Form 4797 Vs Schedule D

Form 4797 Vs Schedule D - Web sale information is not appearing on form 4797 or schedule d. The sale or exchange of property. Property used in a trade or business. 10000 part 3, box 10 (net. Web after completing the interview for the disposition of the rental property, this transaction will appear on form 4797 sales of business property as a gain. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web overview the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. However, part of the gain on the sale or exchange of the depreciable property may have to be recaptured as. Web depending on your tax situation, schedule d may instruct you to prepare and bring over information from other tax forms.

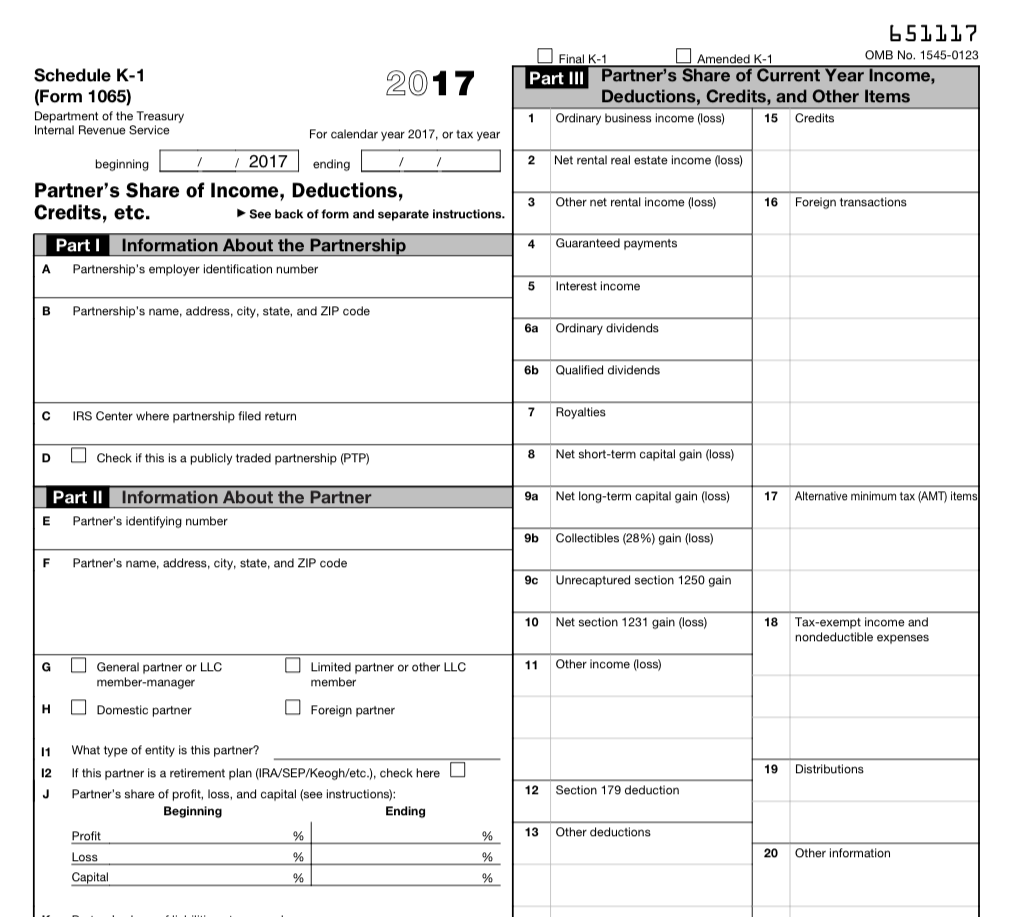

Schedule d transfers to 1040 and is typically taxed at capital gain tax rates. Property used in a trade or business. Web answer report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other dispositions of capital. Web the disposition of capital assets not reported on schedule d. The sale or exchange of: Form 8949 if you sell investments or your. Reported on schedule d • not. The sale or exchange of property. Complete, edit or print tax forms instantly. Web final k1 tax computation schedule d vs 4797 i received a 'final k1' with following details:

Web form 4797, sales of business property is used to report the following transactions: Web schedule d is used to report gains from personal investments, while form 4797 is used to report gains from real estate dealings—those that are done primarily in. Web generally, the gain is reported on form 8949 and schedule d. Web after completing the interview for the disposition of the rental property, this transaction will appear on form 4797 sales of business property as a gain. The full gain will be. Web answer report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other dispositions of capital. Part 3, box 2 (net rental real estate income): Property used in a trade or business. Get ready for tax season deadlines by completing any required tax forms today. The gain or loss for partners and s corporation shareholders from certain section 179 property dispositions by.

What Is the Difference Between a Schedule D and Form 4797?

Web whereas schedule d forms are used to report personal gains, irs form 4797 is used to report profits from real estate transactions centered on business use. Reported on schedule d • not. Get ready for tax season deadlines by completing any required tax forms today. The full gain will be. Form 8949 if you sell investments or your.

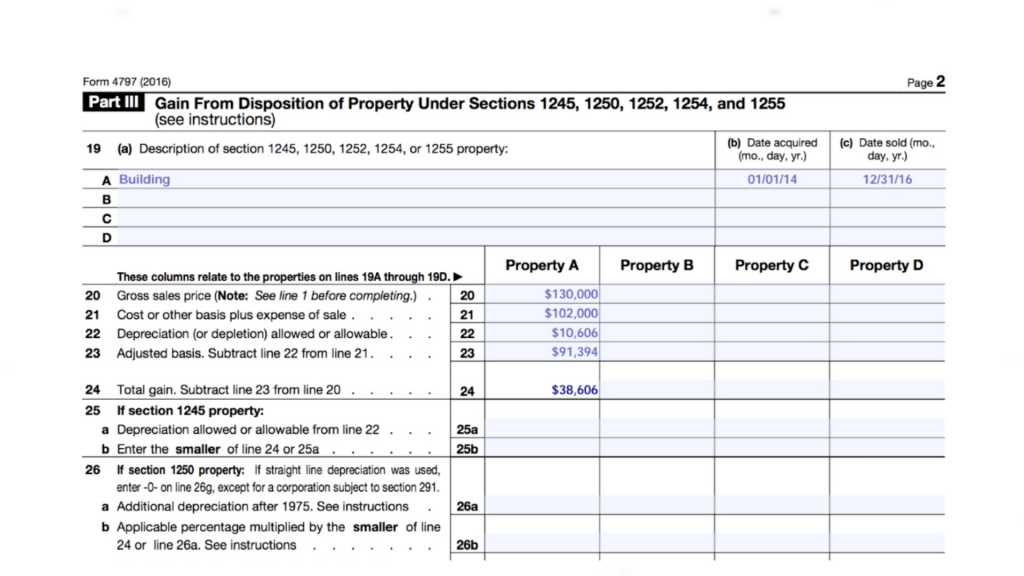

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Part 3, box 2 (net rental real estate income): Web according to the irs, you should use your 4797 form to report all of the following: Web after completing the interview for the disposition of the rental property, this transaction will appear on form 4797 sales of business property as a gain. Complete, edit or print tax forms instantly. Web.

How to Report the Sale of a U.S. Rental Property Madan CA

The sale or exchange of property. Inventory or other property held for sale to customers Web generally, the gain is reported on form 8949 and schedule d. Web whereas schedule d forms are used to report personal gains, irs form 4797 is used to report profits from real estate transactions centered on business use. The involuntary conversion of property and.

Form 4797 1996 Fill out & sign online DocHub

Under section 512(b)(5), sales of property are exempt from unrelated business tax and are not reported on form 4797 or schedule d unless one of the following. The sale or exchange of property. Inventory or other property held for sale to customers Web overview the schedule d form is what most people use to report capital gains and losses that.

Schedule K 1 Form 1040 2021 Tax Forms 1040 Printable

Web the disposition of capital assets not reported on schedule d. The sale or exchange of property. Web overview the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Complete, edit or print tax forms instantly. Web answer report the gain or.

IRS 990 Schedule H 2019 Fill and Sign Printable Template Online

The involuntary conversion of property and. Web according to the irs, you should use your 4797 form to report all of the following: Get ready for tax season deadlines by completing any required tax forms today. Schedule d transfers to 1040 and is typically taxed at capital gain tax rates. Form 8949 if you sell investments or your.

Publication 225 Farmer's Tax Guide; Preparing the Return

Web the disposition of capital assets not reported on schedule d. However, part of the gain on the sale or exchange of the depreciable property may have to be recaptured as. Web 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Form 8949 if you sell investments.

Publication 925 Passive Activity and AtRisk Rules; Publication 925

Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Web answer report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other dispositions of capital. The involuntary conversion of property.

Schedule D Capital Gains and Losses Definition

Web final k1 tax computation schedule d vs 4797 i received a 'final k1' with following details: However, part of the gain on the sale or exchange of the depreciable property may have to be recaptured as. 10000 part 3, box 10 (net. Web according to the irs, you should use your 4797 form to report all of the following:.

TaxHow » You Win Some, You Lose Some. And Then You File Schedule D

Web the disposition of capital assets not reported on schedule d. Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Web form 4797 and schedule d frequently asked questions photo: However, part of the gain on the sale or exchange of the depreciable property.

Web Form 4797, Sales Of Business Property Is Used To Report The Following Transactions:

Web overview the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Reported on schedule d • not. Web schedule d is used to report gains from personal investments, while form 4797 is used to report gains from real estate dealings—those that are done primarily in. Web generally, the gain is reported on form 8949 and schedule d.

Complete, Edit Or Print Tax Forms Instantly.

Web answer report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other dispositions of capital. Web the disposition of capital assets not reported on schedule d. Property used in a trade or business. Web whereas schedule d forms are used to report personal gains, irs form 4797 is used to report profits from real estate transactions centered on business use.

Part 3, Box 2 (Net Rental Real Estate Income):

However, part of the gain on the sale or exchange of the depreciable property may have to be recaptured as. The sale or exchange of: Web sale information is not appearing on form 4797 or schedule d. 10000 part 3, box 10 (net.

The Involuntary Conversion Of Property And.

Web form 4797 and schedule d frequently asked questions photo: Fstop123 / getty images all gains and losses aren't equal when you're paying taxes, especially. Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Web according to the irs, you should use your 4797 form to report all of the following:

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)