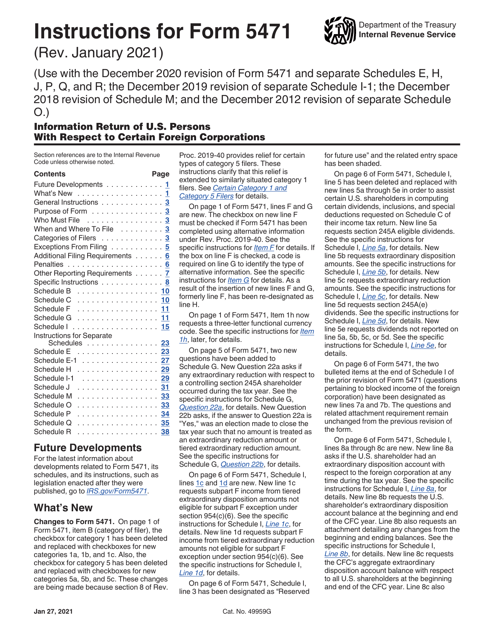

Form 5471 Schedule Q Instructions

Form 5471 Schedule Q Instructions - Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. Web the article is based on the instructions promulgated by the internal revenue service (“irs”). Shareholders of the cfc so. Shareholders of the cfc so that the u.s. Web starting in tax year 2020 a new schedule q (form 5471) is used to report the cfc’s income in each cfc income group to the u.s. Web introduction to schedule q of form 5471 schedule q will be used to report a cfc’s income, deductions, taxes, and assets by cfc income groups. Schedule q & schedule r question: Web category 1 filer any u.s. Web check if any excepted specified foreign financial assets are reported on this form (see instructions). Enter separate category code with respect to which this schedule q is.

The december 2021 revision of separate. Web check if any excepted specified foreign financial assets are reported on this form (see instructions). January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; For this portion of the discussion, we're going to be discussing the purpose of form. Web instructions for form 5471(rev. An sfc includes any foreign corporation with one or more. On schedule q, should column (xi) net income tie to schedule h line 5 current earnings and profits? Web the article is based on the instructions promulgated by the internal revenue service (“irs”). Web and today, we're going to give you an overview of the form 5471. Web at this time, the irs has yet to release draft instructions for forms 5471 and 5471 (schedule q) so it is difficult to comment further on the forthcoming impact.

Web instructions for form 5471(rev. Web the article is based on the instructions promulgated by the internal revenue service (“irs”). Taxpayer who is a shareholder in any section 965 specified foreign corporation. Web schedule q(form 5471) (december 2020) cfc income by cfc income groups department of the treasuryinternal revenue service attach to form 5471. Who must complete the form 5471 schedule q. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web at this time, the irs has yet to release draft instructions for forms 5471 and 5471 (schedule q) so it is difficult to comment further on the forthcoming impact. For this portion of the discussion, we're going to be discussing the purpose of form. Web starting in tax year 2020 a new schedule q (form 5471) is used to report the cfc’s income in each cfc income group to the u.s. So let's jump right into it.

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

And as julie mentioned, there. Web check if any excepted specified foreign financial assets are reported on this form (see instructions). Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. Who must complete the form 5471 schedule q. Shareholders of the cfc.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Web introduction to schedule q of form 5471 schedule q will be used to report a cfc’s income, deductions, taxes, and assets by cfc income groups. Web instructions for form 5471(rev. The december 2021 revision of separate. Web check if any excepted specified foreign financial assets are reported on this form (see instructions). Schedule q & schedule r question:

A Brief Introduction to the Brand New Schedule Q and Schedule R for IRS

Shareholders of the cfc so that the u.s. On schedule q, should column (xi) net income tie to schedule h line 5 current earnings and profits? Web check if any excepted specified foreign financial assets are reported on this form (see instructions). January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web instructions for.

Download Instructions for IRS Form 5471 Information Return of U.S

Schedule q & schedule r question: Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. Web starting in tax year 2020 a new schedule q (form 5471) is used to report the cfc’s income in each cfc income group to the u.s..

IRS Issues Updated New Form 5471 What's New?

Web introduction to schedule q of form 5471 schedule q will be used to report a cfc’s income, deductions, taxes, and assets by cfc income groups. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

Web starting in tax year 2020 a new schedule q (form 5471) is used to report the cfc’s income in each cfc income group to the u.s. Enter separate category code with respect to which this schedule q is. Web on this new schedule q, the cfc income in each cfc income group of the cfc is reported to the.

form 5471 schedule j instructions 2022 Fill Online, Printable

Web schedule q(form 5471) (december 2020) cfc income by cfc income groups department of the treasuryinternal revenue service attach to form 5471. Web complete a separate schedule q with respect to each applicable category of income (see instructions). Web category 1 filer any u.s. Web starting in tax year 2020 a new schedule q (form 5471) is used to report.

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

Enter separate category code with respect to which this schedule q is. Web introduction to schedule q of form 5471 schedule q will be used to report a cfc’s income, deductions, taxes, and assets by cfc income groups. Web instructions for form 5471(rev. Schedule q & schedule r question: Shareholders of the cfc so that the u.s.

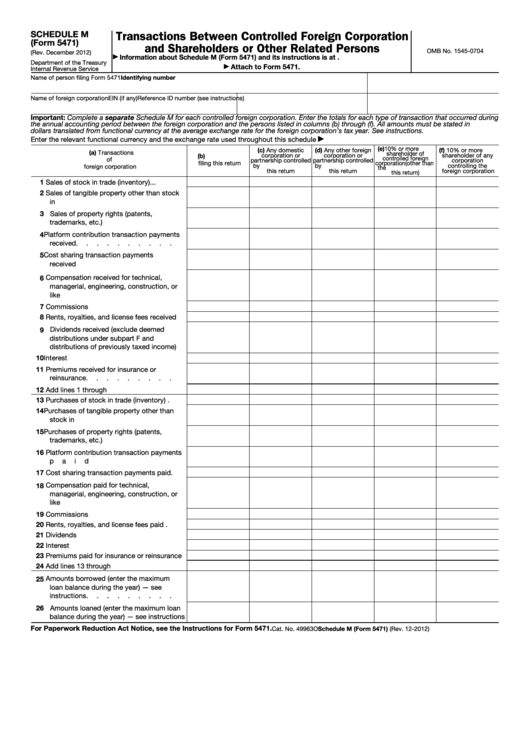

Fillable Form 5471 Schedule M Transactions Between Controlled

Web complete a separate schedule q with respect to each applicable category of income (see instructions). Web form 5471 (schedule r) distributions from a foreign corporation 1220 12/28/2020 form 5471 (schedule q) cfc income by cfc income groups 1222 12/01/2022 form 5471. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web on its.

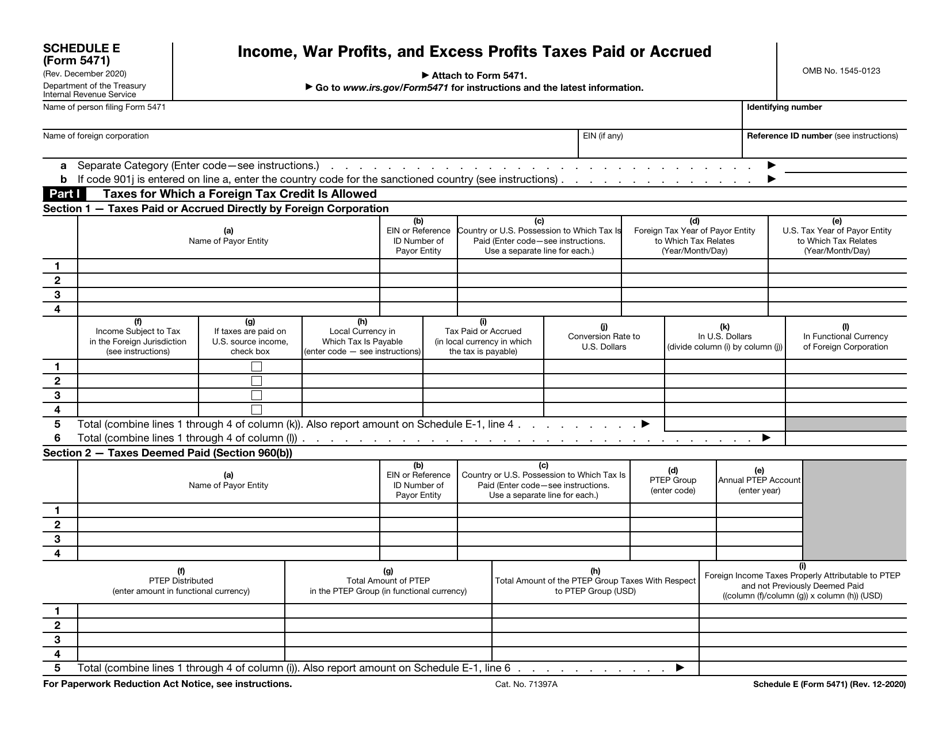

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Anyone preparing a form 5471 knows. Shareholders of the cfc so that the u.s. For this portion of the discussion, we're going to be discussing the purpose of form. Web instructions for form 5471(rev. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of.

Web Instructions For Form 5471(Rev.

On schedule q, should column (xi) net income tie to schedule h line 5 current earnings and profits? Web starting in tax year 2020, the new separate schedule q (form 5471), cfc income by cfc income groups, is used to report the cfc's income in each cfc income. Schedule q & schedule r question: January 2023) (use with the december 2022 revision of form 5471 and separate schedule q;

Shareholders Can Use It To.

Who must complete the form 5471 schedule q. Web schedule q(form 5471) (december 2020) cfc income by cfc income groups department of the treasuryinternal revenue service attach to form 5471. Web check if any excepted specified foreign financial assets are reported on this form (see instructions). Web and today, we're going to give you an overview of the form 5471.

Web Instructions For Form 5471(Rev.

Web the article is based on the instructions promulgated by the internal revenue service (“irs”). Web introduction to schedule q of form 5471 schedule q will be used to report a cfc’s income, deductions, taxes, and assets by cfc income groups. Schedule q (form 5471) (rev. The december 2021 revision of separate.

Web On Its Webpage, The Irs Has Clarified Its Instructions For 2020 Schedule Q (Cfc Income By Cfc Income Groups) Of Form 5471 (Information Return Of U.s.

Anyone preparing a form 5471 knows. Web category 1 filer any u.s. Web on this new schedule q, the cfc income in each cfc income group of the cfc is reported to the u.s. Web complete a separate schedule q with respect to each applicable category of income (see instructions).