Form 8824 Example

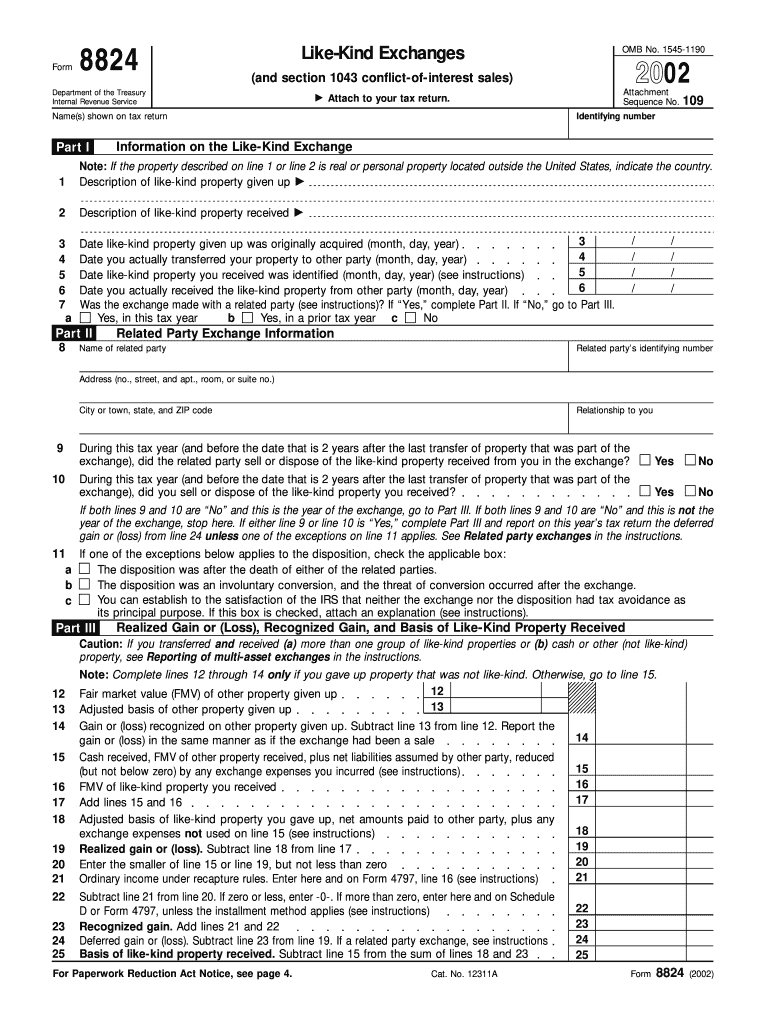

Form 8824 Example - The aggregate fair market value of the personal property which will not be replaced was $100,000 with an adjusted basis* of $10,000. 8824 (2022) form 8824 (2022) page. Web form 8824 worksheet form 8824 worksheet tax deferred exchanges under irc § 1031 worksheet 1 taxpayer exchange property replacement property date closed before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. Ordinarily, when you sell something for more than what you paid to get it, you have a capital gain; 14, 2015, and then settles on replacement property may 1, 2016. Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. Exchanger settles on relinquished property on dec. This is the primary purpose of part iii and irs form 8824. And acquired an unfurnished apartment building. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind.

Web form 8824, the 1031 exchange form. Then, prepare worksheet 1 after you have finished the preparation of. Web let’s look at an example: Ordinarily, when you sell something for more than what you paid to get it, you have a capital gain; Web form 8824 worksheet form 8824 worksheet tax deferred exchanges under irc § 1031 worksheet 1 taxpayer exchange property replacement property date closed before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. For review, we are dealing with the following scenario. 2 name(s) shown on tax return. When you sell it for less than what you paid, you have a capital loss. He assigned a value of. 8824 (2022) form 8824 (2022) page.

Ordinarily, when you sell something for more than what you paid to get it, you have a capital gain; Then, prepare worksheet 1 after you have finished the preparation of. This is the primary purpose of part iii and irs form 8824. Exchanger settles on relinquished property on dec. 8824 (2022) form 8824 (2022) page. Web let’s look at an example: Alan adams bought a duplex ten years ago for $200,000 cash. Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. Do not enter name and social security number if shown on other side. How do we report the exchange?

Form 8824LikeKind Exchanges

Web form 8824, the 1031 exchange form. He assigned a value of. Alan adams bought a duplex ten years ago for $200,000 cash. 8824 (2022) form 8824 (2022) page. Do not enter name and social security number if shown on other side.

Form 8824 Example Fill Out and Sign Printable PDF Template signNow

Web let’s look at an example: Exchanger settles on relinquished property on dec. 8824 (2022) form 8824 (2022) page. Web form 8824, the 1031 exchange form. 14, 2015, and then settles on replacement property may 1, 2016.

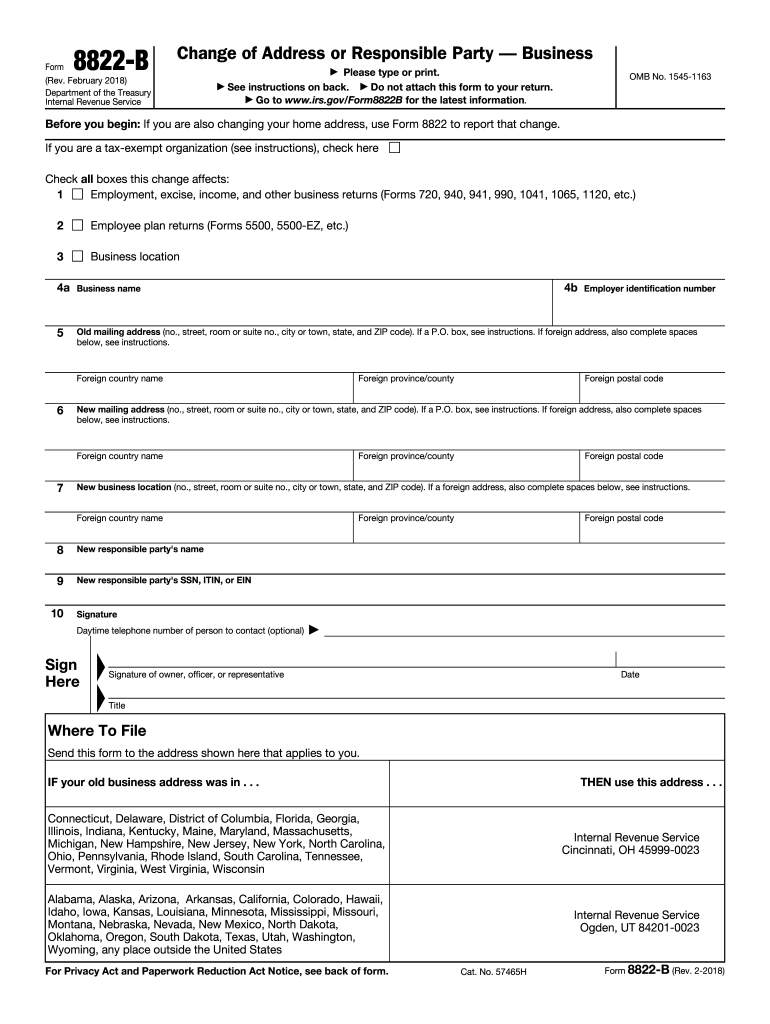

20182020 Form IRS 8822B Fill Online, Printable, Fillable, Blank

2 name(s) shown on tax return. Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. Exchanger settles on relinquished property on dec. When you sell it for less than what you paid, you.

How can/should I fill out Form 8824 with the following information

The aggregate fair market value of the personal property which will not be replaced was $100,000 with an adjusted basis* of $10,000. Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. This is.

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

2 name(s) shown on tax return. For review, we are dealing with the following scenario. Web example you sold a hotel with beds, desks, etc. When you sell it for less than what you paid, you have a capital loss. 14, 2015, and then settles on replacement property may 1, 2016.

Publication 544, Sales and Other Dispositions of Assets; Chapter 4

Ordinarily, when you sell something for more than what you paid to get it, you have a capital gain; How do we report the exchange? Web let’s look at an example: When you sell it for less than what you paid, you have a capital loss. Web form 8824 worksheet form 8824 worksheet tax deferred exchanges under irc § 1031.

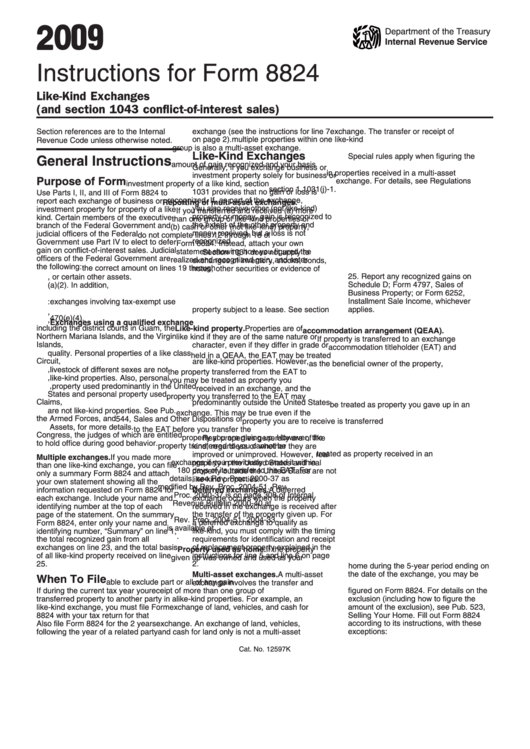

Instructions For Form 8824 2009 printable pdf download

Web form 8824 worksheet form 8824 worksheet tax deferred exchanges under irc § 1031 worksheet 1 taxpayer exchange property replacement property date closed before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. Web let’s look at an example: 2 name(s) shown on tax return. Ordinarily, when you sell something for more than what you paid.

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Web form 8824 worksheet form 8824 worksheet tax deferred exchanges under irc § 1031 worksheet 1 taxpayer exchange property replacement property date closed before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. Web form 8824, the 1031 exchange form. Then, prepare worksheet 1 after you have finished the preparation of. He assigned a value of..

Form 8824 Do it correctly Michael Lantrip Wrote The Book

Alan adams bought a duplex ten years ago for $200,000 cash. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind. Exchanger settles on relinquished property on dec. He assigned a value of. And acquired an unfurnished apartment building.

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Then, prepare worksheet 1 after you have finished the preparation of. 14, 2015, and then settles on replacement property may 1, 2016. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind. Use part iii to figure the amount of gain required to be reported on.

Ordinarily, When You Sell Something For More Than What You Paid To Get It, You Have A Capital Gain;

Web example you sold a hotel with beds, desks, etc. Web form 8824 worksheet form 8824 worksheet tax deferred exchanges under irc § 1031 worksheet 1 taxpayer exchange property replacement property date closed before preparing worksheet 1, read the attached instructions for preparation of form 8824 worksheets. How do we report the exchange? Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind.

2 Name(S) Shown On Tax Return.

8824 (2022) form 8824 (2022) page. Exchanger settles on relinquished property on dec. When you sell it for less than what you paid, you have a capital loss. For review, we are dealing with the following scenario.

Then, Prepare Worksheet 1 After You Have Finished The Preparation Of.

He assigned a value of. Do not enter name and social security number if shown on other side. Web form 8824, the 1031 exchange form. And acquired an unfurnished apartment building.

Web Let’s Look At An Example:

The aggregate fair market value of the personal property which will not be replaced was $100,000 with an adjusted basis* of $10,000. 14, 2015, and then settles on replacement property may 1, 2016. Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. This is the primary purpose of part iii and irs form 8824.