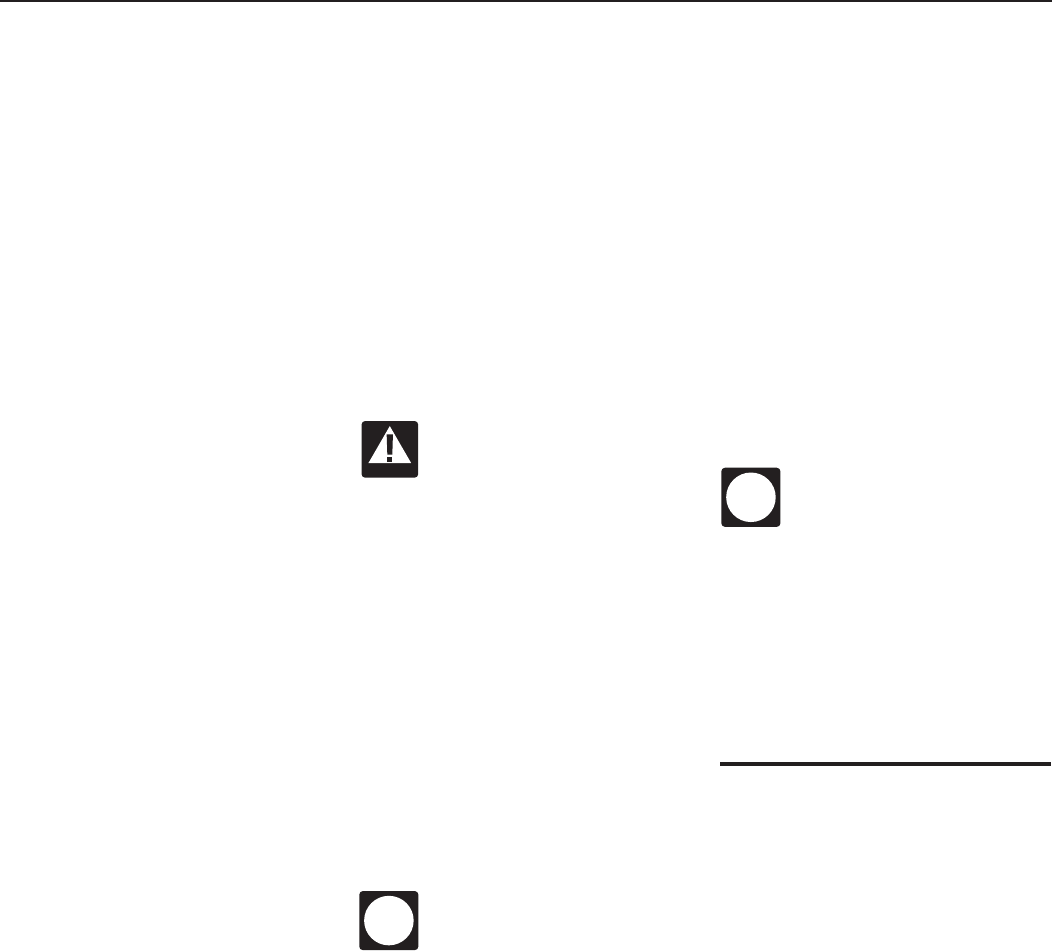

Form 8278 Irs

Form 8278 Irs - This written supervisory approval should be indicated on form 8278. Last, first, middle initial (single name only) 5. Current revision form 8288 pdf instructions for form 8288 ( print version pdf) recent developments applicability date of certain regulations under sections 1446 (a) and (f) pdf Web form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date each page of the form on which penalties are proposed. Web form 8278 is an adjustment document for penalties not subject to deficiency procedures. Assessment and abatement of miscellaneous civil penalties (february 2010) 1. Web 1 failure to file penalty 2 late payment penalty 3 notice of intent to levy 4 accuracy penalty 5 audit penalties 6 penalty on unpaid withheld taxes 7 estimated tax penalty 8 failure to deposit penalty 9 failure to file w2 and w3 forms 10 dishonored check penalty 11 frivolous tax submission penalty 12 failure to provide foreign. Form 8278 reflects columns for penalty description applicable penalty code section, reference number, number of violations, amount of penalty to be assessed or abated. You must withhold even if an application for a withholding certificate is or has been submitted to the irs on the date of transfer. This adjustment was performed manually by someone at irs and the forms you received should explain the reasons for this.

Last, first, middle initial (single name only) 5. Form 8278 reflects columns for penalty description applicable penalty code section, reference number, number of violations, amount of penalty to be assessed or abated. Use this form to report and transmit the amount withheld. Web a transferee must file form 8288 and transmit the tax withheld to the irs by the 20th day after the date of transfer. Ask your own finance question Web form 8278 item 1, name of taxpayer (single name) is used to establish the civil penalty for all mft 55 accounts including taxpayers with an mft 30, mfj filing status. Web form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date each page of the form on which penalties are proposed. Web this withholding serves to collect u.s. Assessment and abatement of miscellaneous civil penalties (february 2010) 1. Current revision form 8288 pdf instructions for form 8288 ( print version pdf) recent developments applicability date of certain regulations under sections 1446 (a) and (f) pdf

Tax that may be owed by the foreign person. Web pursuant to irc 6751(b), written supervisory approval must be indicated before assessing the irc 6702 penalty. The civil penalty name line is automatically established using form 8278, items 1, 2, 3, 5, and 7 when there is an entity module. Written supervisory approval should be obtained after the 30 day period provided in letter 3176c has expired. Catalog number 62278g www.irs.gov form 8278 (rev. Form 8278 reflects columns for penalty description applicable penalty code section, reference number, number of violations, amount of penalty to be assessed or abated. Web form 8278 item 1, name of taxpayer (single name) is used to establish the civil penalty for all mft 55 accounts including taxpayers with an mft 30, mfj filing status. Web department of the treasury — internal revenue service : Ask your own finance question You must withhold even if an application for a withholding certificate is or has been submitted to the irs on the date of transfer.

The IRS 8822 Form To File or Not to File MissNowMrs

Catalog number 62278g www.irs.gov form 8278 (rev. Current revision form 8288 pdf instructions for form 8288 ( print version pdf) recent developments applicability date of certain regulations under sections 1446 (a) and (f) pdf Written supervisory approval should be obtained after the 30 day period provided in letter 3176c has expired. Web 1 failure to file penalty 2 late payment.

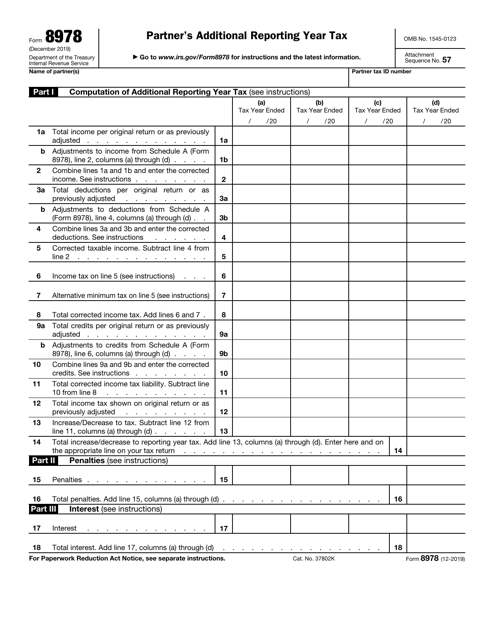

IRS Form 8978 Download Fillable PDF or Fill Online Partner's Additional

Written supervisory approval should be obtained after the 30 day period provided in letter 3176c has expired. Current revision form 8288 pdf instructions for form 8288 ( print version pdf) recent developments applicability date of certain regulations under sections 1446 (a) and (f) pdf Web form 8278 is an adjustment document for penalties not subject to deficiency procedures. This written.

A Frivolous Return Penalty Fraud

Catalog number 62278g www.irs.gov form 8278 (rev. Current revision form 8288 pdf instructions for form 8288 ( print version pdf) recent developments applicability date of certain regulations under sections 1446 (a) and (f) pdf Web this withholding serves to collect u.s. Last, first, middle initial (single name only) 5. Tax that may be owed by the foreign person.

Form 8332 Edit, Fill, Sign Online Handypdf

You must withhold even if an application for a withholding certificate is or has been submitted to the irs on the date of transfer. Last, first, middle initial (single name only) 5. Web department of the treasury — internal revenue service : Web form 8278 item 1, name of taxpayer (single name) is used to establish the civil penalty for.

Fill Free fillable F8275 Form 8275 (Rev. August 2013) PDF form

Web form 8278 is an adjustment document for penalties not subject to deficiency procedures. Web form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date each page of the form on which penalties are proposed. Catalog number 62278g www.irs.gov form 8278 (rev. This adjustment was performed manually by someone at irs.

Fillable Form 8278 Assessment And Abatement Of Miscellaneous Civil

Form 8278 reflects columns for penalty description applicable penalty code section, reference number, number of violations, amount of penalty to be assessed or abated. Web 1 failure to file penalty 2 late payment penalty 3 notice of intent to levy 4 accuracy penalty 5 audit penalties 6 penalty on unpaid withheld taxes 7 estimated tax penalty 8 failure to deposit.

Form 8917 Tuition and Fees Deduction (2014) Free Download

Catalog number 62278g www.irs.gov form 8278 (rev. Use this form to report and transmit the amount withheld. Web department of the treasury — internal revenue service : This adjustment was performed manually by someone at irs and the forms you received should explain the reasons for this. Form 8278 reflects columns for penalty description applicable penalty code section, reference number,.

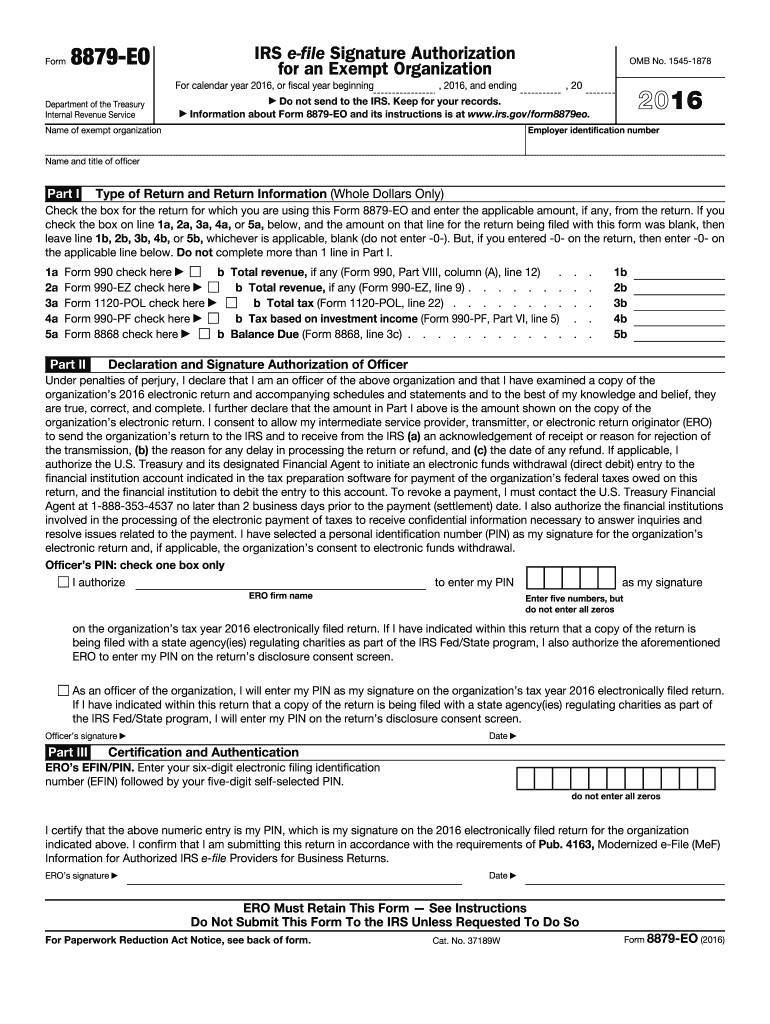

Form 8879 Fill Out and Sign Printable PDF Template signNow

Ask your own finance question Web 1 failure to file penalty 2 late payment penalty 3 notice of intent to levy 4 accuracy penalty 5 audit penalties 6 penalty on unpaid withheld taxes 7 estimated tax penalty 8 failure to deposit penalty 9 failure to file w2 and w3 forms 10 dishonored check penalty 11 frivolous tax submission penalty 12.

IRS Approved 5498 Trustee or Issuer Copy C Laser Tax Form 100 Recipients

Form 8278 reflects columns for penalty description applicable penalty code section, reference number, number of violations, amount of penalty to be assessed or abated. Last, first, middle initial (single name only) 5. Written supervisory approval should be obtained after the 30 day period provided in letter 3176c has expired. Assessment and abatement of miscellaneous civil penalties (february 2010) 1. Web.

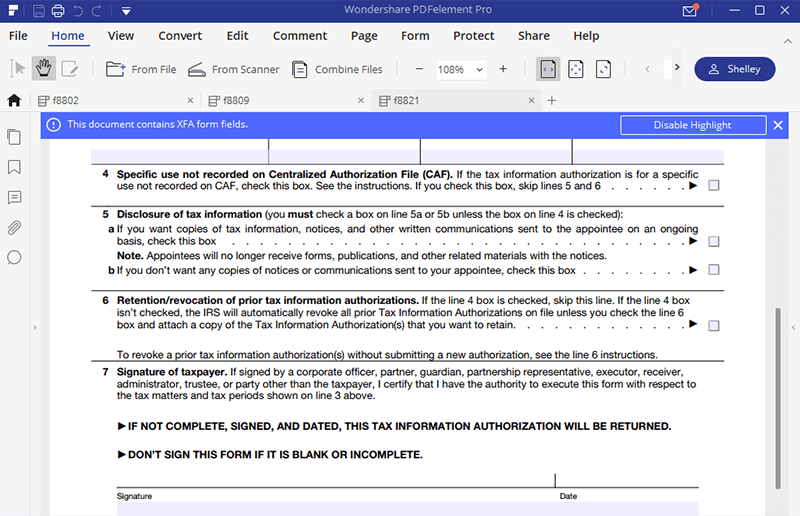

IRS Form 8821 Fill it out with the Best Program

Assessment and abatement of miscellaneous civil penalties (february 2010) 1. Web this withholding serves to collect u.s. The civil penalty name line is automatically established using form 8278, items 1, 2, 3, 5, and 7 when there is an entity module. You must withhold even if an application for a withholding certificate is or has been submitted to the irs.

Assessment And Abatement Of Miscellaneous Civil Penalties (February 2010) 1.

You must withhold even if an application for a withholding certificate is or has been submitted to the irs on the date of transfer. Web form 8278 item 1, name of taxpayer (single name) is used to establish the civil penalty for all mft 55 accounts including taxpayers with an mft 30, mfj filing status. The civil penalty name line is automatically established using form 8278, items 1, 2, 3, 5, and 7 when there is an entity module. Catalog number 62278g www.irs.gov form 8278 (rev.

Web This Withholding Serves To Collect U.s.

This adjustment was performed manually by someone at irs and the forms you received should explain the reasons for this. Web an 8278 tax is an adjustment that is applied to assessments or abatements. Web form 8278 is an adjustment document for penalties not subject to deficiency procedures. Web department of the treasury — internal revenue service :

Form 8278 Reflects Columns For Penalty Description Applicable Penalty Code Section, Reference Number, Number Of Violations, Amount Of Penalty To Be Assessed Or Abated.

Written supervisory approval should be obtained after the 30 day period provided in letter 3176c has expired. Tax that may be owed by the foreign person. Web a transferee must file form 8288 and transmit the tax withheld to the irs by the 20th day after the date of transfer. Current revision form 8288 pdf instructions for form 8288 ( print version pdf) recent developments applicability date of certain regulations under sections 1446 (a) and (f) pdf

This Written Supervisory Approval Should Be Indicated On Form 8278.

Web 1 failure to file penalty 2 late payment penalty 3 notice of intent to levy 4 accuracy penalty 5 audit penalties 6 penalty on unpaid withheld taxes 7 estimated tax penalty 8 failure to deposit penalty 9 failure to file w2 and w3 forms 10 dishonored check penalty 11 frivolous tax submission penalty 12 failure to provide foreign. Ask your own finance question Web pursuant to irc 6751(b), written supervisory approval must be indicated before assessing the irc 6702 penalty. Last, first, middle initial (single name only) 5.