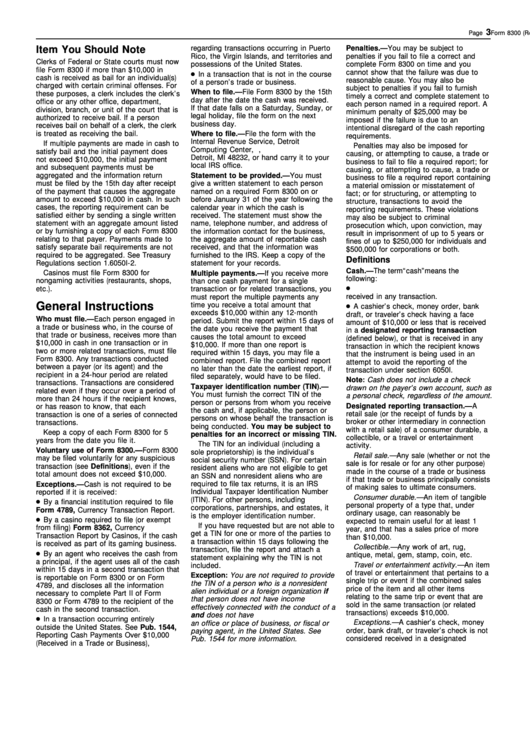

Form 8300 Instructions

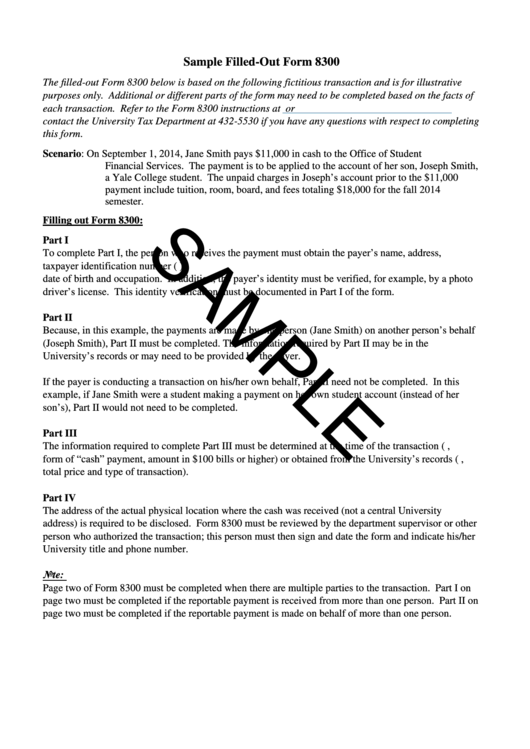

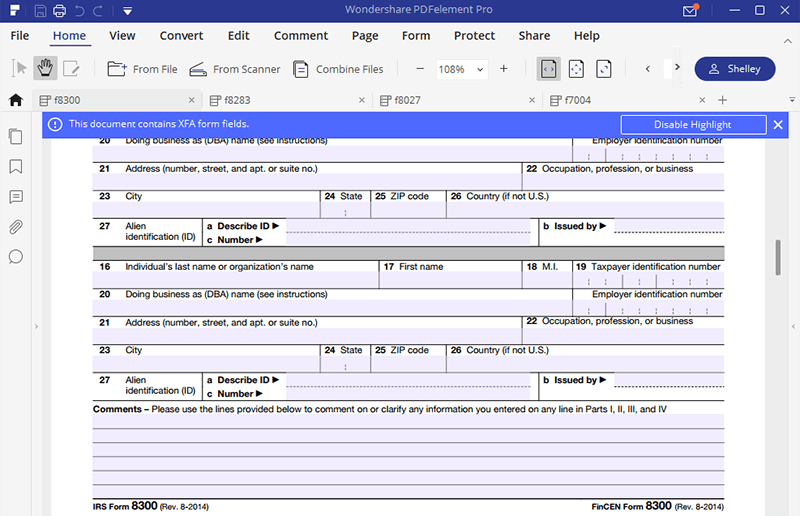

Form 8300 Instructions - To complete the form correctly, you must include everyone who is involved in a transaction. If more than three persons are involved, provide the same information in the comments section on page 2 of the form. 432mm (17) x 279mm (11) fold to: Web as form 8300 or cmir requirements, reporting or recordkeeping requirements imposed through a geographic targeting order, or recordkeeping requirements for funds transfers, transmittals of funds, and purchases of monetary instruments. Web information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms and instructions on how to file. Top 13mm (1/2), center sides. Web form 8300, report of cash payments over $10,000 received in a trade or business. Let’s move to part one of the form. 31 cfr 1010 subpart h. And for the tax professionals who prepare and file form 8300 on behalf of.

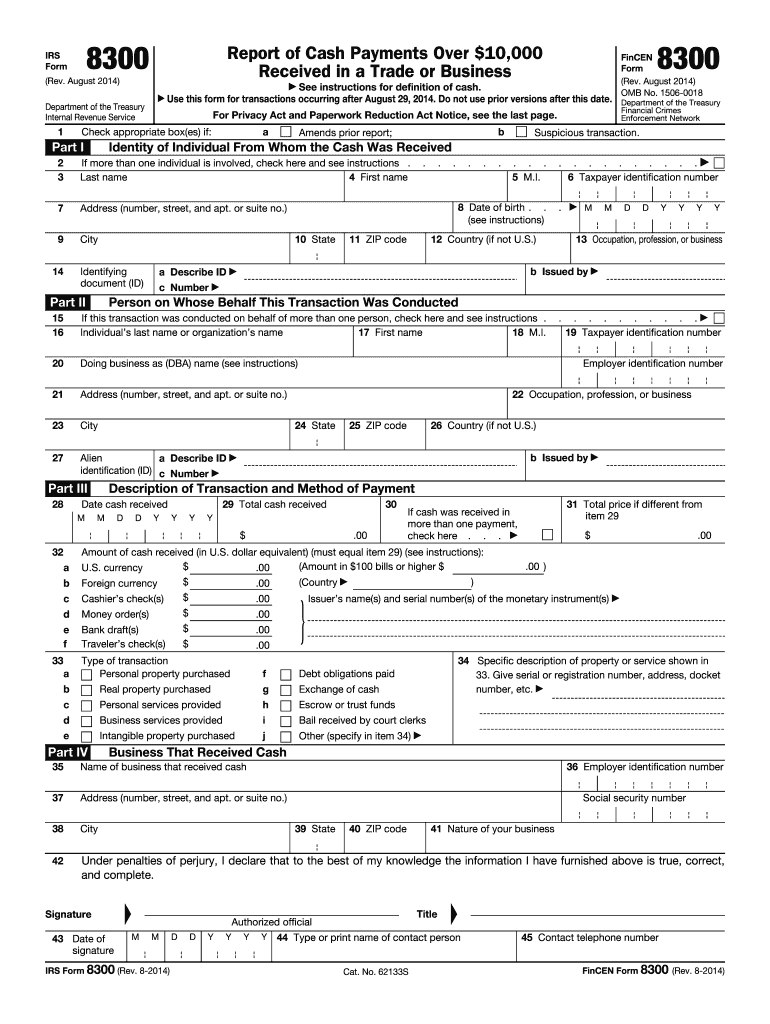

Transactions that require form 8300 include, but are not limited to: August 2014) department of the treasury internal revenue service. Web form 8300, report of cash payments over $10,000 received in a trade or business. Report of cash payments over $10,000 received in a trade or business. Forms marked suspicious are handled confidentially. Web form 8300 and reporting cash payments of over $10,000. See instructions for definition of cash. 216mm (8 1/2) x 279mm (11) perforate: Web provide the same information for the other persons by completing part two on page 2. Web instructions to printers form 8300, page 1 of 6 margins;

This guide is provided to educate and assist u.s. Form 8300 must be filed for each separate transaction that exceeds the $10,000 in cash limit. Web instructions to printers form 8300, page 1 of 6 margins; Web as form 8300 or cmir requirements, reporting or recordkeeping requirements imposed through a geographic targeting order, or recordkeeping requirements for funds transfers, transmittals of funds, and purchases of monetary instruments. It is voluntary but highly encouraged. 31 cfr 1010 subpart h. Transactions that require form 8300 include, but are not limited to: However, only the recipient of the funds is required to file a form 8300 with the irs. Web information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms and instructions on how to file. 216mm (8 1/2) x 279mm (11) perforate:

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

Web reference guide on the irs/fincen form 8300, report of cash payments over $10,000 received in a trade or business. Web form 8300, report of cash payments over $10,000 received in a trade or business. Transactions that require form 8300 include, but are not limited to: Use this form for transactions occurring after august 29, 2014. 31 cfr 1010 subpart.

Form 8300 General Instructions Pages 34 1997 printable pdf download

And for the tax professionals who prepare and file form 8300 on behalf of. Web information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms and instructions on how to file. Top 13mm (1/2), center sides. Web for transactions under the reporting threshold, you can file form 8300, if.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Persons in the continental u.s. Web for transactions under the reporting threshold, you can file form 8300, if the transaction appears suspicious. 432mm (17) x 279mm (11) fold to: It is voluntary but highly encouraged. Report of cash payments over $10,000 received in a trade or business.

Irs 8300 Form Fill Out and Sign Printable PDF Template signNow

However, only the recipient of the funds is required to file a form 8300 with the irs. Persons in the continental u.s. It is voluntary but highly encouraged. Web form 8300, report of cash payments over $10,000 received in a trade or business. Web as form 8300 or cmir requirements, reporting or recordkeeping requirements imposed through a geographic targeting order,.

The IRS Form 8300 and How it Works

Use this form for transactions occurring after august 29, 2014. Territories who have the obligation to file form 8300; Generally, if you're in a trade or business and receive more than $10,000 in cash in a single transaction or in related transactions, you must file form 8300. Web instructions to printers form 8300, page 1 of 6 margins; Web information.

Form 8300 Report of Cash Payments over 10,000 Received in a Trade or

Web for transactions under the reporting threshold, you can file form 8300, if the transaction appears suspicious. Let’s move to part one of the form. Web form 8300 and reporting cash payments of over $10,000. If more than three persons are involved, provide the same information in the comments section on page 2 of the form. It is voluntary but.

Sample FilledOut Form 8300 printable pdf download

31 cfr 1010 subpart h. Web instructions to printers form 8300, page 1 of 6 margins; Form 8300 must be filed for each separate transaction that exceeds the $10,000 in cash limit. Web form 8300, report of cash payments over $10,000 received in a trade or business. Web reference guide on the irs/fincen form 8300, report of cash payments over.

Form 8300 Report of Cash Payments over 10,000 Received in a Trade or

The form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue. Web as form 8300 or cmir requirements, reporting or recordkeeping requirements imposed through a geographic targeting order, or recordkeeping requirements for funds transfers, transmittals of funds, and purchases of monetary instruments. 216mm (8 1/2) x 279mm (11) perforate: Let’s.

IRS Form 8300 Reporting Cash Sales Over 10,000

Forms marked suspicious are handled confidentially. See instructions for definition of cash. Web provide the same information for the other persons by completing part two on page 2. Generally, if you're in a trade or business and receive more than $10,000 in cash in a single transaction or in related transactions, you must file form 8300. And for the tax.

IRS Form 8300 Fill it in a Smart Way

Web reference guide on the irs/fincen form 8300, report of cash payments over $10,000 received in a trade or business. If you or your business receives a payment of $10,000 in cash (or more), the total amount must be included and you are required to file. Web provide the same information for the other persons by completing part two on.

If More Than Three Persons Are Involved, Provide The Same Information In The Comments Section On Page 2 Of The Form.

31 cfr 1010 subpart h. Forms marked suspicious are handled confidentially. Web reference guide on the irs/fincen form 8300, report of cash payments over $10,000 received in a trade or business. Transactions that require form 8300 include, but are not limited to:

Web Provide The Same Information For The Other Persons By Completing Part Two On Page 2.

Let’s move to part one of the form. Web for transactions under the reporting threshold, you can file form 8300, if the transaction appears suspicious. It is voluntary but highly encouraged. Form 8300 must be filed for each separate transaction that exceeds the $10,000 in cash limit.

Report Of Cash Payments Over $10,000 Received In A Trade Or Business.

And like item 13, detail matters here. However, only the recipient of the funds is required to file a form 8300 with the irs. This guide is provided to educate and assist u.s. Use this form for transactions occurring after august 29, 2014.

432Mm (17) X 279Mm (11) Fold To:

Web instructions to printers form 8300, page 1 of 6 margins; And for the tax professionals who prepare and file form 8300 on behalf of. Web form 8300 and reporting cash payments of over $10,000. Territories who have the obligation to file form 8300;