Form 5471 Instructions 2021

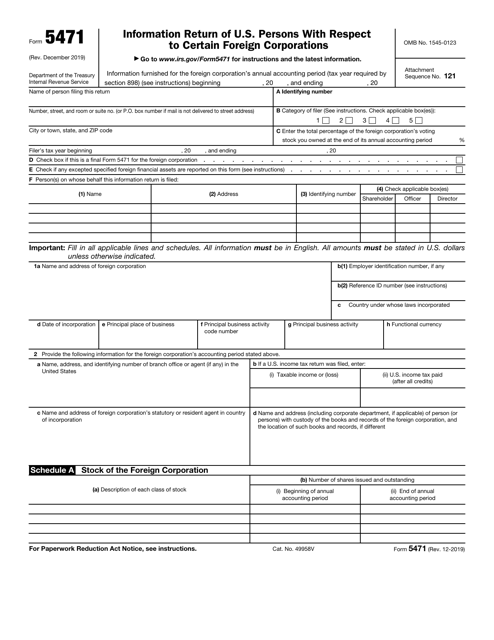

Form 5471 Instructions 2021 - Web the instructions to form 5471 describes a category 5a filer as a u.s. Form 5471 is generally due to be filed at the same time the filer’s tax return is due to be filed (including extensions). Web when a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. Web must be removed before printing. The december 2021 revision of separate. This is the first video in a series which covers the preparation of irs form. It’s intended to provide the irs with a record of which us citizens and residents have ownership of foreign corporations. Persons described in categories of filers below must complete. Web there are lots of schedules and complicated rules, so if you are uncomfortable preparin. Form 5471 has different requirements and instructions for each type of filer, and within each category there are subcategories representing certain.

Web 12/28/2021 form 5471 (schedule m) transactions between controlled foreign corporation and shareholders or other related persons 1221 12/28/2021 inst 5471: January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Form 5471 is a relatively detailed form. We will also attempt to provide guidance as to how to prepare this. Persons described in categories of filers below must complete. Form 5471 is generally due to be filed at the same time the filer’s tax return is due to be filed (including extensions). December 2022) department of the treasury internal revenue service. Web in january of 2021, just keep in mind, tcja came out at the end of 2018 and changed the rules for filing form 5471, because the downward attribution of stock from a foreign. So, a 5a filer is an unrelated section. Web when a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471.

Web must be removed before printing. Web there are lots of schedules and complicated rules, so if you are uncomfortable preparin. Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to. The name of the person filing form 5471 is generally the name of the u.s. Web information about form 5471, information return of u.s. Web instructions for form 5471(rev. Form 5471 as actually filed. Web the instructions to form 5471 describes a category 5a filer as a u.s. Web when a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471.

IRS Form 5471 Carries Heavy Penalties and Consequences

Web in january of 2021, just keep in mind, tcja came out at the end of 2018 and changed the rules for filing form 5471, because the downward attribution of stock from a foreign. Form 5471 as actually filed. Persons with respect to certain foreign corporations. Web must be removed before printing. Web instructions for form 5471(rev.

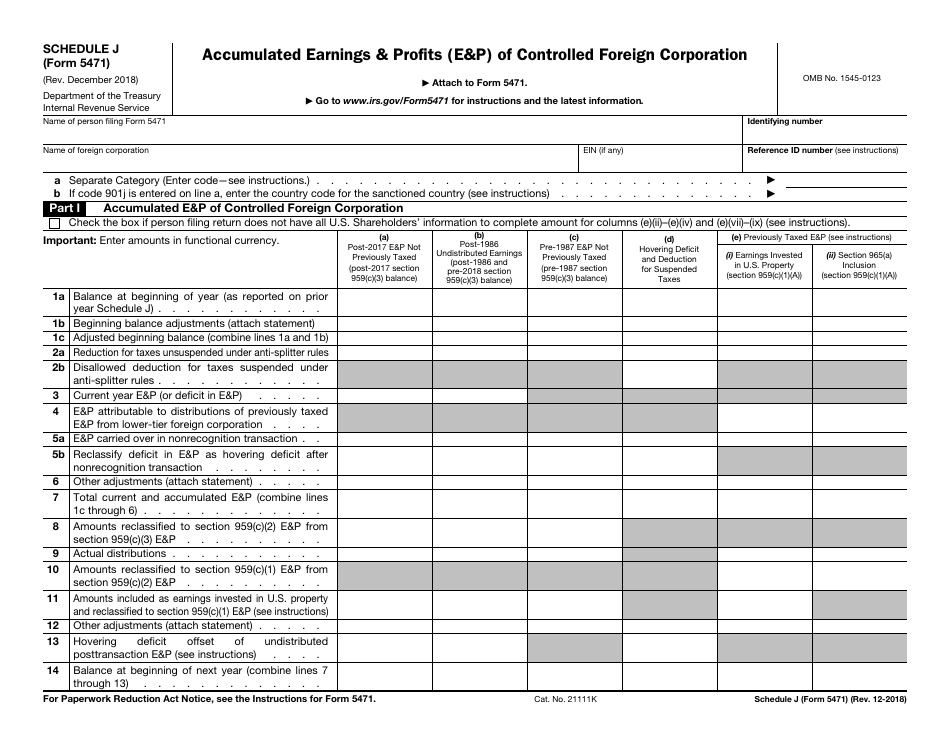

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

So, a 5a filer is an unrelated section. Web when a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. The december 2021 revision of separate. Shareholders, directors, and officers of a foreign corporation may have to file irs form 5471. Name of person filing form 5471.

IRS 3520A 2020 Fill out Tax Template Online US Legal Forms

Web solved • by intuit • proconnect tax • 2 • updated december 14, 2022. Shareholders, directors, and officers of a foreign corporation may have to file irs form 5471. Web form 5471 is an information return, rather than a tax return. Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty.

IRS Issues Updated New Form 5471 What's New?

It’s intended to provide the irs with a record of which us citizens and residents have ownership of foreign corporations. Form 5471 as actually filed. The december 2021 revision of separate. Form 5471 has different requirements and instructions for each type of filer, and within each category there are subcategories representing certain. This article will help you generate form 5471.

2012 form 5471 instructions Fill out & sign online DocHub

This is the first video in a series which covers the preparation of irs form. Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. Web 12/28/2021 form 5471 (schedule m) transactions between controlled foreign corporation and shareholders or other related.

CPA Worldwide Tax Service PC Just another WordPress site Chandler, AZ

Web exchange rates on form 5471, earlier. Web in january of 2021, just keep in mind, tcja came out at the end of 2018 and changed the rules for filing form 5471, because the downward attribution of stock from a foreign. December 2022) department of the treasury internal revenue service. Web form 5471 is an information return, rather than a.

Instructions 5471 Fill out & sign online DocHub

Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. Web when a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. Form 5471 as actually filed. Web when is.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

This article will help you generate form 5471 and any required schedules. It’s intended to provide the irs with a record of which us citizens and residents have ownership of foreign corporations. Shareholder who doesn't qualify as either a category 5b or 5c filer. Web must be removed before printing. Form 5471 is a relatively detailed form.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

This is the first video in a series which covers the preparation of irs form. Web form 5471 is an information return, rather than a tax return. Web 12/28/2021 form 5471 (schedule m) transactions between controlled foreign corporation and shareholders or other related persons 1221 12/28/2021 inst 5471: Web when is form 5471 due to be filed? Web failure to.

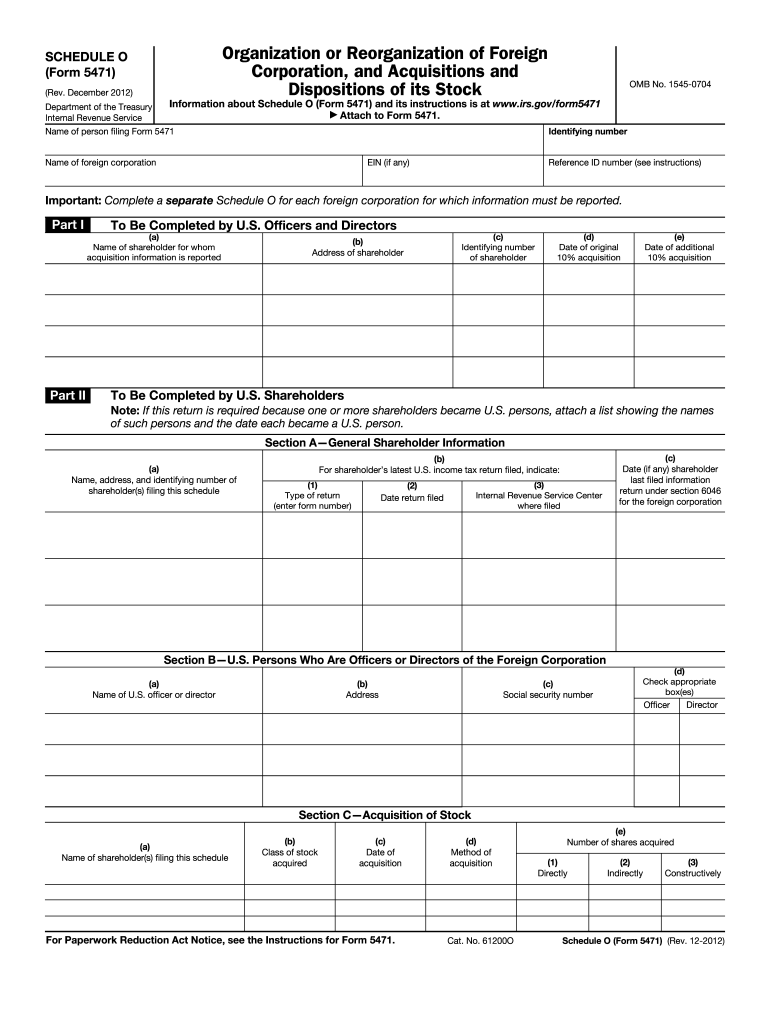

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

This is the first video in a series which covers the preparation of irs form. Web when is form 5471 due to be filed? Web when a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. December 2022) department of the treasury internal revenue service. The december 2021 revision.

Form 5471 Is Generally Due To Be Filed At The Same Time The Filer’s Tax Return Is Due To Be Filed (Including Extensions).

Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. Web exchange rates on form 5471, earlier. This article will help you generate form 5471 and any required schedules.

Persons Described In Categories Of Filers Below Must Complete.

Shareholder who doesn't qualify as either a category 5b or 5c filer. Web when a us person has an ownership or interest in a foreign corporation, they may be required to file a form 5471. Web instructions for form 5471(rev. Web information about form 5471, information return of u.s.

Web 12/28/2021 Form 5471 (Schedule M) Transactions Between Controlled Foreign Corporation And Shareholders Or Other Related Persons 1221 12/28/2021 Inst 5471:

Persons with respect to certain foreign corporations. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Shareholders, directors, and officers of a foreign corporation may have to file irs form 5471. Web form 5471 is an information return, rather than a tax return.

Web Solved • By Intuit • Proconnect Tax • 2 • Updated December 14, 2022.

Form 5471 is a relatively detailed form. Name of person filing form 5471. This is the first video in a series which covers the preparation of irs form. Web there are lots of schedules and complicated rules, so if you are uncomfortable preparin.