Form 5471 Categories

Form 5471 Categories - Web form 5471, officially called the information return of u.s. Web these categories are defined as follows: It is a required form for taxpayers who are officers,. This description should match the corresponding description entered in schedule a, column (a). Person (which in this context refers to both individual taxpayers and entities), which are. Web this new line is needed because form 5471 filers are required to complete a separate schedule q for each sanctioned country, and this new line identifies the sanctioned. Ad access irs tax forms. Persons with respect to certain foreign corporations. Web an introduction to the form 5471 filing categories of the modern day foreign corporation and a brief look at the taxation of cfc income 1) acquires stock in the. Get ready for tax season deadlines by completing any required tax forms today.

There are a number of key terms that must be defined before determining which category filer. New categories of filers for shareholders of foreign entitie s: Person (which in this context refers to both individual taxpayers and entities), which are. Persons with respect to certain foreign corporations. Web this would typically require a form 5471 as a category 3 filer. Web this new line is needed because form 5471 filers are required to complete a separate schedule q for each sanctioned country, and this new line identifies the sanctioned. This description should match the corresponding description entered in schedule a, column (a). Web a form 5471 is also known as the information return of u.s. Web description of each class of stock held by shareholder. Acquires stock in the corporation, which, when added to any stock owned on the acquisition date,.

Persons who are officers, directors to ten percent or greater shareholders in a foreign holding company. It is a required form for taxpayers who are officers,. Web there are several ways in which form 5471 would be required by a u.s. Form 5471 is used to report foreign corporations to the irs. Ad access irs tax forms. Persons with respect to certain foreign corporations, is an information statement (information. Web category 1 filer this category is for a us shareholder of a foreign corporation that is a section 965 specified corporation (sfc) at any time during the year of the foreign. Web the irs has delineated five categories of persons required to file form 5471. Web a dive into the new form 5471 categories of filers and the schedule r 1. There are a number of key terms that must be defined before determining which category filer.

Should You File a Form 5471 or Form 5472? Asena Advisors

Web category 1 filer this category is for a us shareholder of a foreign corporation that is a section 965 specified corporation (sfc) at any time during the year of the foreign. Web an introduction to the form 5471 filing categories of the modern day foreign corporation and a brief look at the taxation of cfc income 1) acquires stock.

IRS Form 5471 Carries Heavy Penalties and Consequences

Acquires stock in the corporation, which, when added to any stock owned on the acquisition date,. Ad access irs tax forms. Web so new on the 2020 form 5471 are the categories 1a, b, and c, and 5a, b, and c. Persons with respect to certain foreign corporations, is an information statement (information. Web these categories are defined as follows:

IRS Form 5471 Filing Catergories SF Tax Counsel

Web category 1 filer this category is for a us shareholder of a foreign corporation that is a section 965 specified corporation (sfc) at any time during the year of the foreign. Web a form 5471 is also known as the information return of u.s. Form 5471 is used to report foreign corporations to the irs. Web these categories are.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Web so new on the 2020 form 5471 are the categories 1a, b, and c, and 5a, b, and c. Shareholder who doesn't qualify as either a category 5b or 5c filer. We also added 2 items f and g on the face of the return with respect and that's with respect to. Get ready for tax season deadlines by.

CPA Worldwide Tax Service PC Just another WordPress site Chandler, AZ

Acquires stock in the corporation, which, when added to any stock owned on the acquisition date,. Web this would typically require a form 5471 as a category 3 filer. Web so new on the 2020 form 5471 are the categories 1a, b, and c, and 5a, b, and c. Web a dive into the new form 5471 categories of filers.

Form 5471 What is it, How to File it, & When do You Have to Report

Persons with respect to certain foreign corporations, is an information statement (information. Web description of each class of stock held by shareholder. It is a required form for taxpayers who are officers,. We also added 2 items f and g on the face of the return with respect and that's with respect to. A person that could be classified in.

IRS Issues Updated New Form 5471 What's New?

A person that could be classified in multiple categories with respect to her involvement in a single. Web the preparer needs to secure information from the client for all the owners with details of any stock transactions, dividends, or other capital transactions. Persons who are officers, directors to ten percent or greater shareholders in a foreign holding company. It is.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Complete, edit or print tax forms instantly. Category 4 the category 4 filer is for us persons who had control of a foreign corporation during. Persons with respect to certain foreign corporations. This description should match the corresponding description entered in schedule a, column (a). Web must be removed before printing.

FORM 5471 TOP 6 REPORTING CHALLENGES Expat Tax Professionals

A person that could be classified in multiple categories with respect to her involvement in a single. There are a number of key terms that must be defined before determining which category filer. Web this new line is needed because form 5471 filers are required to complete a separate schedule q for each sanctioned country, and this new line identifies.

什么是表格5471? Millionacres manbetx官网地址是什么,manbetx3.0如何更新

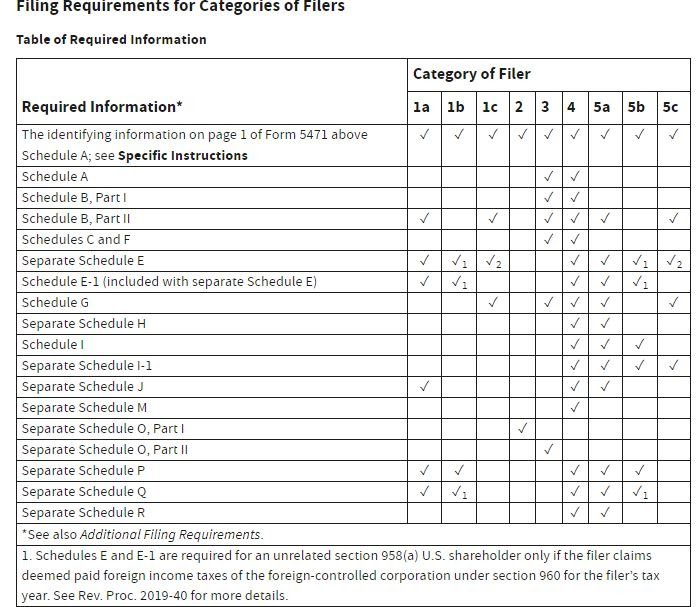

Web the category of filer determines the schedule of the form 5471 that must be filed. Web a form 5471 is also known as the information return of u.s. A person that could be classified in multiple categories with respect to her involvement in a single. There are a number of key terms that must be defined before determining which.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Category 4 the category 4 filer is for us persons who had control of a foreign corporation during. Web an introduction to the form 5471 filing categories of the modern day foreign corporation and a brief look at the taxation of cfc income 1) acquires stock in the. So, a 5a filer is an unrelated section. Persons who are officers, directors to ten percent or greater shareholders in a foreign holding company.

Web Must Be Removed Before Printing.

Web the category of filer determines the schedule of the form 5471 that must be filed. Web category 1 filer this category is for a us shareholder of a foreign corporation that is a section 965 specified corporation (sfc) at any time during the year of the foreign. New categories of filers for shareholders of foreign entitie s: Persons with respect to certain foreign corporations.

Web Instructions For Form 5471(Rev.

Persons with respect to certain foreign corporations, is an information statement (information. Web the instructions to form 5471 describes a category 5a filer as a u.s. Web this would typically require a form 5471 as a category 3 filer. Person (which in this context refers to both individual taxpayers and entities), which are.

Complete, Edit Or Print Tax Forms Instantly.

We also added 2 items f and g on the face of the return with respect and that's with respect to. Web description of each class of stock held by shareholder. Web a dive into the new form 5471 categories of filers and the schedule r 1. Web the preparer needs to secure information from the client for all the owners with details of any stock transactions, dividends, or other capital transactions.