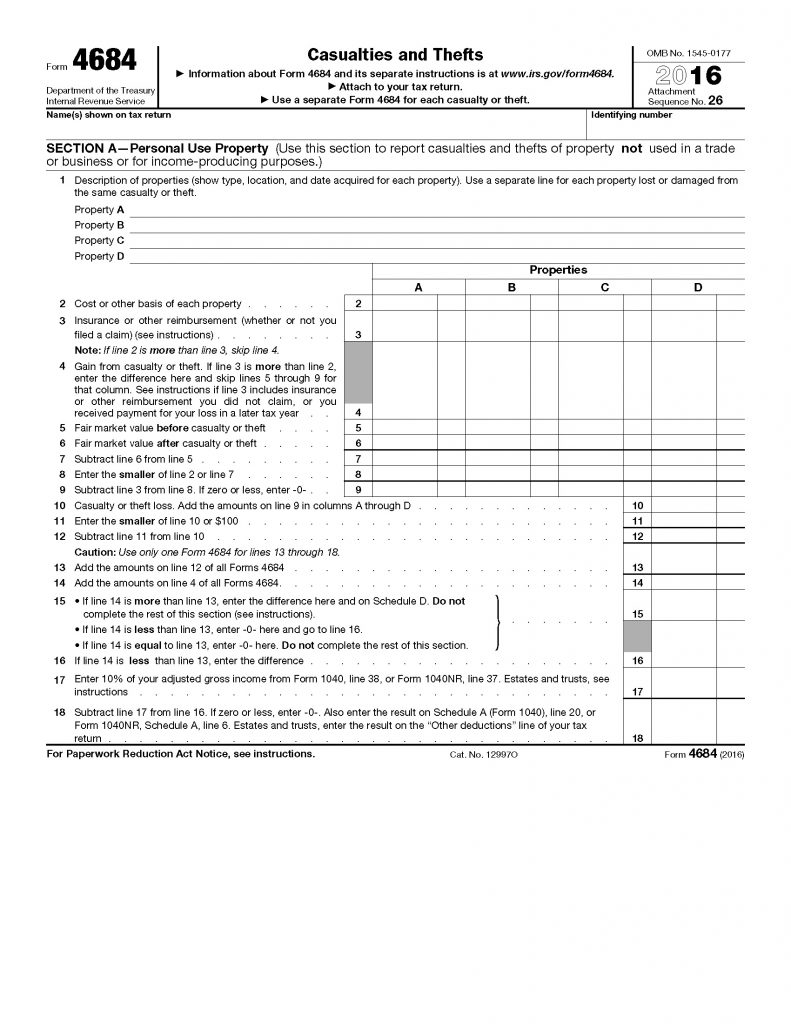

Form 4684 Instructions

Form 4684 Instructions - How the casualty and theft losses deduction works you can only deduct casualty and theft losses if they're directly the result of an event that's a federally declared disaster. Web attach section d of form 4684 to your amended return for the tax year immediately preceding the tax year the loss was sustained to revoke the previous disaster loss deduction. Web instructions for form 4684 casualties and thefts (rev. Attach to your tax return. Name(s) shown on tax return. Casualties and thefts is an irs form to report gains or losses from casualties and theft which may be deductible and reduce taxable income. Don't enter a net qualified disaster loss from form 4684, line 15, on line 15. Figuring out your deduction amount. Complete and attach form 4684 to figure the amount of your loss. When completing form 4684, do not enter an amount on line 5 or line 6 for each.

Web form 4684 department of the treasury internal revenue service casualties and thefts go to www.irs.gov/form4684 for instructions and the latest information. How the casualty and theft losses deduction works you can only deduct casualty and theft losses if they're directly the result of an event that's a federally declared disaster. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Complete and attach form 4684 to figure the amount of your loss. You must file this amended return for the preceding year on or before the date you file the original return or amended return for the disaster year on which you. Web instructions for form 4684 casualties and thefts (rev. Web attach section d of form 4684 to your amended return for the tax year immediately preceding the tax year the loss was sustained to revoke the previous disaster loss deduction. Web a theft can be claimed on form 4684. Attach to your tax return. Don't enter a net qualified disaster loss from form 4684, line 15, on line 15.

Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Complete and attach form 4684 to figure the amount of your loss. Web you can calculate and report casualty and theft losses on irs form 4684. You must file this amended return for the preceding year on or before the date you file the original return or amended return for the disaster year on which you. Attach form 4684 to your tax return to report gains and losses from casualties and thefts. Include the specific safe harbor method used. Name(s) shown on tax return. Only enter the amount from form 4684, line 18, on line 15. Use a separate form 4684 for each casualty or theft. Use the instructions on form 4684 to report gains and losses from casualties and thefts.

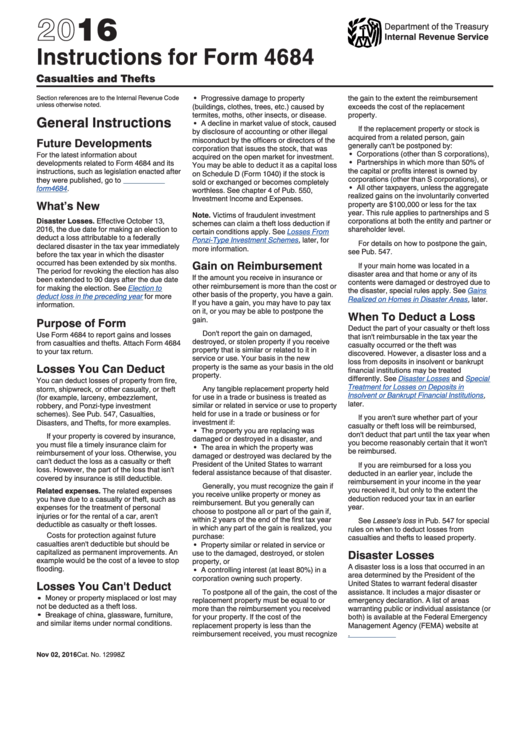

Instructions For Form 4684 Casualties And Thefts 2016 printable pdf

Taxact will use the higher of your itemized deductions or the standard deduction for your filing status to maximize your tax benefit. Figuring out your deduction amount. Web the taxact program uses form 4684 to figure the amount of your loss, and transfers the information to schedule a (form 1040) itemized deductions, line 15. Complete and attach form 4684 to.

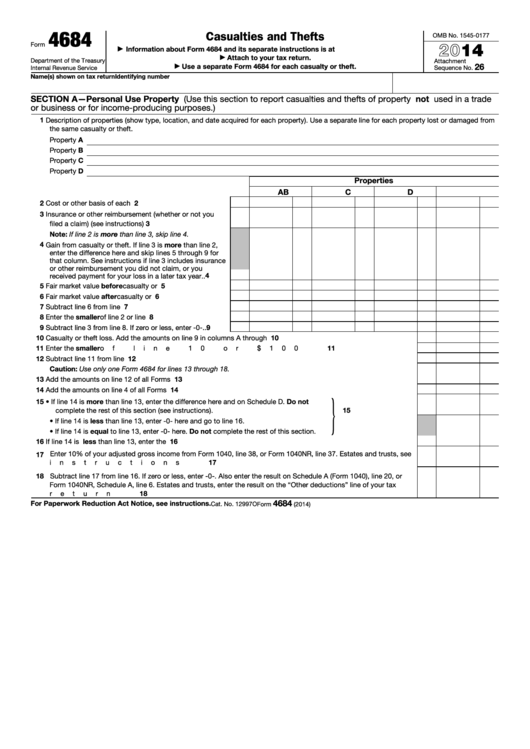

Fillable Form 4684 Casualties And Thefts 2014 printable pdf download

Web form 4684 department of the treasury internal revenue service casualties and thefts go to www.irs.gov/form4684 for instructions and the latest information. How the casualty and theft losses deduction works you can only deduct casualty and theft losses if they're directly the result of an event that's a federally declared disaster. Name(s) shown on tax return. Web instructions for form.

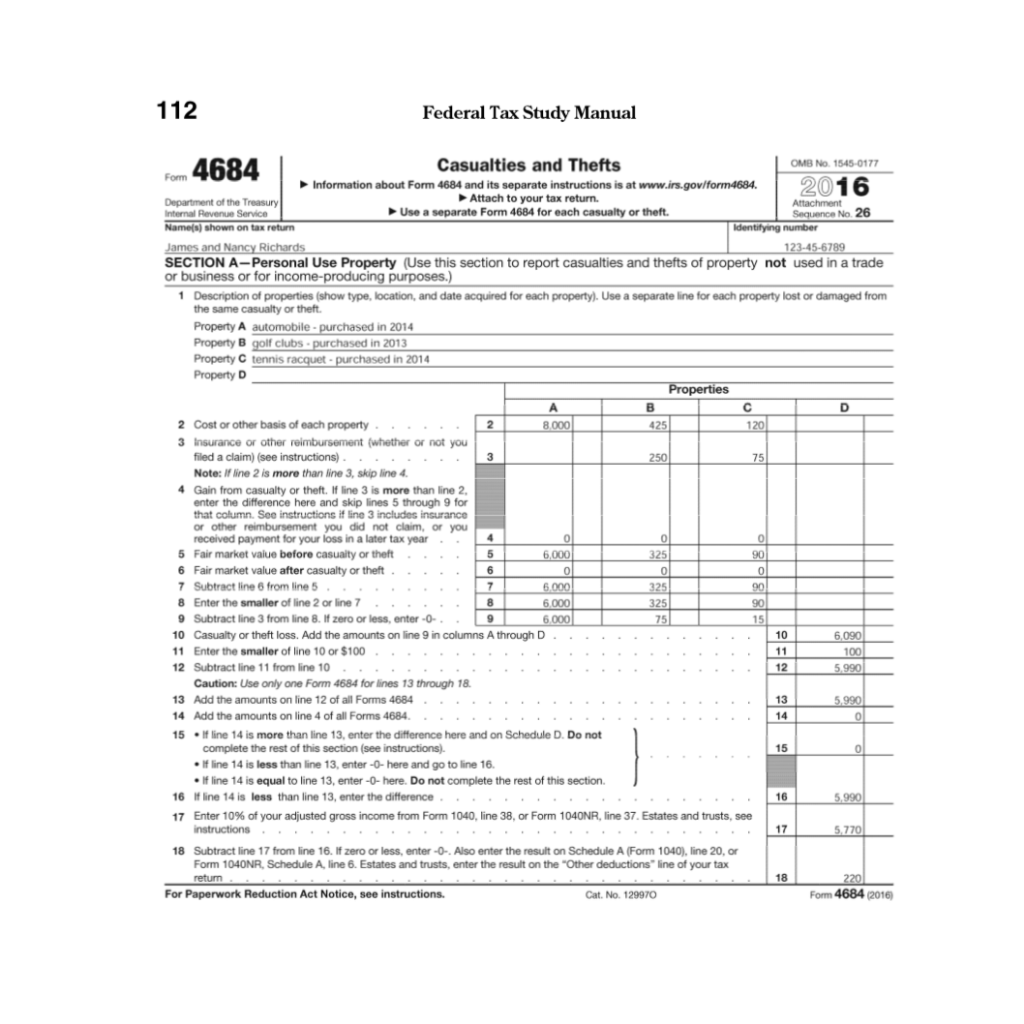

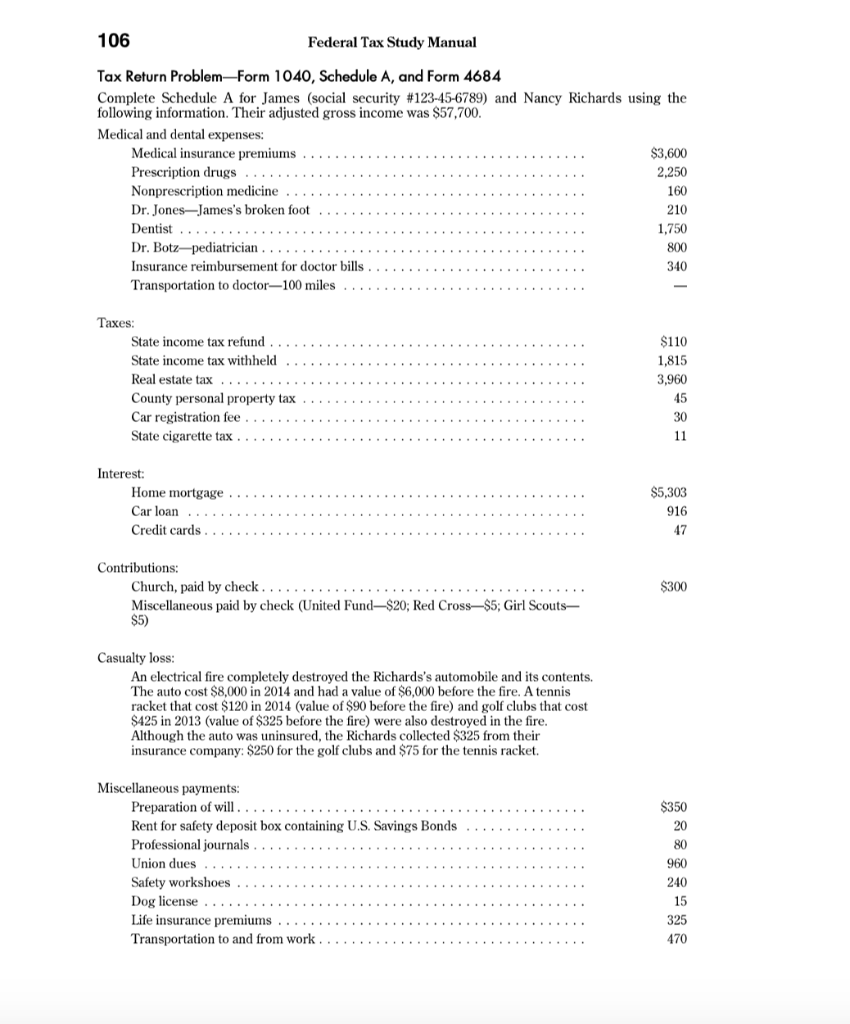

106 Federal Tax Study Manual Tax Return ProblemForm

To figure your deduction for a casualty or theft loss, first figure the amount of. Web attach section d of form 4684 to your amended return for the tax year immediately preceding the tax year the loss was sustained to revoke the previous disaster loss deduction. Web the taxact program uses form 4684 to figure the amount of your loss,.

Form 4684 Casualties and Thefts (2015) Free Download

Complete and attach form 4684 to figure the amount of your loss. Attach to your tax return. February 2020) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web the taxact program uses form 4684 to figure the amount of your loss, and transfers the information to schedule a (form 1040).

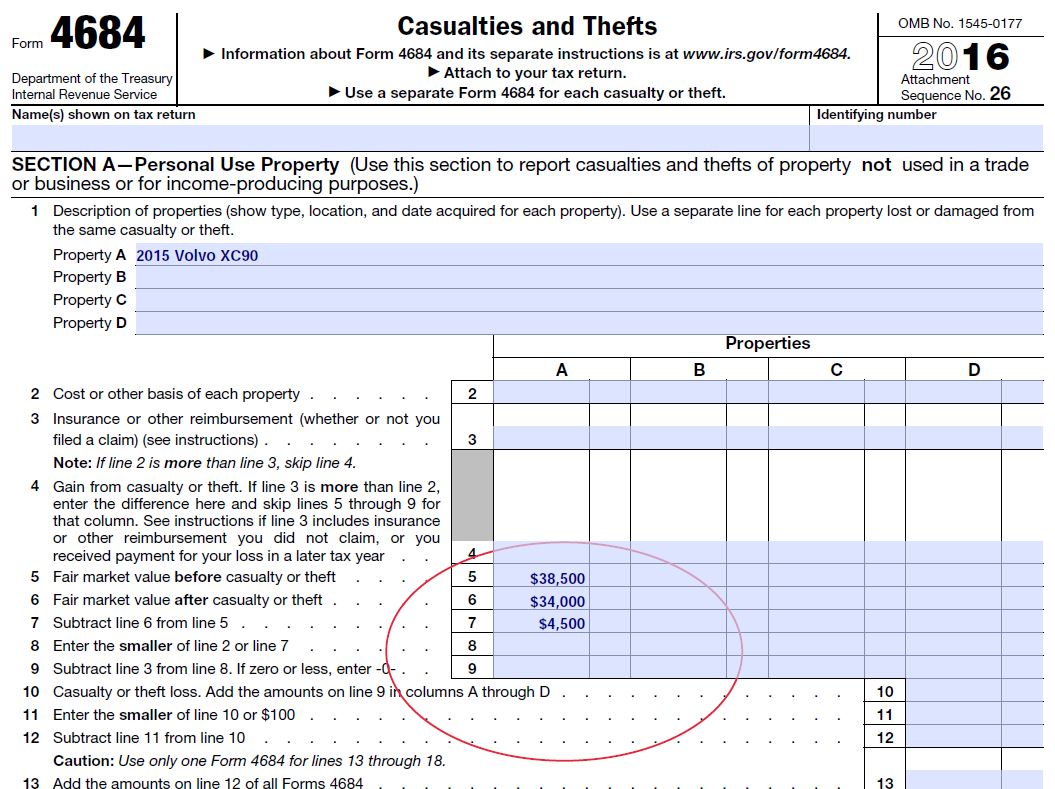

Diminished Value and Taxes, IRS form 4684 Diminished Value Car Appraisal

Use the instructions on form 4684 to report gains and losses from casualties and thefts. When completing form 4684, do not enter an amount on line 5 or line 6 for each. How the casualty and theft losses deduction works you can only deduct casualty and theft losses if they're directly the result of an event that's a federally declared.

IRS Form 4684 How to Deduct Property Damage Losses from a Hurricane

Include the specific safe harbor method used. Web you can calculate and report casualty and theft losses on irs form 4684. Web form 4684 department of the treasury internal revenue service casualties and thefts go to www.irs.gov/form4684 for instructions and the latest information. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how.

Publication 225, Farmer's Tax Guide; Chapter 20 Sample Return

Web a theft can be claimed on form 4684. Web attach section d of form 4684 to your amended return for the tax year immediately preceding the tax year the loss was sustained to revoke the previous disaster loss deduction. You must file this amended return for the preceding year on or before the date you file the original return.

106 Federal Tax Study Manual Tax Return ProblemForm

Use the instructions on form 4684 to report gains and losses from casualties and thefts. Attach form 4684 to your tax return to report gains and losses from casualties and thefts. Only enter the amount from form 4684, line 18, on line 15. To figure your deduction for a casualty or theft loss, first figure the amount of. Web instructions.

SimpleTax Form 4684 YouTube

Web the taxact program uses form 4684 to figure the amount of your loss, and transfers the information to schedule a (form 1040) itemized deductions, line 15. To figure your deduction for a casualty or theft loss, first figure the amount of. Figuring out your deduction amount. How the casualty and theft losses deduction works you can only deduct casualty.

Diminished Value and Taxes, IRS form 4684 Diminished Value of

Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Complete and attach form 4684 to figure the amount of your loss. Only enter the amount from form 4684, line 18, on line 15. Web form 4684 department of the treasury internal revenue service casualties and thefts go to www.irs.gov/form4684 for.

Web Form 4684 Department Of The Treasury Internal Revenue Service Casualties And Thefts Go To Www.irs.gov/Form4684 For Instructions And The Latest Information.

Taxact will use the higher of your itemized deductions or the standard deduction for your filing status to maximize your tax benefit. Use the instructions on form 4684 to report gains and losses from casualties and thefts. Don't enter a net qualified disaster loss from form 4684, line 15, on line 15. To figure your deduction for a casualty or theft loss, first figure the amount of.

Include The Specific Safe Harbor Method Used.

Only enter the amount from form 4684, line 18, on line 15. Web you can calculate and report casualty and theft losses on irs form 4684. Name(s) shown on tax return. Attach to your tax return.

Web The Taxact Program Uses Form 4684 To Figure The Amount Of Your Loss, And Transfers The Information To Schedule A (Form 1040) Itemized Deductions, Line 15.

Web a theft can be claimed on form 4684. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Attach form 4684 to your tax return. Attach form 4684 to your tax return to report gains and losses from casualties and thefts.

February 2020) Department Of The Treasury Internal Revenue Service Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Web attach section d of form 4684 to your amended return for the tax year immediately preceding the tax year the loss was sustained to revoke the previous disaster loss deduction. Figuring out your deduction amount. Casualties and thefts is an irs form to report gains or losses from casualties and theft which may be deductible and reduce taxable income. When completing form 4684, do not enter an amount on line 5 or line 6 for each.