Form 83B Instructions

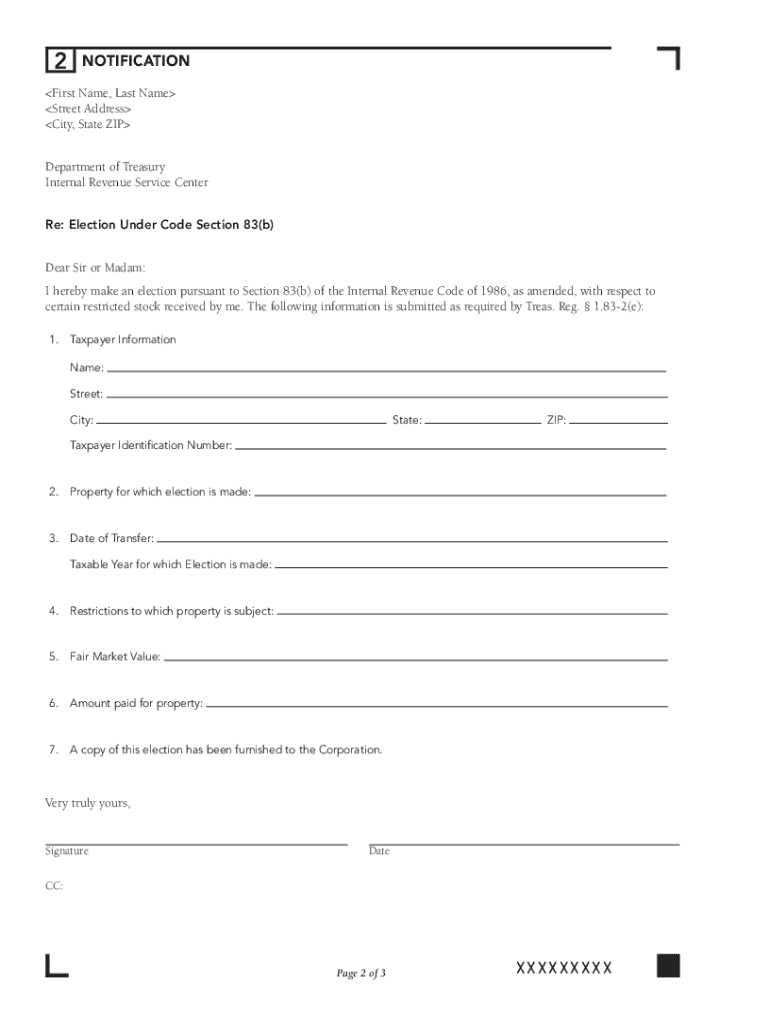

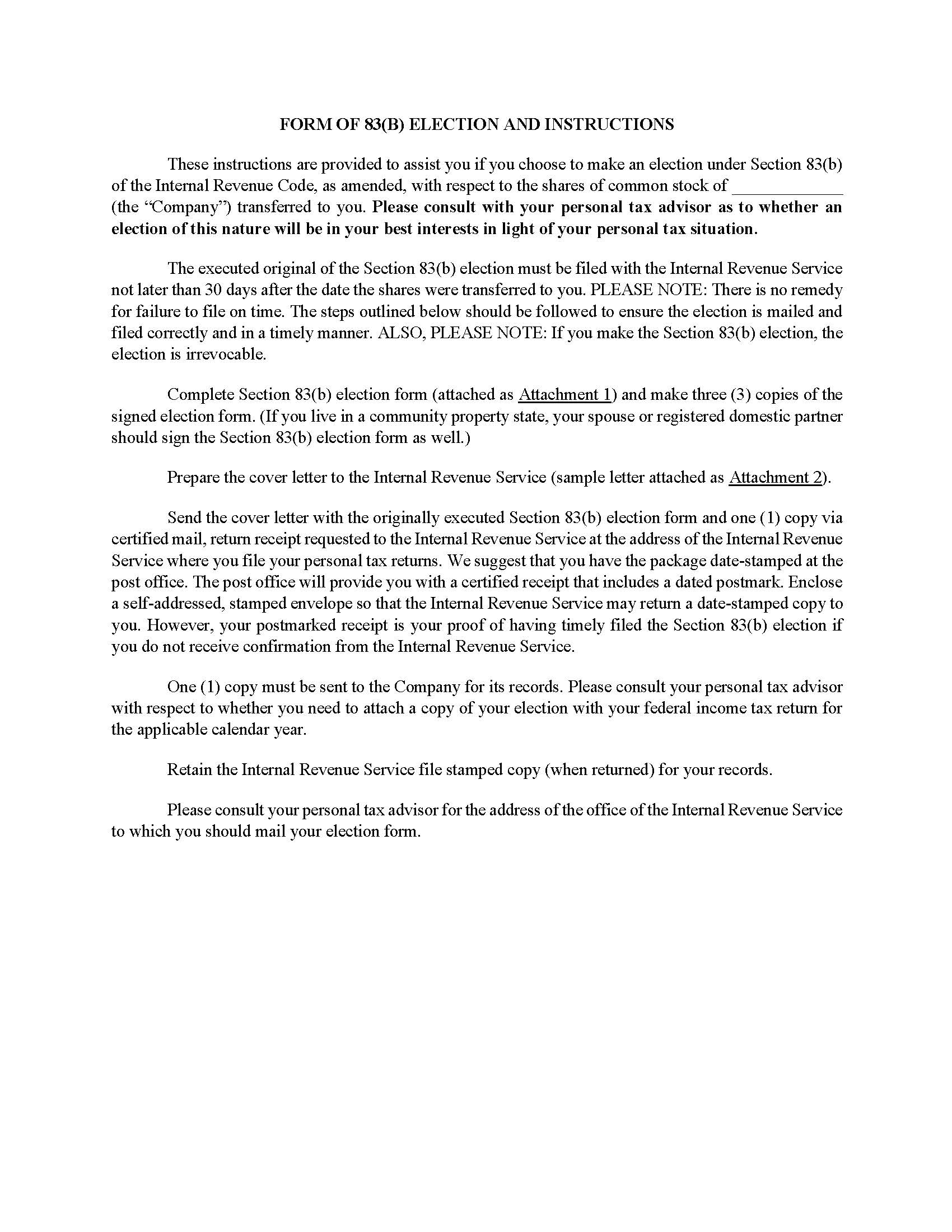

Form 83B Instructions - Mail the letter and 83 (b) election form to the irs address (see dropdown below. Web complete the following steps within 30 days of your award date to make an 83(b) election: Sign online button or tick the. 🖨️ print out 4 copies of the 83 (b) election + 2 copies of the cover letter. Web an 83 (b) election form is a letter sent to the internal revenue service notifying them of your interest to be taxed on your equity, including any restricted shares. Web employees and founders must file an 83(b) election form with the irs to get this favorable tax treatment. You'll find these as part. Web section 83 addresses the income tax consequences of property transferred in connection with the performance of services. Web sign the 83 (b) election form and letter and follow the instructions in the letter. To get started on the form, utilize the fill camp;

Web form 83 (b) is a form that is signed and sent to the internal revenue service (“irs”) making a choice — an election — on when the signatory would like to be taxed. Register and subscribe now to work on your inst's for completing irs section 83(b) form. Web accelerate the date on which the restricted shares are subject to ordinary income rates, and therefore the date in which all appreciation in value will be taxed as capital gain, by. Web upon issuance, no 83(b) election is necessary. Web instructions for completing irs section 83 (b) form: Web the undersigned taxpayer hereby elects, pursuant to section 83 (b) of the internal revenue code of 1986, as amended, to include in his or her gross income for the current taxable. Ad upload, modify or create forms. To get started on the form, utilize the fill camp; Web section 83 addresses the income tax consequences of property transferred in connection with the performance of services. Signnow allows users to edit, sign, fill & share all type of documents online.

Web how to fill out the 83(b) election you’ll need a few pieces of info about you, the company, and your shares. Web form 83 (b) is a form that is signed and sent to the internal revenue service (“irs”) making a choice — an election — on when the signatory would like to be taxed. The board approval (founder stock) for the company and your. Sign online button or tick the. Web accelerate the date on which the restricted shares are subject to ordinary income rates, and therefore the date in which all appreciation in value will be taxed as capital gain, by. Web upon issuance, no 83(b) election is necessary. Web section 83 addresses the income tax consequences of property transferred in connection with the performance of services. Print the irs 83(b) form that has been generated for you on the second page by. Web instructions for filling out this form and enlighten you on an easy solution. Register and subscribe now to work on your inst's for completing irs section 83(b) form.

83b Form Business Law Attorneys Fourscore Business Law

Signnow allows users to edit, sign, fill & share all type of documents online. Mail the letter and 83 (b) election form to the irs address (see dropdown below. Web the way to fill out the instructions for completing irs section 83 (b) form — fidelity online: Web instructions for completing irs section 83 (b) form: Web an 83 (b).

83 b election form pdf Fill out & sign online DocHub

Complete the four enclosed 83(b) election forms* onall 4 copiesof the 83(b) electionforms in this. Try it for free now! Web accelerate the date on which the restricted shares are subject to ordinary income rates, and therefore the date in which all appreciation in value will be taxed as capital gain, by. Web section 83 addresses the income tax consequences.

83b Form Business Law Attorneys Fourscore Business Law

Edit, sign and save insts completing irs 83(b) form. Try it for free now! To get started on the form, utilize the fill camp; Web an 83 (b) election form is a letter sent to the internal revenue service notifying them of your interest to be taxed on your equity, including any restricted shares. Web employees and founders must file.

83 b election electronic signature Fill Online, Printable, Fillable

Ad upload, modify or create forms. 🖨️ print out 4 copies of the 83 (b) election + 2 copies of the cover letter. Web instructions for completing irs section 83 (b) form: You'll find these as part. To get started on the form, utilize the fill camp;

83(b) Election and Restricted Stock Awards YouTube

Web instructions for filling out this form and enlighten you on an easy solution. Web instructions for completing irs section 83 (b) form: Web form 83 (b) is a form that is signed and sent to the internal revenue service (“irs”) making a choice — an election — on when the signatory would like to be taxed. Signnow allows users.

Instruction For Completing IRS Section 83 (B) Form Heading Internal

Mail the letter and 83 (b) election form to the irs address (see dropdown below. Signnow allows users to edit, sign, fill & share all type of documents online. Web how to fill out the 83(b) election you’ll need a few pieces of info about you, the company, and your shares. Web the undersigned taxpayer hereby elects, pursuant to section.

83 (B) Form

Mail the letter and 83 (b) election form to the irs address (see dropdown below. To get started on the form, utilize the fill camp; Sign online button or tick the. Web sign the 83 (b) election form and letter and follow the instructions in the letter. Print the irs 83(b) form that has been generated for you on the.

Form W8BENE Irs forms, Accounting and finance, Irs

To get started on the form, utilize the fill camp; Register and subscribe now to work on your inst's for completing irs section 83(b) form. Try it for free now! Sign online button or tick the. Print the irs 83(b) form that has been generated for you on the second page by.

83 B Election Form And Tax Return Tax Walls

Web section 83 addresses the income tax consequences of property transferred in connection with the performance of services. Try it for free now! Web the way to fill out the instructions for completing irs section 83 (b) form — fidelity online: To make an 83 (b) election you must complete the following steps within 30 days of your award date:..

83 B Election Form And Tax Return Tax Walls

Web upon issuance, no 83(b) election is necessary. Register and subscribe now to work on your inst's for completing irs section 83(b) form. You'll find these as part. Web accelerate the date on which the restricted shares are subject to ordinary income rates, and therefore the date in which all appreciation in value will be taxed as capital gain, by..

Web The Undersigned Taxpayer Hereby Elects, Pursuant To Section 83 (B) Of The Internal Revenue Code Of 1986, As Amended, To Include In His Or Her Gross Income For The Current Taxable.

Edit, sign and save insts completing irs 83(b) form. Mail the letter and 83 (b) election form to the irs address (see dropdown below. Web complete the following steps within 30 days of your award date to make an 83(b) election: Web how to fill out the 83(b) election you’ll need a few pieces of info about you, the company, and your shares.

Web An 83 (B) Election Form Is A Letter Sent To The Internal Revenue Service Notifying Them Of Your Interest To Be Taxed On Your Equity, Including Any Restricted Shares.

Complete the four enclosed 83(b) election forms* onall 4 copiesof the 83(b) electionforms in this. Web accelerate the date on which the restricted shares are subject to ordinary income rates, and therefore the date in which all appreciation in value will be taxed as capital gain, by. Print the irs 83(b) form that has been generated for you on the second page by. Ad upload, modify or create forms.

Try It For Free Now!

Web section 83 addresses the income tax consequences of property transferred in connection with the performance of services. Sign online button or tick the. Web upon issuance, no 83(b) election is necessary. You'll find these as part.

Web Instructions For Filling Out This Form And Enlighten You On An Easy Solution.

Web instructions for completing irs section 83 (b) form: Web employees and founders must file an 83(b) election form with the irs to get this favorable tax treatment. Web when making an 83 (b) election, you request that the irs recognize income and levy income taxes on the acquisition of company shares when granted, rather than. Web form 83 (b) is a form that is signed and sent to the internal revenue service (“irs”) making a choice — an election — on when the signatory would like to be taxed.