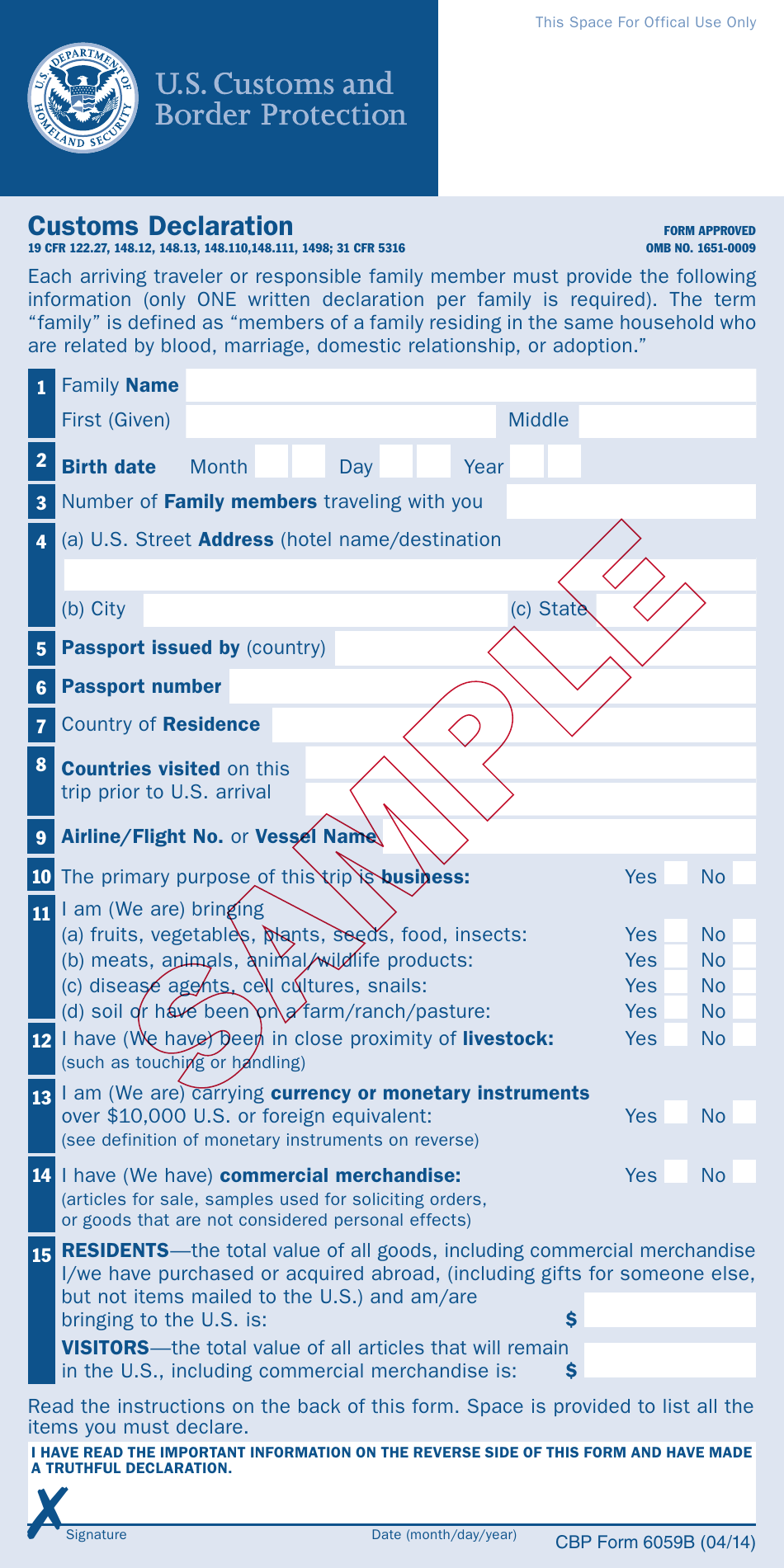

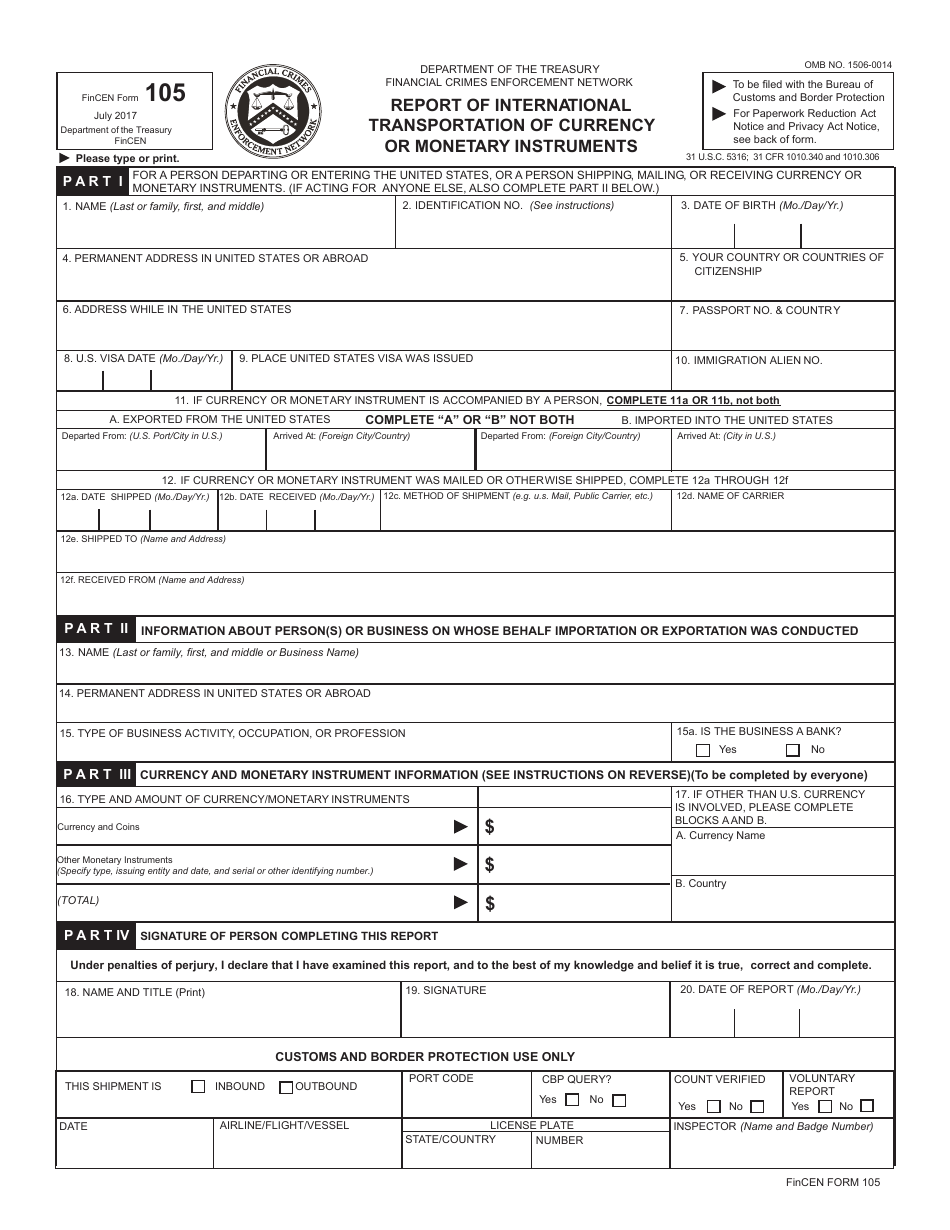

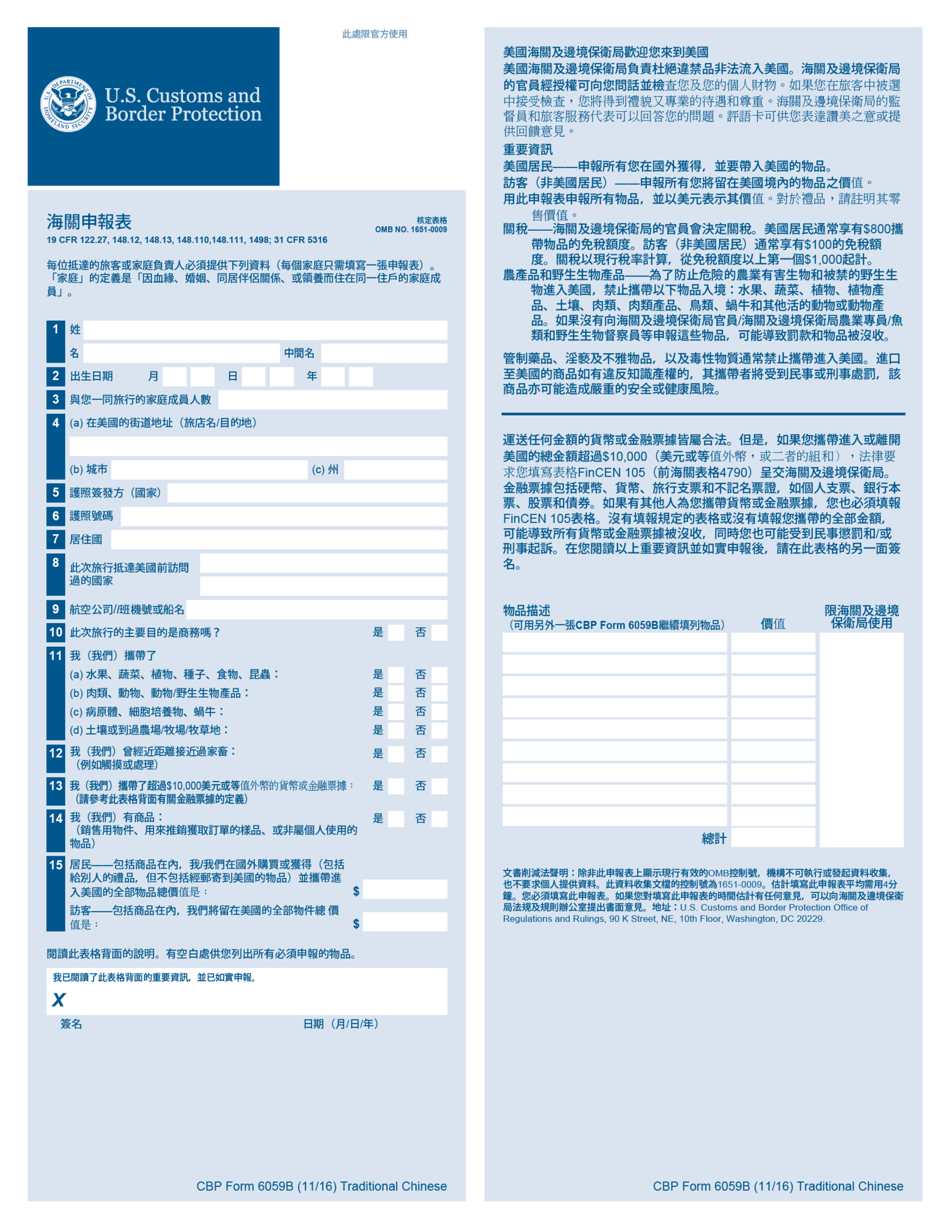

Form 6059B And Fincen 105

Form 6059B And Fincen 105 - Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Web washington—the financial crimes enforcement network (fincen) is informing u.s financial institutions that the financial action task force (fatf), an. This form can be now be filled out prior to or during. Web of both), you are required by law to file a report on fincen 105 (formerly customs form 4790) with u.s. Web this system is provided for authorized use only. The department of homeland security, u.s. Web however, if you bring into or take out of the united states more than $10,000 (us or foreign equivalent, or a combination of both), you are required by law to file a report on fincen. Web you may bring large sums of money with you in the form of cash, money order, or traveler's checks. There is no maximum limit, however, any amount exceeding $10,000 usd must. Customs and border protection will be submitting the following information collection request to the.

However, if it happens to be over $10,000, you must fill out a customs declaration. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency. Include photos, crosses, check and text boxes, if you need. Web money reported via fincen form 105 is reported to the irs to help cut down on money laundering. Typically, if you’re carrying money for legitimate, legal reasons and. Web please note that an item that does not constitute reportable material under the cmir might be subject to other federal reporting requirements (such as the u.s. Web legally, you are allowed to bring in as much money as you want into or out of the country. Web beneficial ownership information reporting. You may bring into or take out of the country, including by mail, as much money as you wish.

International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on. Web document posting date. Form 6059b customs declaration in english and fillable. Web money reported via fincen form 105 is reported to the irs to help cut down on money laundering. Web if you are carrying more than $10,000, you must file a report on fincen 105. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Web please note that an item that does not constitute reportable material under the cmir might be subject to other federal reporting requirements (such as the u.s. This system/website is the property of, operated by, and expressly for the use of the united states government and. However, if it is more than. Customs and border protection will be submitting the following information collection request to the.

Formulario Fincen 105 En Español Fill Online, Printable, Fillable

However, if it happens to be over $10,000, you must fill out a customs declaration. Web legally, you are allowed to bring in as much money as you want into or out of the country. Typically, if you’re carrying money for legitimate, legal reasons and. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency. Include.

Us Landing Card njlasopa

A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency. Include photos, crosses, check and text boxes, if you need. Web this system is provided for authorized use only. Web fincen form 105 before bringing $10,000 in cash to the airport for an international flight, read this article explaining why federal law requires you to file.

CBP Form 6059B Download Printable PDF or Fill Online Customs

However, if it is more than. Typically, if you’re carrying money for legitimate, legal reasons and. Web you may bring large sums of money with you in the form of cash, money order, or traveler's checks. You may bring into or take out of the country, including by mail, as much money as you wish. Web beneficial ownership information reporting.

FinCEN 105 Reporting requirements of carrying cash overseas Nomad

Web you may bring large sums of money with you in the form of cash, money order, or traveler's checks. Web of both), you are required by law to file a report on fincen 105 (formerly customs form 4790) with u.s. The department of homeland security, u.s. Typically, if you’re carrying money for legitimate, legal reasons and. This form can.

FinCEN Form 105 Download Fillable PDF or Fill Online Report of

Fill in the information needed in fincen 105, making use of fillable fields. However, if it happens to be over $10,000, you must fill out a customs declaration. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency. Web document posting date. Web washington—the financial crimes enforcement network (fincen) is informing u.s financial institutions that the.

CBP Form 6059B Download Fillable PDF or Fill Online Customs Declaration

Customs and border protection will be submitting the following information collection request to the. Web however, if you bring into or take out of the united states more than $10,000 (us or foreign equivalent, or a combination of both), you are required by law to file a report on fincen. The department of homeland security, u.s. Web washington—the financial crimes.

CUSTOMS DECLARATION FORM 6059B EBOOK

There is no maximum limit, however, any amount exceeding $10,000 usd must. Typically, if you’re carrying money for legitimate, legal reasons and. Form 6059b customs declaration in english and fillable. Web fincen form 105 before bringing $10,000 in cash to the airport for an international flight, read this article explaining why federal law requires you to file the. You may.

CBP Form 6059B Download Fillable PDF or Fill Online Customs Declaration

The department of homeland security, u.s. Customs and border protection will be submitting the following information collection request to the. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Web open the document in our powerful pdf editor. This form can be now be.

CBP 6059B 20162022 Fill and Sign Printable Template Online US

Form 6059b customs declaration in english and fillable. Web fincen form 105 before bringing $10,000 in cash to the airport for an international flight, read this article explaining why federal law requires you to file the. International travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on. Web.

美国海关出入境 FinCEN 105 Form 申报表格填写下载说明 在美国

Web please note that an item that does not constitute reportable material under the cmir might be subject to other federal reporting requirements (such as the u.s. Typically, if you’re carrying money for legitimate, legal reasons and. Web this system is provided for authorized use only. This system/website is the property of, operated by, and expressly for the use of.

Typically, If You’re Carrying Money For Legitimate, Legal Reasons And.

Web beneficial ownership information reporting. You may bring into or take out of the country, including by mail, as much money as you wish. Web fincen form 105 before bringing $10,000 in cash to the airport for an international flight, read this article explaining why federal law requires you to file the. Web money and other monetary instruments.

International Travelers Entering The United States Must Declare If They Are Carrying Currency Or Monetary Instruments In A Combined Amount Over $10,000 On.

Web washington—the financial crimes enforcement network (fincen) is informing u.s financial institutions that the financial action task force (fatf), an. Web of both), you are required by law to file a report on fincen 105 (formerly customs form 4790) with u.s. Web money reported via fincen form 105 is reported to the irs to help cut down on money laundering. Web please note that an item that does not constitute reportable material under the cmir might be subject to other federal reporting requirements (such as the u.s.

Web Open The Document In Our Powerful Pdf Editor.

Form 6059b customs declaration in english and fillable. Web if you are carrying more than $10,000, you must file a report on fincen 105. Fill in the information needed in fincen 105, making use of fillable fields. Customs and border protection will be submitting the following information collection request to the.

However, If It Is More Than.

A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency. However, if it happens to be over $10,000, you must fill out a customs declaration. This system/website is the property of, operated by, and expressly for the use of the united states government and. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their.