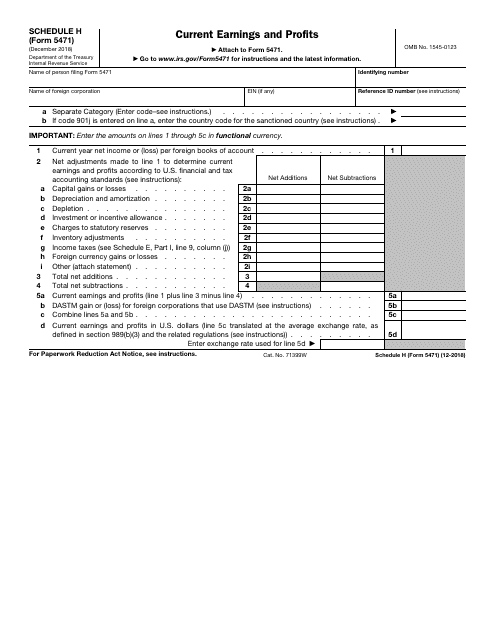

Form 5471 Schedule H

Form 5471 Schedule H - Web form 5471, officially called the information return of u.s. Anyone preparing a form 5471 knows that the. Web schedule h (form 5471) (rev. Recently, schedule h was revised. Gaap income reported on schedule c includes any expenses or income related to ptep that should not be included in current year e&p. The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc. Shareholder described in category 1a, 1b, 4, 5a, or 5b. Web all persons identified in item h must complete a separate schedule p (form 5471) if the person is a u.s. A foreign corporation's e&p is completed in a similar fashion to an e&p calculation for.

Web an overview of schedule h of form 5471 schedule h is used to report a cfc’s current e&p. In such a case, the schedule p must be attached to the statement described above. Recently, schedule h was revised. For instructions and the latest information. Web form 5471, officially called the information return of u.s. Web schedule h (form 5471), current earnings and profits foreign corporation’s that file form 5471 use this schedule to report the current e&p for u.s. Anyone preparing a form 5471 knows that the. December 2021) current earnings and profits. All schedule h (form 5471) revisions Category 4 and category 5 filers complete schedule h.

Web all persons identified in item h must complete a separate schedule p (form 5471) if the person is a u.s. Web schedule h (form 5471) (december 2018) schedule h (form 5471) department of the treasury internal revenue service current earnings and profits attach to form 5471. Web an overview of schedule h of form 5471 schedule h is used to report a cfc’s current e&p. Web form 5471, officially called the information return of u.s. Category 4 and category 5 filers complete schedule h. December 2021) current earnings and profits. For instructions and the latest information. In such a case, the schedule p must be attached to the statement described above. Web schedule h (form 5471), current earnings and profits foreign corporation’s that file form 5471 use this schedule to report the current e&p for u.s. Department of the treasury internal revenue service.

IRS Form 5471 Schedule H Download Fillable PDF or Fill Online Current

Web an overview of schedule h of form 5471 schedule h is used to report a cfc’s current e&p. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). Web schedule h (form 5471) (december 2018) schedule h (form 5471) department of the treasury internal.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

A foreign corporation's e&p is completed in a similar fashion to an e&p calculation for. Web schedule h (form 5471), current earnings and profits foreign corporation’s that file form 5471 use this schedule to report the current e&p for u.s. Shareholder described in category 1a, 1b, 4, 5a, or 5b. For instructions and the latest information. The instructions for schedule.

The IRS Makes Significant Changes to Schedule H of Form 5471 SF Tax

Who must complete schedule h. Web all persons identified in item h must complete a separate schedule p (form 5471) if the person is a u.s. Department of the treasury internal revenue service. Gaap income reported on schedule c includes any expenses or income related to ptep that should not be included in current year e&p. Web schedule h is.

Form 5471, Pages 24 YouTube

Recently, schedule h was revised. Web all persons identified in item h must complete a separate schedule p (form 5471) if the person is a u.s. Go to www.irs.gov/form5471 for instructions and the latest information. December 2021) current earnings and profits. Web schedule h (form 5471), current earnings and profits foreign corporation’s that file form 5471 use this schedule to.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

Who must complete schedule h. Anyone preparing a form 5471 knows that the. All schedule h (form 5471) revisions Category 4 and category 5 filers complete schedule h. Web schedule h (form 5471) (december 2018) schedule h (form 5471) department of the treasury internal revenue service current earnings and profits attach to form 5471.

IRS Form 5471 Schedule E and Schedule H SF Tax Counsel

Anyone preparing a form 5471 knows that the. Shareholder described in category 1a, 1b, 4, 5a, or 5b. A foreign corporation's e&p is completed in a similar fashion to an e&p calculation for. Web form 5471, officially called the information return of u.s. Department of the treasury internal revenue service.

IRS Form 5471 Schedule H SF Tax Counsel

Persons with respect to certain foreign corporations, is an information statement (information return) (as opposed to a tax return) for certain u.s. Who must complete schedule h. Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc. Web schedule h (form 5471) (december 2018) schedule h (form 5471) department of.

Guide to Form 5471 Schedule E and Schedule H SF Tax Counsel

Persons with respect to certain foreign corporations, is an information statement (information return) (as opposed to a tax return) for certain u.s. Shareholder described in category 1a, 1b, 4, 5a, or 5b. Web an overview of schedule h of form 5471 schedule h is used to report a cfc’s current e&p. This article is designed to supplement the irs instructions.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Who must complete schedule h. On lines 1 and 2, the Recently, schedule h was revised. The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Go to www.irs.gov/form5471 for instructions and the latest information.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Web schedule h (form 5471), current earnings and profits foreign corporation’s that file form 5471 use this schedule to report the current e&p for u.s. Department of the treasury internal revenue service. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). For instructions and.

Web Schedule H Is Used To Report A Foreign Corporation’s Current Earnings And Profits (“E&P”) For Us Tax Purposes To The Internal Revenue Service (“Irs”).

Shareholder described in category 1a, 1b, 4, 5a, or 5b. December 2021) current earnings and profits. Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc. Category 4 and category 5 filers complete schedule h.

Go To Www.irs.gov/Form5471 For Instructions And The Latest Information.

Web all persons identified in item h must complete a separate schedule p (form 5471) if the person is a u.s. Department of the treasury internal revenue service. Who must complete schedule h. A foreign corporation's e&p is completed in a similar fashion to an e&p calculation for.

Web An Overview Of Schedule H Of Form 5471 Schedule H Is Used To Report A Cfc’s Current E&P.

Gaap income reported on schedule c includes any expenses or income related to ptep that should not be included in current year e&p. Anyone preparing a form 5471 knows that the. Web form 5471, officially called the information return of u.s. All schedule h (form 5471) revisions

Web Schedule H (Form 5471) (December 2018) Schedule H (Form 5471) Department Of The Treasury Internal Revenue Service Current Earnings And Profits Attach To Form 5471.

For instructions and the latest information. Web schedule h (form 5471), current earnings and profits foreign corporation’s that file form 5471 use this schedule to report the current e&p for u.s. In such a case, the schedule p must be attached to the statement described above. Recently, schedule h was revised.