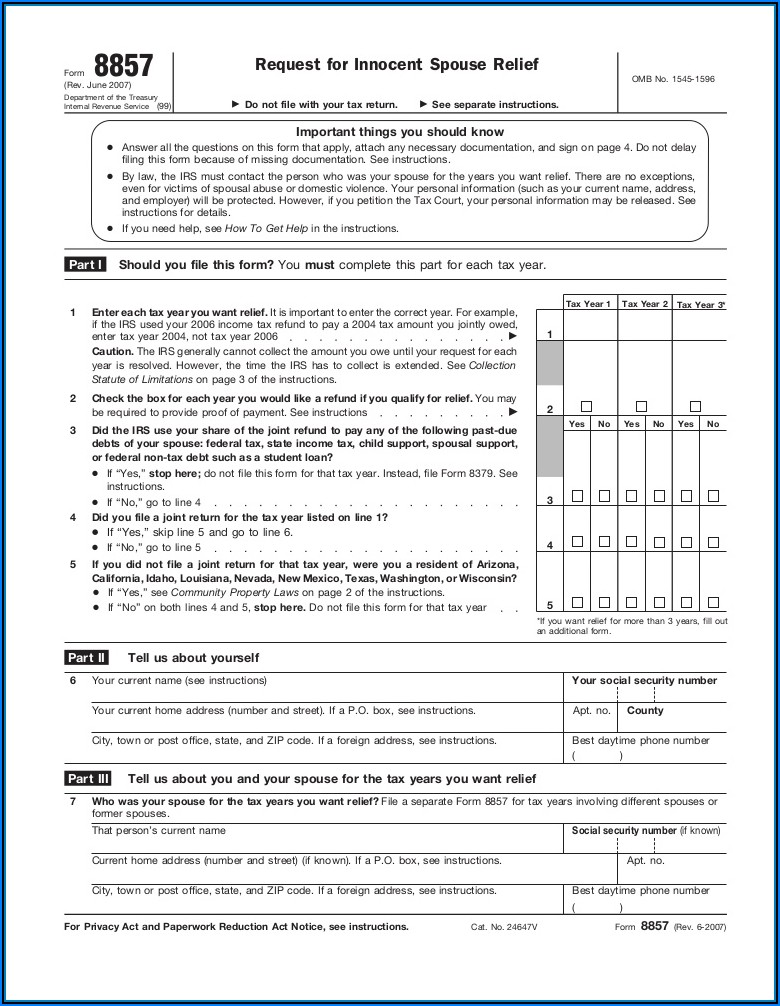

Form 8379 Pdf

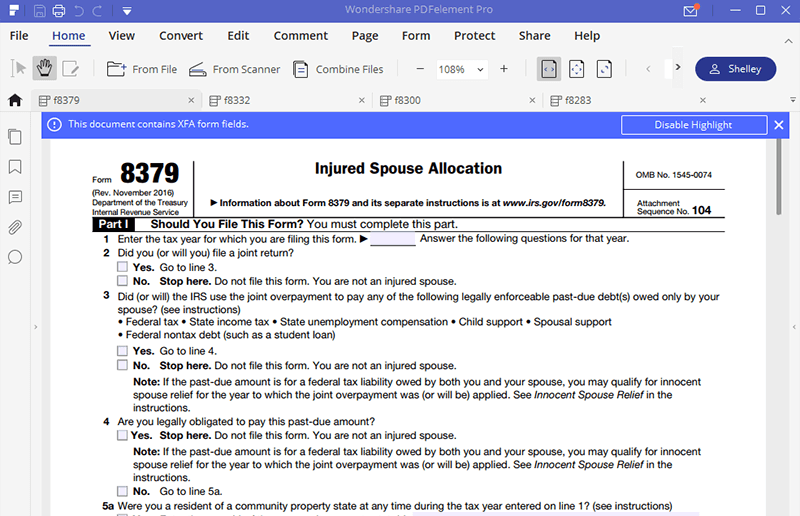

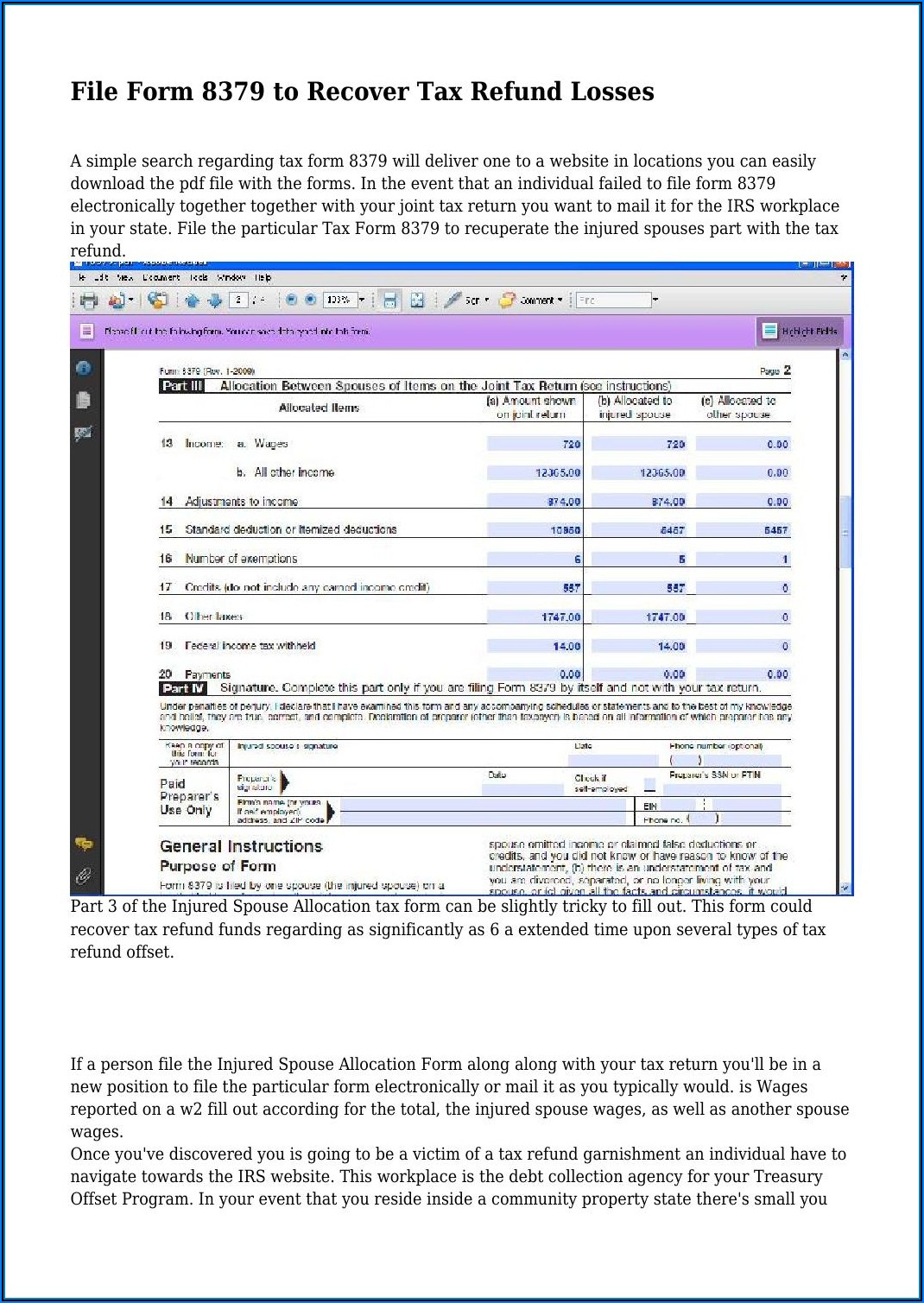

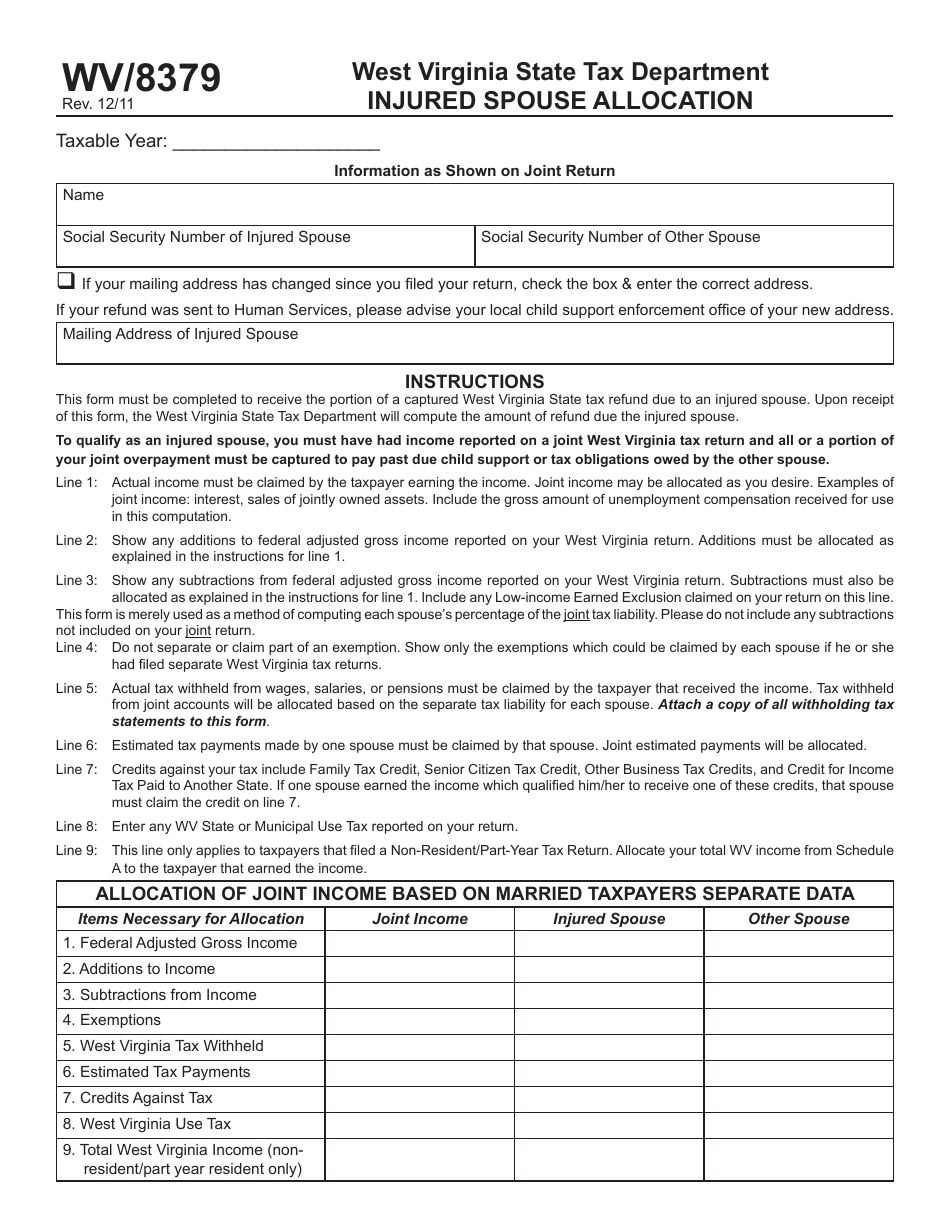

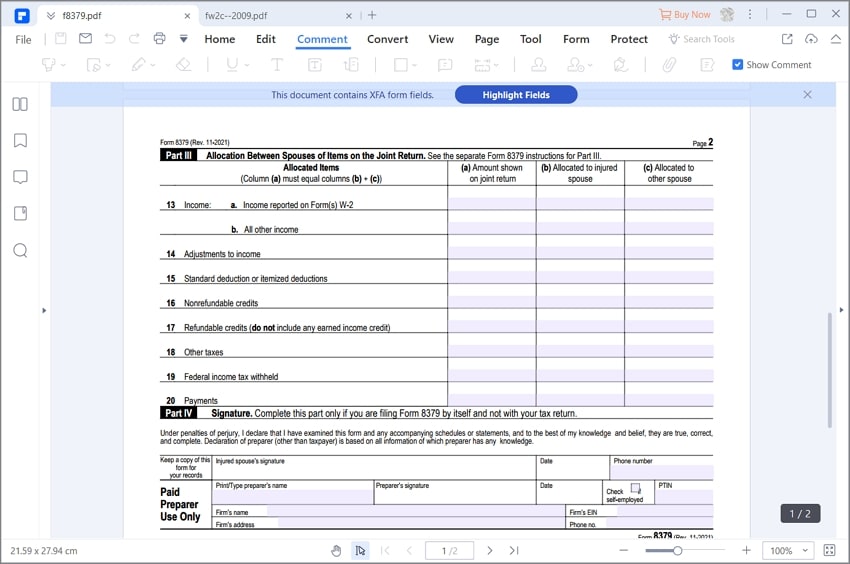

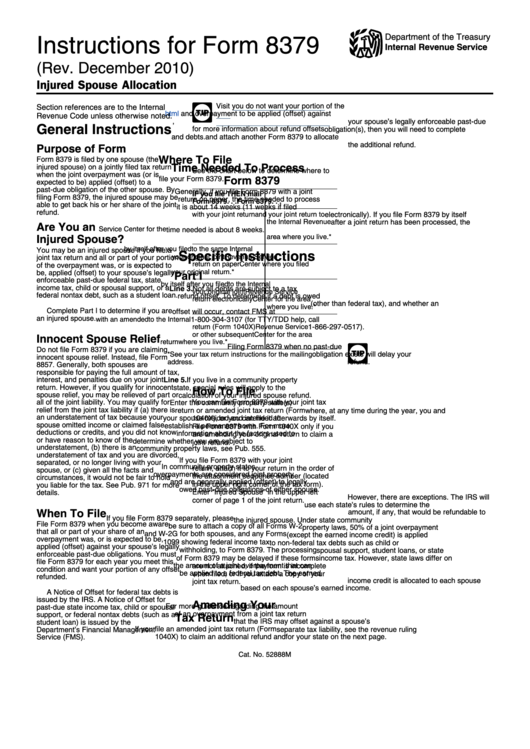

Form 8379 Pdf - If you did not electronically file form 8379 injured spouse allocation when you filed your original tax return, you need to send. Form 8379 is used by injured. You received and reported income. Web file form 8379 if only item 1 below applies. More about the federal form 8379 we last updated. Complete, edit or print tax forms instantly. Web form 8379 generally, if you file form 8379 with a joint return on paper, the time needed to process it is about 14 weeks (11 weeks if filed electronically). Ad access irs tax forms. If you file form 8379 by. If you have already filed the joint tax return, mail form 8379 by itself to the internal revenue service.

Easily fill out pdf blank, edit, and sign them. Web form 8379 essentially asks the irs to release the injured spouse's portion of the refund. Get ready for this year's tax season quickly and safely with pdffiller! If you have already filed the joint tax return, mail form 8379 by itself to the internal revenue service. Quickly add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from. Complete, edit or print tax forms instantly. The following steps given below can guide you to show how to complete the irs form 8379. You can download or print current or past. Complete, edit or print tax forms instantly. Web the form will be filed with your tax return, due on tax day.

Web a tax document known as irs form 8379 can be used to reclaim a portion of a tax refund that has already been or will be utilized to settle an unpaid debt of the other. Otherwise, in order to claim your tax refund back, you will have to file form 8379 separately after you have filed your tax. Click the button get form to open it and start editing. Web up to $40 cash back easily complete a printable irs 8379 form 2021 online. Web irs 8379 is a form that must be filled by the spouse that is injured and wants to receive the return of taxes that were overpaid. Web irs form 8379 is a tax form that can be filed to reclaim part of a tax refund that has been used to pay for an overdue debt. Complete, edit or print tax forms instantly. Web you may file form 8379 to claim your part of the refund if all three of the following apply: Quickly add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from. The following steps given below can guide you to show how to complete the irs form 8379.

Form 8379 Share Everything but the Refund! pdfFiller Blog

Web edit form 8379 instructions 2020. Web you may file form 8379 to claim your part of the refund if all three of the following apply: Web form 8379 generally, if you file form 8379 with a joint return on paper, the time needed to process it is about 14 weeks (11 weeks if filed electronically). They will be returning.

Irs Form 8379 Online Form Resume Examples N8VZddpO9w

Additional information instructions for form 8379,. If you have already filed the joint tax return, mail form 8379 by itself to the internal revenue service. More about the federal form 8379 we last updated. Quickly add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from. Complete, edit or print tax forms.

Форма IRS 8379 заполните правильно

Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past. Get ready for tax season deadlines by completing any required tax forms today. Web up to $40 cash back easily complete a printable irs 8379 form 2021 online..

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

If a married couple files a joint tax return. Web how to submit the irs 8379 instructions on the internet: If you file form 8379 by. Fill in all required lines in the selected document utilizing our. Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file.

Form WV/8379 Download Printable PDF or Fill Online Injured Spouse

The following steps given below can guide you to show how to complete the irs form 8379. Web irs form 8379 is a tax form that can be filed to reclaim part of a tax refund that has been used to pay for an overdue debt. Fill in all required lines in the selected document utilizing our. Quickly add and.

Form 8379 Instructions Fillable and Editable PDF Template

If you have already filed the joint tax return, mail form 8379 by itself to the internal revenue service. Additional information instructions for form 8379,. Save or instantly send your ready documents. Web form 8379 essentially asks the irs to release the injured spouse's portion of the refund. Web irs form 8379 is a tax form that can be filed.

IRS Form 8379 Fill it Right

Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. You can download or print current or past. Web how to submit the irs 8379 instructions on the internet: Web up to $40 cash back easily complete a printable irs 8379 form 2021 online. Web irs form 8379 is a legal.

Instructions For Form 8379 Injured Spouse Allocation 2010 printable

Save or instantly send your ready documents. Get ready for tax season deadlines by completing any required tax forms today. Web up to $40 cash back easily complete a printable irs 8379 form 2021 online. Web you may file form 8379 to claim your part of the refund if all three of the following apply: You can download or print.

Line 13b Form 8379 Fill online, Printable, Fillable Blank

The following steps given below can guide you to show how to complete the irs form 8379. Web a tax document known as irs form 8379 can be used to reclaim a portion of a tax refund that has already been or will be utilized to settle an unpaid debt of the other. Web file form 8379 if only item.

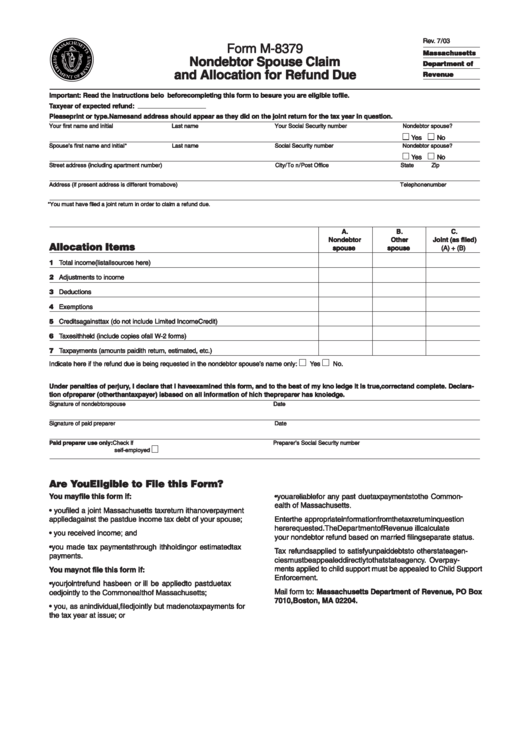

Form M8379 Nondebtor Spouse Claim And Allocation For Refund Due

Web instructions for how to fill out irs form 8379. Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. The following steps given below can guide you to show how to complete the irs form 8379. Web edit form 8379 instructions 2020. Save or instantly send your ready documents.

Web Form 8379 Essentially Asks The Irs To Release The Injured Spouse's Portion Of The Refund.

Form 8379 is used by injured. Complete, edit or print tax forms instantly. If you did not electronically file form 8379 injured spouse allocation when you filed your original tax return, you need to send. Get ready for tax season deadlines by completing any required tax forms today.

Web Instructions For How To Fill Out Irs Form 8379.

They will be returning as a part of the join refund. Web irs form 8379 is a legal paper needed to be completed in the situation when one of the partners (the one considered injured) wants to claim for a tax refund filed together with. You received and reported income. Web file form 8379 if only item 1 below applies.

Create A Blank & Editable 8379 Form,.

You can download or print current or past. Web you may file form 8379 to claim your part of the refund if all three of the following apply: Web irs form 8379 is a tax form that can be filed to reclaim part of a tax refund that has been used to pay for an overdue debt. Ad access irs tax forms.

If A Married Couple Files A Joint Tax Return.

Web if you file form 8379 by itself after a joint return has already been processed, the time needed is about 8 weeks. Web form 8379 generally, if you file form 8379 with a joint return on paper, the time needed to process it is about 14 weeks (11 weeks if filed electronically). Additional information instructions for form 8379,. Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file.