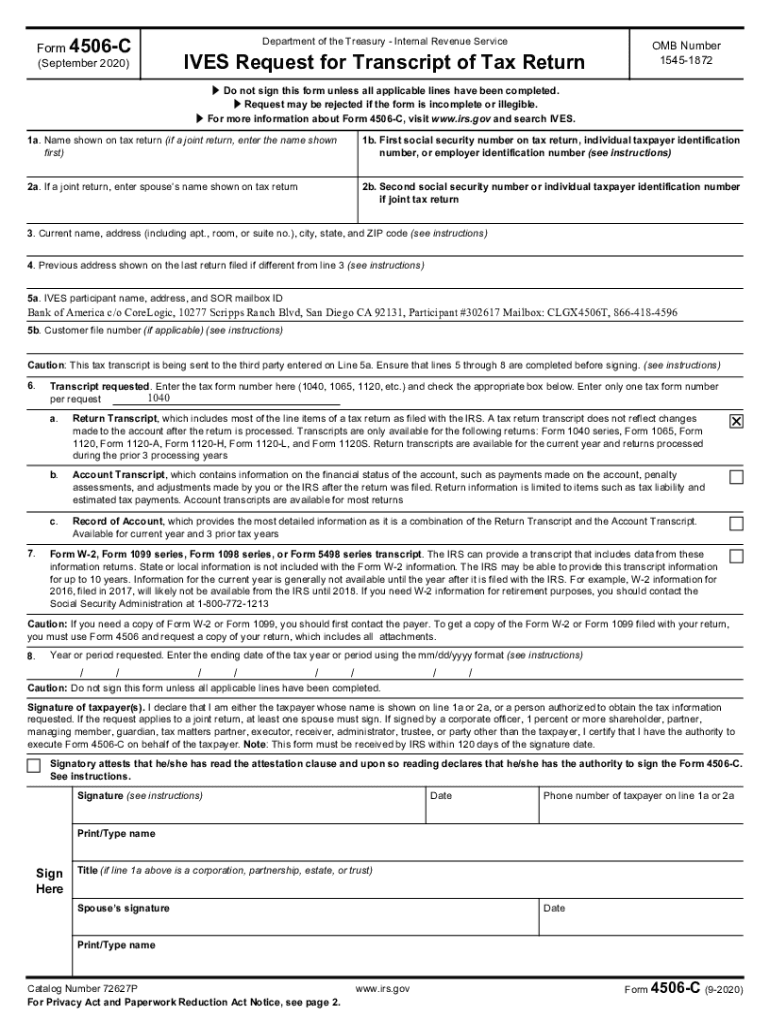

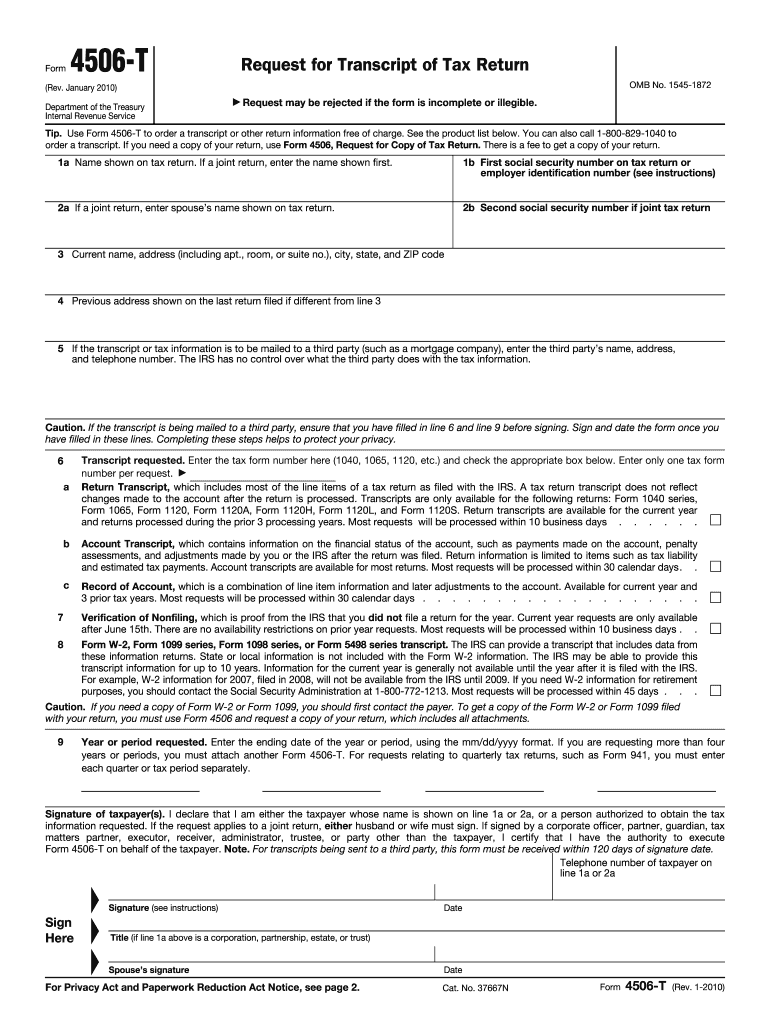

Form 4506-C Instructions - Phone number of taxpayer on line 1a or 2a signature (see instructions) date for privacy act and paperwork reduction act notice, see page 2. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Carefully read and understand the instructions provided. Signatory attests that he/she has read the. A copy of an exempt or political organization’s return, report, or notice. Fannie mae requires lenders to have each borrower whose income (regardless of income. You do not have to. Spouse’s current name line 3: Web up to $40 cash back begin by downloading the 4506 c form from the official website of the internal revenue service (irs). Follow example to complete form.

You will designate (on line 5a) a third party to receive the information. Fannie mae requires lenders to have each borrower whose income (regardless of income. Follow example to complete form. Web up to $40 cash back begin by downloading the 4506 c form from the official website of the internal revenue service (irs). Leave all of section 7 blank for business requests. Carefully read and understand the instructions provided. Web execute form 4506 on behalf of the taxpayer. Mm dd yyyy must be checked. Spouse’s current name line 3: Web form cannot be sent to the irs with any missing fields do not check;

This form must be received by irs within 120 days of the signature date. You do not have to. Fill in tax years needed: A copy of an exempt or political organization’s return, report, or notice. Phone number of taxpayer on line 1a or 2a signature (see instructions) date for privacy act and paperwork reduction act notice, see page 2. You will designate (on line 5a) a third party to receive the information. However, effective may 1, 2021,. The originator is responsible for. Tap ‘add new signature’ when the signature wizard. Fannie mae requires lenders to have each borrower whose income (regardless of income.

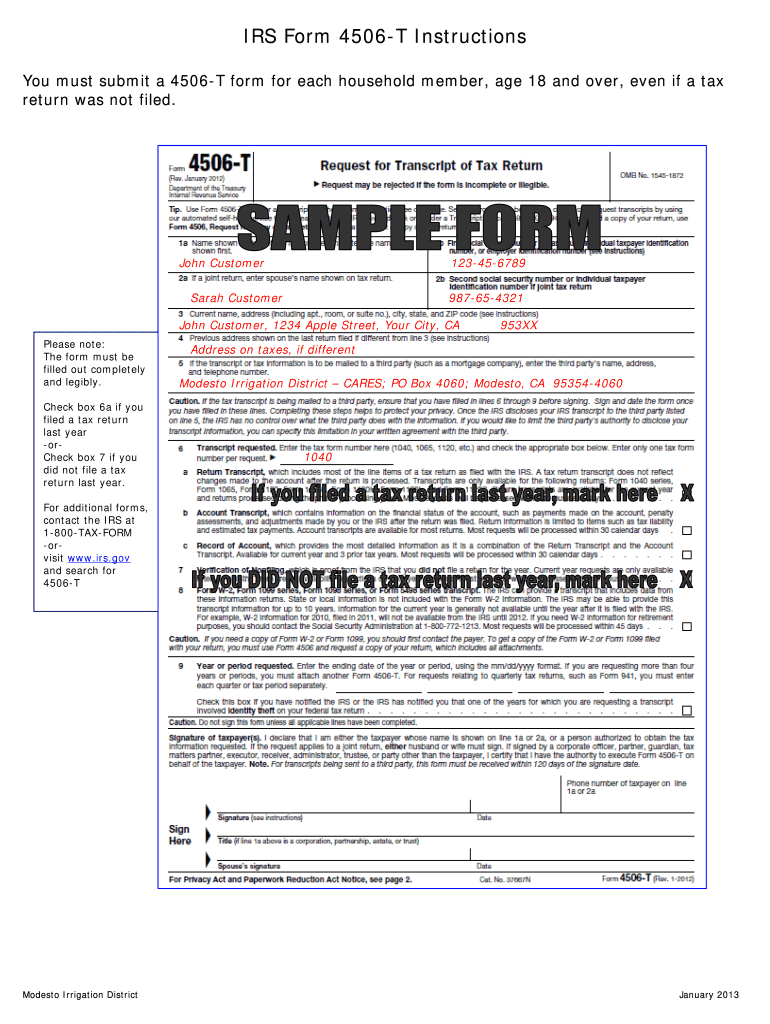

4506T Form Instructions 📝 Get IRS Form 4506 T Printable Federal Tax

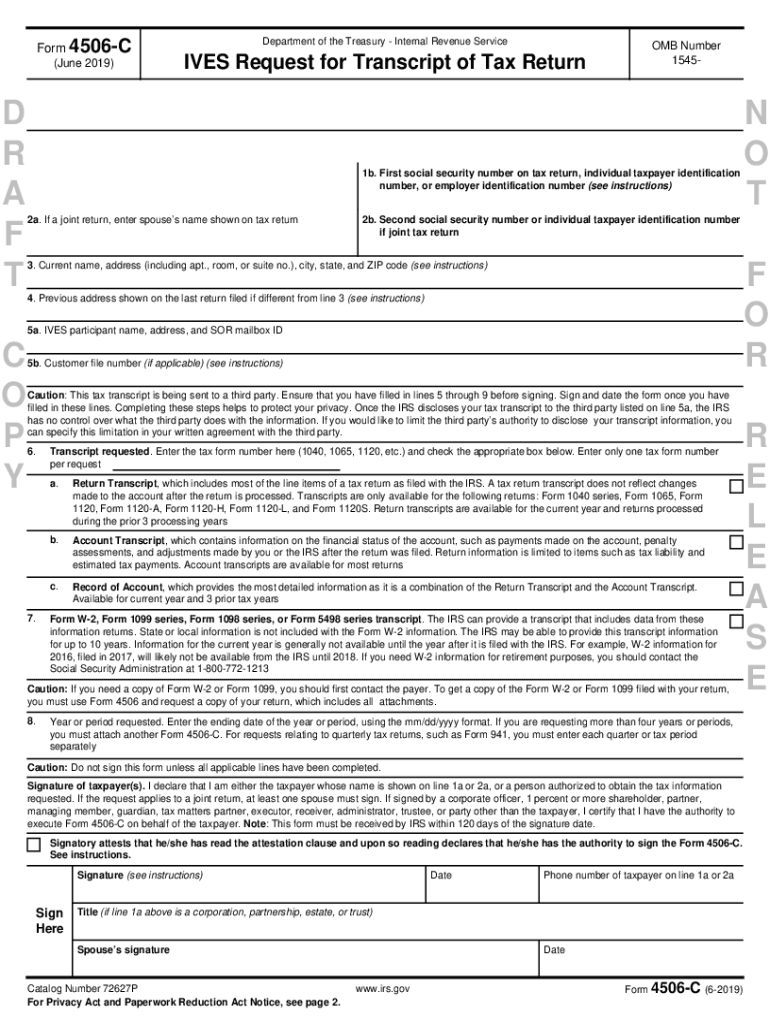

Carefully read and understand the instructions provided. You will designate (on line 5a) a third party to receive the information. Fannie mae requires lenders to have each borrower whose income (regardless of income. Tap ‘add new signature’ when the signature wizard. Only list a spouse if their own.

IRS releases new form 4506C

Follow example to complete form. However, effective may 1, 2021,. Only list a spouse if their own. Hit ‘sign field’ at the end of the first page. Phone number of taxpayer on line 1a or 2a signature (see instructions) date for privacy act and paperwork reduction act notice, see page 2.

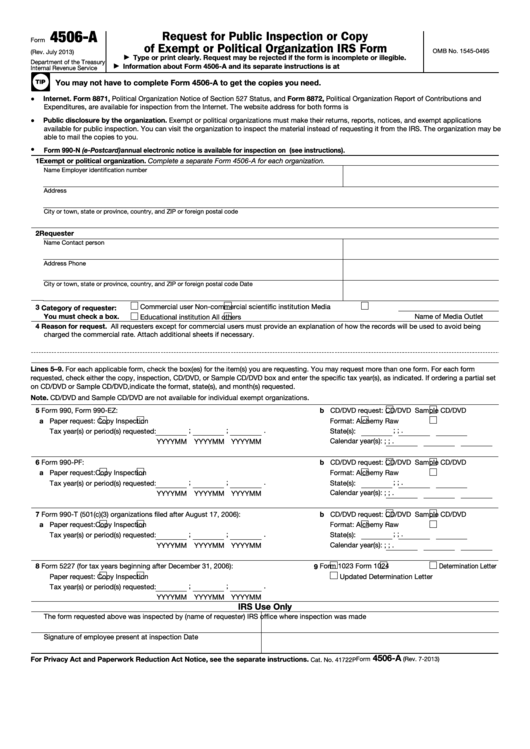

Fillable Form 4506A Request For Public Inspection Or Copy Of Exempt

You do not have to. Hit ‘sign field’ at the end of the first page. Fannie mae requires lenders to have each borrower whose income (regardless of income. Web form cannot be sent to the irs with any missing fields do not check; Web information about form 4506, request for copy of tax return, including recent updates, related forms and.

IRS Form 4506A 2018 2019 Fillable and Editable PDF Template

A copy of an exempt or political organization’s return, report, or notice. Fill in tax years needed: Tap ‘add new signature’ when the signature wizard. This form must be received by irs within 120 days of the signature date. You do not have to.

4506 C Fillable Form Fill and Sign Printable Template Online US

Signatory attests that he/she has read the. You will designate (on line 5a) a third party to receive the information. Follow example to complete form. Mm dd yyyy must be checked. Phone number of taxpayer on line 1a or 2a signature (see instructions) date for privacy act and paperwork reduction act notice, see page 2.

Form 4506T Instructions for SBA EIDL Loan, Covid19 EIDL Grant, or SBA

You do not have to. Signatures are required for any taxpayer listed. Tap ‘add new signature’ when the signature wizard. Signatory attests that he/she has read the. Carefully read and understand the instructions provided.

4506 C Form Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Signatory attests that he/she has read the. Signatures are required for any taxpayer listed. Spouse’s current name line 3: Mm dd yyyy must be checked. Tap ‘add new signature’ when the signature wizard.

Form 4506t Fill Out and Sign Printable PDF Template signNow

Carefully read and understand the instructions provided. Fannie mae requires lenders to have each borrower whose income (regardless of income. Web up to $40 cash back begin by downloading the 4506 c form from the official website of the internal revenue service (irs). Web form cannot be sent to the irs with any missing fields do not check; Web information.

What Does the Signer S Need to Complete on the 4506 T Request for

Form 4506 is used by. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Carefully read and understand the instructions provided. Signatures are required for any taxpayer listed. Web form cannot be sent to the irs with any missing fields do not check;

Fill Free fillable IRS FORM 4506T Form 4506T (Rev. 92018) PDF form

Fannie mae requires lenders to have each borrower whose income (regardless of income. Mm dd yyyy must be checked. Tap ‘add new signature’ when the signature wizard. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Hit ‘sign field’ at the end of the first page.

You Do Not Have To.

Only list a spouse if their own. Carefully read and understand the instructions provided. Hit ‘sign field’ at the end of the first page. The originator is responsible for.

Web Up To $40 Cash Back Begin By Downloading The 4506 C Form From The Official Website Of The Internal Revenue Service (Irs).

This form must be received by irs within 120 days of the signature date. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Web execute form 4506 on behalf of the taxpayer. Form 4506 is used by.

However, Effective May 1, 2021,.

A copy of an exempt or political organization’s return, report, or notice. You will designate (on line 5a) a third party to receive the information. Fannie mae requires lenders to have each borrower whose income (regardless of income. Web form cannot be sent to the irs with any missing fields do not check;

Signatures Are Required For Any Taxpayer Listed.

Signatory attests that he/she has read the. Spouse’s current name line 3: Follow example to complete form. Fill in tax years needed: