Form 5405 Pdf

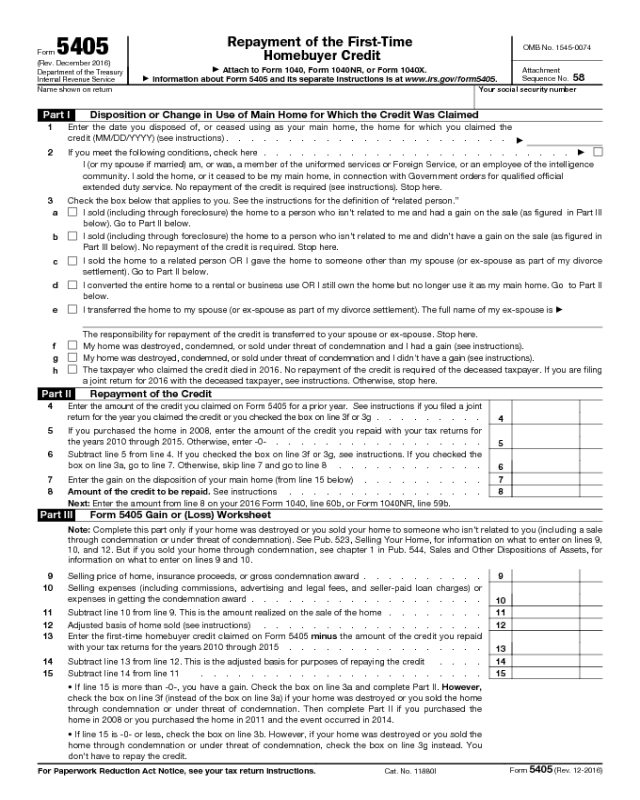

Form 5405 Pdf - Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. The form is used for the credit received if you bought a. Complete, edit or print tax forms instantly. December 2012) department of the treasury internal revenue service. Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web the pdf will only contain the 5405 form if you purchased your home in 2008 and you meet either of the following conditions: See instructions if you filed a joint return for the year you claimed the credit or you checked the box on line. Part iii form 5405 gain or (loss) worksheet. Get ready for tax season deadlines by completing any required tax forms today. Notify the irs that the home for which you claimed the credit was disposed of or.

You disposed of it in 2021. December 2010) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. In the case of a sale, including through foreclosure, this is the year in which. You disposed of it in 2022. Web form 5405 is a tax form used by individuals who have purchased a home for the first time or by those who have experienced a significant change in their home ownership status. November 2020) department of the treasury internal revenue service. The form is used for the credit received if you bought a. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be.

You disposed of it in 2021. Get ready for tax season deadlines by completing any required tax forms today. You ceased using it as your. Web enter the amount of the credit you claimed on form 5405 for a prior year. December 2012) department of the treasury internal revenue service. Web form 5405 is a tax form used by individuals who have purchased a home for the first time or by those who have experienced a significant change in their home ownership status. Notify the irs that the home for which you claimed the credit was disposed of or. Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and you meet either of the following conditions. See instructions if you filed a joint return for the year you claimed the credit or you checked the box on line. Web the irs requires you to prepare irs form 5405 before you can claim the credit.

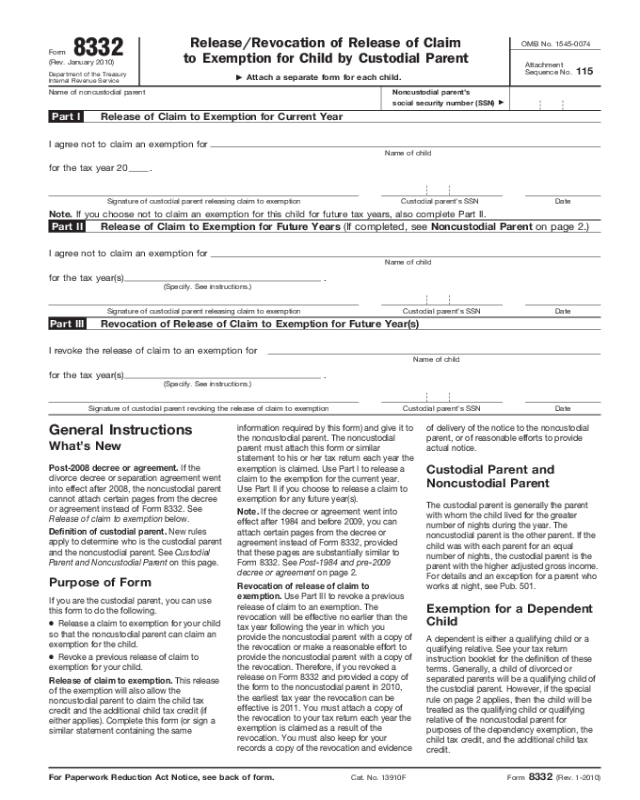

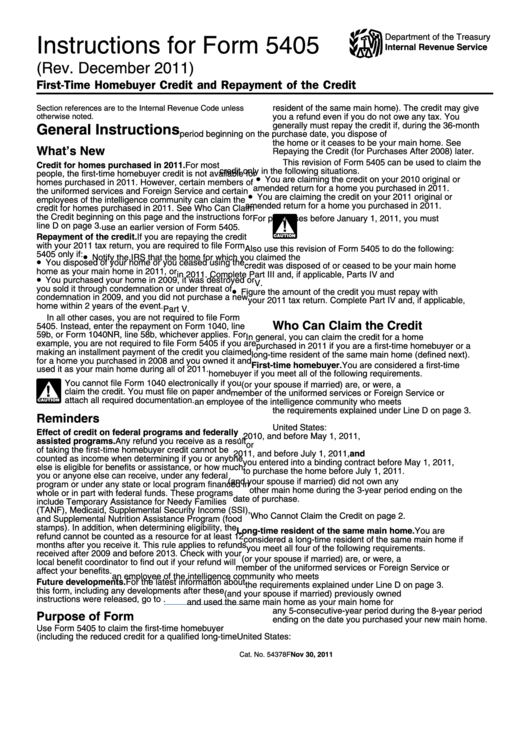

Download Instructions for IRS Form 5405 Repayment of the FirstTime

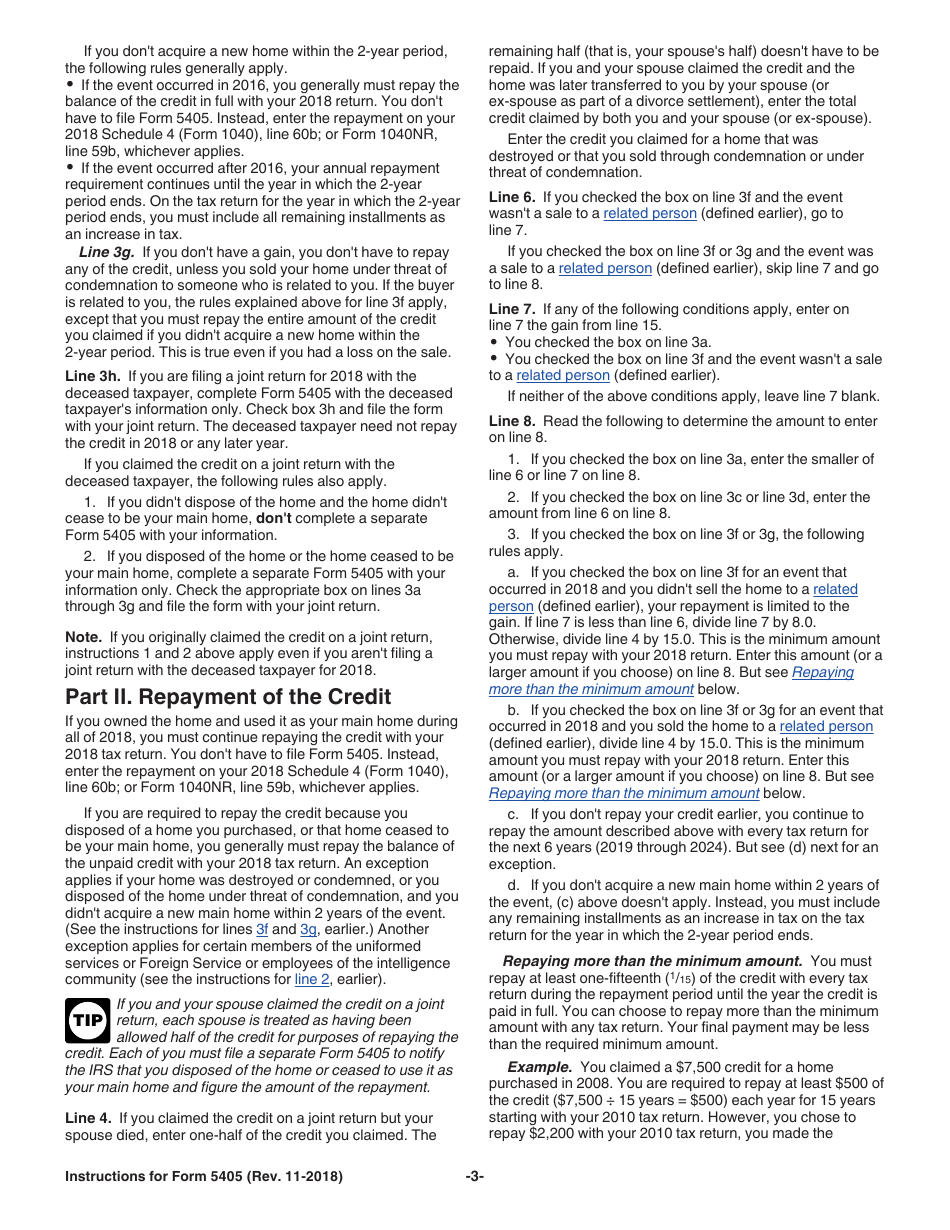

Web use form 5405 to do the following. December 2012) department of the treasury internal revenue service. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Attach to form 1040, form 1040nr,. December 2010) department of the treasury internal revenue service.

Fill Free fillable Repayment of the FirstTime Homebuyer Credit Form

See instructions if you filed a joint return for the year you claimed the credit or you checked the box on line. Attach to your 2009 or 2010. Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and you meet either of the following conditions. Get ready for tax season deadlines.

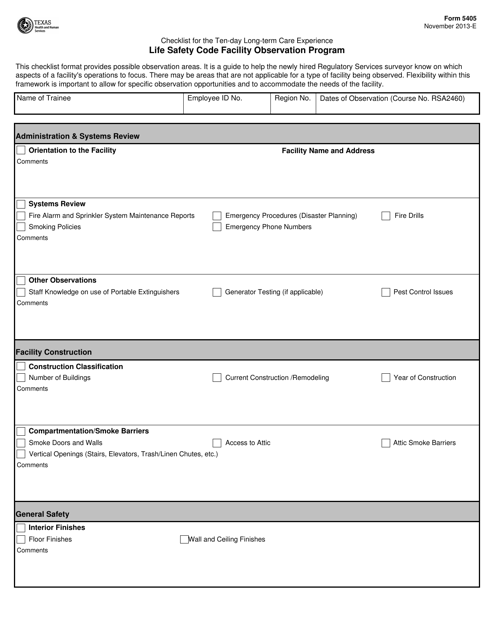

Form 5405 Download Fillable PDF or Fill Online Checklist for the Ten

Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. November 2020) department of the treasury internal revenue service. Attach to your 2009 or 2010. Web you must file form 5405 with your 2021 tax return if you purchased your home in 2008 and.

Popular Home Buyer Interest Form, House Plan App

Web the pdf will only contain the 5405 form if you purchased your home in 2008 and you meet either of the following conditions: Attach to your 2009 or 2010. The form is used for the credit received if you bought a. Part iii form 5405 gain or (loss) worksheet. Notice concerning fiduciary relationship 1122 11/16/2022 inst 56:

FIA Historic Database

Part iii form 5405 gain or (loss) worksheet. You disposed of it in 2021. December 2010) department of the treasury internal revenue service. Web download your fillable irs form 5405 in pdf at the end of the 2000s, residents of the united states who decided to buy a home for the first time could use a profitable. Attach to form.

Form 5405 Edit, Fill, Sign Online Handypdf

In the case of a sale, including through foreclosure, this is the year in which. Attach to your 2009 or 2010. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be. December 2010) department of the treasury internal revenue service. You disposed of it in 2022.

Instructions For Form 5405 FirstTime Homebuyer Credit And Repayment

December 2010) department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Attach to form 1040, form 1040nr,. You disposed of it in 2022. Web enter the amount of the credit you claimed on form 5405 for a prior year.

Form 5405 FirstTime Homebuyer Credit and Repayment of the Credit

Web the pdf will only contain the 5405 form if you purchased your home in 2008 and you meet either of the following conditions: Web the irs requires you to prepare irs form 5405 before you can claim the credit. Get ready for tax season deadlines by completing any required tax forms today. December 2010) department of the treasury internal.

FIA Historic Database

Attach to your 2009 or 2010. See instructions if you filed a joint return for the year you claimed the credit or you checked the box on line. Attach to form 1040, form 1040nr,. November 2020) department of the treasury internal revenue service. Web form 5405 needs to be completed in the year the home is disposed of or ceases.

2020 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

You disposed of it in 2022. Notify the irs that the home for which you claimed the credit was disposed of or. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home. Part iii form 5405 gain or (loss) worksheet. In the case of a sale, including through.

In The Case Of A Sale, Including Through Foreclosure, This Is The Year In Which.

You disposed of it in 2022. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home. You disposed of it in 2021. December 2010) department of the treasury internal revenue service.

Web The Irs Requires You To Prepare Irs Form 5405 Before You Can Claim The Credit.

Complete, edit or print tax forms instantly. December 2010) department of the treasury internal revenue service. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web use form 5405 to do the following.

Part Iii Form 5405 Gain Or (Loss) Worksheet.

Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be. Attach to form 1040, form 1040nr,. Notify the irs that the home for which you claimed the credit was disposed of or. The form is used for the credit received if you bought a.

You Disposed Of It In 2022.

You ceased using it as your. December 2012) department of the treasury internal revenue service. November 2020) department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)