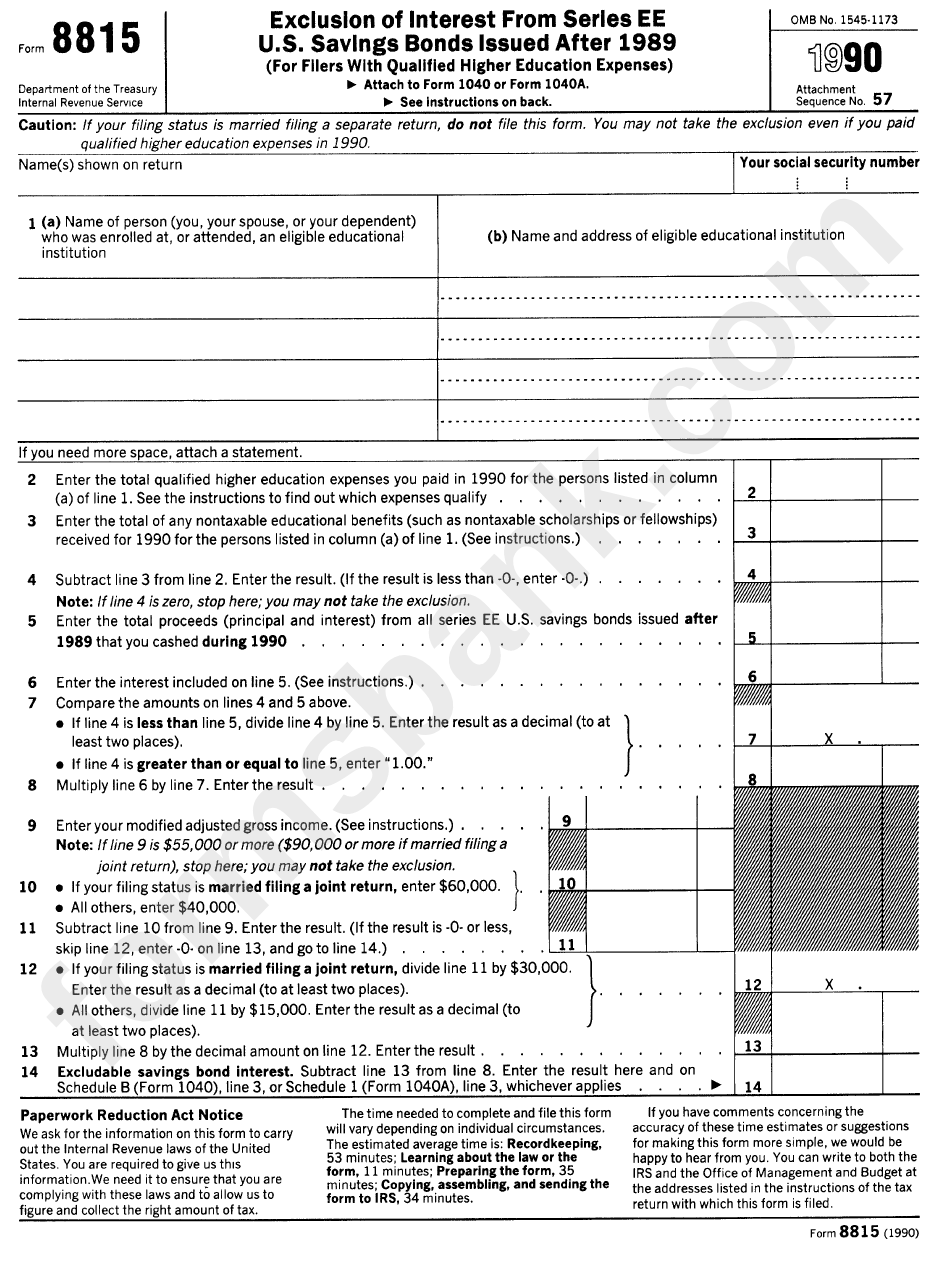

Form 8815 Instructions

Form 8815 Instructions - Editable, free, and easy to use; If you cashed series ee or i u.s. The latest version available from the executive services directorate; Easily fill out pdf blank, edit, and sign them. To complete form 8815 you will need to enter all the. Savings bonds in 2013 that were issued after 1989, you may be able to exclude from your income part or all of the. The latest version available from the army publishing directorate; Web from the form 8815 instructions, enter the total of nontaxable educational benefits including qtp distribution (payments) used for qualified education expenses on. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the amount of your qualified 2020 disaster distributions made for 2020 or. Editable, printable, and free to use;

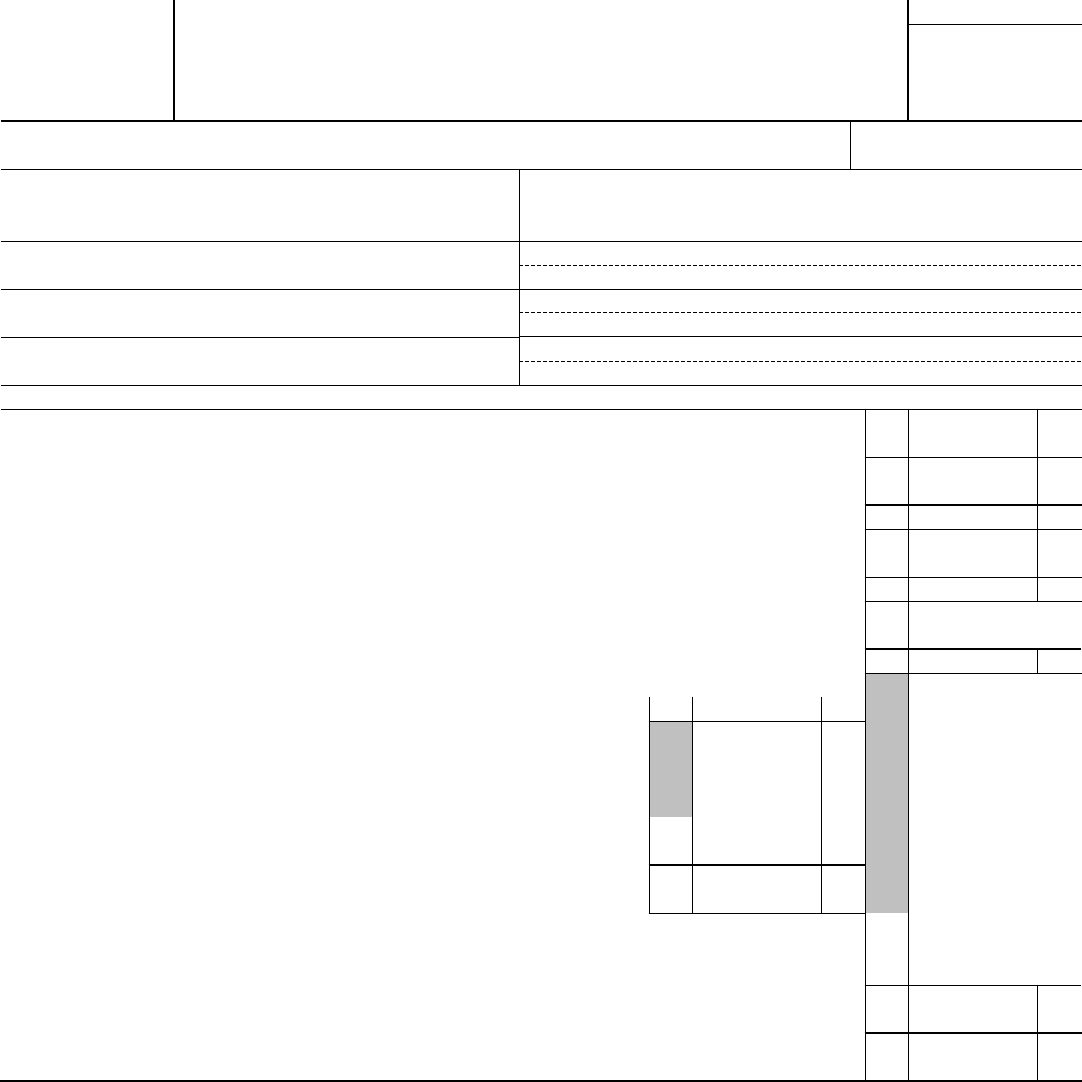

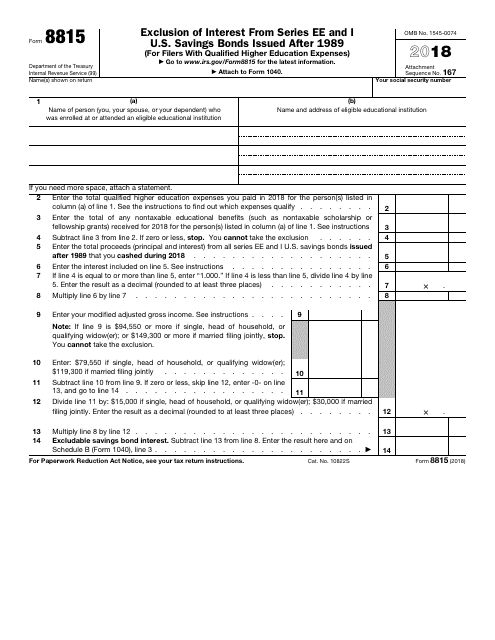

The latest version available from the executive services directorate; Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i u.s. If you cashed series ee or i u.s. Save or instantly send your ready documents. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. Authority (superseded by/rescinded by) superseded/replaced other pub/form. To complete form 8815 you will need to enter all the. Savings bonds issued after 1989 (for filers with qualified. (the instructions that come with irs form 8815 explain both qualified expenses and. The latest version available from the army publishing directorate;

Editable, free, and easy to use; For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. Authority (superseded by/rescinded by) superseded/replaced other pub/form. Easily fill out pdf blank, edit, and sign them. (the instructions that come with irs form 8815 explain both qualified expenses and. Web you paid qualified higher education expenses to an eligible institution that same tax year. Savings bonds in 2013 that were issued after 1989, you may be able to exclude from your income part or all of the. Web from the form 8815 instructions, enter the total of nontaxable educational benefits including qtp distribution (payments) used for qualified education expenses on. To complete form 8815 you will need to enter all the. The latest version available from the executive services directorate;

Form 8815 Edit, Fill, Sign Online Handypdf

Web from the form 8815 instructions, enter the total of nontaxable educational benefits including qtp distribution (payments) used for qualified education expenses on. To complete form 8815 you will need to enter all the. Savings bonds issued after 1989 (for filers with qualified. The latest version available from the army publishing directorate; If you cashed series ee or i u.s.

Online IRS Form 8815 2019 Fillable and Editable PDF Template

The latest version available from the army publishing directorate; The latest version available from the executive services directorate; (the instructions that come with irs form 8815 explain both qualified expenses and. Web you paid qualified higher education expenses to an eligible institution that same tax year. Save or instantly send your ready documents.

Form 8815 Exclusion Of Interest printable pdf download

The latest version available from the executive services directorate; Editable, printable, and free to use; Savings bonds in 2013 that were issued after 1989, you may be able to exclude from your income part or all of the. Web you paid qualified higher education expenses to an eligible institution that same tax year. Web form 8815 department of the treasury.

Schedule 8812 Line 5 Worksheet A Guide For Taxpayers In 2023 4th Of

Savings bonds issued after 1989 (for filers with qualified. Savings bonds in 2013 that were issued after 1989, you may be able to exclude from your income part or all of the. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the amount of your qualified 2020 disaster distributions made for.

2016 Form 8815 Edit, Fill, Sign Online Handypdf

Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the amount of your qualified 2020 disaster distributions made for 2020 or. Editable, free, and easy to use; For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the.

Lego technic white tile tile 2 x 2 with number 1 pattern ref 3068bp81

Authority (superseded by/rescinded by) superseded/replaced other pub/form. Editable, free, and easy to use; Web you paid qualified higher education expenses to an eligible institution that same tax year. (the instructions that come with irs form 8815 explain both qualified expenses and. Savings bonds issued after 1989 (for filers with qualified.

Form 8815 ≡ Fill Out Printable PDF Forms Online

The latest version available from the army publishing directorate; Web from the form 8815 instructions, enter the total of nontaxable educational benefits including qtp distribution (payments) used for qualified education expenses on. Web you paid qualified higher education expenses to an eligible institution that same tax year. Web form 8815 department of the treasury internal revenue service (99) exclusion of.

Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

The latest version available from the army publishing directorate; Easily fill out pdf blank, edit, and sign them. The latest version available from the executive services directorate; Save or instantly send your ready documents. (the instructions that come with irs form 8815 explain both qualified expenses and.

Form 8815 Edit, Fill, Sign Online Handypdf

Web from the form 8815 instructions, enter the total of nontaxable educational benefits including qtp distribution (payments) used for qualified education expenses on. Savings bonds in 2013 that were issued after 1989, you may be able to exclude from your income part or all of the. Editable, free, and easy to use; Savings bonds issued after 1989 (for filers with.

IRS Form 8815 Download Fillable PDF or Fill Online Exclusion of

Web you paid qualified higher education expenses to an eligible institution that same tax year. The latest version available from the army publishing directorate; Editable, printable, and free to use; Web from the form 8815 instructions, enter the total of nontaxable educational benefits including qtp distribution (payments) used for qualified education expenses on. Easily fill out pdf blank, edit, and.

For Children Under Age 18 And Certain Older Children Described Below In Who Must File , Unearned Income Over $2,300 Is Taxed At The Parent's Rate If The.

(the instructions that come with irs form 8815 explain both qualified expenses and. Savings bonds in 2013 that were issued after 1989, you may be able to exclude from your income part or all of the. To complete form 8815 you will need to enter all the. If you cashed series ee or i u.s.

The Latest Version Available From The Executive Services Directorate;

Authority (superseded by/rescinded by) superseded/replaced other pub/form. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the amount of your qualified 2020 disaster distributions made for 2020 or. Easily fill out pdf blank, edit, and sign them. Web you paid qualified higher education expenses to an eligible institution that same tax year.

Save Or Instantly Send Your Ready Documents.

Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i u.s. The latest version available from the army publishing directorate; Web from the form 8815 instructions, enter the total of nontaxable educational benefits including qtp distribution (payments) used for qualified education expenses on. Editable, free, and easy to use;

Savings Bonds Issued After 1989 (For Filers With Qualified.

Editable, printable, and free to use;