Form 5558 Deadline

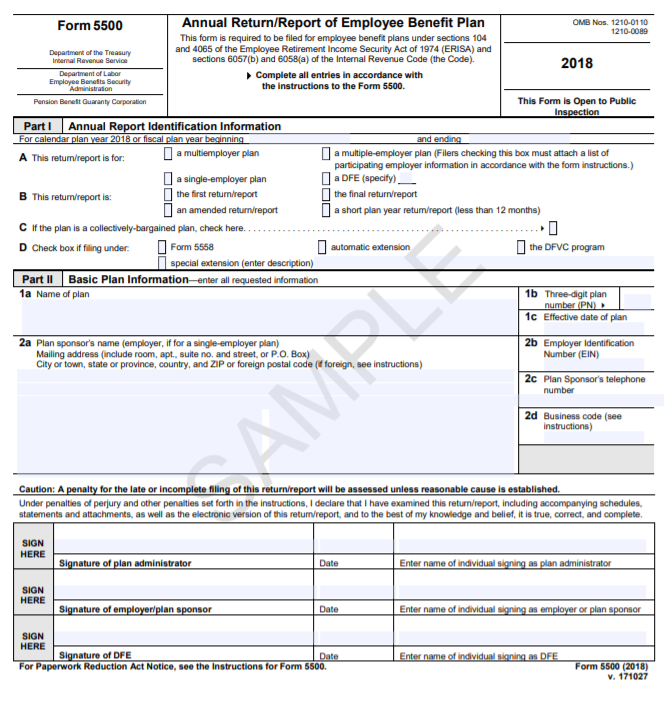

Form 5558 Deadline - If the filing date falls on a saturday, sunday, or a legal. Web the deadline for filing form 5500, the annual return/report of employee benefit plans is the last day of the seventh month after the plan’s year end. Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. 15) are imposed by the department of labor (dol) and the irs, the agencies that. Web overlapping penalties for failing to timely file form 5500 by july 31 (or, with a form 5558 extension, by oct. Web the deadlines for filing tax returns in conjunction with the 5558 extension form vary depending on the specific return for which you request the extra time. If you meet requirements described above and file on time, your extension is automatically approved until “the date that is no later than the 15th day of the 3rd month after the return/report’s normal due date.” Unless specified otherwise, reference to form 5500 series return includes: Any taxes owed must be paid with the application for an extension to complete form 5530. Extension of time to file form 5330.

If the filing date falls on a saturday, sunday, or a legal. Web the deadline for filing form 5500, the annual return/report of employee benefit plans is the last day of the seventh month after the plan’s year end. Form 5330 can also extend. If you meet requirements described above and file on time, your extension is automatically approved until “the date that is no later than the 15th day of the 3rd month after the return/report’s normal due date.” Web overlapping penalties for failing to timely file form 5500 by july 31 (or, with a form 5558 extension, by oct. Unless specified otherwise, reference to form 5500 series return includes: Extension of time to file form 5330. This extension doesn't allow employers more time to pay any taxes that are due. 15) are imposed by the department of labor (dol) and the irs, the agencies that. Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond.

Form 5330 can also extend. If you meet requirements described above and file on time, your extension is automatically approved until “the date that is no later than the 15th day of the 3rd month after the return/report’s normal due date.” Any taxes owed must be paid with the application for an extension to complete form 5530. Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Failure to prepare and file form 5500 by the deadline can result in a dol penalty of up to $1,100/day. Extension of time to file form 5330. Web overlapping penalties for failing to timely file form 5500 by july 31 (or, with a form 5558 extension, by oct. Unless specified otherwise, reference to form 5500 series return includes: If the filing date falls on a saturday, sunday, or a legal. Web the deadline for filing form 5500, the annual return/report of employee benefit plans is the last day of the seventh month after the plan’s year end.

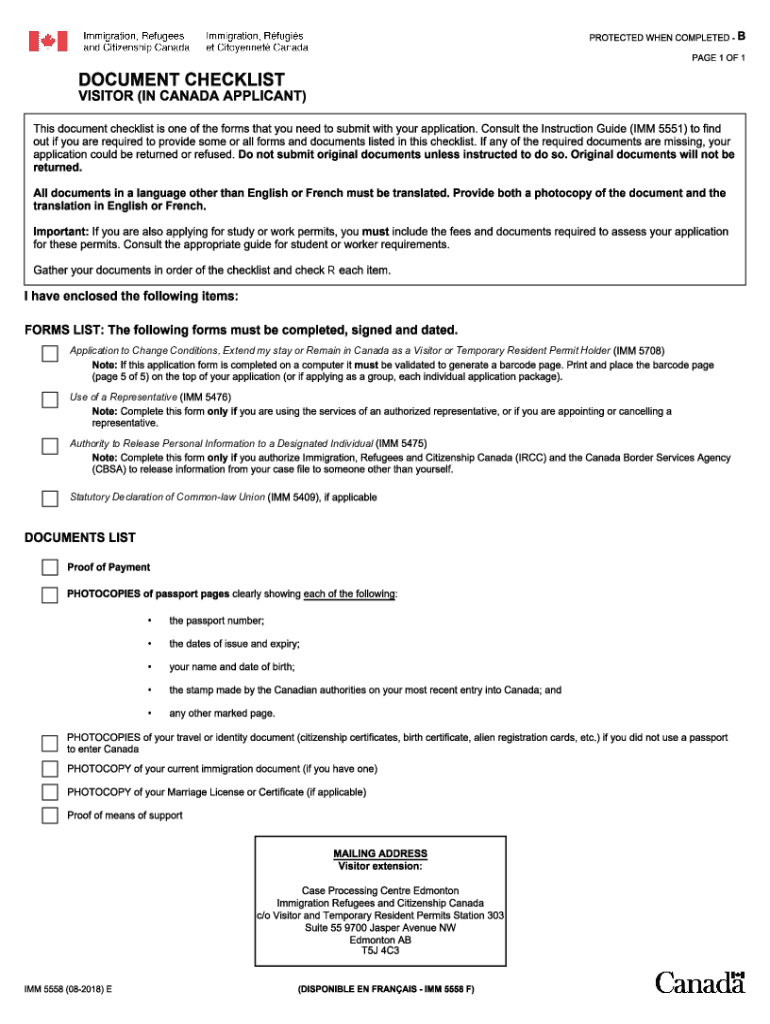

20182022 Form Canada IMM 5558 E Fill Online, Printable, Fillable

Extension of time to file form 5330. Web the deadline for filing form 5500, the annual return/report of employee benefit plans is the last day of the seventh month after the plan’s year end. Form 5330 can also extend. Any taxes owed must be paid with the application for an extension to complete form 5530. If you meet requirements described.

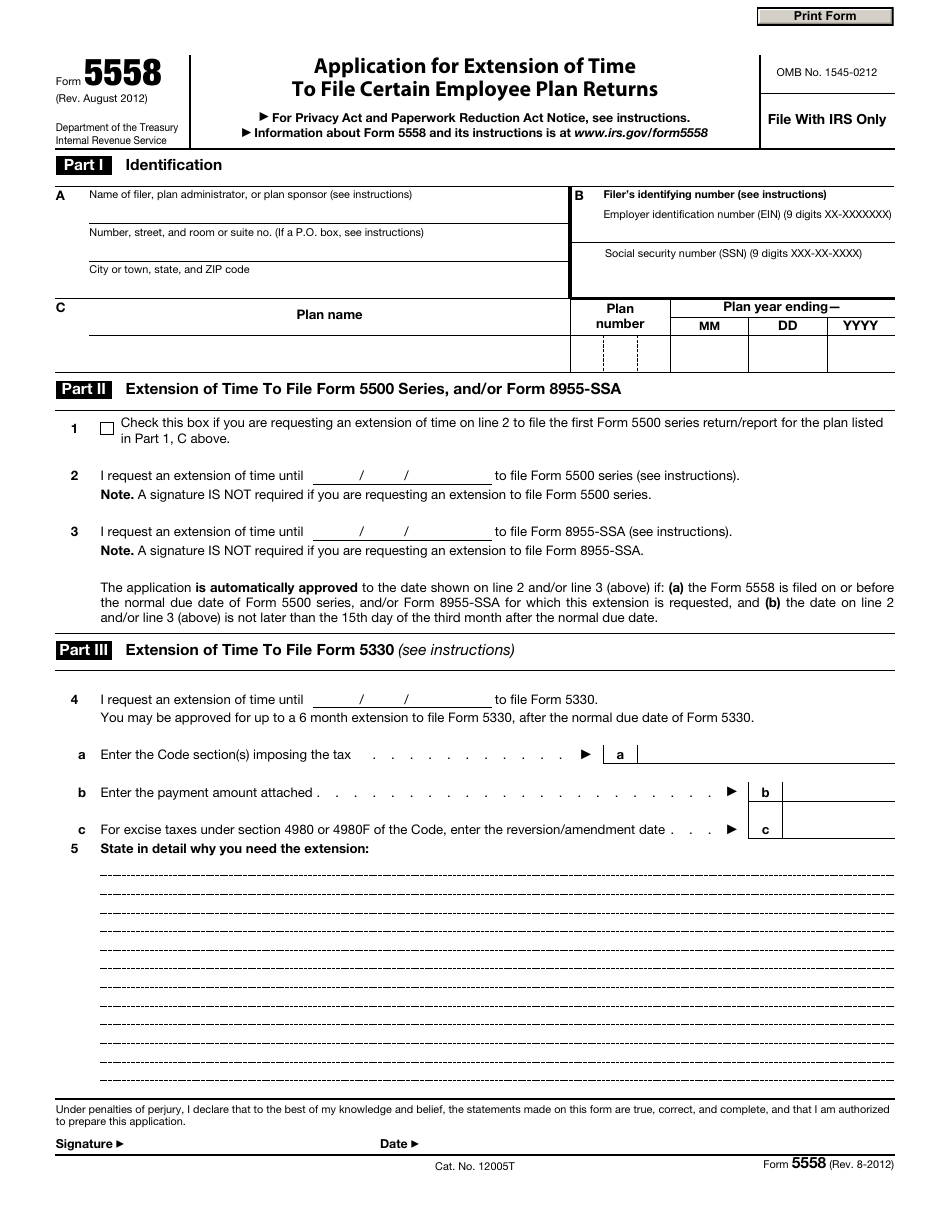

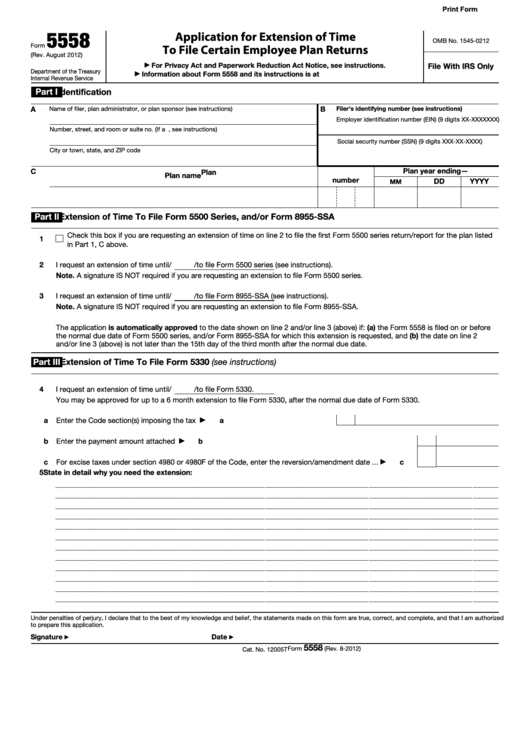

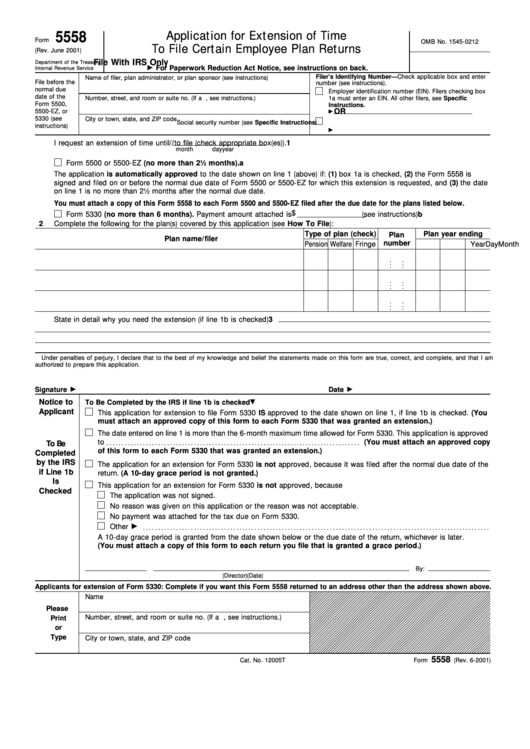

Form 5558 Application for Extension of Time to File Certain Employee

15) are imposed by the department of labor (dol) and the irs, the agencies that. If you meet requirements described above and file on time, your extension is automatically approved until “the date that is no later than the 15th day of the 3rd month after the return/report’s normal due date.” Form 5330 can also extend. Web overlapping penalties for.

Form 5558 Application For Extension Of Time To File Certain Employee

Web the deadlines for filing tax returns in conjunction with the 5558 extension form vary depending on the specific return for which you request the extra time. Failure to prepare and file form 5500 by the deadline can result in a dol penalty of up to $1,100/day. Unless specified otherwise, reference to form 5500 series return includes: Web the deadline.

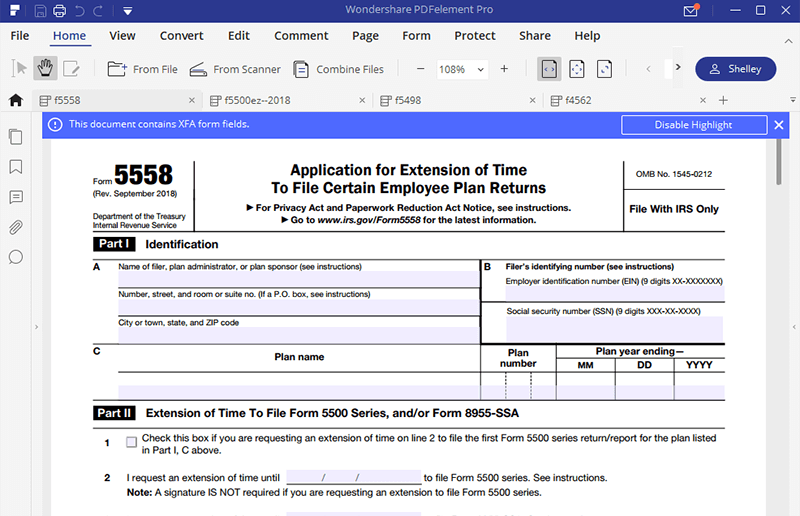

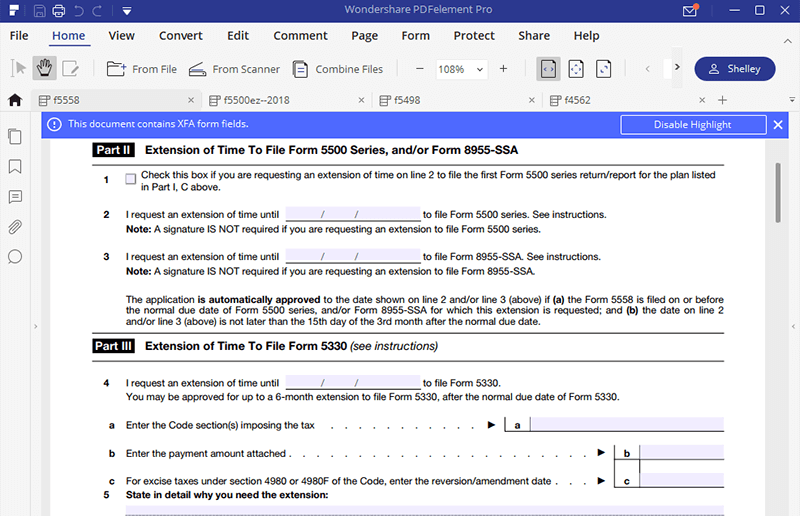

IRS Form 5558 A Guide to Fill it the Right Way

Failure to prepare and file form 5500 by the deadline can result in a dol penalty of up to $1,100/day. This extension doesn't allow employers more time to pay any taxes that are due. 15) are imposed by the department of labor (dol) and the irs, the agencies that. Any taxes owed must be paid with the application for an.

Avoid Using the 5500 Extension Wrangle 5500 ERISA Reporting and

Form 5330 can also extend. This extension doesn't allow employers more time to pay any taxes that are due. Extension of time to file form 5330. Web the deadline for filing form 5500, the annual return/report of employee benefit plans is the last day of the seventh month after the plan’s year end. 15) are imposed by the department of.

Form 5558 Extension The Complete Guide [Form & IRS Hazards] » Online 5500

Web the deadlines for filing tax returns in conjunction with the 5558 extension form vary depending on the specific return for which you request the extra time. Form 5330 can also extend. Any taxes owed must be paid with the application for an extension to complete form 5530. Web overlapping penalties for failing to timely file form 5500 by july.

IRS Form 5558 Download Fillable PDF or Fill Online Application for

Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. If you meet requirements described above and file on time, your extension is automatically approved until.

Fillable Form 5558 Application For Extension Of Time To File Certain

If you meet requirements described above and file on time, your extension is automatically approved until “the date that is no later than the 15th day of the 3rd month after the return/report’s normal due date.” Web the deadlines for filing tax returns in conjunction with the 5558 extension form vary depending on the specific return for which you request.

Form 9 Deadline Is Form 9 Deadline Any Good? Ten Ways You Can Be

Any taxes owed must be paid with the application for an extension to complete form 5530. Extension of time to file form 5330. 15) are imposed by the department of labor (dol) and the irs, the agencies that. If you meet requirements described above and file on time, your extension is automatically approved until “the date that is no later.

IRS Form 5558 A Guide to Fill it the Right Way

Unless specified otherwise, reference to form 5500 series return includes: Web overlapping penalties for failing to timely file form 5500 by july 31 (or, with a form 5558 extension, by oct. Web the deadlines for filing tax returns in conjunction with the 5558 extension form vary depending on the specific return for which you request the extra time. Web the.

Web If You Received A Cp Notice About Filing Your Form 5500 Series Return Or Form 5558, Application For Extension Of Time To File Certain Employee Plan Returns, The Following Information Will Help You Understand Why You Received The Notice And How To Respond.

Web the deadlines for filing tax returns in conjunction with the 5558 extension form vary depending on the specific return for which you request the extra time. Unless specified otherwise, reference to form 5500 series return includes: Web the deadline for filing form 5500, the annual return/report of employee benefit plans is the last day of the seventh month after the plan’s year end. If you meet requirements described above and file on time, your extension is automatically approved until “the date that is no later than the 15th day of the 3rd month after the return/report’s normal due date.”

Web Overlapping Penalties For Failing To Timely File Form 5500 By July 31 (Or, With A Form 5558 Extension, By Oct.

If the filing date falls on a saturday, sunday, or a legal. Form 5330 can also extend. 15) are imposed by the department of labor (dol) and the irs, the agencies that. Extension of time to file form 5330.

This Extension Doesn't Allow Employers More Time To Pay Any Taxes That Are Due.

Any taxes owed must be paid with the application for an extension to complete form 5530. Failure to prepare and file form 5500 by the deadline can result in a dol penalty of up to $1,100/day.

![Form 5558 Extension The Complete Guide [Form & IRS Hazards] » Online 5500](https://online5500.com/wp-content/uploads/2022/04/p1-768x512.jpg)