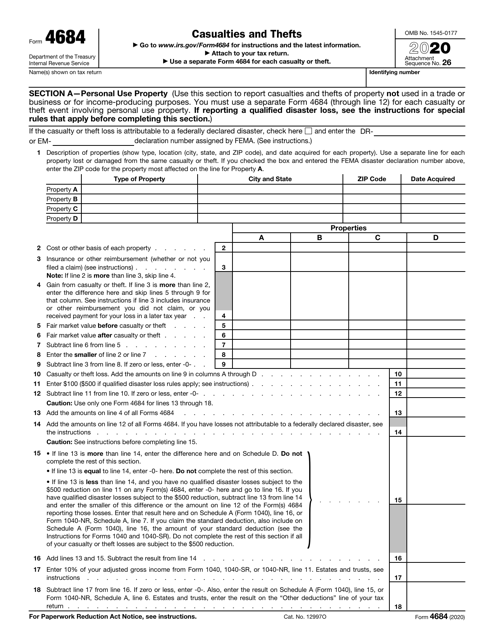

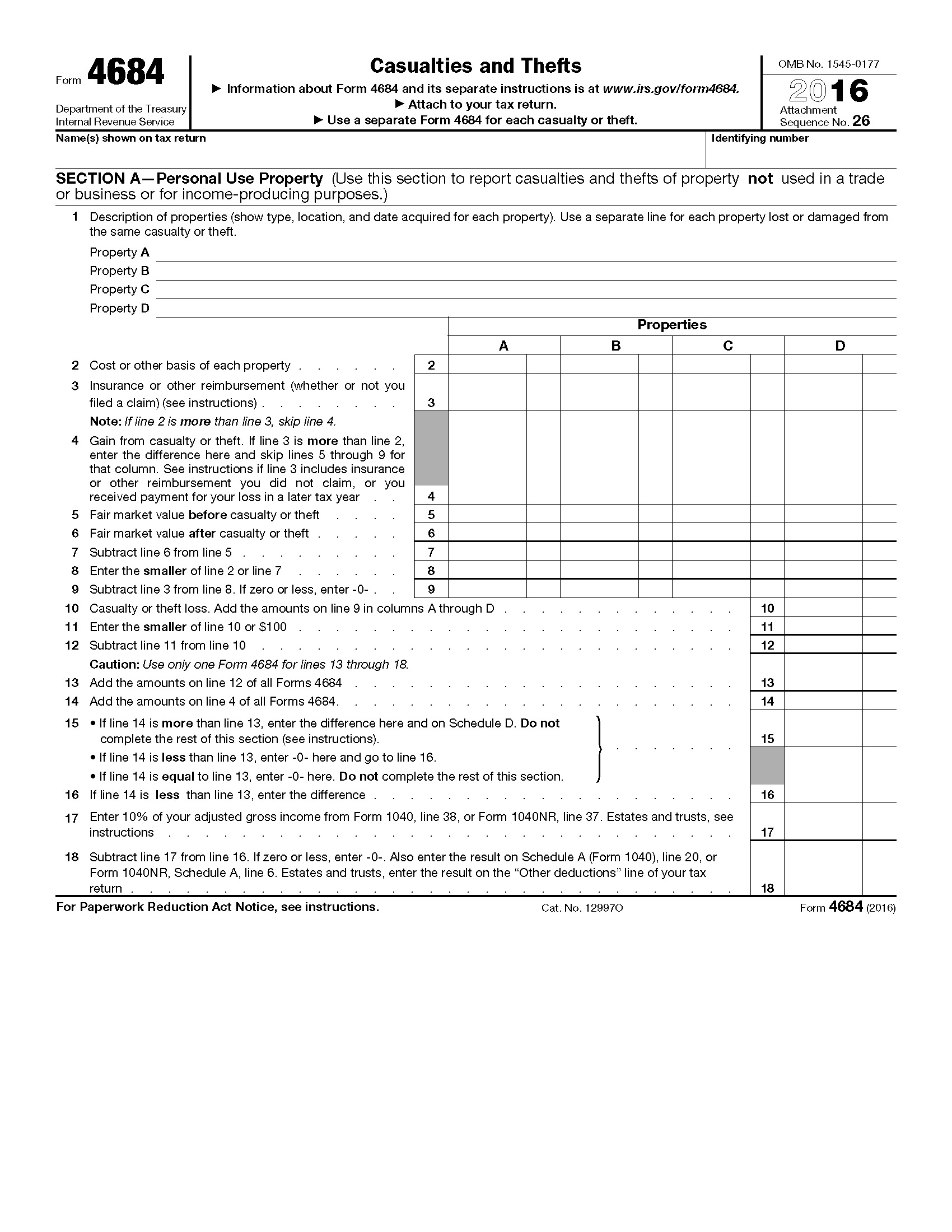

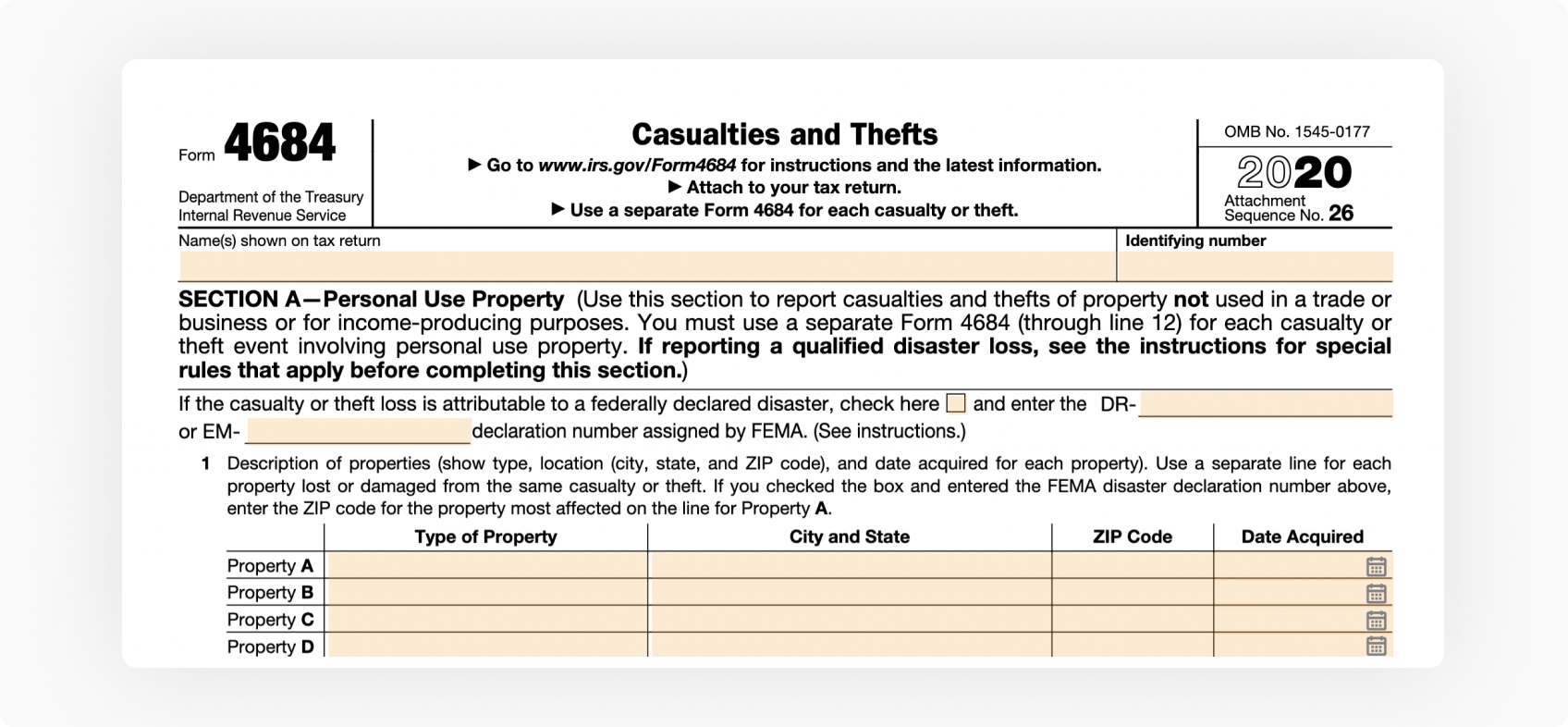

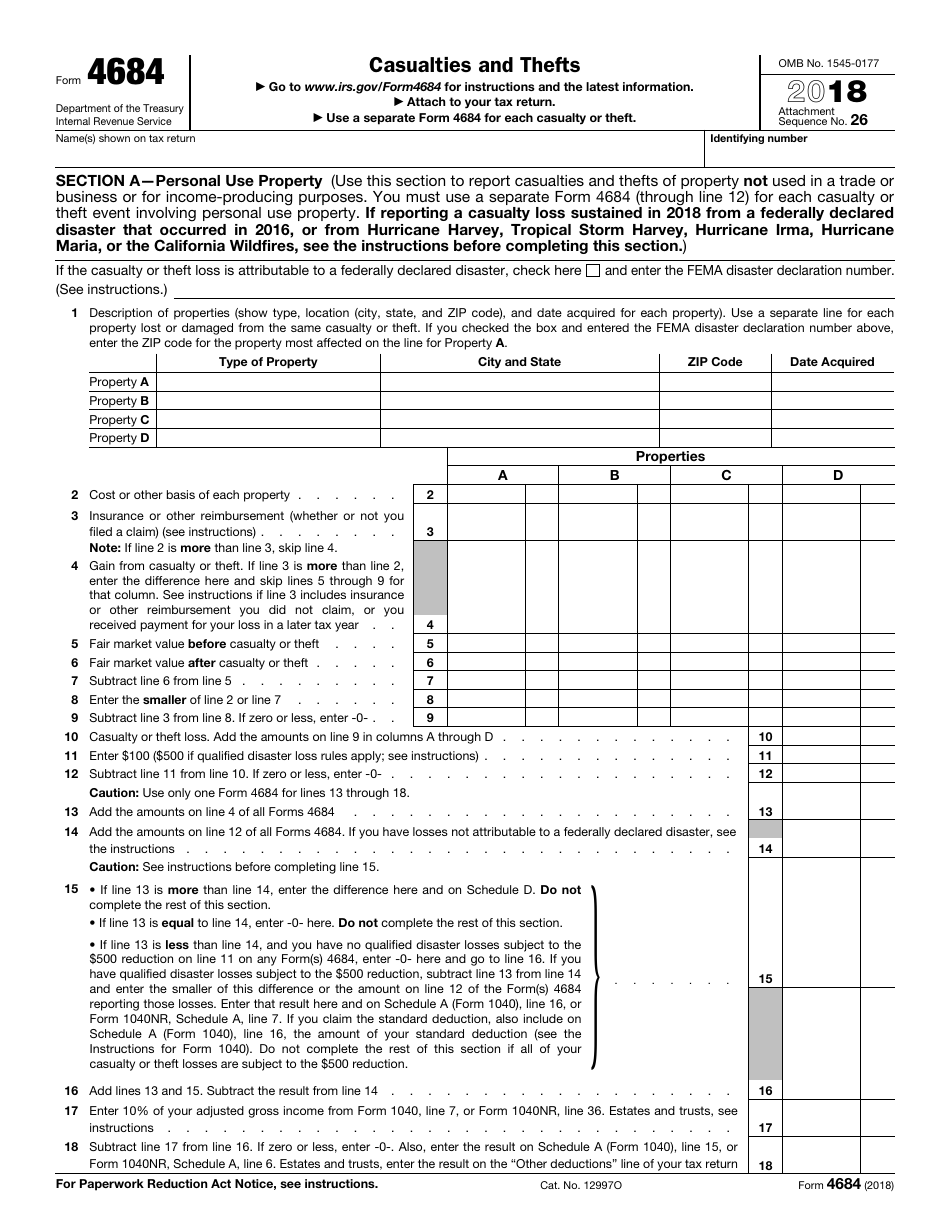

Form 4684 Casualties And Thefts

Form 4684 Casualties And Thefts - Car, boat, and other accidents;. Web what is form 4684? The taxpayer must report the. Web the 2018 form 4684 is available at irs.gov/ form4684. Casualty and theft losses line 15 complete and attach form 4684 to. Web use a separate form 4684 for each casualty or theft. Complete, edit or print tax forms instantly. Web ' use a separate form 4684 for each different casualty or theft. Solved•by intuit•updated july 19, 2022. Web this will be the date the casualty or theft occurred on.

Get ready for tax season deadlines by completing any required tax forms today. The taxpayer must report the. Losses you can deduct for tax years 2018 through 2025: This article will assist you with entering a casualty or theft for form 4684 in. Web use a separate form 4684 for each casualty or theft. Ad access irs tax forms. Car, boat, and other accidents;. Web casualty and theft losses. If you have a casualty and/or theft loss on property used 100% for business, you will report the loss. Cost or basis (do not reduce by depreciation) select the casualties and thefts (4684) section from the lower.

Name(s) shown on tax return. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web this will be the date the casualty or theft occurred on. Fair market value after casualty or theft; Losses you can deduct for tax years 2018 through 2025: Web use a separate form 4684 for each casualty or theft. Cost or basis (do not reduce by depreciation) select the casualties and thefts (4684) section from the lower. Casualty and theft losses line 15 complete and attach form 4684 to. Web the 2018 form 4684 is available at irs.gov/ form4684.

IRS Form 4684 Download Fillable PDF or Fill Online Casualties and

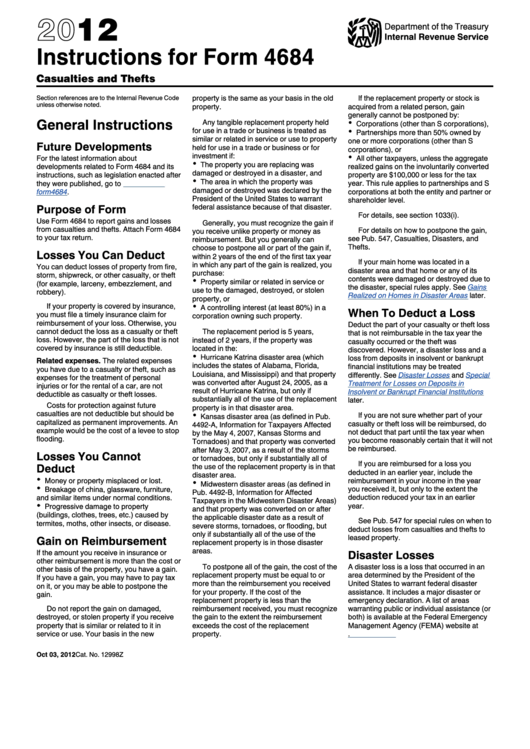

Only enter the amount from form 4684, line 18, on line 15. Sequence no.26 name(s) shown on tax return identifying number section a—personal use property (use this. Casualty and theft losses line 15 complete and attach form 4684 to. Web according to the 2017 instructions for form 4684, qualified disaster losses are personal casualty losses sustained as a result of.

Gallery of 1099 form Colorado 2017 Inspirational Irs form 4684

Ad download or email irs 4684 & more fillable forms, register and subscribe now! Web use a separate form 4684 for each casualty or theft. Complete, edit or print tax forms instantly. The taxpayer must report the. Sequence no.26 name(s) shown on tax return identifying number section a—personal use property (use this.

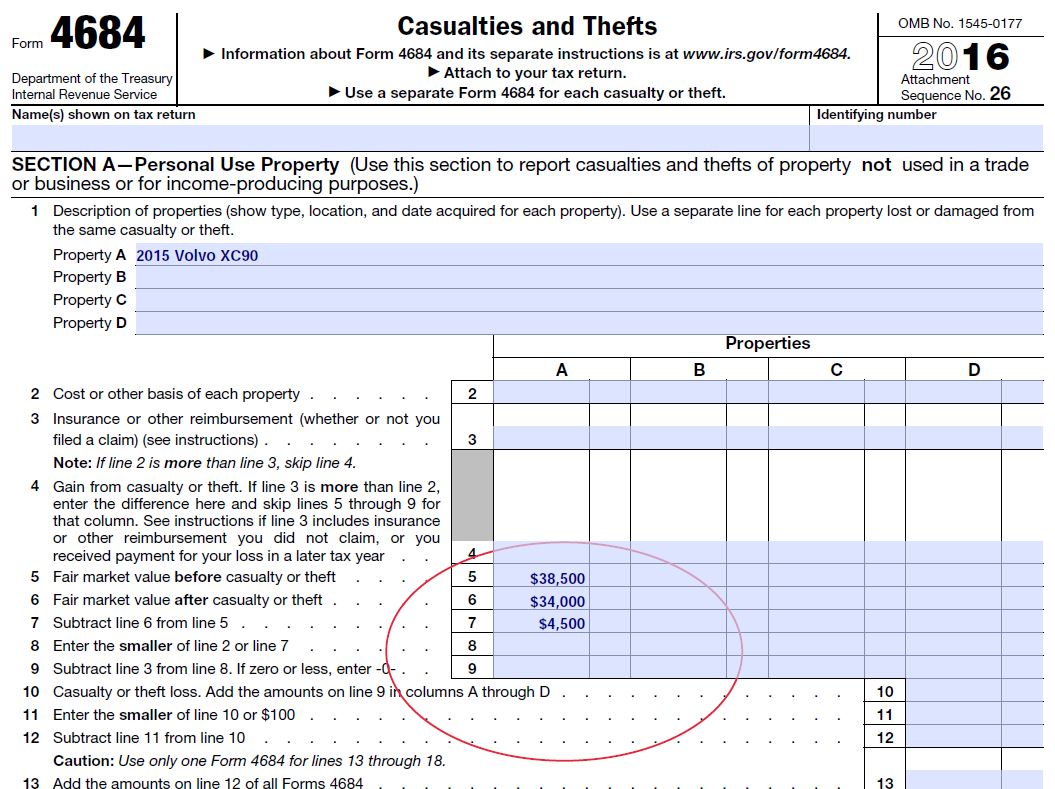

Diminished Value and Taxes, IRS form 4684 Diminished Value Car Appraisal

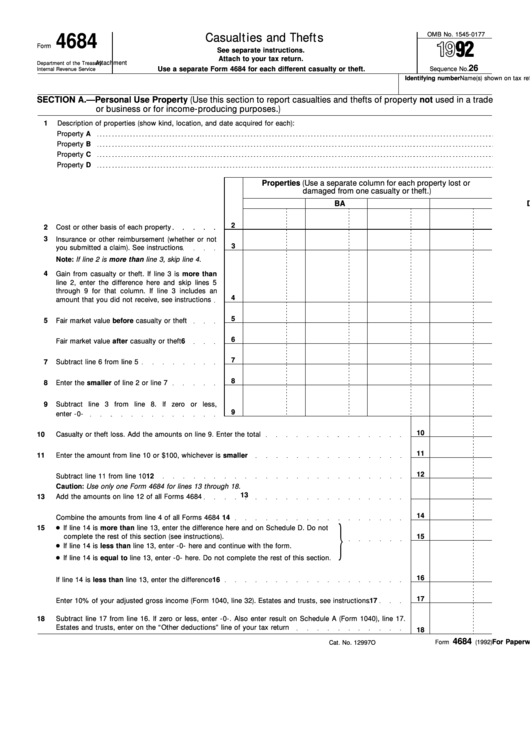

Sequence no.26 name(s) shown on tax return identifying number section a—personal use property (use this. Web ' use a separate form 4684 for each different casualty or theft. Form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the. Complete and attach form 4684 to figure the amount of your.

Instructions For Form 4684 Casualties And Thefts 2012 printable pdf

Only enter the amount from form 4684, line 18, on line 15. Web a casualty loss is claimed on form 4684, casualties and thefts, and is reported on schedule a as an itemized deduction. Sequence no.26 name(s) shown on tax return identifying number section a—personal use property (use this. This article will assist you with entering a casualty or theft.

Form 4684 Casualties And Thefts 1992 printable pdf download

The taxpayer must report the. This article will assist you with entering a casualty or theft for form 4684 in. If you have a casualty and/or theft loss on property used 100% for business, you will report the loss. Web fair market value before casualty or theft; Car, boat, and other accidents;.

Form 4684 Casualties and Thefts (2015) Free Download

Web casualty and theft losses. Ad download or email irs 4684 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web according to the 2017 instructions for form 4684, qualified disaster losses are personal casualty losses sustained as a result of a federally declared disaster that occurred in. Fair market value after casualty or.

IRS Form 4684 Casualties and Thefts Diminished Value Car Appraisal

Sequence no.26 name(s) shown on tax return identifying number section a—personal use property (use this. Fair market value after casualty or theft; Ad access irs tax forms. Name(s) shown on tax return. If you have a casualty and/or theft loss on property used 100% for business, you will report the loss.

irsform4684casualtiesthefts pdfFiller Blog

Ad download or email irs 4684 & more fillable forms, register and subscribe now! Limitation on personal casualty and theft losses. Sequence no.26 name(s) shown on tax return identifying number section a—personal use property (use this. Fair market value after casualty or theft; Solved•by intuit•updated july 19, 2022.

Form 4684 Casualties And Thefts Definition

Limitation on personal casualty and theft losses. We last updated the casualties and thefts in january 2023, so this is the latest version of form 4684, fully updated for tax. Complete and attach form 4684 to figure the amount of your loss. Web casualty and theft losses. Cost or basis (do not reduce by depreciation) select the casualties and thefts.

IRS Form 4684 2018 Fill Out, Sign Online and Download Fillable PDF

Only enter the amount from form 4684, line 18, on line 15. Web what is form 4684? This article will assist you with entering a casualty or theft for form 4684 in. Losses you can deduct for tax years 2018 through 2025: Car, boat, and other accidents;.

Name(S) Shown On Tax Return.

Personal casualty and theft losses of an individual sustained in a tax. Form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the. Complete, edit or print tax forms instantly. Ad access irs tax forms.

For Multiple Personal Casualty Events, Enter.

Web what is form 4684? If you have a casualty and/or theft loss on property used 100% for business, you will report the loss. The taxpayer must report the. Web entering a casualty or theft for form 4684.

Casualty And Theft Losses Line 15 Complete And Attach Form 4684 To.

Web a casualty loss is claimed on form 4684, casualties and thefts, and is reported on schedule a as an itemized deduction. Losses you can deduct for tax years 2018 through 2025: Complete, edit or print tax forms instantly. Web ' use a separate form 4684 for each different casualty or theft.

Web Fair Market Value Before Casualty Or Theft;

Solved•by intuit•updated july 19, 2022. Web use a separate form 4684 for each casualty or theft. Web this will be the date the casualty or theft occurred on. This article will assist you with entering a casualty or theft for form 4684 in.