Form 5471 Sch P

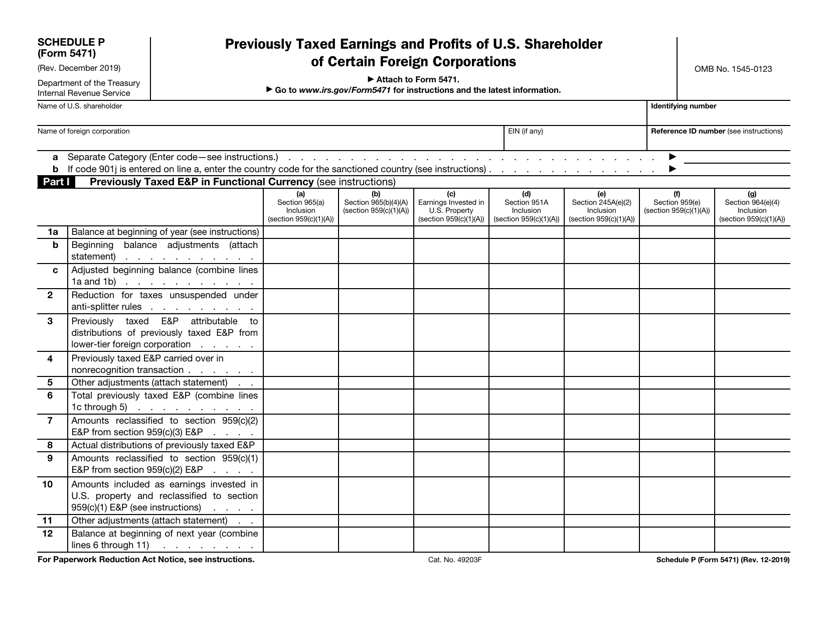

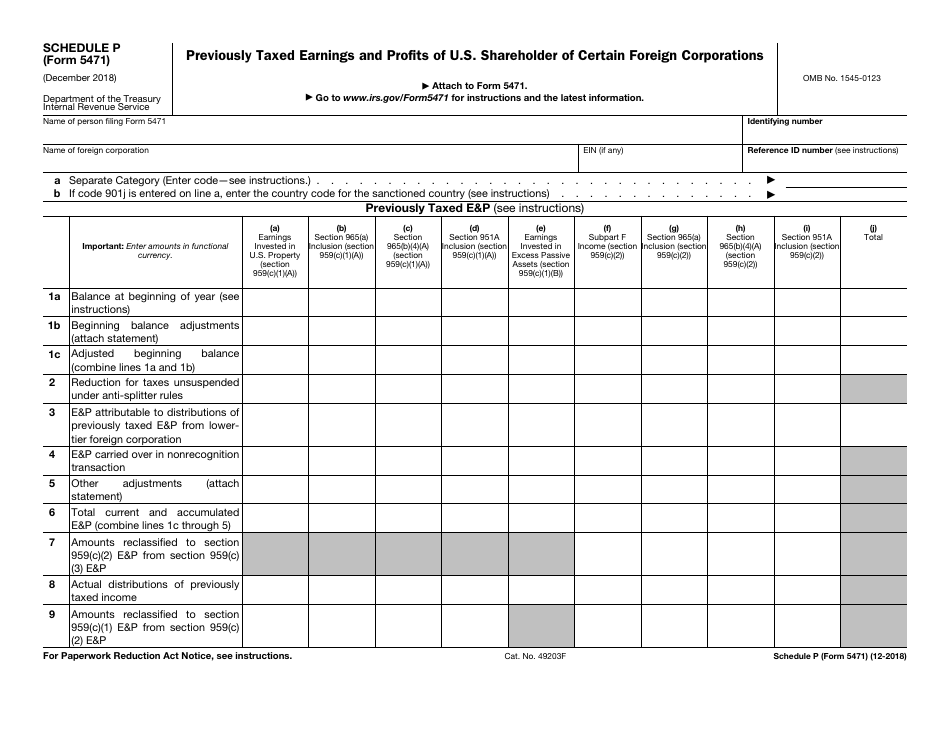

Form 5471 Sch P - Schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. Shareholder of certain foreign corporations. Select the add button within section 22 to create a new sheet assigned to the same 5471 entity. Shareholder of a controlled foreign corporation (“cfc”) in the cfc’s functional currency (part i) and in u.s. Web select the applicable 5471 entity. Let’s go through the basics of schedule p and ptep: Or the category 1 filer has previously taxed e&p related to section 965 that is reportable on schedule p (form 5471). Name of person filing form. Web schedule p (form 5471) (rev. For instructions and the latest information.

For instructions and the latest information. Specific schedule p reporting rules Web schedule p (form 5471) (rev. Persons with respect to certain foreign corporations. Web future developments for the latest information about developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. For instructions and the latest information. Web select the applicable 5471 entity. December 2022) department of the treasury internal revenue service. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Or the category 1 filer has previously taxed e&p related to section 965 that is reportable on schedule p (form 5471).

Let’s go through the basics of schedule p and ptep: Shareholder of certain foreign corporations. Web information about form 5471, information return of u.s. Or the category 1 filer has previously taxed e&p related to section 965 that is reportable on schedule p (form 5471). Shareholder of a controlled foreign corporation (“cfc”). Shareholder of a specified foreign corporation (“sfc. The term ptep refers to earnings and profits (“e&p”) of a foreign corporation. This schedule is also used to report the ptep of the u.s. December 2020) department of the treasury internal revenue service. For instructions and the latest information.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

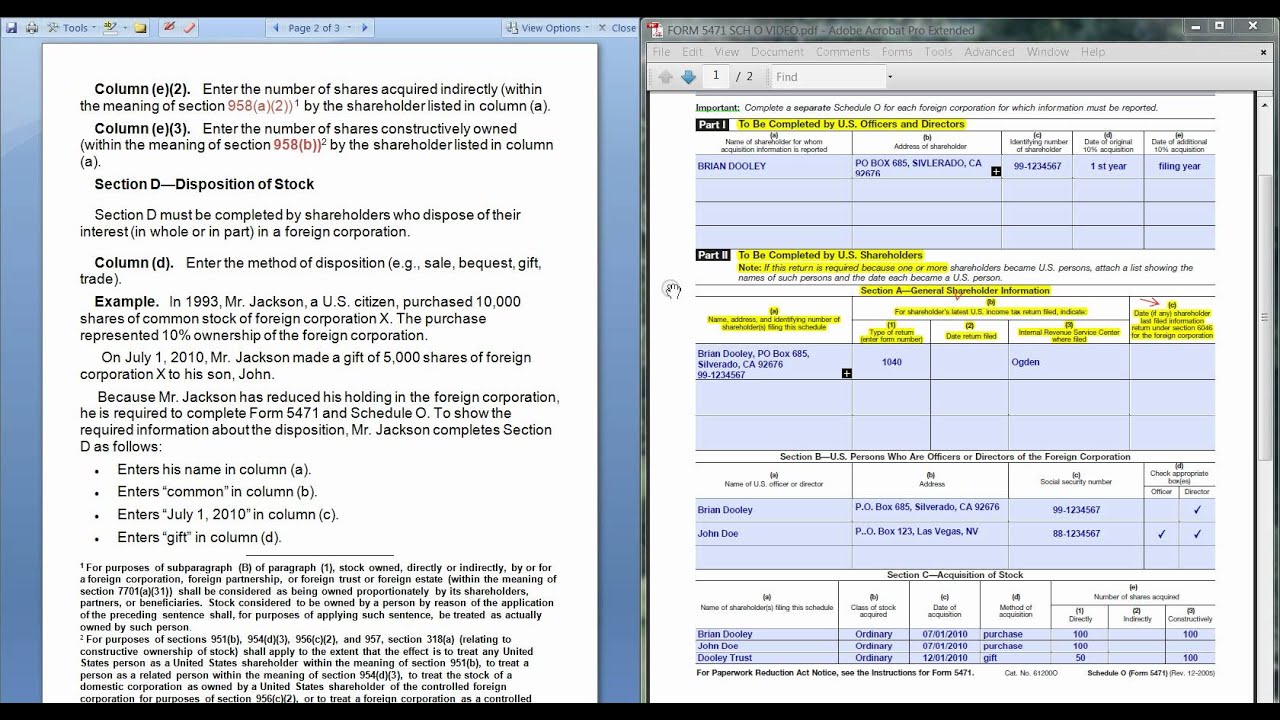

Persons with respect to certain foreign corporations. Web information about form 5471, information return of u.s. In lines 3 and 4, input a shareholder name and ein. Let’s go through the basics of schedule p and ptep: Specific schedule p reporting rules

IRS Form 5471 Carries Heavy Penalties and Consequences

Shareholder of a controlled foreign corporation (“cfc”) in the cfc’s functional currency (part i) and in u.s. Shareholder of certain foreign corporations. Schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. Web schedule p is used to report the previously taxed earnings and profits (“ptep”) of the u.s. In lines 3.

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

Shareholder of certain foreign corporations. The term ptep refers to earnings and profits (“e&p”) of a foreign corporation. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. Name of person filing form. Shareholder of a specified foreign corporation (“sfc.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Shareholder of a controlled foreign corporation (“cfc”) in the cfc’s functional currency (part i) and in u.s. Web future developments for the latest information about developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Specific schedule p reporting rules December 2022) department of the treasury internal revenue service..

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Web schedule p is used to report the previously taxed earnings and profits (“ptep”) of the u.s. Specific schedule p reporting rules Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Shareholder of certain foreign corporations. Shareholder of certain foreign corporations.

FORM 5471 SCHEDULE O CONTROLLED FOREIGN CORPORATION.avi YouTube

Or the category 1 filer has previously taxed e&p related to section 965 that is reportable on schedule p (form 5471). Shareholder of a controlled foreign corporation (“cfc”) in the cfc’s functional currency (part i) and in u.s. Let’s go through the basics of schedule p and ptep: Schedule p of form 5471 is used to report previously taxed earnings.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Let’s go through the basics of schedule p and ptep: Web select the applicable 5471 entity. Shareholder of a specified foreign corporation (“sfc. Web future developments for the latest information about developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Web in order to track the ptep for.

Demystifying the Form 5471 Part 7. Schedule P SF Tax Counsel

Web schedule p is used to report the previously taxed earnings and profits (“ptep”) of the u.s. This schedule is also used to report the ptep of the u.s. For instructions and the latest information. Let’s go through the basics of schedule p and ptep: Shareholder of a controlled foreign corporation (“cfc”).

A Dive into the New Form 5471 Categories of Filers and the Schedule R

December 2020) department of the treasury internal revenue service. What’s new changes to form 5471. Shareholder of certain foreign corporations. For instructions and the latest information. Schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s.

IRS Issues Updated New Form 5471 What's New?

Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service. Shareholder of a controlled foreign corporation (“cfc”) in the cfc’s functional currency (part i) and in u.s. Specific schedule p reporting rules This schedule is also used to report the ptep of the u.s. Let’s go through the basics of schedule p and ptep:

Shareholder Of A Specified Foreign Corporation (“Sfc.

Shareholder of certain foreign corporations. Let’s go through the basics of schedule p and ptep: What’s new changes to form 5471. In lines 3 and 4, input a shareholder name and ein.

Web Schedule P (Form 5471) (December 2018) Department Of The Treasury Internal Revenue Service.

Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. Persons with respect to certain foreign corporations. Web information about form 5471, information return of u.s.

For Instructions And The Latest Information.

Shareholder of certain foreign corporations. Or the category 1 filer has previously taxed e&p related to section 965 that is reportable on schedule p (form 5471). Previously taxed earnings and profits of u.s. The term ptep refers to earnings and profits (“e&p”) of a foreign corporation.

Name Of Person Filing Form.

File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Shareholder of a controlled foreign corporation (“cfc”) in the cfc’s functional currency (part i) and in u.s. This schedule is also used to report the ptep of the u.s. Shareholder of a controlled foreign corporation (“cfc”).