Form 5329 2020

Form 5329 2020 - Web iras for 2020 than is allowable or you had an amount on line 25 of your 2019 form 5329. Complete, edit or print tax forms instantly. Web for information on filing form 5329, see reporting additional taxes, later. Try it for free now! Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, hsas, or able. Use form 5329 to report additional taxes on iras, other qualified. If you timely filed your 2020 tax return. This form is called “additional taxes on. Open your return and click on search on the top of your screen. Web this form is used to report additional taxes on:

Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, hsas, or able. This form is called “additional taxes on. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Web to fill out form 5329: Web this form is used to report additional taxes on: Open your return and click on search on the top of your screen. Complete, edit or print tax forms instantly. Upload, modify or create forms. Use form 5329 to report additional taxes on iras, other qualified. If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the.

Enter your excess contributions from line 24 of your 2019 form 5329. Web this form is used to report additional taxes on: Excess contributions withdrawn by due date of return. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Use form 5329 to report additional taxes on iras, other qualified. Try it for free now! Complete, edit or print tax forms instantly. Web for information on filing form 5329, see reporting additional taxes, later. This form is called “additional taxes on. Web to fill out form 5329:

IRS Approves New Option for Structured Settlements!

Upload, modify or create forms. Use form 5329 to report additional taxes on iras, other qualified. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the. Web this form is used to.

Form 5329 Instructions & Exception Information for IRS Form 5329

Upload, modify or create forms. Department of the treasury internal revenue service. Web to fill out form 5329: Web for information on filing form 5329, see reporting additional taxes, later. Excess contributions withdrawn by due date of return.

irs form 5329 missed rmd 2019 2020 Fill Online, Printable, Fillable

This form is called “additional taxes on. If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the. In the search box, type form 5329 and click on the magnifying glass icon on the. Try it for free now! Web to fill out form 5329:

Fill Free fillable Form 5329 2019 Additional Taxes on Qualified Plans

Enter your excess contributions from line 24 of your 2019 form 5329. Excess contributions withdrawn by due date of return. This form is called “additional taxes on. Web for information on filing form 5329, see reporting additional taxes, later. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years.

Form 5329 Edit, Fill, Sign Online Handypdf

Excess contributions withdrawn by due date of return. Upload, modify or create forms. In the search box, type form 5329 and click on the magnifying glass icon on the. Department of the treasury internal revenue service. If you timely filed your 2020 tax return.

Sample Letter To Irs To Waive Late Penalty Ideas nomatterwadiwill

If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Use form 5329 to report.

How to fill out Form 5329.. Avoid Required Minimum Distribution 50

Upload, modify or create forms. Web go to www.irs.gov/form5329 for instructions and the latest information. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Try it for free now! This form is called “additional taxes on.

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Web iras for 2020 than is allowable or you had an amount on line 25 of your 2019 form 5329. Use form 5329 to report additional taxes on iras, other qualified. Open your return and click on search on the top of your screen. Web form 5329 is used by any individual who has established a retirement account, annuity or.

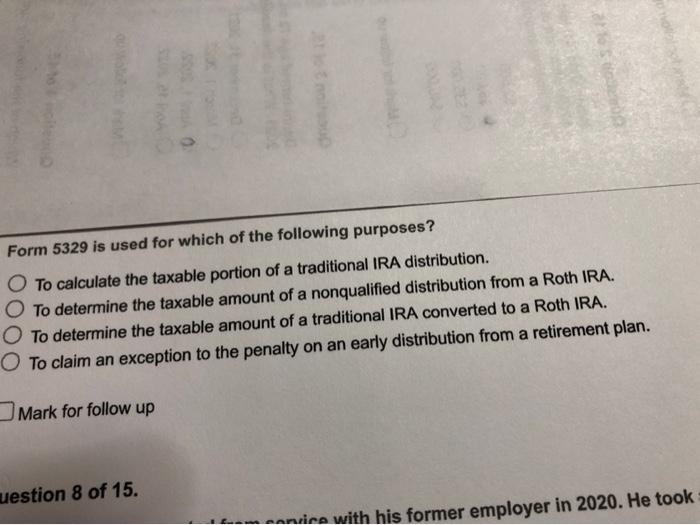

Solved Form 5329 is used for which of the following

In the search box, type form 5329 and click on the magnifying glass icon on the. Web go to www.irs.gov/form5329 for instructions and the latest information. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Enter your excess contributions from line 24 of your 2019 form 5329. Try it for free now!

Form 5329 Instructions & Exception Information for IRS Form 5329

Complete, edit or print tax forms instantly. This form is called “additional taxes on. In the search box, type form 5329 and click on the magnifying glass icon on the. Open your return and click on search on the top of your screen. Web go to www.irs.gov/form5329 for instructions and the latest information.

Web Go To Www.irs.gov/Form5329 For Instructions And The Latest Information.

Department of the treasury internal revenue service. Web this form is used to report additional taxes on: Web for information on filing form 5329, see reporting additional taxes, later. In the search box, type form 5329 and click on the magnifying glass icon on the.

If The Contributions Made To Your Traditional Ira, Roth Ira, Coverdell Esa, Archer Msa, Or Hsa Exceed Your Maximum Contribution Limit For The.

Use form 5329 to report additional taxes on iras, other qualified. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Web to fill out form 5329: Complete, edit or print tax forms instantly.

Try It For Free Now!

Web iras for 2020 than is allowable or you had an amount on line 25 of your 2019 form 5329. Open your return and click on search on the top of your screen. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Excess contributions withdrawn by due date of return.

Iras, Other Qualified Retirement Plans, Modified Endowment Contracts, Coverdell Esas, Qtps, Archer Msas, Hsas, Or Able.

Upload, modify or create forms. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Enter your excess contributions from line 24 of your 2019 form 5329. If you timely filed your 2020 tax return.