Form 6765 Instructions 2021

Form 6765 Instructions 2021 - Web provide total qualified employee wage expenses, total qualified supply expenses, and total qualified contract research expenses for the claim year (these may. Web use form 6765 to figure and claim the credit for increasing research activities (research credit), to elect the reduced credit under section 280c, and to elect to claim a certain. Web federal credit for increasing research activities form 6765 pdf form content report error it appears you don't have a pdf plugin for this browser. Bba partnerships cannot file amended returns but instead, must file under. Finally, the memorandum indicates that the claim must “provide the total qualified employee wage expenses, total qualified supply expenses, and total qualified. The irs will provide a grace period (until january 10, 2022) before requiring the. This is an excellent resource for employers that are interested in expanding their r&d efforts by including research expense credits. Web this may be done using form 6765, credit for increasing research activities pdf. Web instructions on filling out form 6765: The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other federal.

Bba partnerships cannot file amended returns but instead, must file under. Web effective january 10, 2022, this new guidance required taxpayers to submit additional information that was not previously requested on form 6765 to substantiate. The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other federal. Please use the link below. Web instructions on filling out form 6765: Web the draft form 6765 instructions remind taxpayers of the process to follow for bba partnerships. Web the internal revenue service issued an early release draft this month of instructions for irs form 6765, “credit for increasing research activities,” to properly. Web use form 6765 to figure and claim the credit for increasing research activities (research credit), to elect the reduced credit under section 280c, and to elect to claim a certain. This is an excellent resource for employers that are interested in expanding their r&d efforts by including research expense credits. Web federal credit for increasing research activities form 6765 pdf form content report error it appears you don't have a pdf plugin for this browser.

Web use form 6765 to figure and claim the credit for increasing research activities (research credit), to elect the reduced credit under section 280c, and to elect to claim a certain. Web the internal revenue service issued an early release draft this month of instructions for irs form 6765, “credit for increasing research activities,” to properly. The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other federal. Web effective january 10, 2022, this new guidance required taxpayers to submit additional information that was not previously requested on form 6765 to substantiate. The irs will provide a grace period (until january 10, 2022) before requiring the. This is an excellent resource for employers that are interested in expanding their r&d efforts by including research expense credits. Web provide total qualified employee wage expenses, total qualified supply expenses, and total qualified contract research expenses for the claim year (these may. Web up to $40 cash back 2010 6765 form form 6765 credit for increasing research activities attach to your tax return. Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as. Web instructions on filling out form 6765:

Instructions For Form 2555 Instructions For Form 2555, Foreign Earned

Bba partnerships cannot file amended returns but instead, must file under. Web up to $40 cash back 2010 6765 form form 6765 credit for increasing research activities attach to your tax return. Web provide total qualified employee wage expenses, total qualified supply expenses, and total qualified contract research expenses for the claim year (these may. Web the draft form 6765.

2018 2019 IRS Form 6765 Fill Out Digital PDF Sample

Web effective january 10, 2022, this new guidance required taxpayers to submit additional information that was not previously requested on form 6765 to substantiate. Web use form 6765 to figure and claim the credit for increasing research activities (research credit), to elect the reduced credit under section 280c, and to elect to claim a certain. Web federal credit for increasing.

How to Fill Out Form 6765 (R&D Tax Credit) RD Tax Credit Software

Web up to $40 cash back 2010 6765 form form 6765 credit for increasing research activities attach to your tax return. Web federal credit for increasing research activities form 6765 pdf form content report error it appears you don't have a pdf plugin for this browser. Web this article will assist you with generating form 6765, credit for increasing research.

IRS Form 6765

Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as. This is an excellent resource for employers that are interested in expanding their r&d efforts by including research expense credits. Web the draft form 6765 instructions.

Form 6765*Credit for Increasing Research Activities

Bba partnerships cannot file amended returns but instead, must file under. Web federal credit for increasing research activities form 6765 pdf form content report error it appears you don't have a pdf plugin for this browser. This is an excellent resource for employers that are interested in expanding their r&d efforts by including research expense credits. Web instructions on filling.

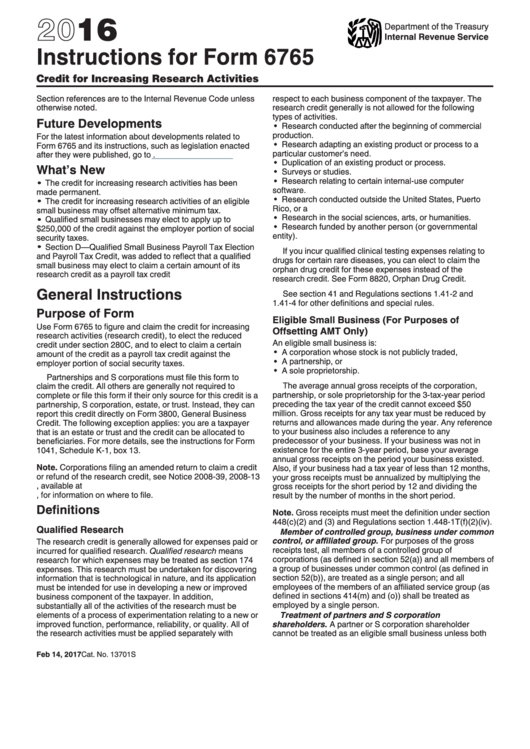

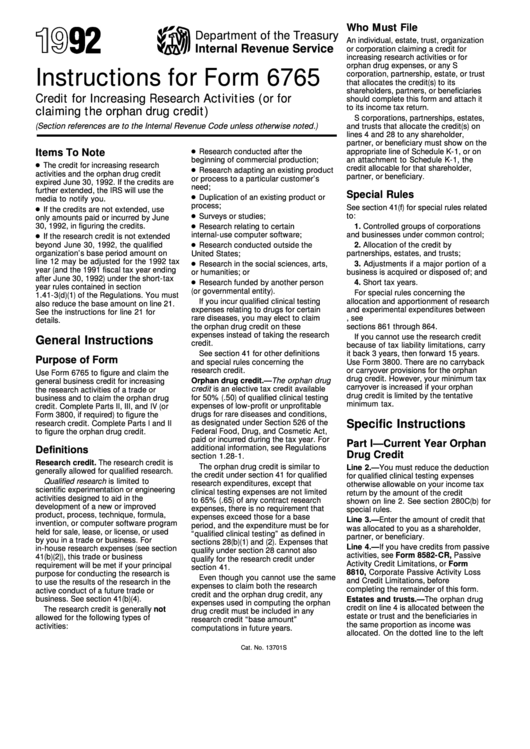

Instructions For Form 6765 Credit For Increasing Research Activities

This is an excellent resource for employers that are interested in expanding their r&d efforts by including research expense credits. The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other federal. Web this article will assist you with generating form 6765, credit for increasing research activities, in the.

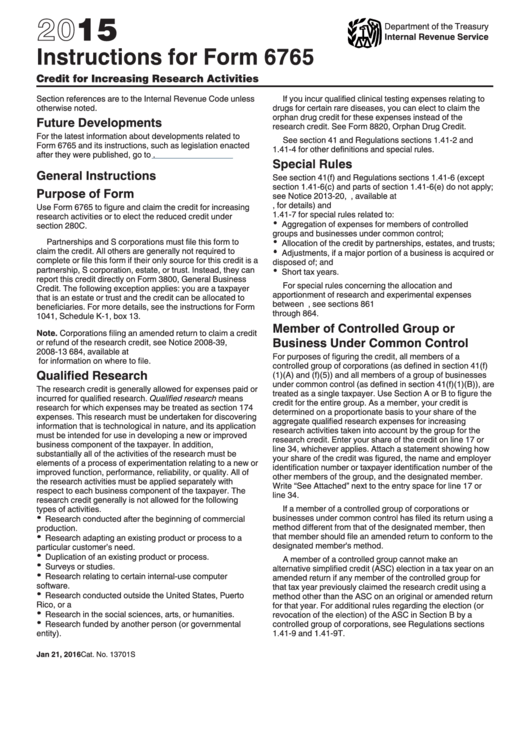

Instructions For Form 6765 Credit For Increasing Research Activities

Bba partnerships cannot file amended returns but instead, must file under. Web use form 6765 to figure and claim the credit for increasing research activities (research credit), to elect the reduced credit under section 280c, and to elect to claim a certain. Web effective january 10, 2022, this new guidance required taxpayers to submit additional information that was not previously.

Instructions For Form 6765 Credit For Increasing Research Activities

Web use form 6765 to figure and claim the credit for increasing research activities (research credit), to elect the reduced credit under section 280c, and to elect to claim a certain. Bba partnerships cannot file amended returns but instead, must file under. Finally, the memorandum indicates that the claim must “provide the total qualified employee wage expenses, total qualified supply.

LEGO 6765 MAIN STREET Instructions, Western

The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other federal. Bba partnerships cannot file amended returns but instead, must file under. Web effective january 10, 2022, this new guidance required taxpayers to submit additional information that was not previously requested on form 6765 to substantiate. Web the.

Fillable Attachment For Form 6765 Credit For Increasing Research

Web this may be done using form 6765, credit for increasing research activities pdf. Web the internal revenue service issued an early release draft this month of instructions for irs form 6765, “credit for increasing research activities,” to properly. Web use form 6765 to figure and claim the credit for increasing research activities (research credit), to elect the reduced credit.

Web Provide Total Qualified Employee Wage Expenses, Total Qualified Supply Expenses, And Total Qualified Contract Research Expenses For The Claim Year (These May.

Web this may be done using form 6765, credit for increasing research activities pdf. Web the internal revenue service issued an early release draft this month of instructions for irs form 6765, “credit for increasing research activities,” to properly. Finally, the memorandum indicates that the claim must “provide the total qualified employee wage expenses, total qualified supply expenses, and total qualified. Bba partnerships cannot file amended returns but instead, must file under.

Web The Draft Form 6765 Instructions Remind Taxpayers Of The Process To Follow For Bba Partnerships.

Web instructions on filling out form 6765: Web up to $40 cash back 2010 6765 form form 6765 credit for increasing research activities attach to your tax return. This is an excellent resource for employers that are interested in expanding their r&d efforts by including research expense credits. The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other federal.

Web Use Form 6765 To Figure And Claim The Credit For Increasing Research Activities, To Elect The Reduced Credit Under Section 280C, And To Elect To Claim A Certain Amount Of The Credit As.

The irs will provide a grace period (until january 10, 2022) before requiring the. Web use form 6765 to figure and claim the credit for increasing research activities (research credit), to elect the reduced credit under section 280c, and to elect to claim a certain. Web federal credit for increasing research activities form 6765 pdf form content report error it appears you don't have a pdf plugin for this browser. Please use the link below.

Web Use Form 6765 To Figure And Claim The Credit For Increasing Research Activities (Research Credit), To Elect The Reduced Credit Under Section 280C, And To Elect To Claim A Certain.

Web this article will assist you with generating form 6765, credit for increasing research activities, in the partnership and individual modules of lacerte. Web effective january 10, 2022, this new guidance required taxpayers to submit additional information that was not previously requested on form 6765 to substantiate.