Form 8288 B

Form 8288 B - Real property interests, before or on the date of closing. Real property interests, including recent updates, related forms and instructions on how to file. The tax withheld on the acquisition of a u.s. A buyer or other transferee of a u.s. The irs will normally act on an application by the 90th day after a complete application is received. Real property interests) for each person subject to withholding. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Web to apply for the firpta exemption: Name of transferor (attach additional sheets if more than one transferor) identification number. Or suite no., or rural route.

Web information about form 8288, u.s. Real property interests) for each person subject to withholding. The irs will normally act on an application by the 90th day after a complete application is received. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Web to apply for the firpta exemption: Real property interests, including recent updates, related forms and instructions on how to file. February 2016) application for withholding certificate for dispositions by foreign persons of u.s. The tax withheld on the acquisition of a u.s. Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to. Web complete the withholding agent information and part i through part v, as applicable.

Real property interests) for each person subject to withholding. Name of transferor (attach additional sheets if more than one transferor) identification number. The irs will normally act on an application by the 90th day after a complete application is received. Generally, transferees must file form 8288 by the 20th day after the date of the disposition. Foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Real property interest from a foreign person is reported and paid using form 8288. Report only one disposition on each form 8288 filed. Real property interests, before or on the date of closing. Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to.

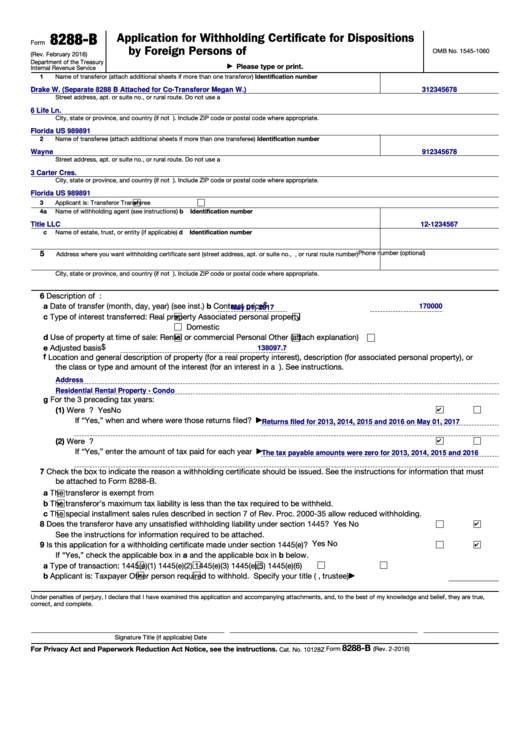

Fillable Form 8288B Application For Withholding Certificate For

Generally, transferees must file form 8288 by the 20th day after the date of the disposition. Web to apply for the firpta exemption: Or suite no., or rural route. Real property interests, before or on the date of closing. Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to.

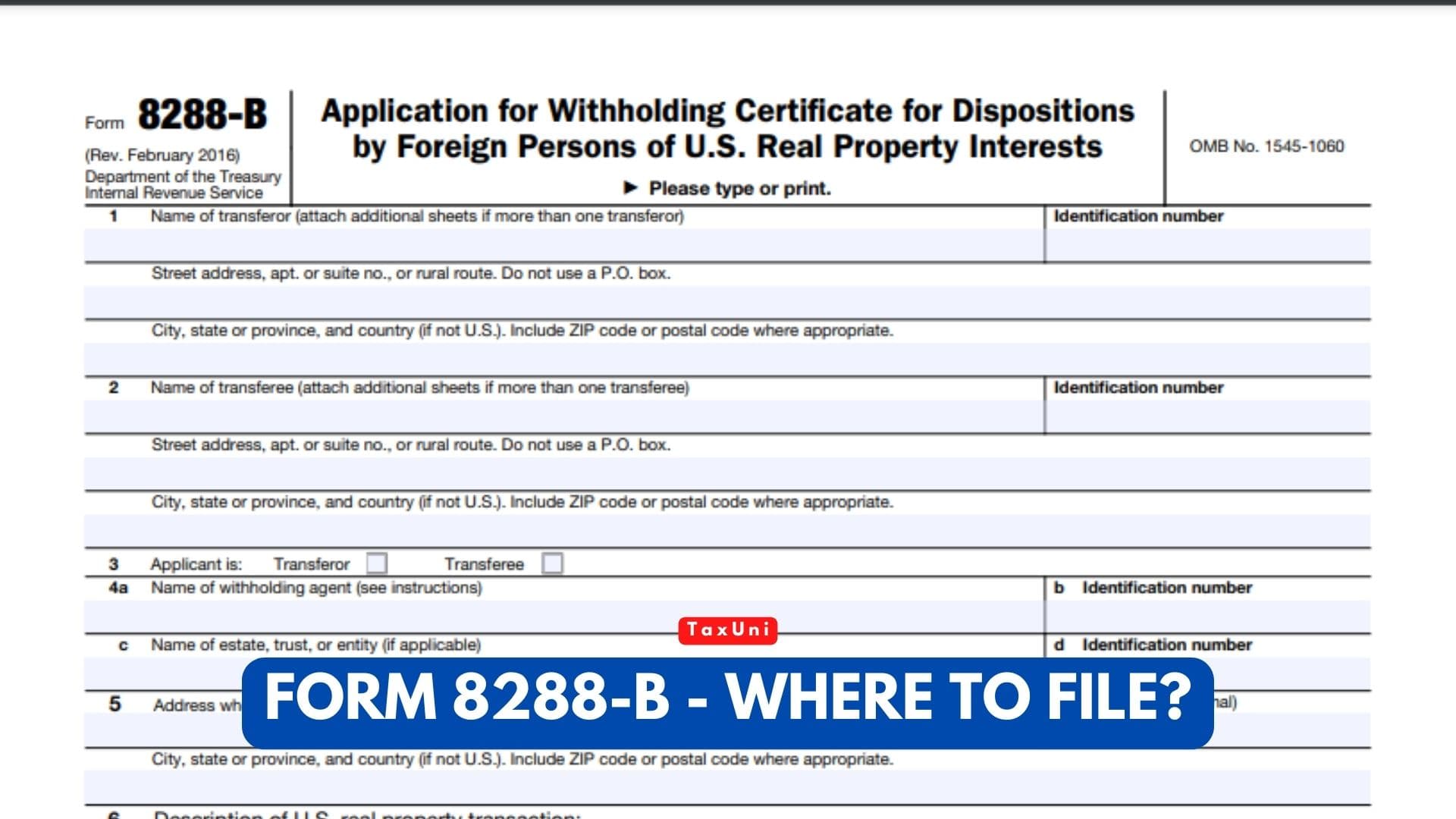

What Is IRS Form 8288B?

Web information about form 8288, u.s. Attach additional sheets if you need more space. Real property interests please type or print. Generally, transferees must file form 8288 by the 20th day after the date of the disposition. Real property interests, before or on the date of closing.

Form 8288B Where to File?

Foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Attach additional sheets if you need more space. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. February 2016) application for withholding certificate for dispositions by foreign persons of u.s..

Form 8288B Application for Withholding Certificate for Dispositions

The tax withheld on the acquisition of a u.s. Foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Withholding tax return for dispositions by foreign persons of u.s. A buyer or other transferee of a u.s. The 15% will be held in escrow while the firpta unit approves or.

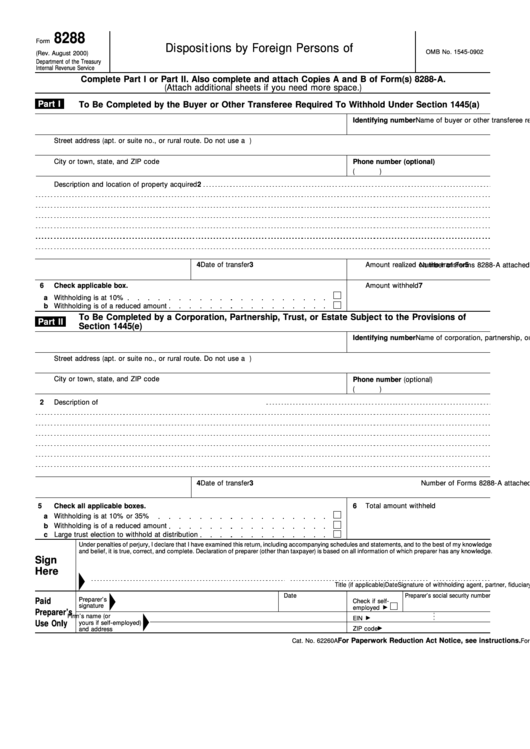

Form 8288 U.s. Withholding Tax Return For Dispositions By Foreign

Real property interest from a foreign person is reported and paid using form 8288. Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to. Real property interests please type or print. Name of transferor (attach additional sheets if more than one transferor) identification number. Generally, transferees must file form 8288 by the 20th day after.

Form 8288B Where to File?

The irs will normally act on an application by the 90th day after a complete application is received. Name of transferor (attach additional sheets if more than one transferor) identification number. Web information about form 8288, u.s. If you receive a withholding certificate from the irs that excuses withholding, you are not required to file form 8288. The 15% will.

Form 8288B Processing Time

Report only one disposition on each form 8288 filed. Attach additional sheets if you need more space. February 2016) application for withholding certificate for dispositions by foreign persons of u.s. Real property interests please type or print. Web information about form 8288, u.s.

Form 8288B Application for Withholding Certificate for Dispositions

Generally, transferees must file form 8288 by the 20th day after the date of the disposition. February 2016) application for withholding certificate for dispositions by foreign persons of u.s. Name of transferor (attach additional sheets if more than one transferor) identification number. A buyer or other transferee of a u.s. Web to apply for the firpta exemption:

Irs form 8288 b instructions

Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to. Real property interests, before or on the date of closing. Attach additional sheets if you need more space. Or suite no., or rural route. Web information about form 8288, u.s.

Form 8288B Application for Withholding Certificate for Dispositions

Real property interests please type or print. Web to apply for the firpta exemption: Real property interest from a foreign person is reported and paid using form 8288. Web complete the withholding agent information and part i through part v, as applicable. Real property interests, before or on the date of closing.

Foreign Persons Use This Form To Apply For A Withholding Certificate To Reduce Or Eliminate Withholding On Dispositions Of U.s.

Real property interests please type or print. If you receive a withholding certificate from the irs that excuses withholding, you are not required to file form 8288. Web to apply for the firpta exemption: Web information about form 8288, u.s.

Name Of Transferor (Attach Additional Sheets If More Than One Transferor) Identification Number.

Generally, transferees must file form 8288 by the 20th day after the date of the disposition. Withholding tax return for dispositions by foreign persons of u.s. Web complete the withholding agent information and part i through part v, as applicable. The irs will normally act on an application by the 90th day after a complete application is received.

Real Property Interests, Before Or On The Date Of Closing.

February 2016) application for withholding certificate for dispositions by foreign persons of u.s. If the withholding certificate is received prior to the sale, the buyer can rely on the withholding certificate for. Attach additional sheets if you need more space. The tax withheld on the acquisition of a u.s.

A Buyer Or Other Transferee Of A U.s.

Report only one disposition on each form 8288 filed. Real property interests) for each person subject to withholding. Real property interests, including recent updates, related forms and instructions on how to file. Real property interest, and a corporation, qualified investment entity, or fiduciary that is required to.