Form 8379 Instructions

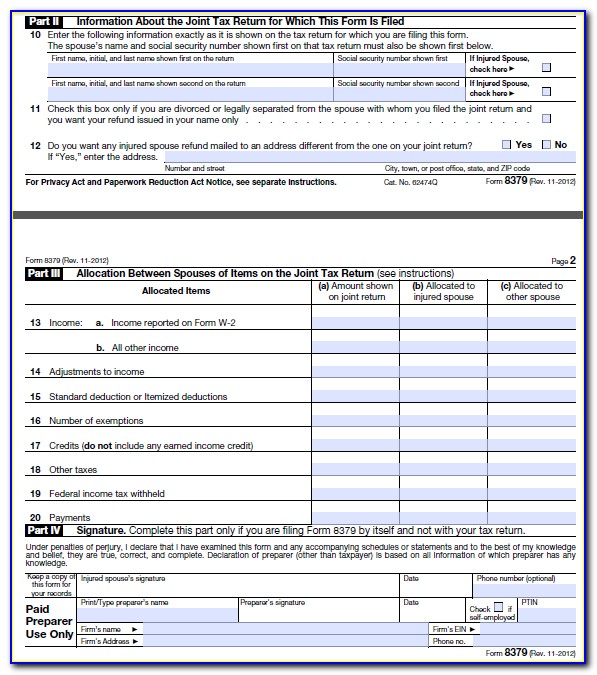

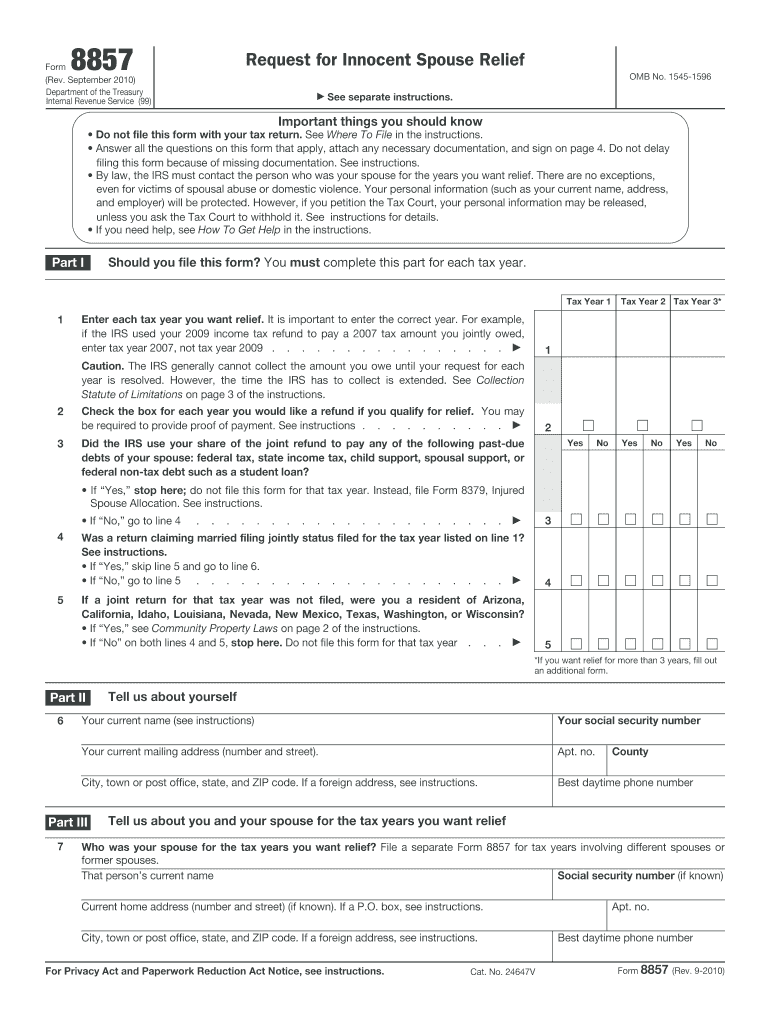

Form 8379 Instructions - Alternatively, the injured spouse can file it separately from the return if they find out after they file that a. To file this form in turbotax: November 2021) department of the treasury internal revenue service. Web filling out the form. Web form 8379 is used by injured spouses to compute their share of a joint tax refund. You must file jointly to use this form. A couple can file form 8379 along with their joint tax return if they expect their refund to be seized. You must file form 8379 within 3 years You must file form 8379 for each year you meet this condition and want your portion of any offset refunded. Web the bottom portion of the form is used to allocate the income, deductions, withholdings, exemptions and credits to the correct taxpayers.

Web form 8379 is used by injured spouses to compute their share of a joint tax refund. November 2021) department of the treasury internal revenue service. You must file form 8379 for each year you meet this condition and want your portion of any offset refunded. You must file form 8379 within 3 years For instructions and the latest information. Web what is irs form 8379? You can file this form before or after the offset occurs, depending on when you become aware of the separate debt, and can file. The injured spouse on a jointly filed tax return files form 8379 to get back their share of the joint refund when the joint overpayment is. Web the bottom portion of the form is used to allocate the income, deductions, withholdings, exemptions and credits to the correct taxpayers. Filing an 8379 will delay your federal refund by up to 14 weeks.

Filing an 8379 will delay your federal refund by up to 14 weeks. Web what is irs form 8379? You must file jointly to use this form. To file this form in turbotax: Enter the tax year for which you are filing. Web filling out the form. You must file form 8379 for each year you meet this condition and want your portion of any offset refunded. The injured spouse on a jointly filed tax return files form 8379 to get back their share of the joint refund when the joint overpayment is. How do i allocate my income on form 8379? Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund.

Can File Form 8379 Electronically hqfilecloud

November 2021) department of the treasury internal revenue service. The injured spouse on a jointly filed tax return files form 8379 to get back their share of the joint refund when the joint overpayment is. By filing form 8379, the injured spouse may be able to get back his or her share of the joint refund. You must complete this.

How To Complete Irs Form 8379 Form Resume Examples aEDvmqAk1Y

November 2021) department of the treasury internal revenue service. 104 part i should you file this form? You must file jointly to use this form. To file this form in turbotax: Web filling out the form.

Form 8379 Download Fill Out and Sign Printable PDF Template signNow

The injured spouse on a jointly filed tax return files form 8379 to get back their share of the joint refund when the joint overpayment is. A couple can file form 8379 along with their joint tax return if they expect their refund to be seized. You must file form 8379 within 3 years How do i allocate my income.

Irs Amended Form Status Universal Network

Alternatively, the injured spouse can file it separately from the return if they find out after they file that a. A couple can file form 8379 along with their joint tax return if they expect their refund to be seized. For instructions and the latest information. Web you need to file form 8379 for each year you’re an injured spouse.

Irs Forms Ss 4 Instructions Form Resume Examples GEOGQVKDVr

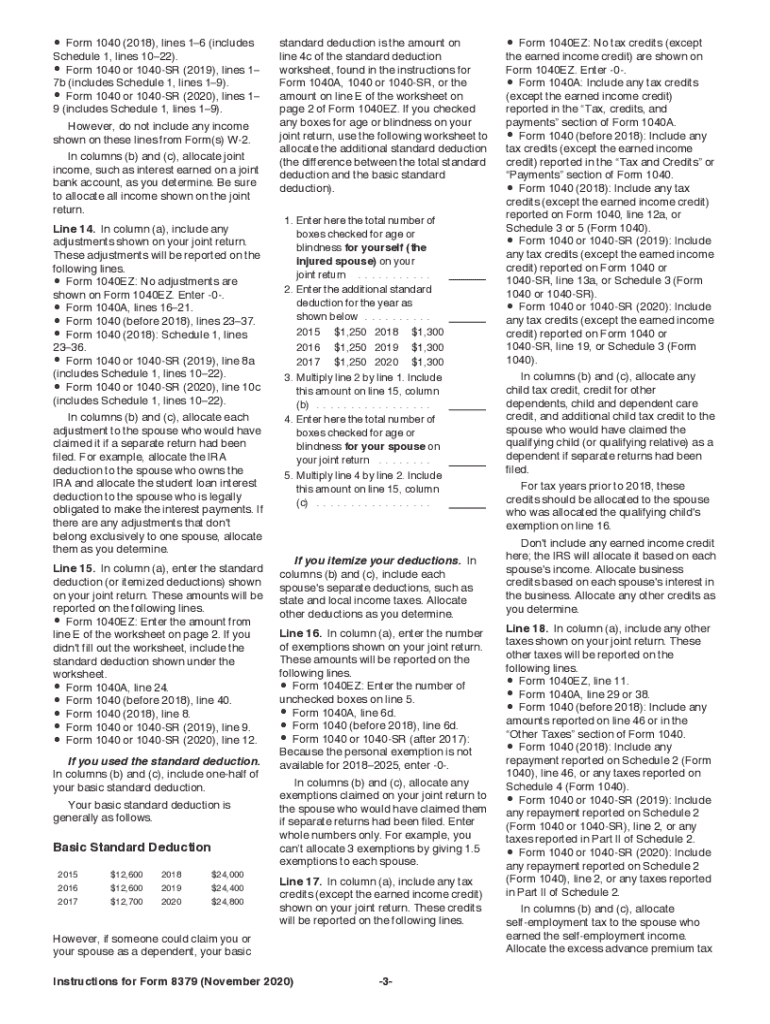

Filing an 8379 will delay your federal refund by up to 14 weeks. How do i allocate my income on form 8379? 104 part i should you file this form? Web the bottom portion of the form is used to allocate the income, deductions, withholdings, exemptions and credits to the correct taxpayers. You must file jointly to use this form.

Form 8379 Edit, Fill, Sign Online Handypdf

How do i allocate my income on form 8379? A couple can file form 8379 along with their joint tax return if they expect their refund to be seized. Alternatively, the injured spouse can file it separately from the return if they find out after they file that a. Web filling out the form. You must file form 8379 within.

Irs Forms 8379 Instructions Form Resume Examples Wk9y660LY3

Enter the tax year for which you are filing. Web filling out the form. To file this form in turbotax: 104 part i should you file this form? You must file form 8379 for each year you meet this condition and want your portion of any offset refunded.

example of form 8379 filled out Fill Online, Printable, Fillable

The allocation instructions are as follows: Enter the tax year for which you are filing. For instructions and the latest information. You can file this form before or after the offset occurs, depending on when you become aware of the separate debt, and can file. Alternatively, the injured spouse can file it separately from the return if they find out.

Form 8379 Instructions Fillable and Editable PDF Template

Web the bottom portion of the form is used to allocate the income, deductions, withholdings, exemptions and credits to the correct taxpayers. Enter the tax year for which you are filing. You must file jointly to use this form. Alternatively, the injured spouse can file it separately from the return if they find out after they file that a. You.

IRS 8379 Instructions 2020 Fill out Tax Template Online US Legal Forms

Web form 8379 is used by injured spouses to compute their share of a joint tax refund. Web the bottom portion of the form is used to allocate the income, deductions, withholdings, exemptions and credits to the correct taxpayers. You must file form 8379 within 3 years You must file form 8379 for each year you meet this condition and.

You Must File Form 8379 Within 3 Years

The injured spouse on a jointly filed tax return files form 8379 to get back their share of the joint refund when the joint overpayment is. Web form 8379 is used by injured spouses to compute their share of a joint tax refund. You must file form 8379 for each year you meet this condition and want your portion of any offset refunded. Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund.

Web The Bottom Portion Of The Form Is Used To Allocate The Income, Deductions, Withholdings, Exemptions And Credits To The Correct Taxpayers.

Alternatively, the injured spouse can file it separately from the return if they find out after they file that a. You must file jointly to use this form. You must file form 8379 for each year you meet this condition and want your portion of any offset refunded. Enter the tax year for which you are filing.

How Do I Allocate My Income On Form 8379?

To file this form in turbotax: By filing form 8379, the injured spouse may be able to get back his or her share of the joint refund. A couple can file form 8379 along with their joint tax return if they expect their refund to be seized. November 2021) department of the treasury internal revenue service.

104 Part I Should You File This Form?

Web filling out the form. Filing an 8379 will delay your federal refund by up to 14 weeks. For instructions and the latest information. The allocation instructions are as follows: