Form 8752 Instructions

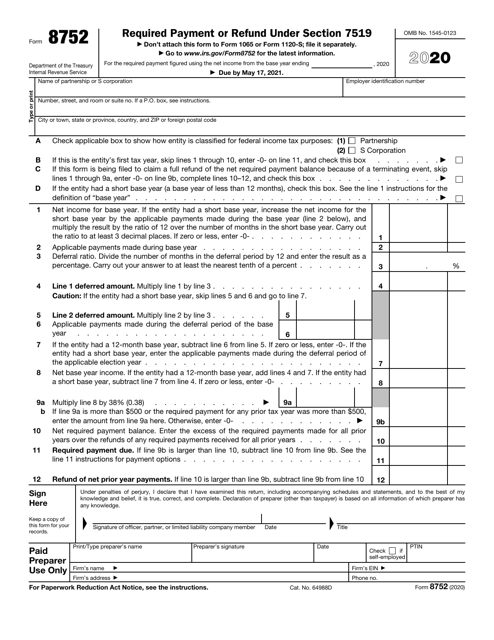

Form 8752 Instructions - Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. Excess required payments over refunds received (for all prior years) amended return. Net income for base year. Essentially its like a security deposit that a landlord may require from a tenant. Web for privacy act and paperwork reduction act notice, see back of form. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Taxpayers that have a valid election under section 444 should try to calculate any payment or refund under section 7519 as soon as possible in order to better manage cash flow. Required payment for any prior tax year was more than $500. Form 8752 irs service center.

The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Essentially its like a security deposit that a landlord may require from a tenant. Web for privacy act and paperwork reduction act notice, see back of form. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. Net income for base year. Required payment for any prior tax year was more than $500. Due by may 17, 2010 2009 date preparer’s ssn or ptin preparer’s signature. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Department of the treasury internal revenue service.

Form 8752 irs service center. General instructions purpose of form. Form 8752 will be filed by partnerships and s corporations who have elected to file their income tax returns on a tax year other than the required year. Required payment for any prior tax year was more than $500. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Net income for base year. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. Taxpayers that have a valid election under section 444 should try to calculate any payment or refund under section 7519 as soon as possible in order to better manage cash flow. For the required payment figured using.

IRS Form 8752 Download Fillable PDF or Fill Online Required Payment or

Form 8752 will be filed by partnerships and s corporations who have elected to file their income tax returns on a tax year other than the required year. Web for privacy act and paperwork reduction act notice, see back of form. Taxpayers that have a valid election under section 444 should try to calculate any payment or refund under section.

Nissan and Datsun Manuals > Sentra XE L41.8L (QG18DE) (2000

General instructions purpose of form. Web information about form 8752, required payment or refund under section 7519, including recent updates, related forms and instructions on how to file. Web developments related to form 8752 and its instructions, such as legislation enacted after they were published, go to. Department of the treasury internal revenue service. Web a comprehensive federal, state &.

TAYLOR 8752 OPERATING INSTRUCTIONS MANUAL Pdf Download ManualsLib

Excess required payments over refunds received (for all prior years) amended return. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. For the required payment figured.

Taylor 8752 TempRite Single Use Manual Dishwasher 170 Degrees F Test

Essentially its like a security deposit that a landlord may require from a tenant. Form 8752 irs service center. For the required payment figured using. Web information about form 8752, required payment or refund under section 7519, including recent updates, related forms and instructions on how to file. Web per irs instructions, the 2019 form 8752 (required payment or refund.

3.11.249 Processing Form 8752 Internal Revenue Service

For the required payment figured using. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Form 8752 will be filed by partnerships and s corporations who have elected to file their income tax returns on a tax year other than the required.

3.11.249 Processing Form 8752 Internal Revenue Service

Net income for base year. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Required payment for any prior tax year was more than $500. Web a comprehensive federal, state & international tax resource that you can trust to provide you with.

Form 4852 Substitute for Form W2, Wage and Tax Statement, or Form

Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Essentially its like a security deposit that a landlord may require from a tenant. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to.

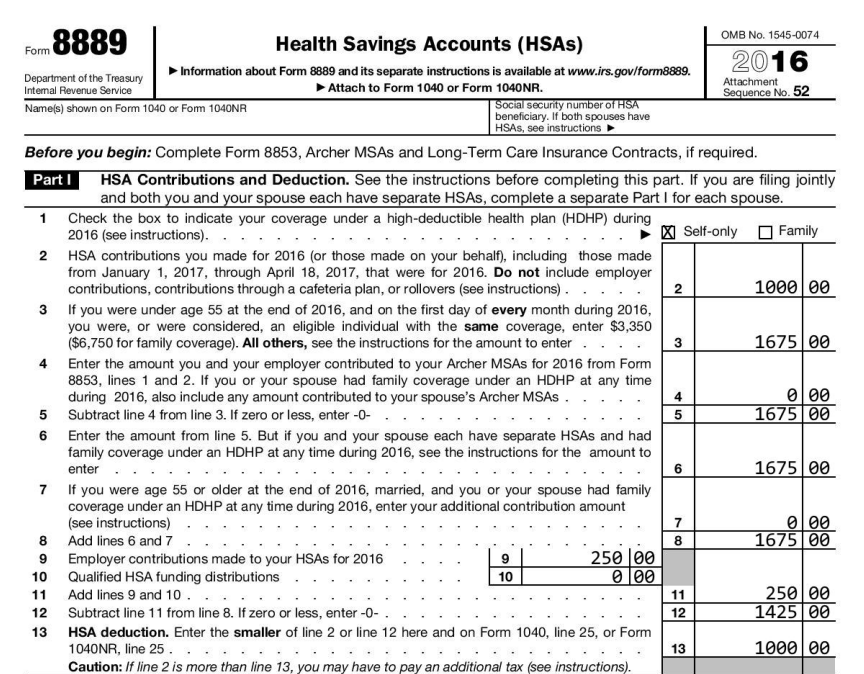

2016 HSA Form 8889 Instructions and Example HSA Edge

The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Form 8752 will be filed by partnerships and s corporations who have elected to file their income.

Taylor 8752 TempRite Single Use Manual Dishwasher 170 Degrees F Test

Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Web per irs instructions, the 2019.

3.11.249 Processing Form 8752 Internal Revenue Service

Required payment for any prior tax year was more than $500. Web information about form 8752, required payment or refund under section 7519, including recent updates, related forms and instructions on how to file. General instructions purpose of form. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a.

Web A Comprehensive Federal, State & International Tax Resource That You Can Trust To Provide You With Answers To Your Most Important Tax Questions.

Form 8752 irs service center. Excess required payments over refunds received (for all prior years) amended return. Department of the treasury internal revenue service. Taxpayers that have a valid election under section 444 should try to calculate any payment or refund under section 7519 as soon as possible in order to better manage cash flow.

Net Income For Base Year.

For the required payment figured using. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Web for privacy act and paperwork reduction act notice, see back of form.

The Irs Asks Fiscal Year, S Corporation S, And Partnership S To File A Form 8752.

Partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net prior year payments. Form 8752 will be filed by partnerships and s corporations who have elected to file their income tax returns on a tax year other than the required year. Web the instructions in this section are for coding and editing of form 8752, required payment or refund under section 7519. Web developments related to form 8752 and its instructions, such as legislation enacted after they were published, go to.

Essentially Its Like A Security Deposit That A Landlord May Require From A Tenant.

Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. Required payment for any prior tax year was more than $500. Web information about form 8752, required payment or refund under section 7519, including recent updates, related forms and instructions on how to file. Due by may 17, 2010 2009 date preparer’s ssn or ptin preparer’s signature.

/Page-1544006.png)