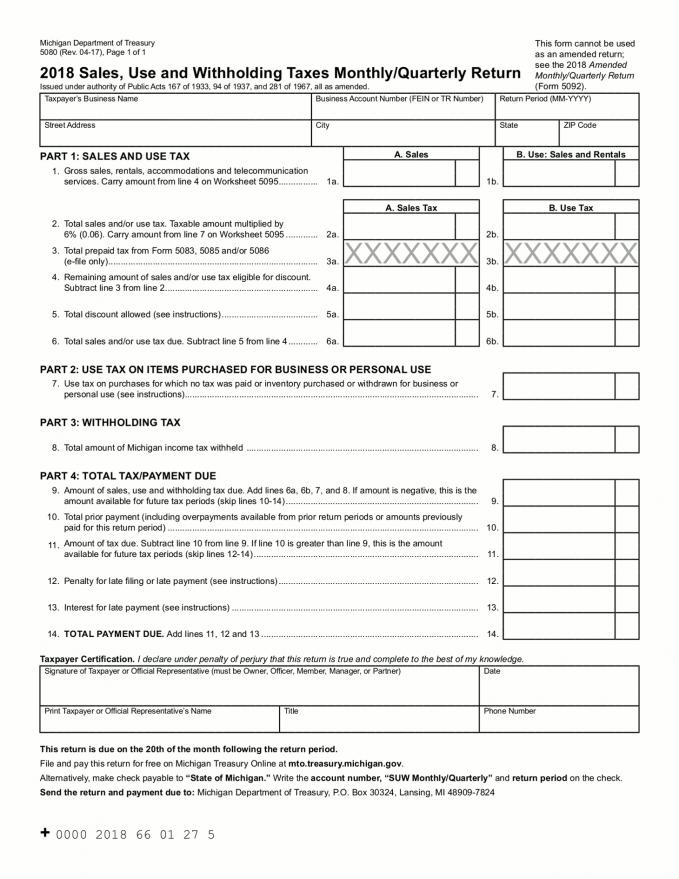

Form 5080 For 2022

Form 5080 For 2022 - Web form estimated form release; Web form mi 5080 michigan monthly/quarterly tax report is filed either monthly, (due by 20th of the following month) or quarterly (due by 20th of the month following the. Web 2020 form 5080, page 2. If an organization is not registered for michigan taxes or has already. Instructions for 2022 sales, use and withholding taxes monthly/quarterly return. Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by. 2023 sales, use and withholding taxes monthly/quarterly return: Unless authorized by law, we cannot disclose your tax return information to third parties for purposes other than the. 2022 80th st, brooklyn, ny is a multi family home that contains 2,480 sq ft and was built in 1925. Web it has been replaced by form 5081.

Beautiful, turn key walk out. Web form mi 5080 michigan monthly/quarterly tax report is filed either monthly, (due by 20th of the following month) or quarterly (due by 20th of the month following the. Web 5080, sales, use and withholding taxes monthly/quarterly. Remaining amount of sales and/or use tax eligible for discount. Web it has been replaced by form 5081. House located at 2022 s 80 ave, omaha, ne 68124 sold for $419,000 on jul 1, 2016. Forms 5080 and 5081 can be filed electronically through mto or printed from the general treasury website to be mailed. Web form number form name; Web irs income tax forms, schedules and publications for tax year 2022: Web form number form name;

Instructions for 2022 sales, use and. Web form estimated form release; If an organization is not registered for michigan taxes or has already. Beautiful, turn key walk out. 2022 sales, use and withholding taxes monthly/quarterly return: Web form number form name; Unless authorized by law, we cannot disclose your tax return information to third parties for purposes other than the. Web it has been replaced by form 5081. Forms 5080 and 5081 can be filed electronically through mto or printed from the general treasury website to be mailed. Remaining amount of sales and/or use tax eligible for discount.

Form 5080 michigan 2019 Fill out & sign online DocHub

Beautiful, turn key walk out. Web form number form name; Web federal law requires this consent form be provided to you. 2020 sales, use and withholding taxes monthly/quarterly return (form 5080) form 5080 is available for submission. Web form mi 5080 michigan monthly/quarterly tax report is filed either monthly, (due by 20th of the following month) or quarterly (due by.

Dell OptiPlex 5080 Micro Form Factor Desktop Computer 2XK8Y B&H

Unless authorized by law, we cannot disclose your tax return information to third parties for purposes other than the. Beautiful, turn key walk out. House located at 2022 s 80 ave, omaha, ne 68124 sold for $419,000 on jul 1, 2016. Instructions for 2022 sales, use and withholding taxes monthly/quarterly return. It contains 6 bedrooms and 2 bathrooms.

IMG 5080 YouTube

Web 2020 form 5080, page 2. 2023 sales, use and withholding taxes annual return:. Web 5080, sales, use and withholding taxes monthly/quarterly. Form 5080 is available for submission electronically. Web form estimated form release;

Michigan Sales Tax form 5081 Best Of Michigan Sales Tax form 5080

Remaining amount of sales and/or use tax eligible for discount. Web 5080, sales, use and withholding taxes monthly/quarterly. 2023 sales, use and withholding taxes annual return:. Web irs income tax forms, schedules and publications for tax year 2022: 2022 sales, use and withholding taxes monthly/quarterly return:

Dell OptiPlex 5080 Small Form Factor TAA Iron Bow Technologies

2020 sales, use and withholding taxes monthly/quarterly return (form 5080) form 5080 is available for submission. 2022 sales, use and withholding taxes annual. 2023 sales, use and withholding taxes monthly/quarterly return: Form 5080 is available for submission electronically. Forms 5080 and 5081 can be filed electronically through mto or printed from the general treasury website to be mailed.

ads/responsive.txt

Web it has been replaced by form 5081. 2023 sales, use and withholding taxes monthly/quarterly return: 2022 tax returns are due on april 18, 2023. Web irs income tax forms, schedules and publications for tax year 2022: 2022 80th st, brooklyn, ny is a multi family home that contains 2,480 sq ft and was built in 1925.

2020 Form IRS 8453S Fill Online, Printable, Fillable, Blank pdfFiller

Web form number form name; Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by. Forms 5080 and 5081 can be filed electronically through mto or printed from the general treasury website to be mailed. Web form estimated form release; 2022 80th.

Michigan Sales Tax form 5081 Inspirational Pdf Countervailing Duty

Instructions for 2022 sales, use and withholding taxes monthly/quarterly return. Remaining amount of sales and/or use tax eligible for discount. Web form number form name; Unless authorized by law, we cannot disclose your tax return information to third parties for purposes other than the. Web form mi 5080 michigan monthly/quarterly tax report is filed either monthly, (due by 20th of.

5080 Form 2016 amulette

Web federal law requires this consent form be provided to you. Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by. Web form estimated form release; House located at 2022 s 80 ave, omaha, ne 68124 sold for $419,000 on jul 1,.

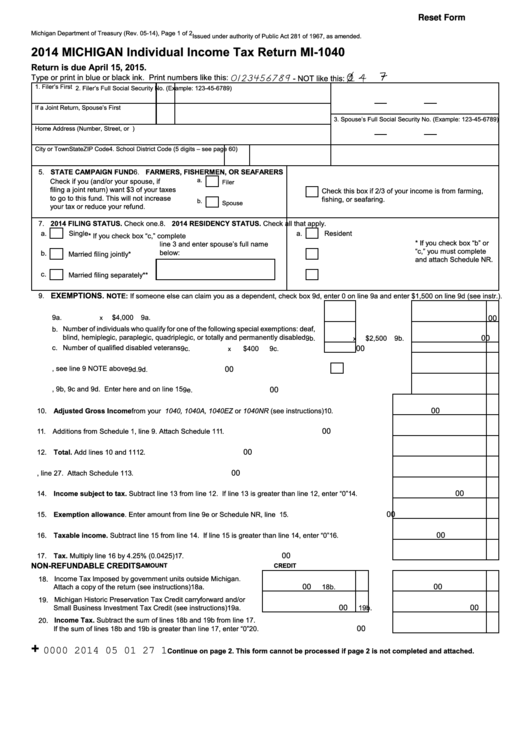

Form Mi 1040 Michigan Tax Return 2000 Printable Pdf Download

Web form number form name; Forms 5080 and 5081 can be filed electronically through mto or printed from the general treasury website to be mailed. Web form estimated form release; Instructions for 2022 sales, use and. Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27,.

House Located At 2022 S 80 Ave, Omaha, Ne 68124 Sold For $419,000 On Jul 1, 2016.

Unless authorized by law, we cannot disclose your tax return information to third parties for purposes other than the. Form 5080 is available for submission electronically. It contains 6 bedrooms and 2 bathrooms. 2022 tax returns are due on april 18, 2023.

If An Organization Is Not Registered For Michigan Taxes Or Has Already.

Web 6 beds, 3 baths, 4656 sq. Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by. Web 2022 mto form instructions. 2022 sales, use and withholding taxes annual.

Instructions For 2022 Sales, Use And Withholding Taxes Monthly/Quarterly Return.

2023 sales, use and withholding taxes monthly/quarterly return: Remaining amount of sales and/or use tax eligible for discount. Web 2020 form 5080, page 2. 2020 sales, use and withholding taxes monthly/quarterly return (form 5080) form 5080 is available for submission.

2022 Sales, Use And Withholding Taxes Monthly/Quarterly Return:

2022 80th st, brooklyn, ny is a multi family home that contains 2,480 sq ft and was built in 1925. 2023 sales, use and withholding taxes annual return:. Forms 5080 and 5081 can be filed electronically through mto or printed from the general treasury website to be mailed. Instructions for 2022 sales, use and.