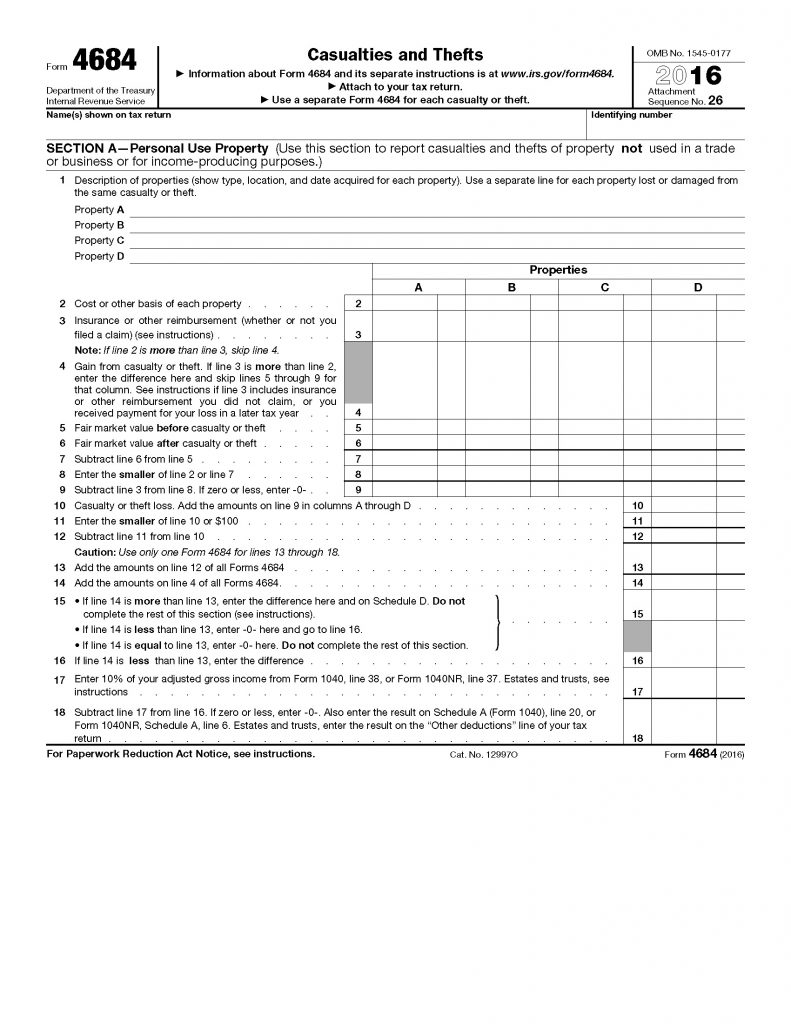

Form 4684 Pdf

Form 4684 Pdf - Tax relief for homeowners with corrosive drywall: Choose the correct version of the editable pdf form from the list and. If the loss involved a home used for a business for which you are filing schedule c (form 1040), profit or loss from. Complete, sign, print and send your tax documents easily with us legal forms. More about the federal form 4684 we last updated. Web what is considered a casualty loss deduction (form 4684)? Limitation on personal casualty and theft losses. Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ½ ¿ » casualties and thefts (rev. A casualty occurs when your. Web find and fill out the correct irs form 4684.

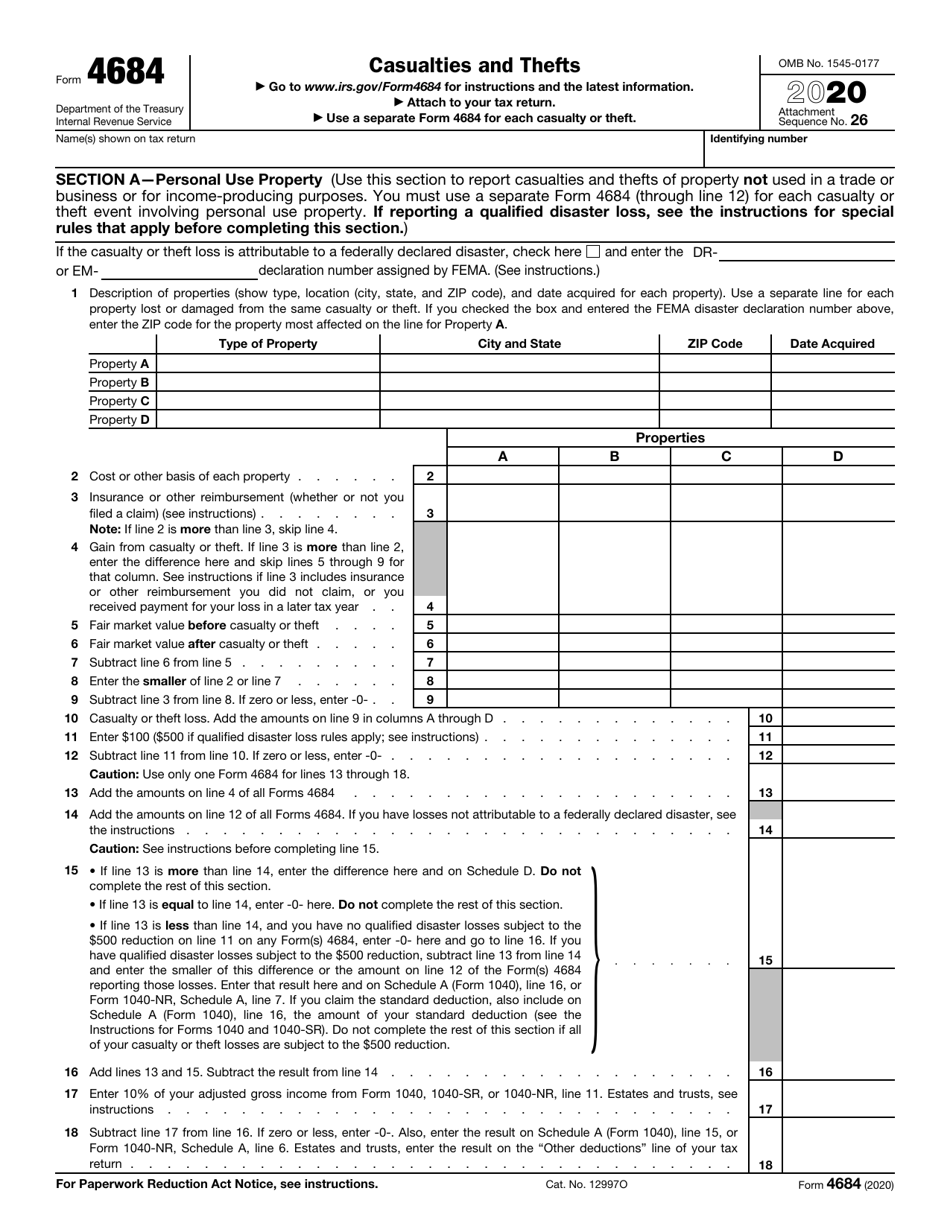

Ad complete irs tax forms online or print government tax documents. Web form 4684 department of the treasury internal revenue service casualties and thefts ago to www.irs.gov/form4684 for instructions and the latest information. Complete, edit or print tax forms instantly. 26 page 2 name(s) shown on tax return. Get ready for tax season deadlines by completing any required tax forms today. Beginning in 2018 , the tax cuts and jobs act suspended the itemized deduction for personal casualties and theft. Choose the correct version of the editable pdf form from the list and. Tax relief for homeowners with corrosive drywall: Web about publication 547, casualties, disasters, and thefts. Web form 4684 (2020) attachment sequence no.

Complete, edit or print tax forms instantly. Web editable irs 4684 2020. If reporting a qualified disaster loss, see the instructions for special rules that apply. Get ready for tax season deadlines by completing any required tax forms today. Limitation on personal casualty and theft losses. February 2020) »æ·èêã»äê å¼ ê¾» è»·éëèï 26 page 2 name(s) shown on tax return. Ad complete irs tax forms online or print government tax documents. Web attach form 4684 to your tax return to report gains and losses from casualties and thefts. Choose the correct version of the editable pdf form from the list and.

IRS Form 4684 Download Fillable PDF or Fill Online Casualties and

Web form 4684 department of the treasury internal revenue service casualties and thefts ago to www.irs.gov/form4684 for instructions and the latest information. Complete, sign, print and send your tax documents easily with us legal forms. Web form 4684 (2020) attachment sequence no. Web first, complete form 4684, section b, lines 19 through 26. Web attach form 4684 to your tax.

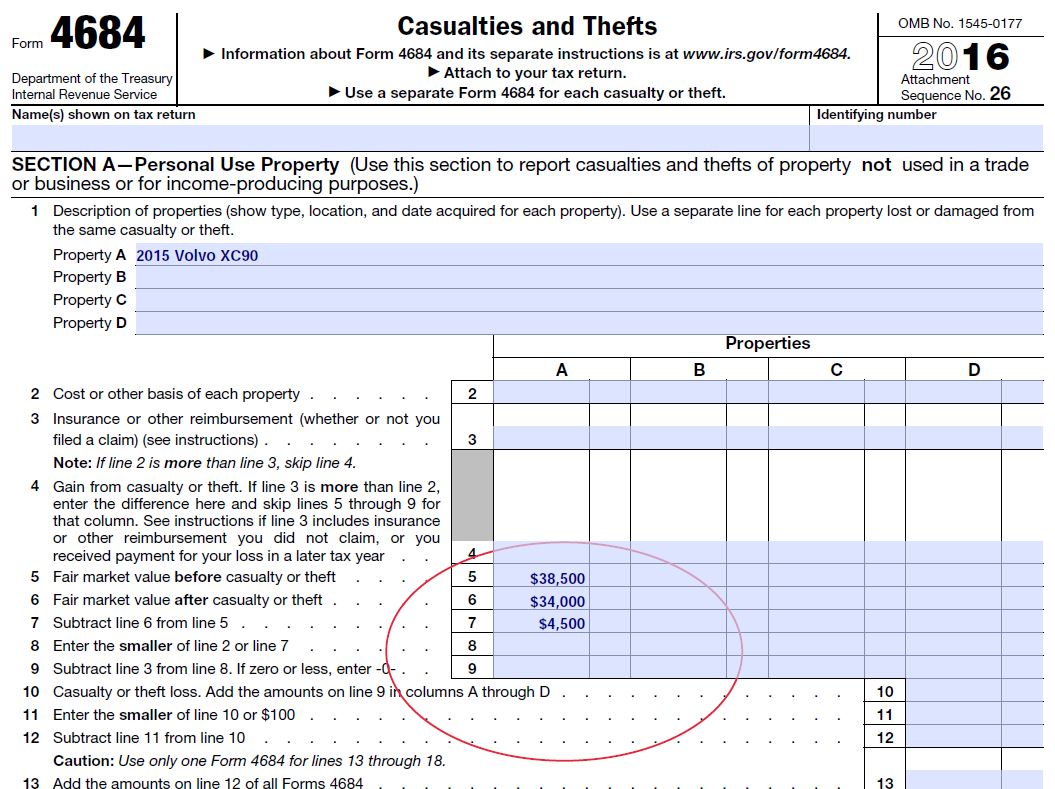

Diminished Value and Taxes, IRS form 4684 Diminished Value Car Appraisal

Web find and fill out the correct irs form 4684. Web form 4684 (2020) attachment sequence no. Complete, edit or print tax forms instantly. Complete, sign, print and send your tax documents easily with us legal forms. 26 page 2 name(s) shown on tax return.

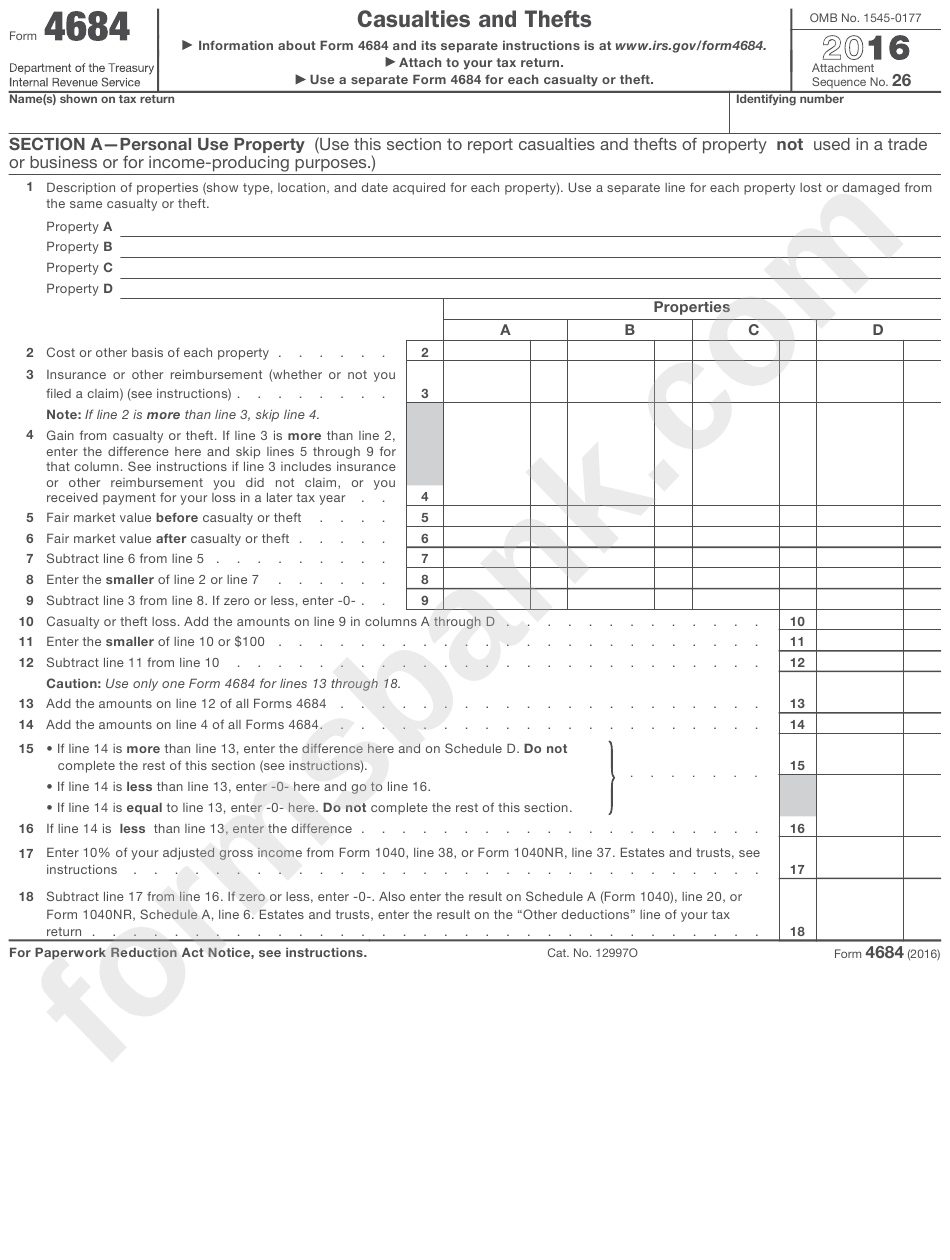

Form 4684 Casualties And Thefts 2016 printable pdf download

A casualty occurs when your. If the loss involved a home used for a business for which you are filing schedule c (form 1040), profit or loss from. Web attach form 4684 to your tax return to report gains and losses from casualties and thefts. Web find and fill out the correct irs form 4684. 26 page 2 name(s) shown.

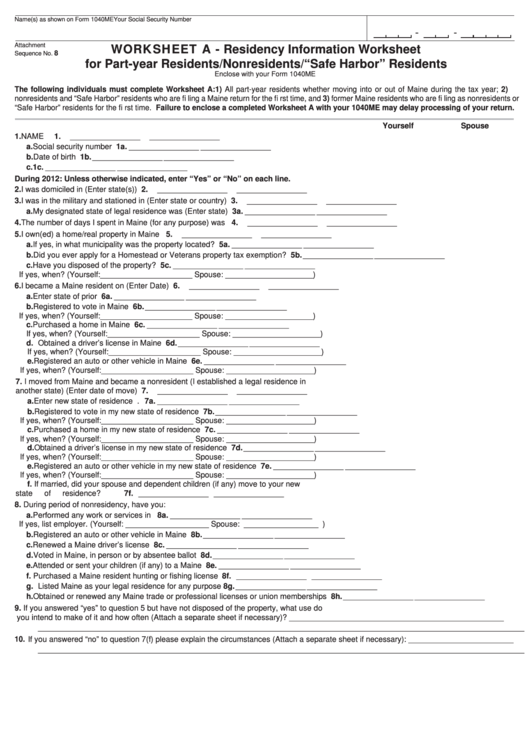

Fillable Residency Information Worksheet For PartYear Residents

If reporting a qualified disaster loss, see the instructions for special rules that apply. Web the 2018 form 4684 is available at irs.gov/ form4684. If the loss involved a home used for a business for which you are filing schedule c (form 1040), profit or loss from. Get ready for tax season deadlines by completing any required tax forms today..

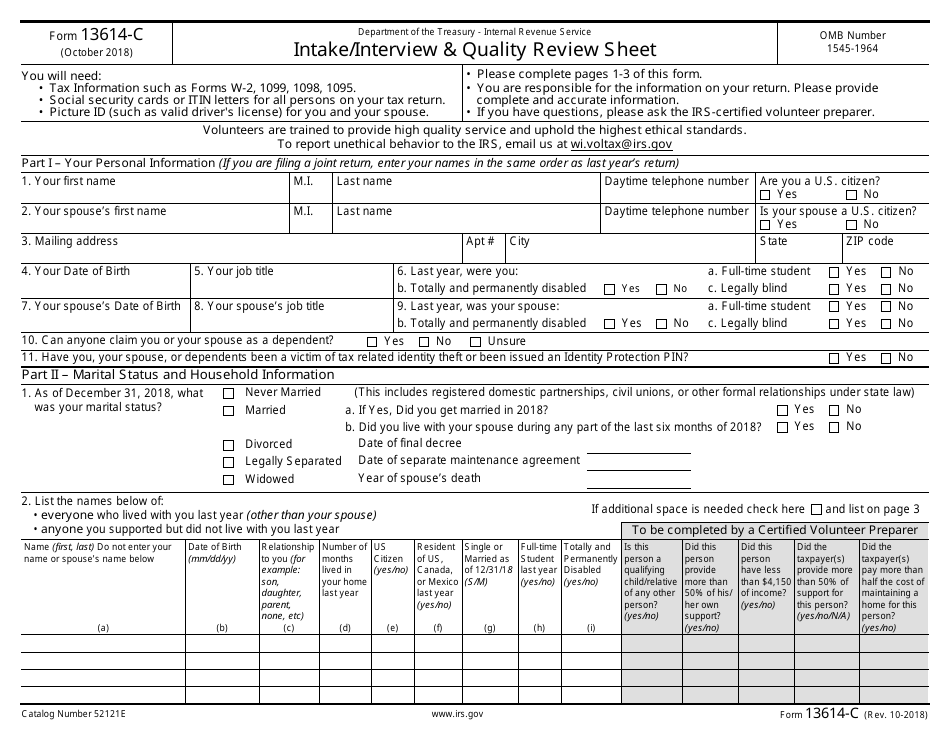

IRS Form 13614C Download Fillable PDF or Fill Online Intake/Interview

Tax relief for homeowners with corrosive drywall: Download blank or fill out online in pdf format. Beginning in 2018 , the tax cuts and jobs act suspended the itemized deduction for personal casualties and theft. Ad download or email irs 4684 & more fillable forms, register and subscribe now! Web about publication 547, casualties, disasters, and thefts.

Diminished Value and Taxes, IRS form 4684 Diminished Value of

Tax relief for homeowners with corrosive drywall: Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ½ ¿ » casualties and thefts (rev. Limitation on personal casualty and theft losses. If the loss involved a home used for a business for which you are filing schedule c (form 1040), profit or loss from. More about the federal form 4684 we last updated.

Fill Free fillable F4684 Accessible 2019 Form 4684 PDF form

Complete, sign, print and send your tax documents easily with us legal forms. Download blank or fill out online in pdf format. Web editable irs 4684 2020. 26 page 2 name(s) shown on tax return. Web the 2018 form 4684 is available at irs.gov/ form4684.

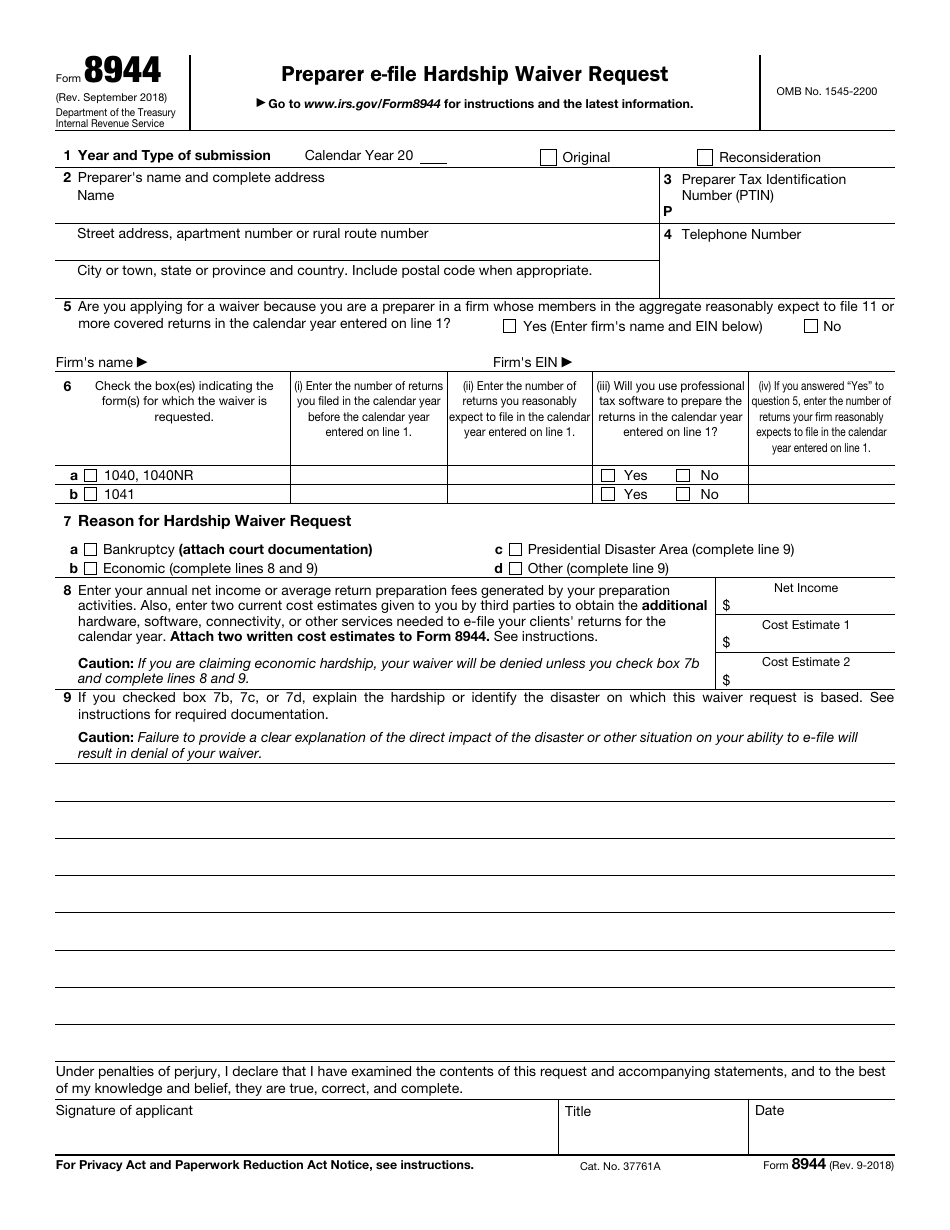

IRS Form 8944 Download Fillable PDF or Fill Online Preparer EFile

Choose the correct version of the editable pdf form from the list and. This publication explains the tax treatment of casualties, thefts, and losses on deposits. More about the federal form 4684 we last updated. Ad download or email irs 4684 & more fillable forms, register and subscribe now! Web find and fill out the correct irs form 4684.

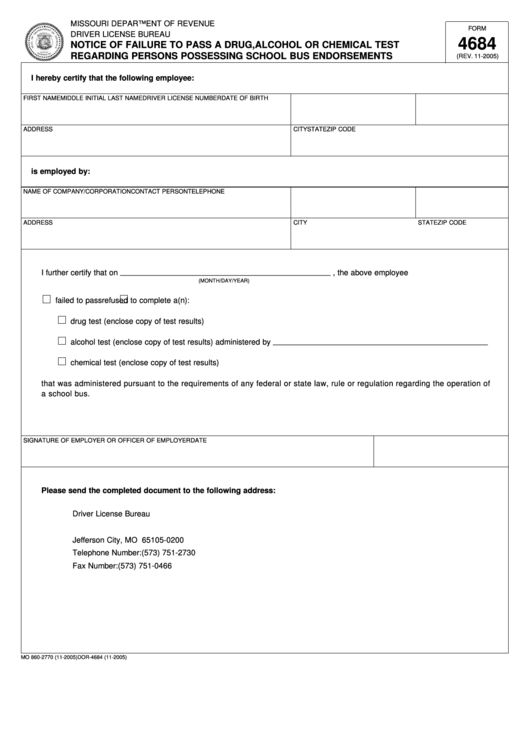

Fillable Form 4684 Notice Of Failure To Pass A Drug, Alcohol Or

Web the 2018 form 4684 is available at irs.gov/ form4684. Web first, complete form 4684, section b, lines 19 through 26. This publication explains the tax treatment of casualties, thefts, and losses on deposits. Web editable irs 4684 2020. Ad download or email irs 4684 & more fillable forms, register and subscribe now!

Fill Free fillable Form 4684 Casualties and Thefts 2019 PDF form

Web find and fill out the correct irs form 4684. Complete, edit or print tax forms instantly. Web what is considered a casualty loss deduction (form 4684)? Complete, sign, print and send your tax documents easily with us legal forms. Do not enter name and identifying number if shown on other side.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Tax relief for homeowners with corrosive drywall: Web attach form 4684 to your tax return to report gains and losses from casualties and thefts. If reporting a qualified disaster loss, see the instructions for special rules that apply. Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ½ ¿ » casualties and thefts (rev.

Download Blank Or Fill Out Online In Pdf Format.

Web form 4684 department of the treasury internal revenue service casualties and thefts ago to www.irs.gov/form4684 for instructions and the latest information. Web what is considered a casualty loss deduction (form 4684)? February 2020) »æ·èêã»äê å¼ ê¾» è»·éëèï Web first, complete form 4684, section b, lines 19 through 26.

Web Form 4684 (2020) Attachment Sequence No.

Web about publication 547, casualties, disasters, and thefts. Web download your fillable irs form 4684 in pdf table of contents application purpose key requirements damage from drywall and concrete how to fill out form 4684. Complete, edit or print tax forms instantly. Limitation on personal casualty and theft losses.

Web Editable Irs 4684 2020.

Personal casualty and theft losses of an individual sustained in a tax. Web general instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were. More about the federal form 4684 we last updated. This publication explains the tax treatment of casualties, thefts, and losses on deposits.