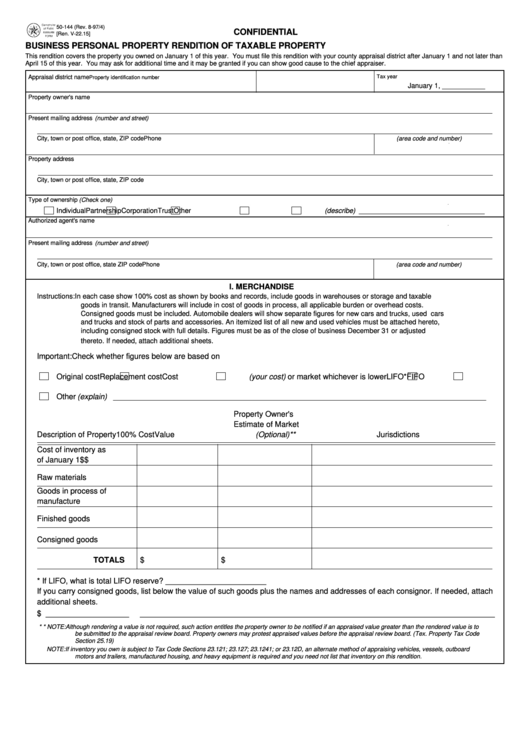

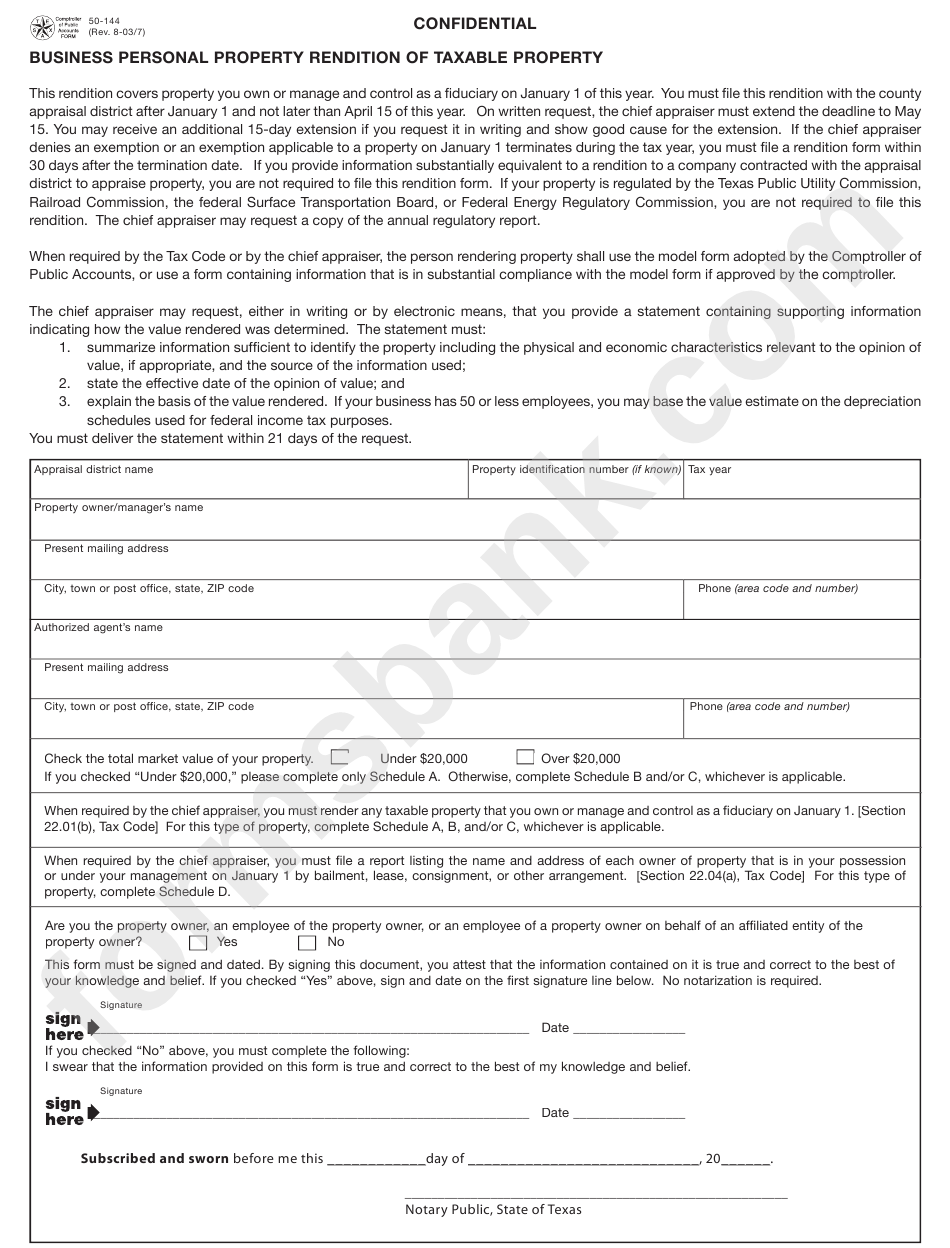

Form 50 144

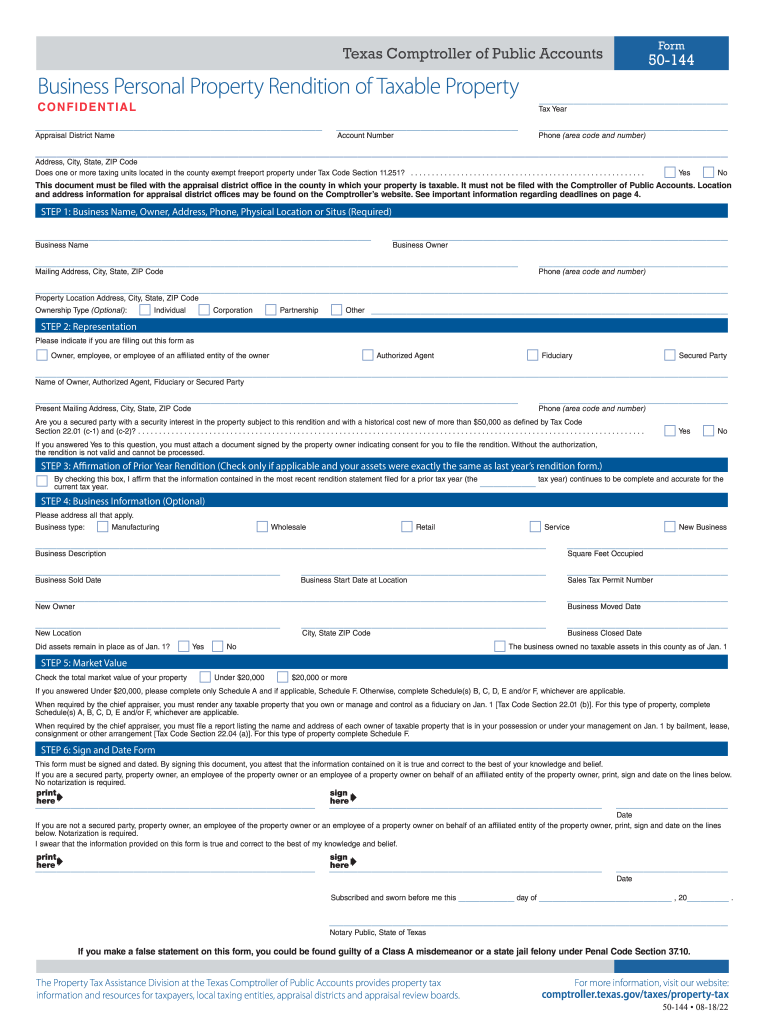

Form 50 144 - Business personal property rendition of taxable property. Good faith estimate of market. Web how it works upload the 50 144 edit & sign form 50 144 fort bend from anywhere save your changes and share 50 144 form what makes the 50 144 legally valid? Web video instructions and help with filling out and completing texas comptroller form 50 144. Web click on new document and choose the form importing option: This form is for use in rendering, pursu. Web form # efile pdf; Web edit form 50 144 2020. This document must be filed with the appraisal district office in the county in which your. Web find and fill out the correct texas comptroller of public accounts form 50 144.

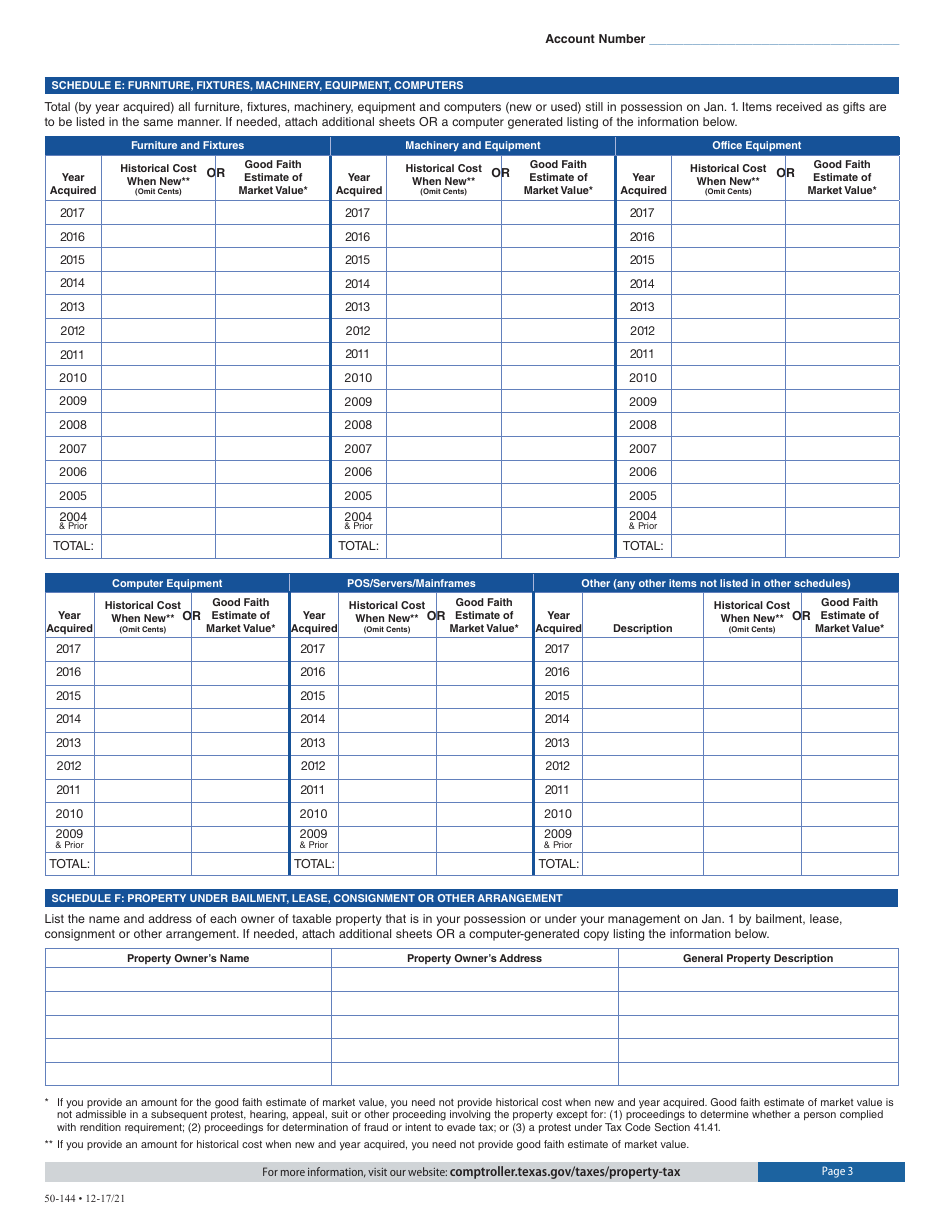

Easily add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your paperwork. 2023 normal useful life and depreciation schedule; Estimate of quantity of each type. Web video instructions and help with filling out and completing texas comptroller form 50 144. Please print and complete the form (s) and return with any additional required information to: Web click on new document and choose the form importing option: Good faith estimate of market. This document must be filed with the appraisal district office in the county in which your. Web there is no charge to file for any exemption. General property description by type/category.

Please print and complete the form (s) and return with any additional required information to: Choose the correct version of the. This document must be filed with the appraisal district office in the county in which your. Disabled veterans or survivor’s exemption: Web how it works upload the 50 144 edit & sign form 50 144 fort bend from anywhere save your changes and share 50 144 form what makes the 50 144 legally valid? This video will help you deal with the form 50 144 property tax without any problems. Business personal property rendition of taxable (galveston central appraisal district) form. Make adjustments to the sample. Web there is no charge to file for any exemption. This form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on jan.

Fillable Form 50144 Business Personal Property Rendition Of Taxable

Choose the correct version of the. Disabled veterans or survivor’s exemption: Business personal property rendition of taxable property. Easily add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your paperwork. This form is for use in rendering, pursu.

Form 50144 Business Personal Property Rendition Of Taxable Property

Web there is no charge to file for any exemption. Disabled veterans or survivor’s exemption: Web video instructions and help with filling out and completing texas comptroller form 50 144. This form is for use in rendering, pursu. Business personal property rendition of taxable property.

(Form 144)

Web how it works upload the 50 144 edit & sign form 50 144 fort bend from anywhere save your changes and share 50 144 form what makes the 50 144 legally valid? Upload form 50 144 from your device, the cloud, or a protected link. This document must be filed with the appraisal district office in the county in.

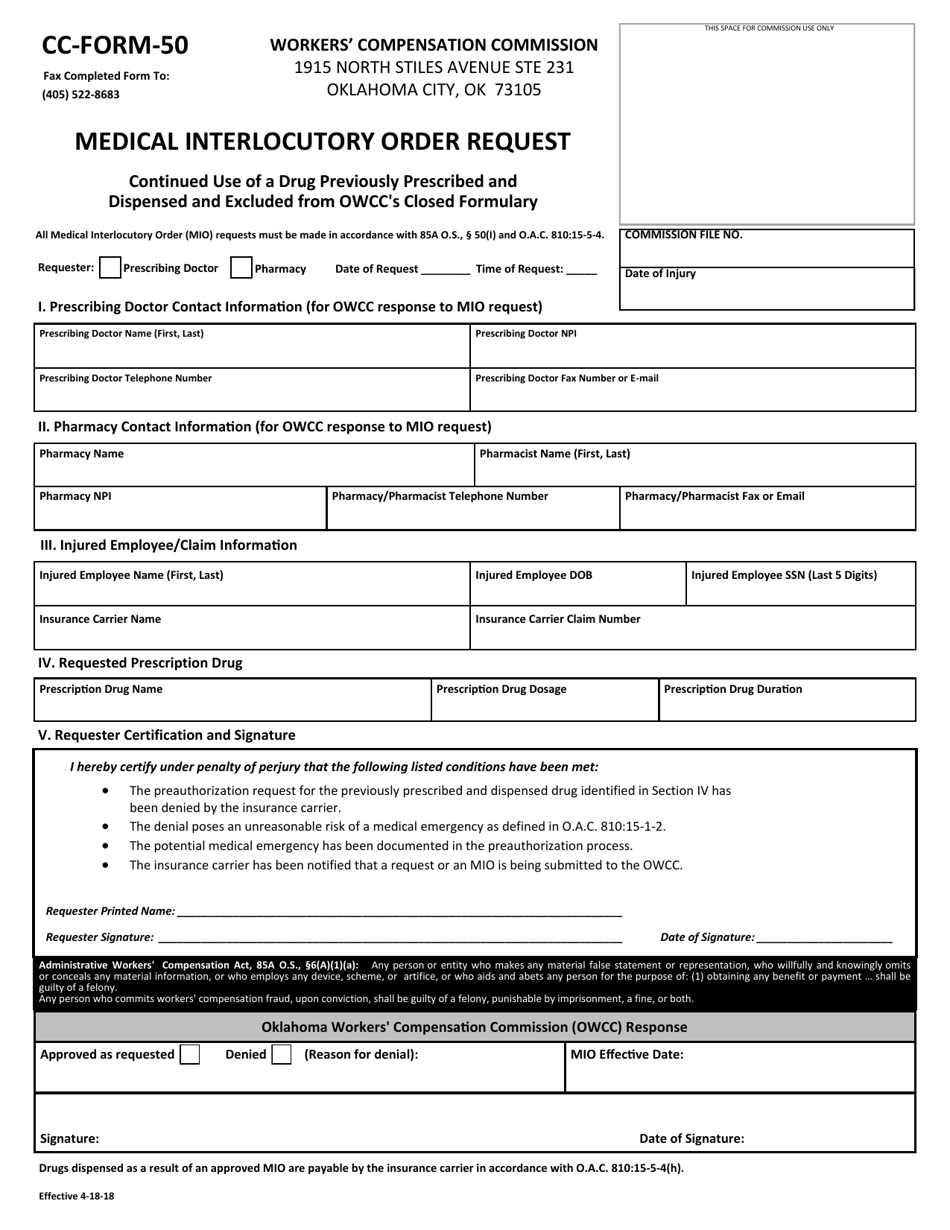

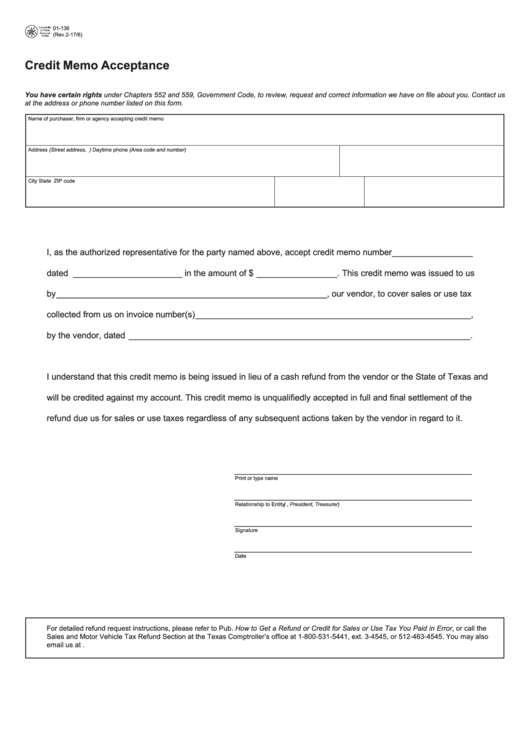

CC Form 50 Download Fillable PDF or Fill Online Medical Interlocutory

Choose the correct version of the. This form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on jan. General property description by type/category. Web how it works upload the 50 144 edit & sign form 50 144 fort bend from anywhere save your changes and share.

Parcial Integrador C Economía I (2015) UES 21

2023 normal useful life and depreciation schedule; This document must be filed with the appraisal district office in the county in which your. Web edit form 50 144 2020. Business personal property rendition of taxable (galveston central appraisal district) form. Web find and fill out the correct texas comptroller of public accounts form 50 144.

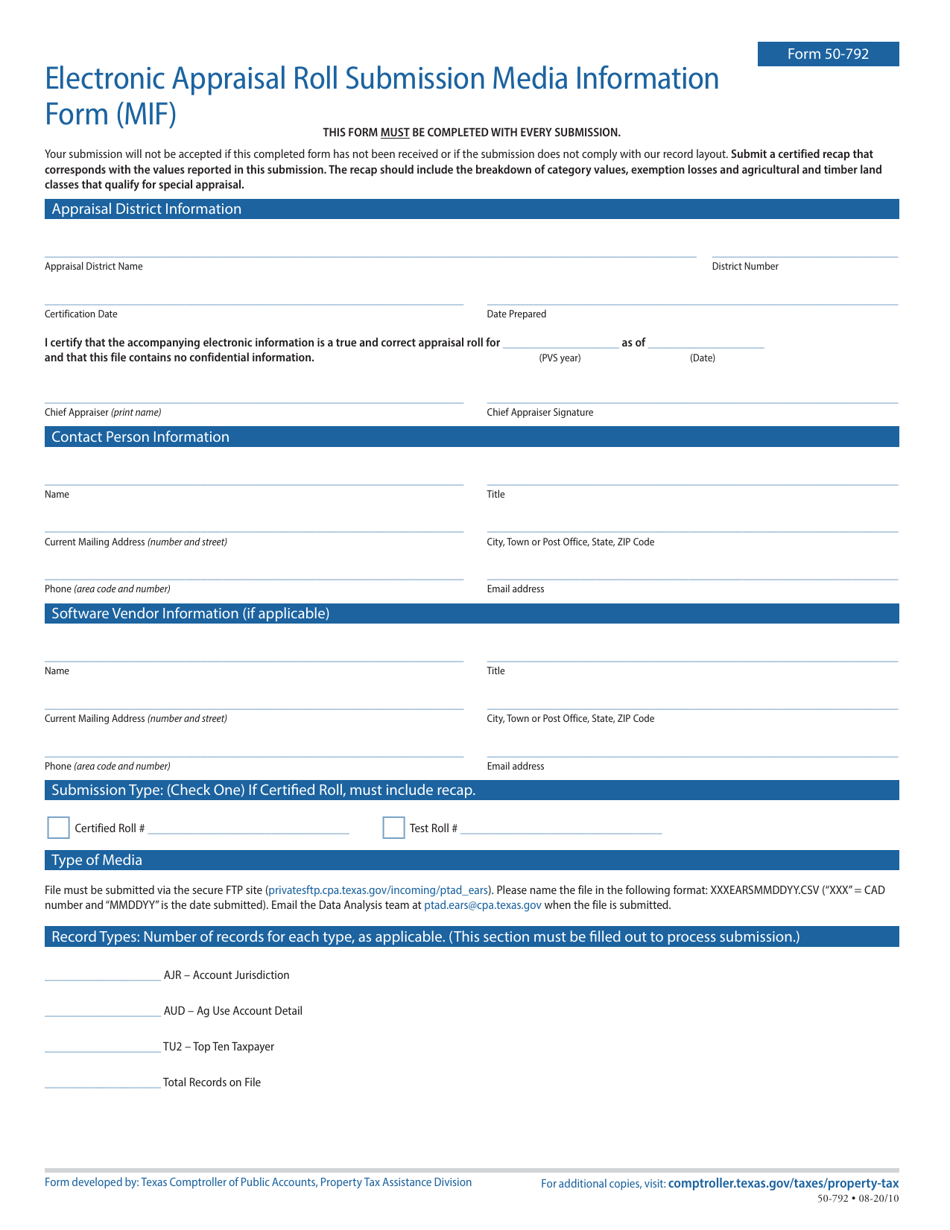

Form 50792 Download Fillable PDF or Fill Online Electronic Appraisal

Business personal property rendition of taxable property. Web video instructions and help with filling out and completing texas comptroller form 50 144. This video will help you deal with the form 50 144 property tax without any problems. Web how it works upload the 50 144 edit & sign form 50 144 fort bend from anywhere save your changes and.

Form 50144 Fill Out, Sign Online and Download Fillable PDF, Texas

Good faith estimate of market. Web find and fill out the correct texas comptroller of public accounts form 50 144. 2023 normal useful life and depreciation schedule; Web click on new document and choose the form importing option: General property description by type/category.

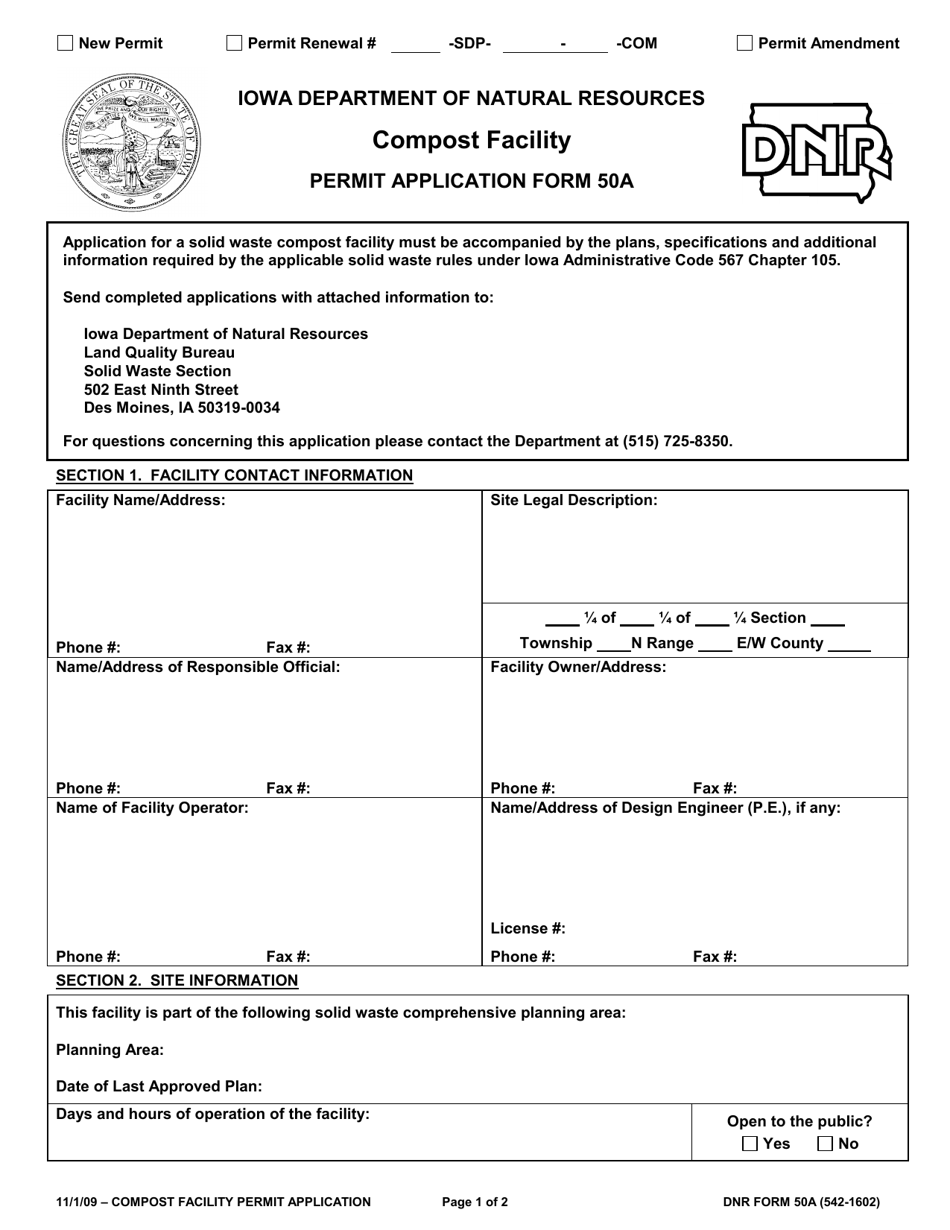

Form 50A (DNR Form 5421602) Download Fillable PDF or Fill Online

Web form # efile pdf; Business personal property rendition of taxable property. Make adjustments to the sample. Web find and fill out the correct texas comptroller of public accounts form 50 144. This document must be filed with the appraisal district office in the county in which your.

985 Texas Tax Forms And Templates free to download in PDF

Web find and fill out the correct texas comptroller of public accounts form 50 144. Upload form 50 144 from your device, the cloud, or a protected link. General property description by type/category. Make adjustments to the sample. This form is for use in rendering, pursu.

Form 50 144 Fill Out and Sign Printable PDF Template signNow

Web there is no charge to file for any exemption. This document must be filed with the appraisal district office in the county in which your. Business personal property rendition of taxable property. 2023 normal useful life and depreciation schedule; Make adjustments to the sample.

Web How It Works Upload The 50 144 Edit & Sign Form 50 144 Fort Bend From Anywhere Save Your Changes And Share 50 144 Form What Makes The 50 144 Legally Valid?

Please print and complete the form (s) and return with any additional required information to: Web denton county clerk redaction public procedures and information (pdf) denton county clerk redaction request form (pdf) marriage application (pdf) marriage record. Upload form 50 144 from your device, the cloud, or a protected link. Choose the correct version of the.

Web Video Instructions And Help With Filling Out And Completing Texas Comptroller Form 50 144.

This form is for use in rendering, pursu. General property description by type/category. Web edit form 50 144 2020. Make adjustments to the sample.

Business Personal Property Rendition Of Taxable (Galveston Central Appraisal District) Form.

Estimate of quantity of each type. Easily add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your paperwork. Web click on new document and choose the form importing option: This video will help you deal with the form 50 144 property tax without any problems.

Good Faith Estimate Of Market.

This document must be filed with the appraisal district office in the county in which your. This form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on jan. Business personal property rendition of taxable property. 2023 normal useful life and depreciation schedule;