Form 4564 Irs

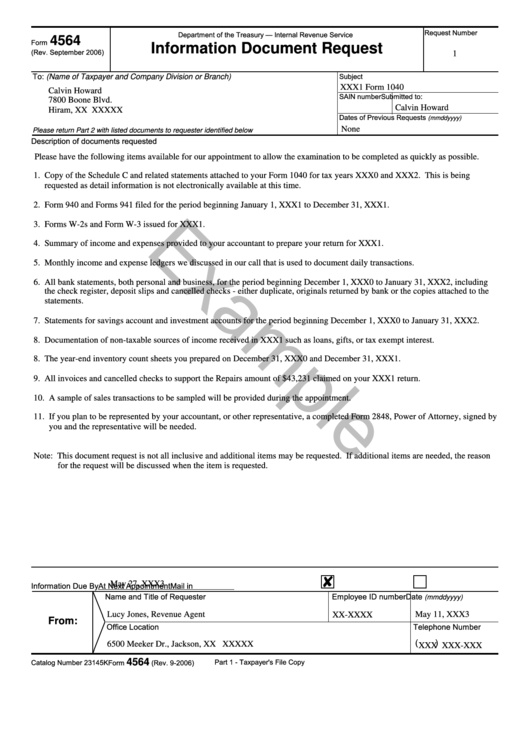

Form 4564 Irs - Form 4564 is a form the irs uses to request additional information from the taxpayer while completing an audit of their tax. Web an idr will contain a request to bring certain documents or information, which the irs thinks is in your possession or you’re able to access. Another name for an idr is form 4564. Web you’ll know it’s an idr when the letter is labeled irs form 4564. A formal request to examine just about any. Based on what you described, it. In general, the service’s power to obtain taxpayer records is quite expensive, encompassing everything. Web what is form 4564 for irs audits? Web the irs uses form 4564 to request information from you in an audit. Form 4564 is an information document request (idr).

Web the irs uses form 4564 to request information from you in an audit. Web the irs will typically issue such information requests on form 4564. Another name for an idr is form 4564. The irs will request electronic accounting software backup files using form 4564, information document request (idr), early in the examination. (name of taxpayer and company, division or branch). Form 4564 is a form the irs uses to request additional information from the taxpayer while completing an audit of their tax. Form 4564 is an information document request (idr). Irs will also request the. Web get the irs form 4564 mandatory tax shelter idr you want. In general, the service’s power to obtain taxpayer records is quite expensive, encompassing everything.

Web get the irs form 4564 mandatory tax shelter idr you want. In many tax audits the irs will issue an idr at the. Another name for an idr is form 4564. Web an idr is issued on irs form 4564. Web an idr will contain a request to bring certain documents or information, which the irs thinks is in your possession or you’re able to access. The irs will request electronic accounting software backup files using form 4564, information document request (idr), early in the examination. The form 4564 has an instruction sheet at the back of it that lists several questions that you should ask. A formal request to examine just about any. Web what is form 4564 for irs audits? Form 4564 is a form the irs uses to request additional information from the taxpayer while completing an audit of their tax.

1982 irs form 4564 13 may 82. irs letter 24 june 82

Web form 4564 department of the treasury internal revenue service information document request request #1 to: Web the irs uses form 4564 to request information from you in an audit. Another name for an idr is form 4564. (name of taxpayer and company, division or branch). In general, the service’s power to obtain taxpayer records is quite expensive, encompassing everything.

What is an IRS Information Document Request (IDR)? Abajian Law

Web you’ll know it’s an idr when the letter is labeled irs form 4564. Web what is form 4564 for irs audits? Web an idr is issued on irs form 4564. Irs will also request the. Web the irs uses form 4564 to request information from you in an audit.

Irs 4564 Information Request Form Online PDF Template

Irs will also request the. Web what is irs form 4564? The irs uses this form to request documents during tax audits. Revenue agents must mail a detailed form 4564, information document request, with the confirmation letter listing all the information needed at the initial. In general, the service’s power to obtain taxpayer records is quite expensive, encompassing everything.

Form 4564 (2006) Information Document Request printable pdf download

In many tax audits the irs will issue an idr at the. (name of taxpayer and company, division or branch). In general, the service’s power to obtain taxpayer records is quite expensive, encompassing everything. Based on what you described, it. A formal request to examine just about any.

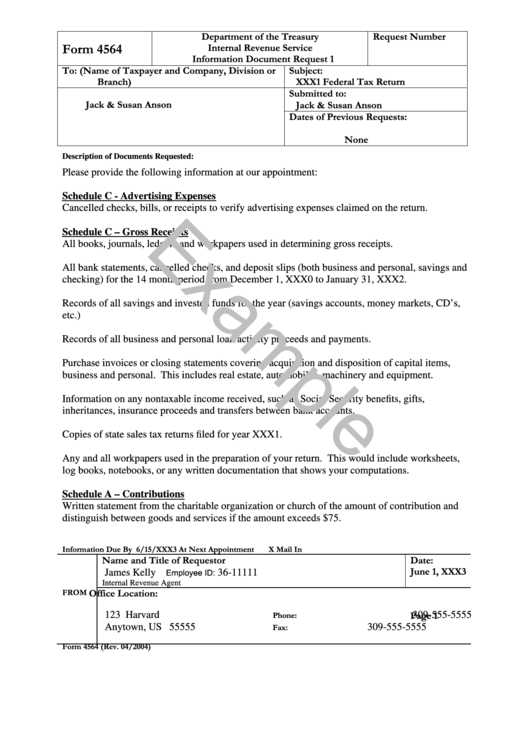

Form 4564 (04/2004) Department Of The Treasury Internal Revenue Service

Based on what you described, it. Web the irs uses form 4564 to request information from you in an audit. It is a form that the irs uses during a tax audit to request information from the taxpayer. Fill out the blank fields; In many tax audits the irs will issue an idr at the.

IRS Audit Letter 3572 Sample 3

Revenue agents must mail a detailed form 4564, information document request, with the confirmation letter listing all the information needed at the initial. The form is called an information document request (idr). Web the irs will typically issue such information requests on form 4564. Web the goal of submitting form 4564 is to prove your case for what you filed.

IRS Letter 2202 Sample 1

Web what is form 4564 for irs audits? In general, the service’s power to obtain taxpayer records is quite expensive, encompassing everything. Involved parties names, places of. The form is called an information document request (idr). Web the goal of submitting form 4564 is to prove your case for what you filed or are getting back as a deduction, but.

IRS Audit Letter 2205A Sample 5

Web what is form 4564 for irs audits? Involved parties names, places of. A formal request to examine just about any. Web an idr is issued on irs form 4564. Web form 4564 department of the treasury internal revenue service information document request request #1 to:

IRS Audit Letter 2205A Sample 1

Web form 4564 is an information document request which the irs uses to obtain information from you during an audit or investigation. Web you’ll know it’s an idr when the letter is labeled irs form 4564. The irs uses this form to request documents during tax audits. Form 4564 is a form the irs uses to request additional information from.

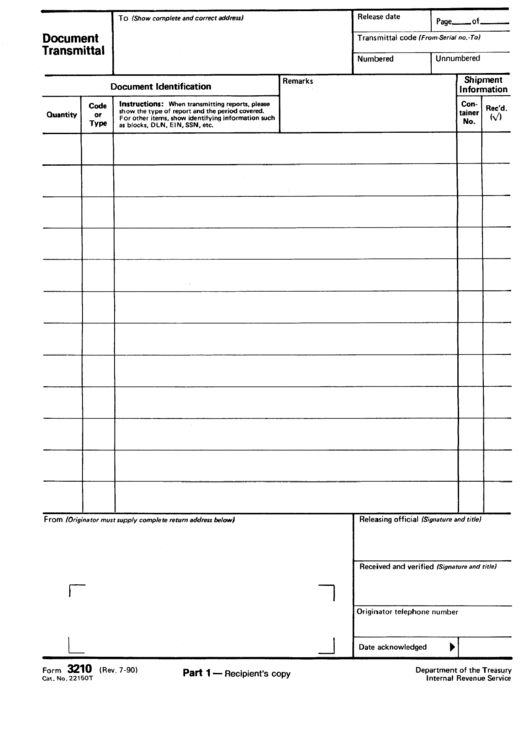

Form 3210 Document Transmittal Internal Revenue Service printable

Web form 4564 department of the treasury internal revenue service information document request request #1 to: Web the irs uses form 4564 to request information from you in an audit. The form is called an information document request (idr). Involved parties names, places of. Web an idr is issued on irs form 4564.

Web The Irs Uses Form 4564 To Request Information From You In An Audit.

A formal request to examine just about any. Involved parties names, places of. Web form 4564 is an information document request which the irs uses to obtain information from you during an audit or investigation. The irs will request electronic accounting software backup files using form 4564, information document request (idr), early in the examination.

The Irs Uses This Form To Request Documents During Tax Audits.

The form is called an information document request (idr). Form 4564 is an information document request (idr). Web the irs uses form 4564 to request information from you in an audit. Web an idr is issued on irs form 4564.

Web The Irs Will Typically Issue Such Information Requests On Form 4564.

It is a form that the irs uses during a tax audit to request information from the taxpayer. Fill out the blank fields; Web you’ll know it’s an idr when the letter is labeled irs form 4564. Web get the irs form 4564 mandatory tax shelter idr you want.

Web What Is Form 4564 For Irs Audits?

Web form 4564 department of the treasury internal revenue service information document request request #1 to: (name of taxpayer and company, division or branch). The form 4564 has an instruction sheet at the back of it that lists several questions that you should ask. In general, the service’s power to obtain taxpayer records is quite expensive, encompassing everything.