Form 8804 Mailing Address

Form 8804 Mailing Address - Any forms that are filed to the irs separately from form. Web file forms 8804, 8805, and 8813 with: Web use the chart to determine where to file form 7004 based on the tax form you complete. If the post office does not deliver mail to the. Then the foreign partner must. Box 409101 ogden, ut 84409. Any forms that are filed to the irs separately. Form 8725, excise tax on. Web how to request an extension if needed to request an extension for filing form 8804, you will need to complete and submit irs form 7004 *, which can be. Web print posted by pat raskob things to know about form 8804 when it comes to your tax fillings, you cannot afford not to know all the requisite forms to be filled and filed by the.

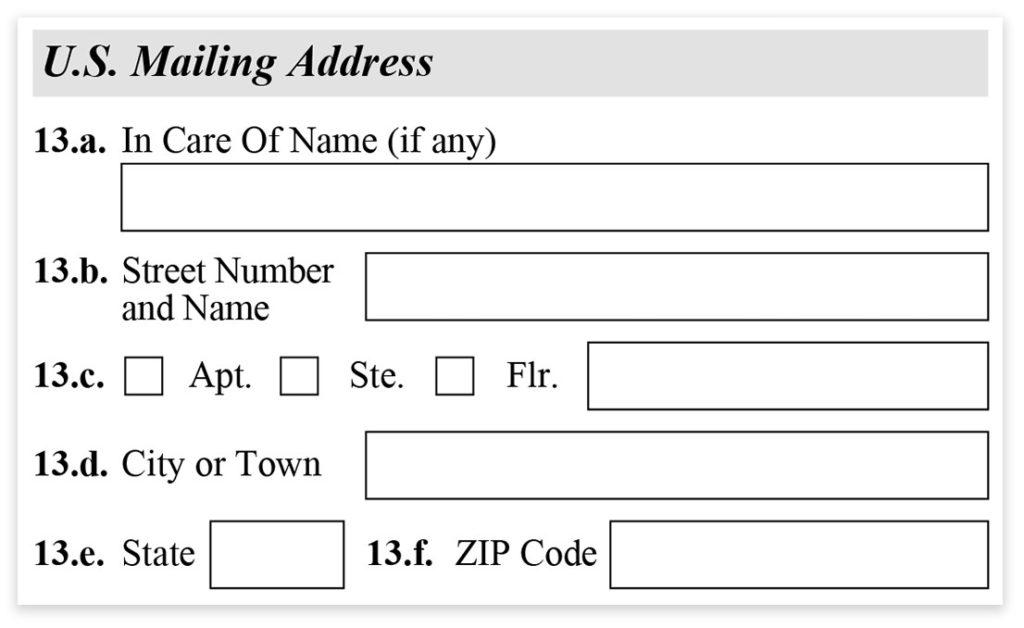

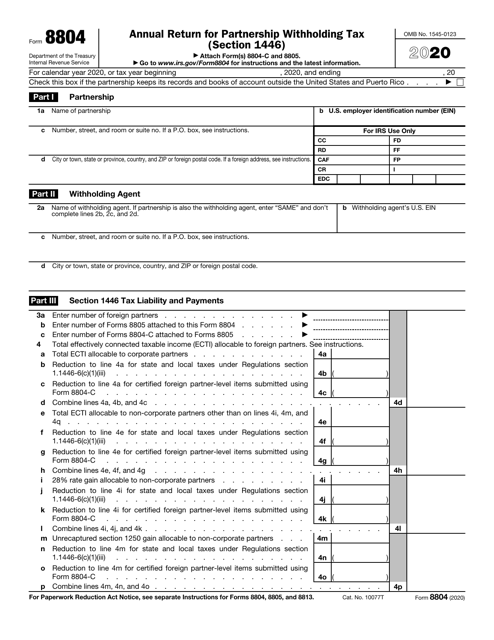

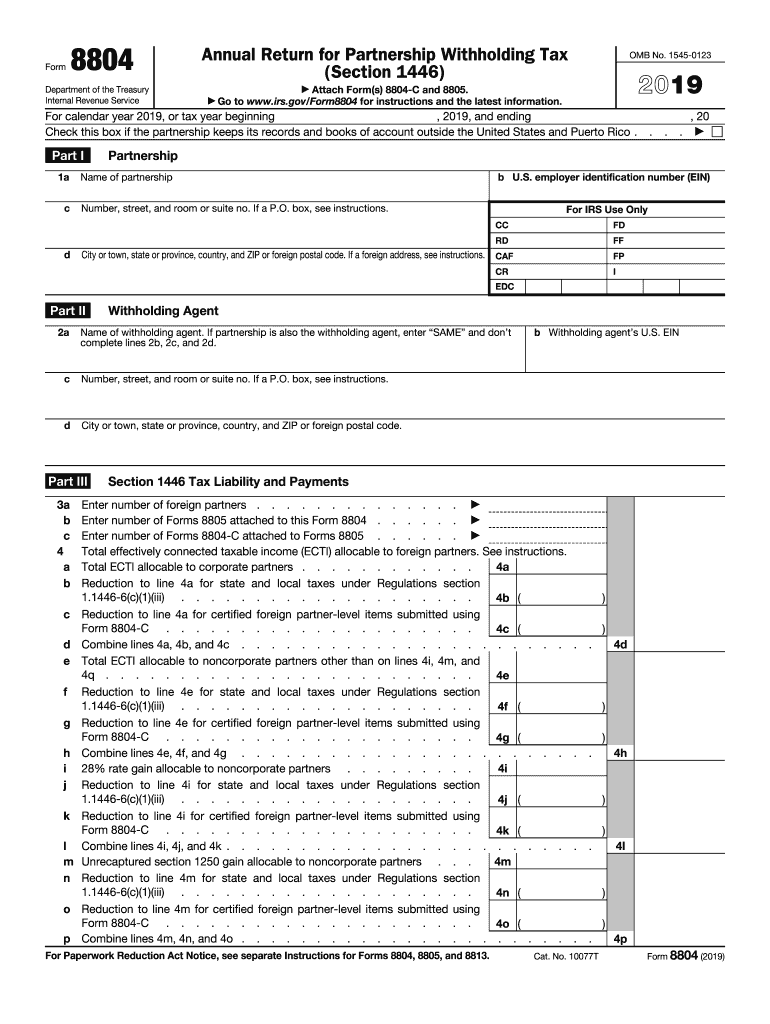

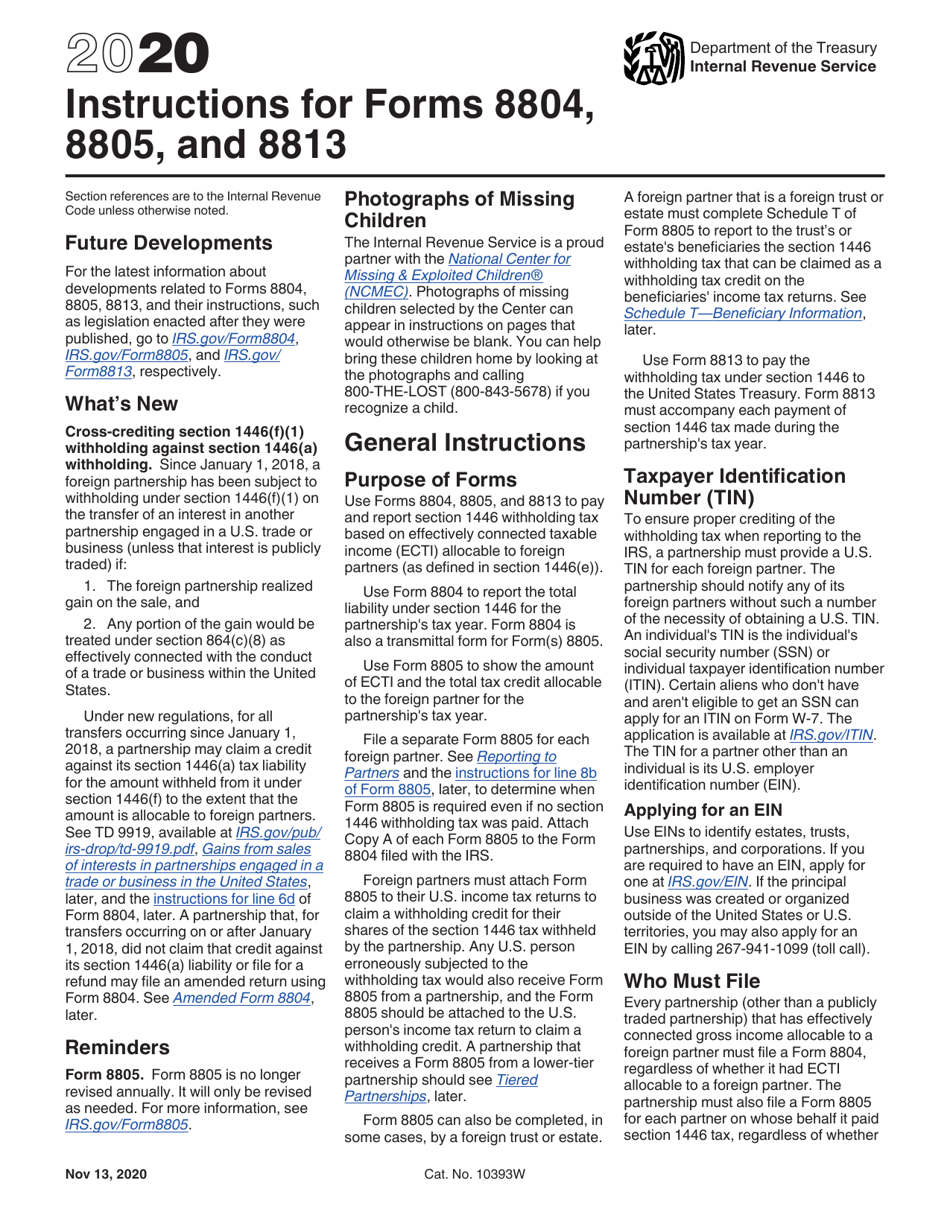

Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. A partnership can file an amended form 8804. Web key takeaways form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. City or town, state or province, country, and zip or foreign postal code. Web file forms 8804, 8805, and 8813 with: If the post office does not deliver mail to the. Internal revenue service center p.o. Web when providing a u.s. Web form 8804 2019 annual return for partnership withholding tax. Then the foreign partner must.

Then the foreign partner must. If the post office does not deliver mail to the. A partnership can file an amended form 8804. Form 8725, excise tax on. Withholding tax must be paid on. Web file forms 8804, 8805, and 8813 with: Select the appropriate form from the table below to determine where to. Box 409101 ogden, ut 84409. Web key takeaways form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. Web form 8804, annual return for partnership withholding tax (section 1446) form 8805, foreign partner's information statement of section 1446 withholding tax;.

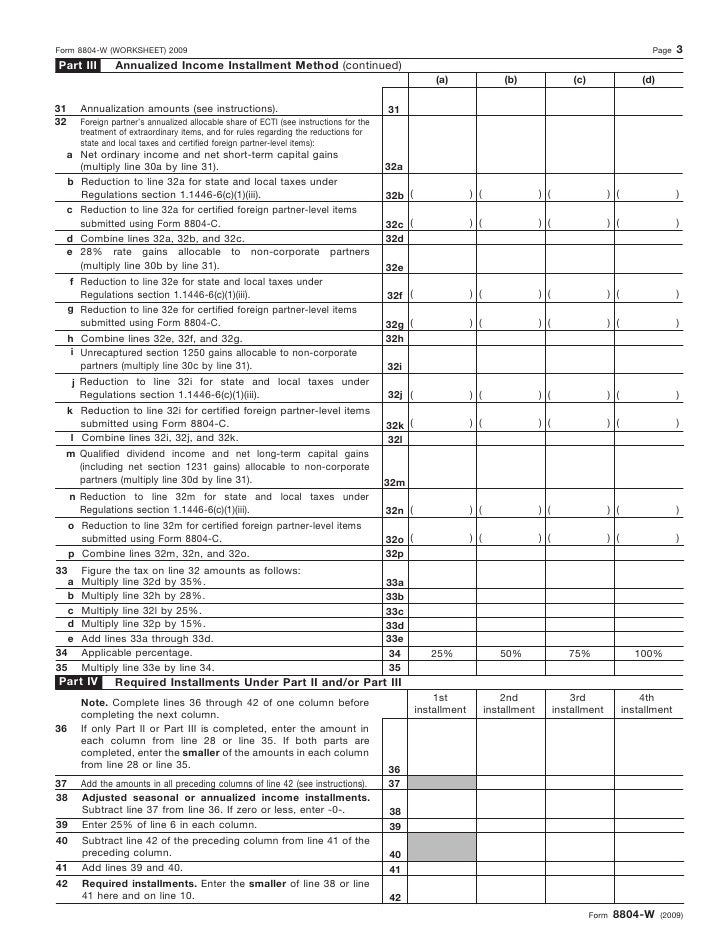

Form 8804W Installment Payments of Section 1446 Tax for Partnership…

Internal revenue service center p.o. Partnership or the foreign partners of a foreign partnership with. The irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Then the.

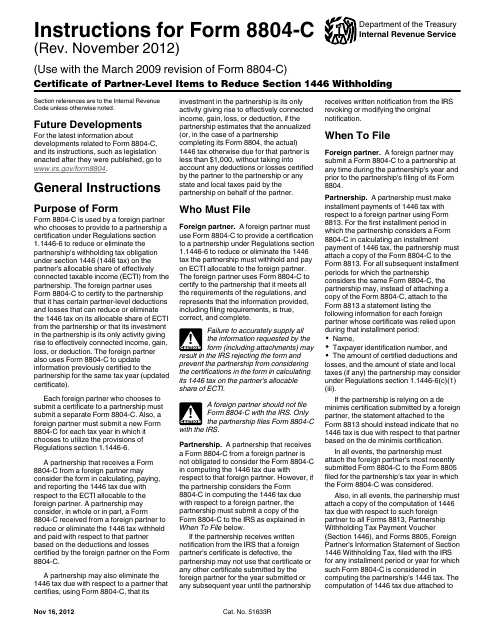

Form 8804C Certificate of PartnerLevel Items to Reduce Section 1446

Then the foreign partner must. Web key takeaways form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. City or town, state or province, country, and zip or foreign postal code. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on.

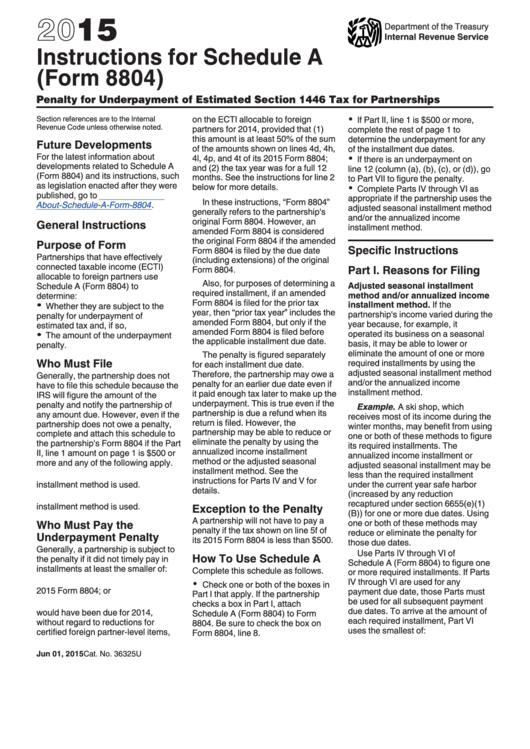

Instructions For Schedule A (Form 8804) Penalty For Underpayment Of

Box 409101 ogden, ut 84409. Web file forms 8804, 8805, and 8813 with: If the post office does not deliver mail to the. Web how to request an extension if needed to request an extension for filing form 8804, you will need to complete and submit irs form 7004 *, which can be. Web print posted by pat raskob things.

Download Instructions for IRS Form 8804C Certificate of PartnerLevel

Box 409101 ogden, ut 84409. City or town, state or province, country, and zip or foreign postal code. Withholding tax must be paid on. Internal revenue service center p.o. Web form 8804, annual return for partnership withholding tax (section 1446) form 8805, foreign partner's information statement of section 1446 withholding tax;.

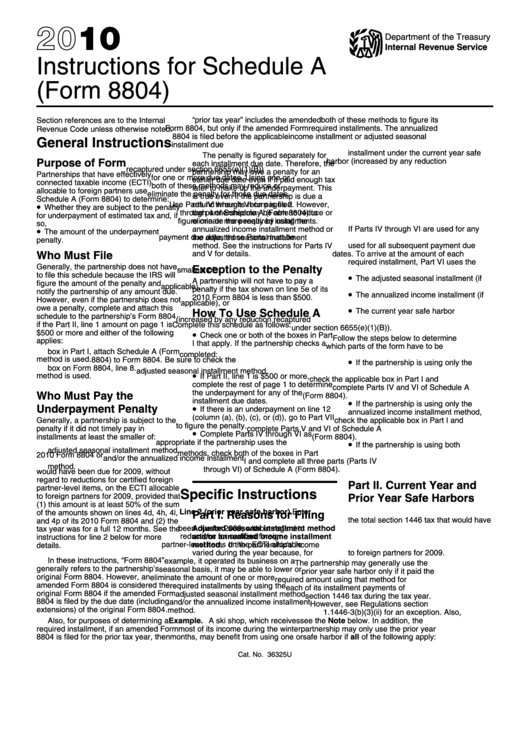

Instructions For Schedule A (Form 8804) 2010 printable pdf download

If the post office does not deliver mail to the. Any forms that are filed to the irs separately from form. The irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004. Form 8725, excise tax on. City or town, state or province, country, and zip or foreign postal code.

3.22.15 Foreign Partnership Withholding Internal Revenue Service

Then the foreign partner must. Internal revenue service center p.o. Web form 8804 is an annual summary statement of the various forms 8805 that are sent to the foreign partners of a u.s. Select the appropriate form from the table below to determine where to. Any forms that are filed to the irs separately from form.

Form I485 Step by Step Instructions SimpleCitizen

Web 49 rows form 8716 mailing addresses. Web when providing a u.s. Select the appropriate form from the table below to determine where to. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. If a foreign address, see instructions.

IRS Form 8804 Download Fillable PDF or Fill Online Annual Return for

Any forms that are filed to the irs separately from form. Web use the chart to determine where to file form 7004 based on the tax form you complete. Partnership or the foreign partners of a foreign partnership with. Web key takeaways form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes..

Form 8804 Fill Out and Sign Printable PDF Template signNow

Select the appropriate form from the table below to determine where to. Web when providing a u.s. Web print posted by pat raskob things to know about form 8804 when it comes to your tax fillings, you cannot afford not to know all the requisite forms to be filled and filed by the. Box 409101 ogden, ut 84409. Partnership or.

Download Instructions for IRS Form 8804, 8805, 8813 PDF, 2020

Withholding tax must be paid on. Web print posted by pat raskob things to know about form 8804 when it comes to your tax fillings, you cannot afford not to know all the requisite forms to be filled and filed by the. The irs supports electronic filing only for form 1065 and related forms and schedules and the extension form.

Web Key Takeaways Form 8804 Summarizes Any Form 8805 You Sent To Your Foreign Partners, Even If You Didn’t Withhold Taxes.

Partnership or the foreign partners of a foreign partnership with. Then the foreign partner must. Web the irs supports electronic filing only for form 1065 and related forms and schedules and the extension form 7004. Select the appropriate form from the table below to determine where to.

Web 49 Rows Form 8716 Mailing Addresses.

If the post office does not deliver mail to the. Web when providing a u.s. If a foreign address, see instructions. Web print posted by pat raskob things to know about form 8804 when it comes to your tax fillings, you cannot afford not to know all the requisite forms to be filled and filed by the.

Then The Foreign Partner Must.

Web form 8804 2019 annual return for partnership withholding tax. A partnership can file an amended form 8804. Web form 8804, annual return for partnership withholding tax (section 1446) form 8805, foreign partner's information statement of section 1446 withholding tax;. Withholding tax must be paid on.

Internal Revenue Service Center P.o.

Any forms that are filed to the irs separately. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. Web form 8804 is an annual summary statement of the various forms 8805 that are sent to the foreign partners of a u.s. Web file forms 8804, 8805, and 8813 with: