Form 8812 For 2021

Form 8812 For 2021 - Go to www.irs.gov/schedule8812 for instructions and the latest information. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). Web advance child tax credit payment reconciliation form 8812. The actc may give you a refund even if you do not owe any tax. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. Section references are to the internal revenue code unless otherwise noted. The actc is a refundable credit. Web updated for tax year 2022 • february 9, 2023 01:46 pm. There are currently no advance payments for 2022. If you received advance payments of the child tax credit in 2021, you will need to report the payment amount on.

If you received advance payments of the child tax credit in 2021, you will need to report the payment amount on. Go to www.irs.gov/schedule8812 for instructions and the latest information. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). This is for 2021 returns only. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. The ctc and odc are nonrefundable credits. There are currently no advance payments for 2022. Web advance child tax credit payment reconciliation form 8812. Web 2020 instructions for schedule 8812 (rev. The actc may give you a refund even if you do not owe any tax.

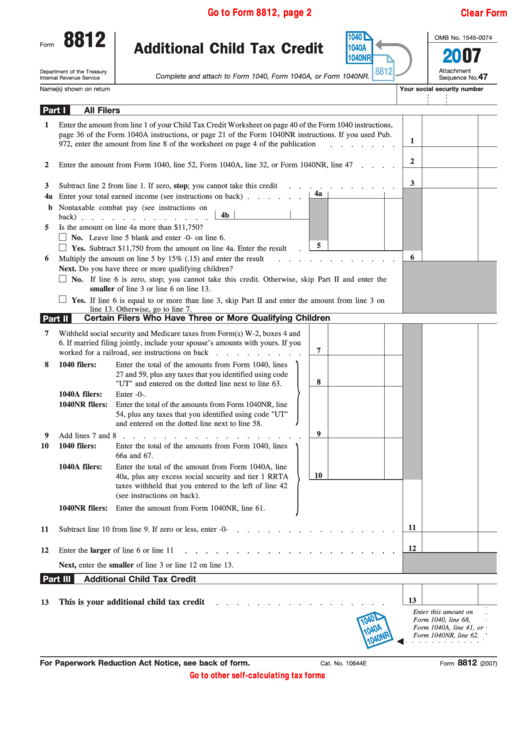

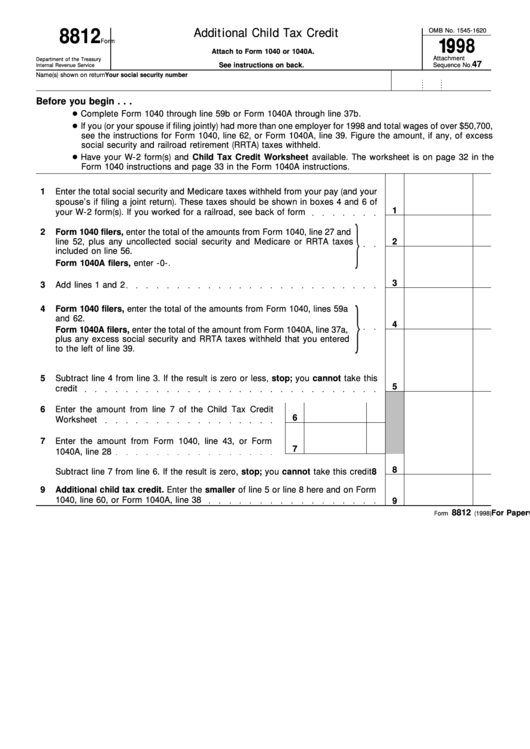

Web printable form 1040 schedule 8812. The ctc and odc are nonrefundable credits. Section references are to the internal revenue code unless otherwise noted. The actc is a refundable credit. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). Web updated for tax year 2022 • february 9, 2023 01:46 pm. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Click any of the irs schedule 8812 form links below to download, save, view, and print the file for the corresponding year. Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. If you have children and a low tax bill, you may need irs form 8812 to claim all of your child tax credit.

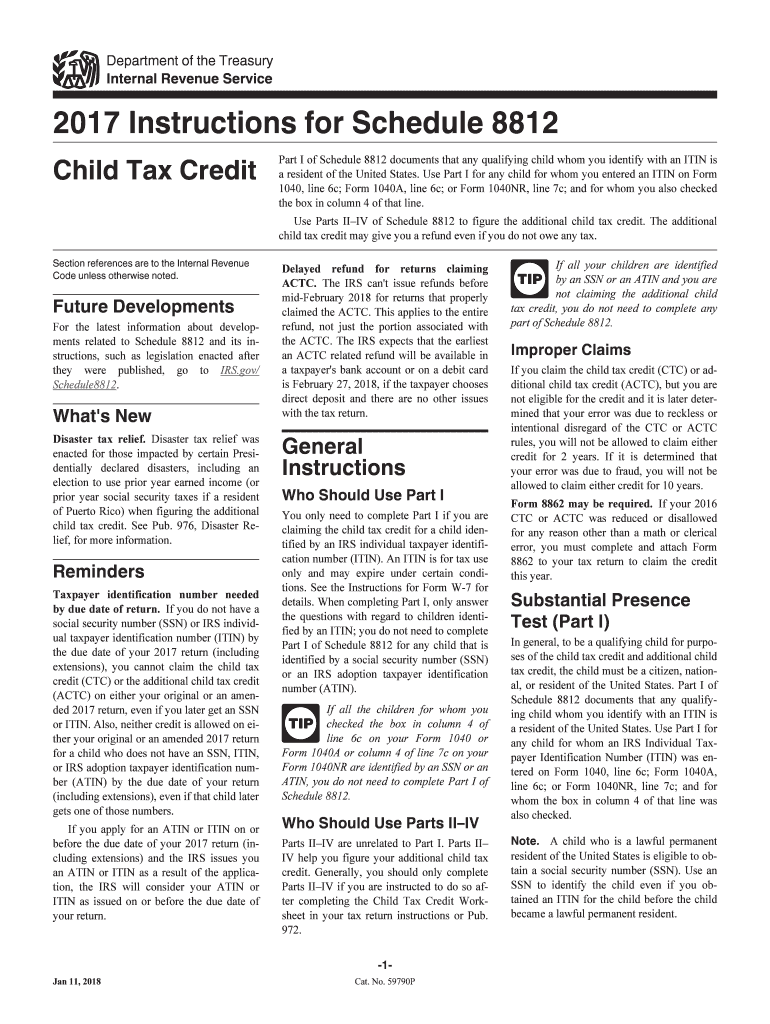

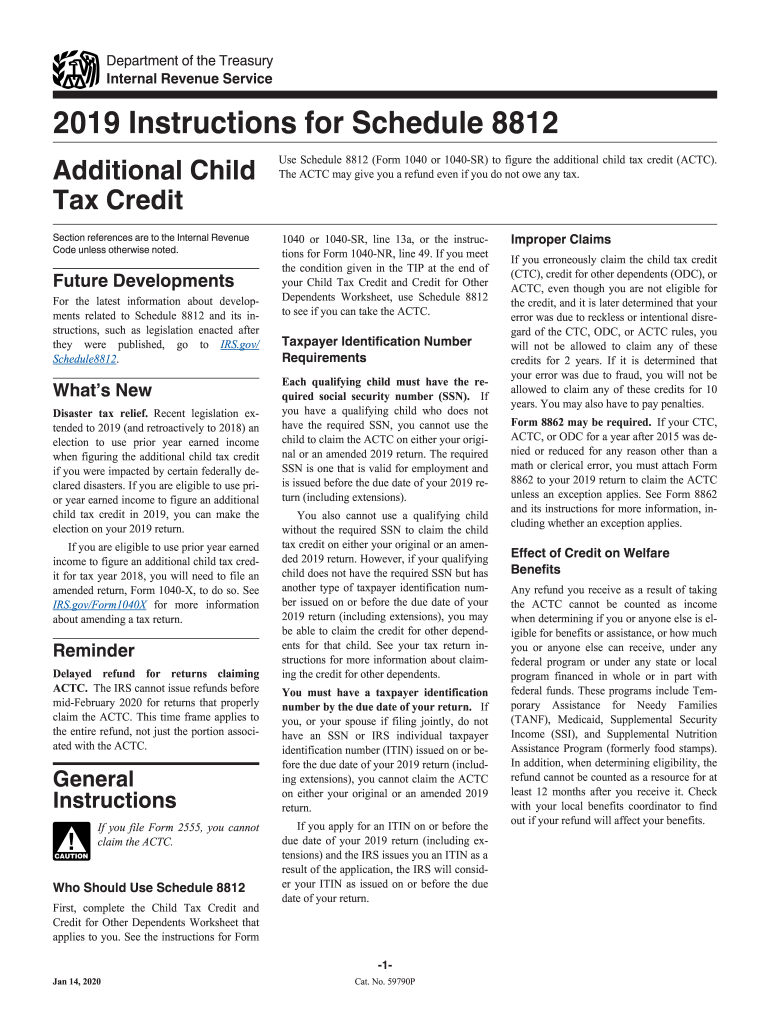

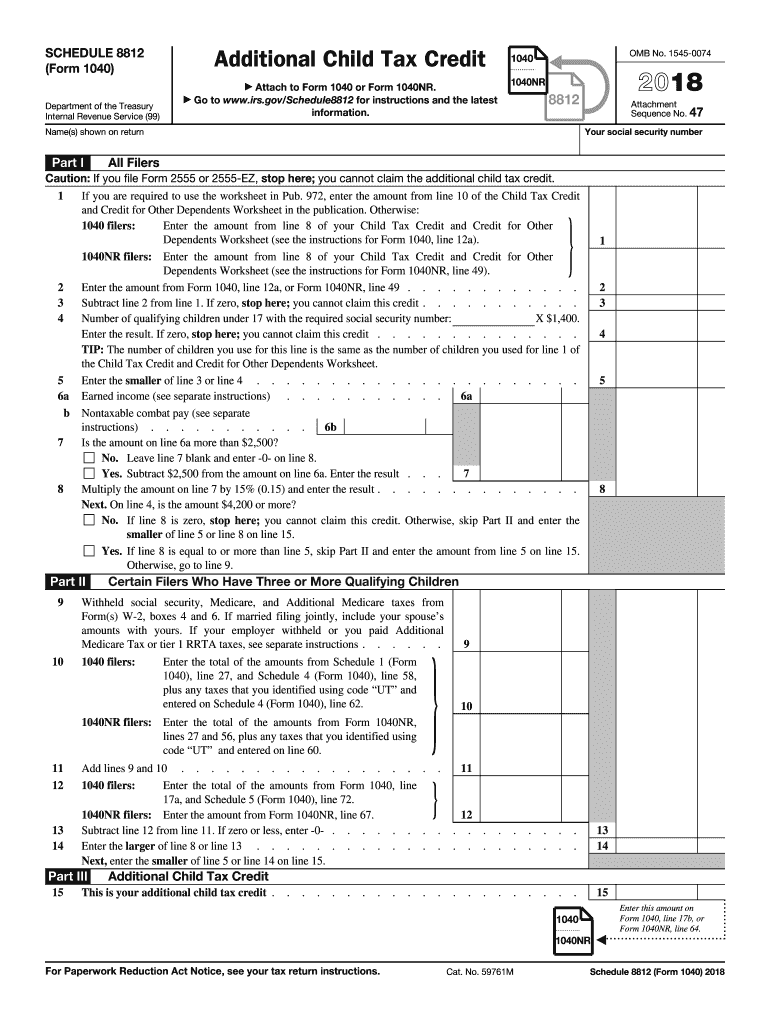

Irs Instructions Form 8812 Fill Out and Sign Printable PDF Template

There are currently no advance payments for 2022. These free pdf files are unaltered and are sourced directly from the publisher. Click any of the irs schedule 8812 form links below to download, save, view, and print the file for the corresponding year. The ctc and odc are nonrefundable credits. Web printable form 1040 schedule 8812.

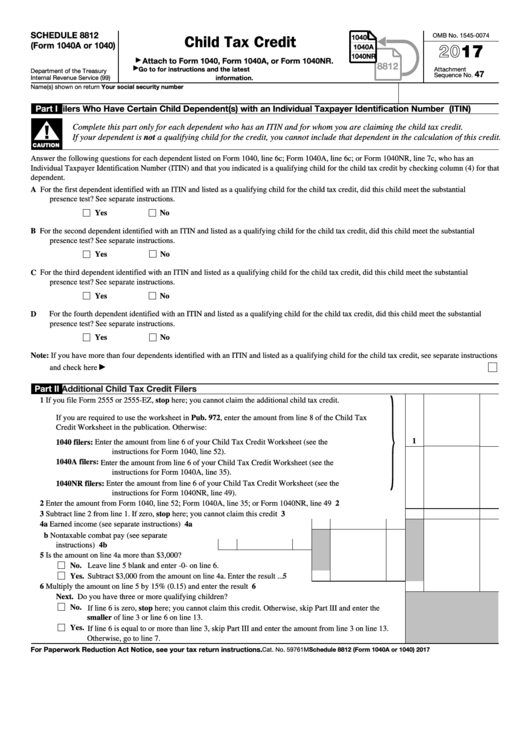

Schedule 8812 Instructions Fill Out and Sign Printable PDF Template

There are currently no advance payments for 2022. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Section references are to the internal revenue code unless otherwise noted. The ctc and odc are nonrefundable credits. Web 2020 instructions for schedule 8812 (rev.

Schedule 8812 What is IRS Form Schedule 8812 & Filing Instructions

Web printable form 1040 schedule 8812. Click any of the irs schedule 8812 form links below to download, save, view, and print the file for the corresponding year. The ctc and odc are nonrefundable credits. Go to www.irs.gov/schedule8812 for instructions and the latest information. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child.

Top 8 Form 8812 Templates free to download in PDF format

The ctc and odc are nonrefundable credits. Go to www.irs.gov/schedule8812 for instructions and the latest information. There are currently no advance payments for 2022. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). The ctc and odc are nonrefundable credits.

What Is The Credit Limit Worksheet A For Form 8812

Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). There are currently no advance payments for 2022. Web use schedule 8812 (form 1040) to figure your child.

Form 8812, Additional Child Tax Credit printable pdf download

If you received advance payments of the child tax credit in 2021, you will need to report the payment amount on. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments.

8812 Instructions Tax Form Fill Out and Sign Printable PDF Template

Web 2020 instructions for schedule 8812 (rev. The ctc and odc are nonrefundable credits. These free pdf files are unaltered and are sourced directly from the publisher. Web updated for tax year 2022 • february 9, 2023 01:46 pm. The ctc and odc are nonrefundable credits.

2015 form 8812 pdf Fill out & sign online DocHub

This is for 2021 returns only. There are currently no advance payments for 2022. The ctc and odc are nonrefundable credits. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). Web advance child tax credit payment reconciliation form 8812.

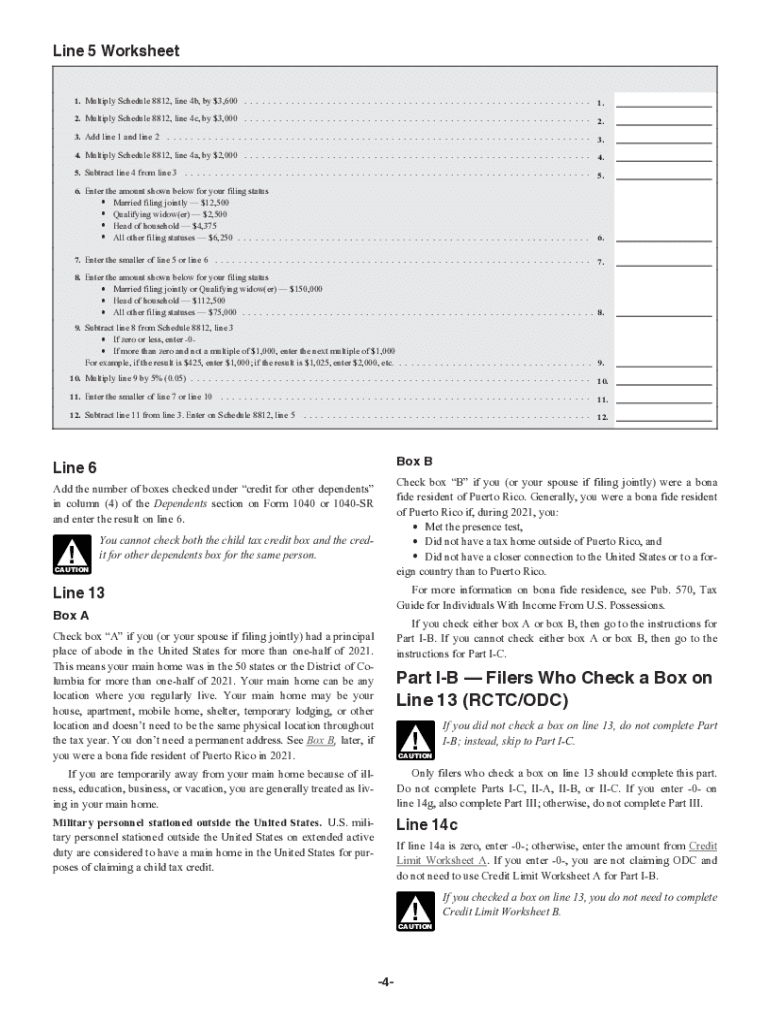

8812 Worksheet

This is for 2021 returns only. The ctc and odc are nonrefundable credits. Web updated for tax year 2022 • february 9, 2023 01:46 pm. Web 2020 instructions for schedule 8812 (rev. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc).

Credit Limit Worksheets A Form

Web 2020 instructions for schedule 8812 (rev. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. The ctc and odc are nonrefundable credits. Click any of the irs.

These Free Pdf Files Are Unaltered And Are Sourced Directly From The Publisher.

If you have children and a low tax bill, you may need irs form 8812 to claim all of your child tax credit. Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. Go to www.irs.gov/schedule8812 for instructions and the latest information.

January 2021)Additional Child Tax Credit Use Schedule 8812 (Form 1040) To Figure The Additional Child Tax Credit (Actc).

The actc may give you a refund even if you do not owe any tax. Web printable form 1040 schedule 8812. Go to www.irs.gov/schedule8812 for instructions and the latest information. Web updated for tax year 2022 • february 9, 2023 01:46 pm.

There Are Currently No Advance Payments For 2022.

This is for 2021 returns only. Section references are to the internal revenue code unless otherwise noted. The actc is a refundable credit. Click any of the irs schedule 8812 form links below to download, save, view, and print the file for the corresponding year.

The Ctc And Odc Are Nonrefundable Credits.

Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web advance child tax credit payment reconciliation form 8812. If you received advance payments of the child tax credit in 2021, you will need to report the payment amount on. The ctc and odc are nonrefundable credits.