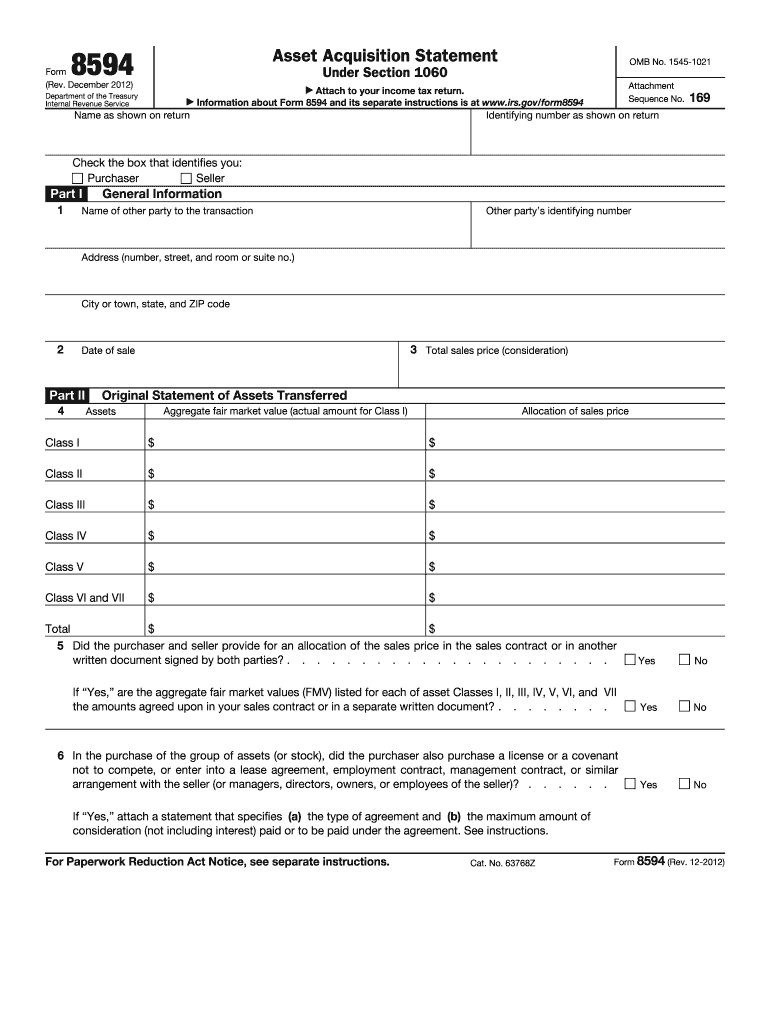

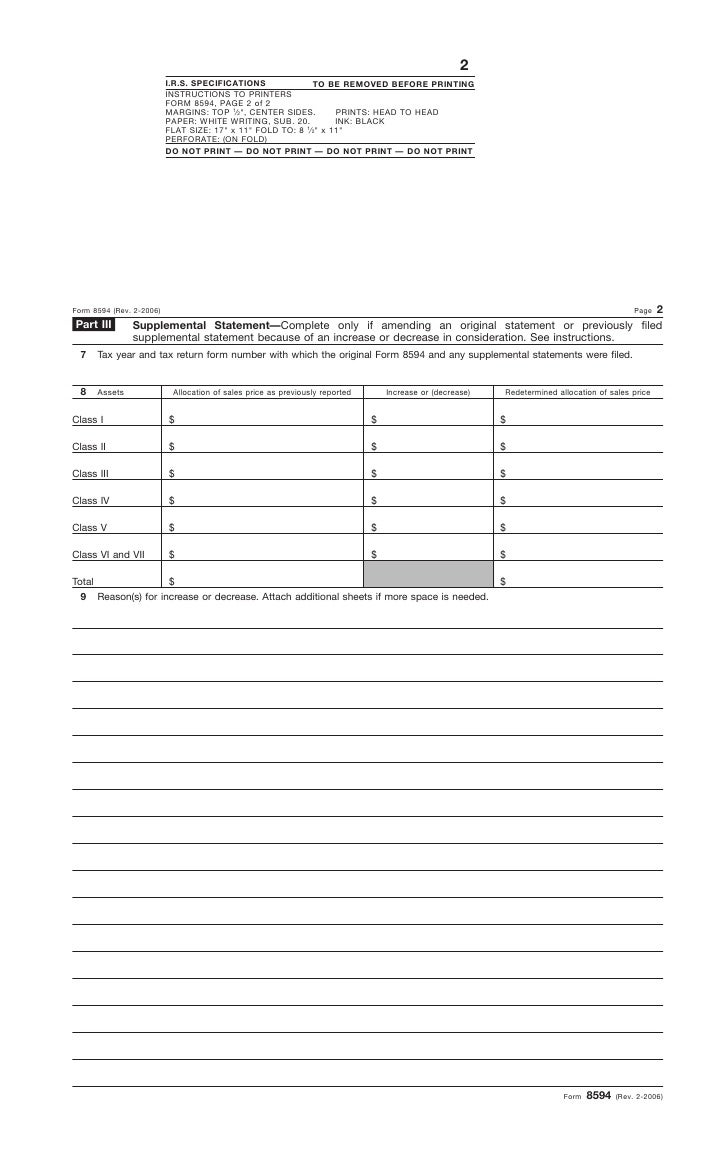

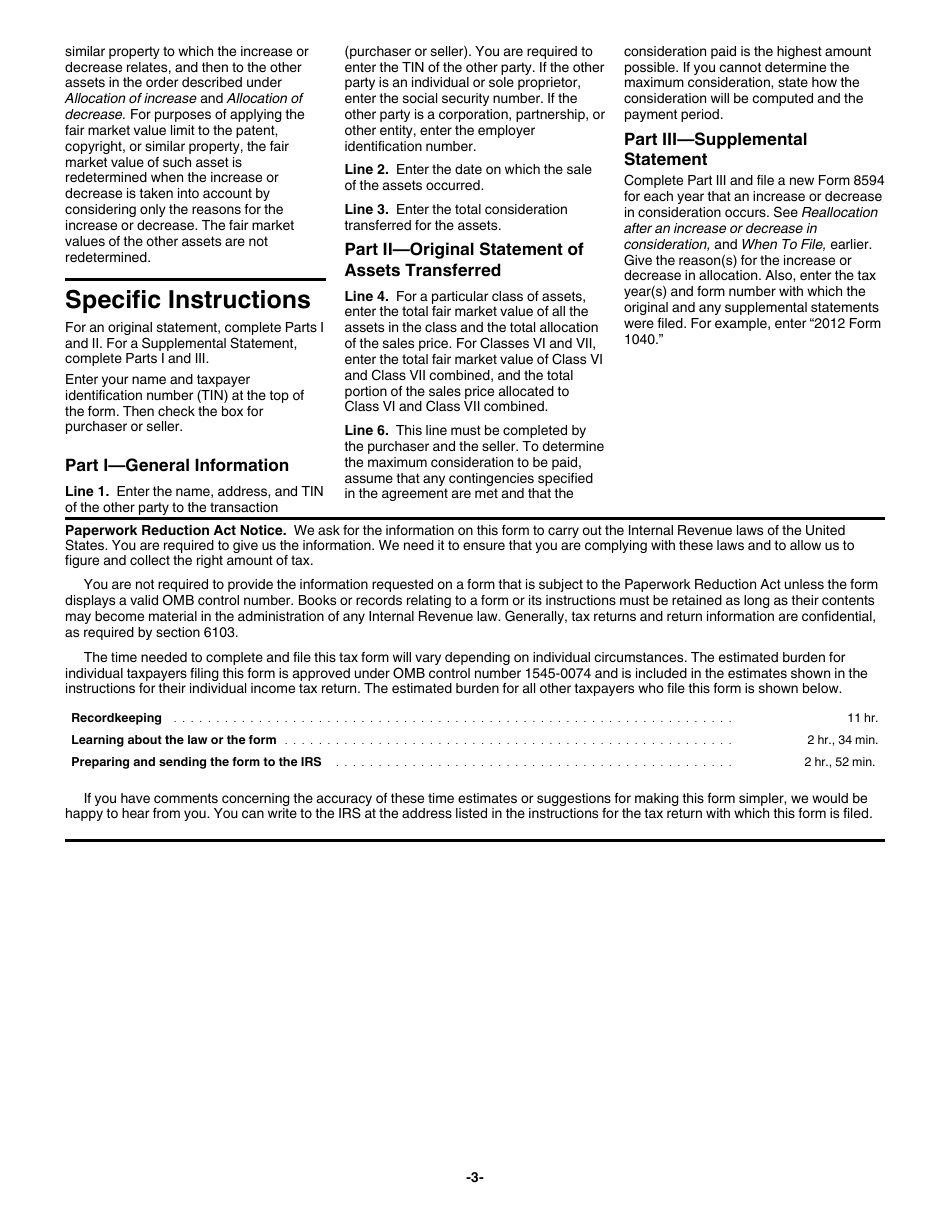

Form 8594 Instructions

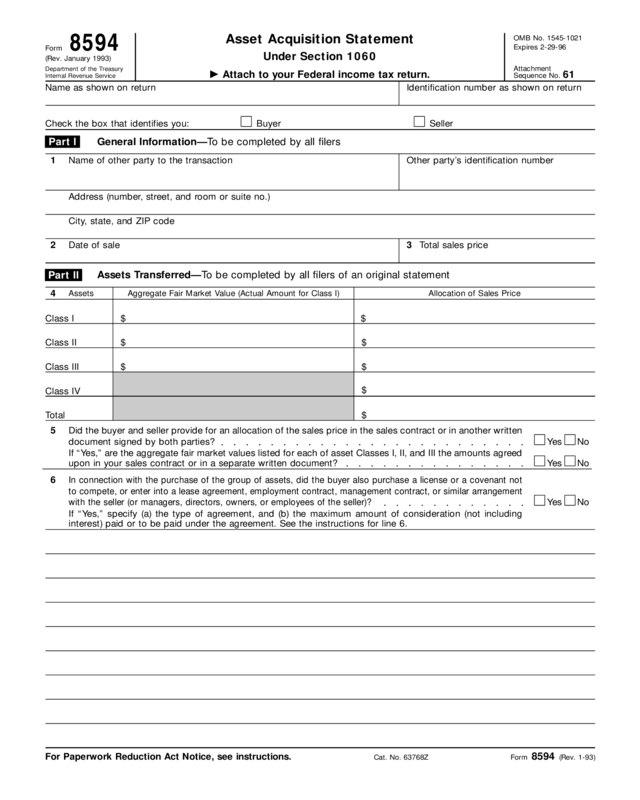

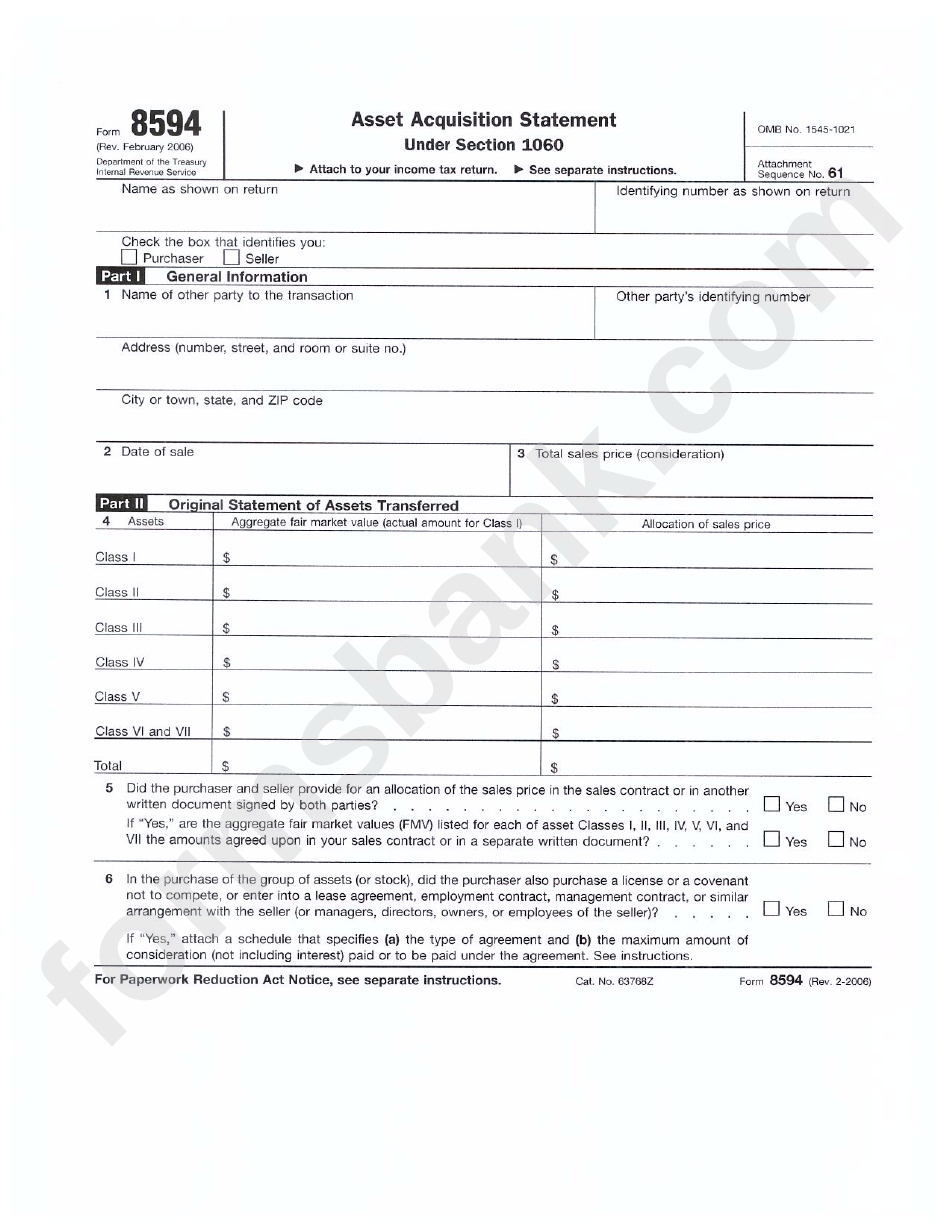

Form 8594 Instructions - Web generally, attach form 8594 to your income tax return for the year in which the sale date occurred. Web instructions for form 8594. The following income tax return for the year in which the definitions are the classifications for For asset acquisitions occurring after march 15, 2001, make the allocation among the following assets in proportion to (but not more than) their fair market value on the purchase date in the following order: For instructions and the latest information. Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file. Than any nonrecourse debt to which the when to file property is subject. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Purpose of form generally, attach form 8594 to your classes of assets. You can print other federal tax forms here.

Web irs form 8594 instructions lists the following seven classes of assets: Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Purpose of form generally, attach form 8594 to your classes of assets. Web form 8594 instructions list seven classes of assets. Cash and general deposit accounts (including savings and checking accounts) other than certificates of deposit held in bank,s, savings and loan associations, and other depository institutions. Failure to file the required documents may result in penalties. If the amount allocated to any asset is increased or decreased after the year in which the sale occurs, the seller and/or purchaser (whoever is affected) must complete parts i and iii of form 8594 and attach the form to the income tax return for Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. The form must be filed when a group of assets were transferred (in a trade or business), and if the buyer’s basis in such assets is determined by the amount paid for the assets. Web instructions for form 8594.

For asset acquisitions occurring after march 15, 2001, make the allocation among the following assets in proportion to (but not more than) their fair market value on the purchase date in the following order: The irs instructs that both the buyer and seller must file the form and attach their income tax returns. Web generally, attach form 8594 to your income tax return for the year in which the sale date occurred. Attach to your income tax return. Web form 8594 instructions list seven classes of assets. Web instructions for form 8594. Cash and general deposit accounts (including savings and checking accounts) other than certificates of deposit held in bank,s, savings and loan associations, and other depository institutions. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Web irs form 8594 instructions lists the following seven classes of assets: For instructions and the latest information.

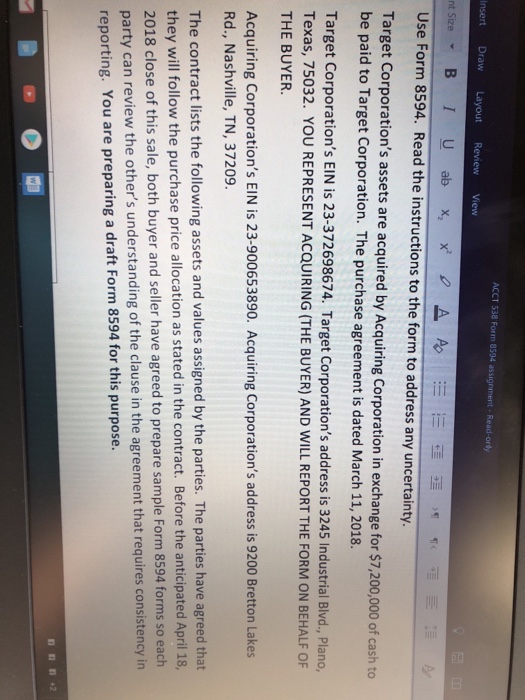

Solved ACCT 538 Form 8594 assignment Readorly Insert Draw

You can print other federal tax forms here. The buyer or seller must also update the amount allocated to the asset on his or her income tax return. November 2021) department of the treasury internal revenue service. The following income tax return for the year in which the definitions are the classifications for For asset acquisitions occurring after march 15,.

Form 8594 Instructions Fill Out and Sign Printable PDF Template signNow

Cash and general deposit accounts (including savings and checking accounts) other than certificates of deposit held in bank,s, savings and loan associations, and other depository institutions. Purpose of form generally, attach form 8594 to your classes of assets. Web irs form 8594 instructions lists the following seven classes of assets: Web we last updated the asset acquisition statement under section.

Form 8594Asset Acquisition Statement

Web generally, attach form 8594 to your income tax return for the year in which the sale date occurred. The form must be filed when a group of assets were transferred (in a trade or business), and if the buyer’s basis in such assets is determined by the amount paid for the assets. For instructions and the latest information. The.

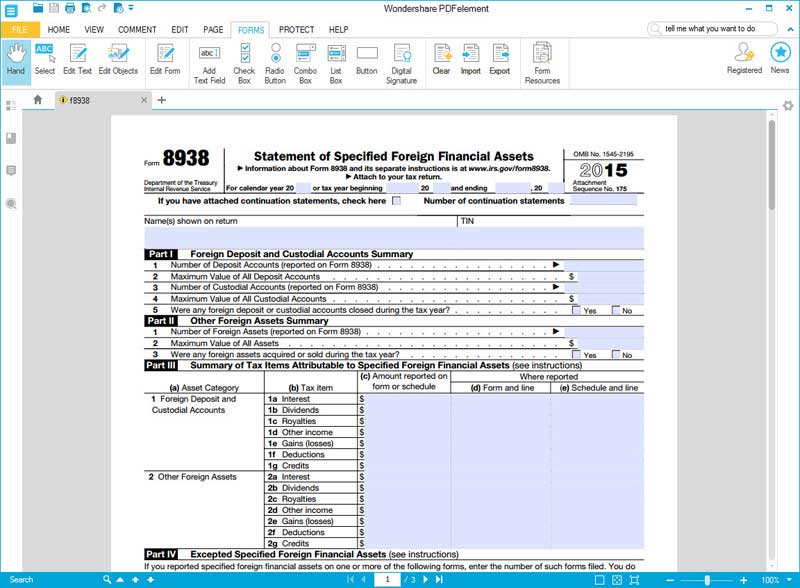

IRS Form 8938 How to Fill it with the Best Form Filler

The irs instructs that both the buyer and seller must file the form and attach their income tax returns. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if.

Download Instructions for IRS Form 8594 Asset Acquisition Statement

Web the irs form 8594 must be completed and attached to an income tax return by the buyer or seller. You can print other federal tax forms here. For instructions and the latest information. Cash and general deposit accounts (including savings and checking accounts) other than certificates of deposit held in bank,s, savings and loan associations, and other depository institutions..

Form 8594 Edit, Fill, Sign Online Handypdf

Failure to file the required documents may result in penalties. You can print other federal tax forms here. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. The irs instructs that both the buyer and seller must file the form and attach their income tax.

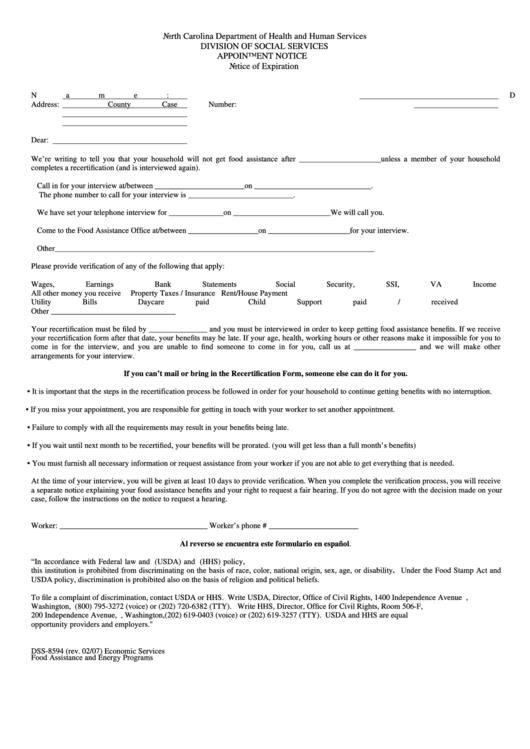

Fillable Form Dss8594 Notice Of Expiration North Carolina

Attach to your income tax return. Web the irs form 8594 must be completed and attached to an income tax return by the buyer or seller. Failure to file the required documents may result in penalties. You can print other federal tax forms here. The irs instructs that both the buyer and seller must file the form and attach their.

Instructions for Form 8594

November 2021) department of the treasury internal revenue service. Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file. Attach to your income tax return. The irs instructs that both the buyer and seller must file the form and attach their income tax returns. Web form 8594 instructions.

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. Web instructions for form 8594. November 2021) department of the treasury internal revenue service. The following income tax return for the year in which the definitions are the classifications for Failure.

How Many of the 5,211 Former U.S. Citizens (who Renounced in 2014 and

Web irs form 8594 instructions lists the following seven classes of assets: November 2021) department of the treasury internal revenue service. The following income tax return for the year in which the definitions are the classifications for Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file. If.

Web Instructions For Form 8594.

The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Purpose of form generally, attach form 8594 to your classes of assets. The following income tax return for the year in which the definitions are the classifications for Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file.

Web We Last Updated The Asset Acquisition Statement Under Section 1060 In February 2023, So This Is The Latest Version Of Form 8594, Fully Updated For Tax Year 2022.

The irs instructs that both the buyer and seller must file the form and attach their income tax returns. Web irs form 8594 instructions lists the following seven classes of assets: Failure to file the required documents may result in penalties. November 2021) department of the treasury internal revenue service.

You Can Print Other Federal Tax Forms Here.

The form must be filed when a group of assets were transferred (in a trade or business), and if the buyer’s basis in such assets is determined by the amount paid for the assets. For asset acquisitions occurring after march 15, 2001, make the allocation among the following assets in proportion to (but not more than) their fair market value on the purchase date in the following order: Than any nonrecourse debt to which the when to file property is subject. For instructions and the latest information.

Web Form 8594 Instructions List Seven Classes Of Assets.

Cash and general deposit accounts (including savings and checking accounts) other than certificates of deposit held in bank,s, savings and loan associations, and other depository institutions. The buyer or seller must also update the amount allocated to the asset on his or her income tax return. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Attach to your income tax return.