Form 8824 Instructions 2021

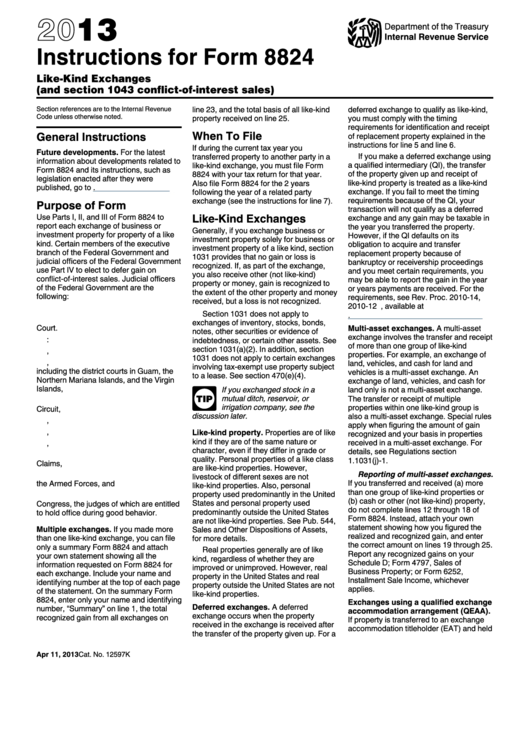

Form 8824 Instructions 2021 - There are two ways to handle a 1031 and turbotax can only use one method. Section iii of the form determines the net results of the transaction (gain or. Web general instructions future developments. The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other. Web the gain or loss, if any, will instead flow to form 4797 from form 8824. Web form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. Special rules specific line instructions (also involuntary conversions and. For the latest information about developments related to form 8824 and its instructions, such as legislation enacted after they were. Click the link for more. For the latest information about developments related to form 8824 and its instructions, such as legislation enacted after they were.

8.5 draft ok to print. List the address or legal description and type of property relinquished (sold). Ad complete irs tax forms online or print government tax documents. See the form 8997 instructions. Get ready for tax season deadlines by completing any required tax forms today. Web part i sale acquisition date of purchase date of sale line 1: For the latest information about developments related to form 8824 and its instructions, such as legislation enacted after they were. Here are the instructions for form 8824. Web 1 & 4. See the instructions for exceptions.

Certain exchanges of property are not. The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other. List the address or legal description and type of property relinquished (sold). Get ready for tax season deadlines by completing any required tax forms today. Web general instructions future developments. Special rules specific line instructions (also involuntary conversions and. Web 1 & 4. Purpose of form use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of. Web the gain or loss, if any, will instead flow to form 4797 from form 8824. 8.5 draft ok to print.

How can/should I fill out Form 8824 with the following information

For the latest information about developments related to form 8824 and its instructions, such as legislation enacted after they were. Web 1 & 4. Get ready for tax season deadlines by completing any required tax forms today. Click the link for more. For the latest information about developments related to form 8824 and its instructions, such as legislation enacted after.

Form 8824LikeKind Exchanges

Ad complete irs tax forms online or print government tax documents. List the address or legal description and type of property relinquished (sold). Web the gain or loss, if any, will instead flow to form 4797 from form 8824. Web 1 & 4. Certain exchanges of property are not.

Online IRS Form 8824 2019 Fillable and Editable PDF Template

For the latest information about developments related to form 8824 and its instructions, such as legislation enacted after they were. Web form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. See the instructions for exceptions. The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden, invites the.

Instructions For Form 8824 LikeKind Exchanges (And Section 1043

Web the gain or loss, if any, will instead flow to form 4797 from form 8824. List the address or legal description and type of property relinquished (sold). The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other. Web general instructions future developments. 8.5 draft ok to print.

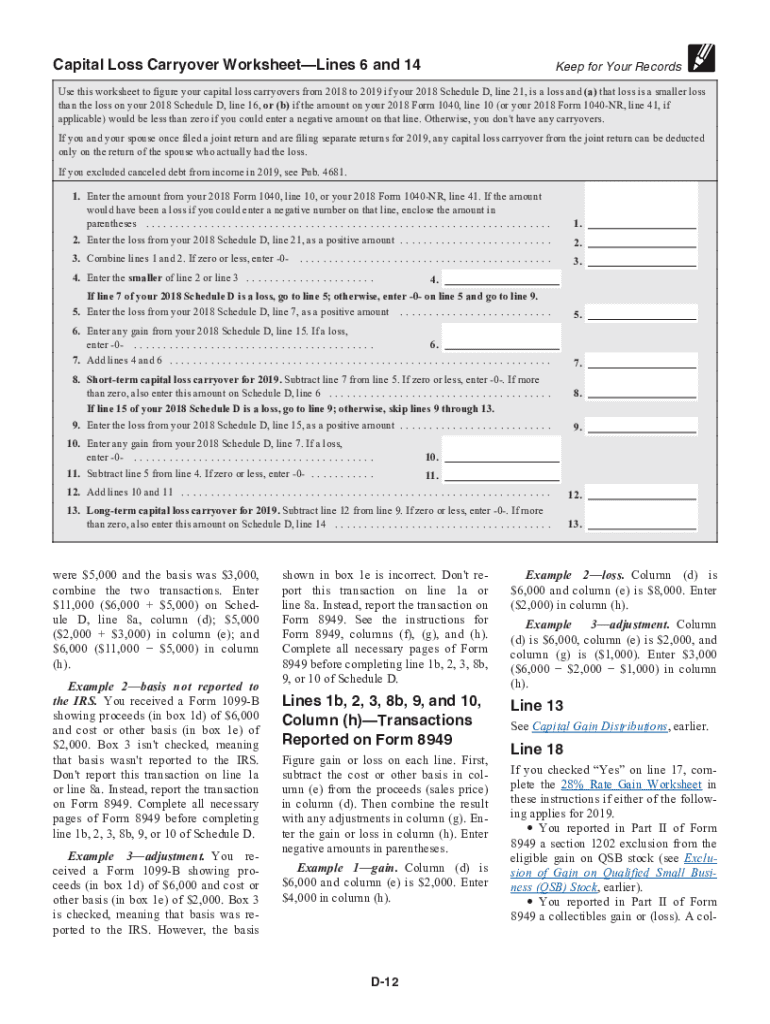

2020 Irs 1040 Schedule Instructions Fill Out and Sign Printable PDF

Get ready for tax season deadlines by completing any required tax forms today. Web general instructions future developments. Here are the instructions for form 8824. Web part i sale acquisition date of purchase date of sale line 1: Web the gain or loss, if any, will instead flow to form 4797 from form 8824.

LEGO 8824 Hovercraft Set Parts Inventory and Instructions LEGO

Get ready for tax season deadlines by completing any required tax forms today. There are two ways to handle a 1031 and turbotax can only use one method. See the instructions for exceptions. Ad complete irs tax forms online or print government tax documents. Web form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction.

IRS 4797 2020 Fill out Tax Template Online US Legal Forms

Certain exchanges of property are not. Purpose of form use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of. Ad complete irs tax forms online or print government tax documents. Web the gain or loss, if any, will instead flow to form 4797 from form 8824. For.

1031 Exchange Form 8824 Universal Network

Special rules specific line instructions (also involuntary conversions and. 8.5 draft ok to print. Web instructions for form 8824 ah xsl/xml page 1 of 4 userid: Here are the instructions for form 8824. Get ready for tax season deadlines by completing any required tax forms today.

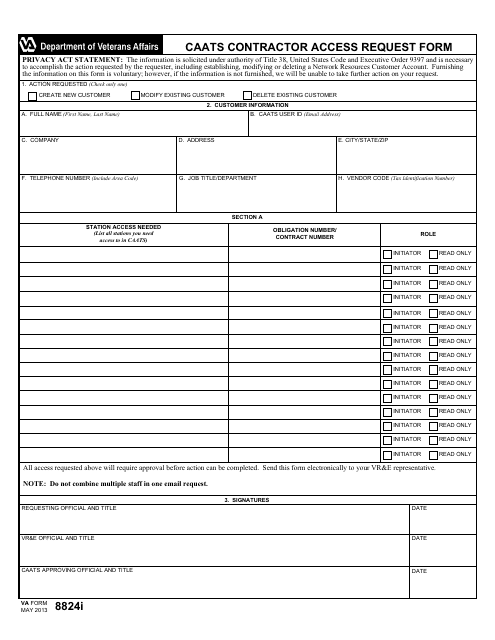

VA Form 8824i Download Fillable PDF or Fill Online Caats Contractor

Web form 8824 worksheetworksheet 2 tax deferred exchanges under irc § 1031 analysis of cash boot received or paid sale of exchange property sale. For the latest information about developments related to form 8824 and its instructions, such as legislation enacted after they were. Certain exchanges of property are not. List the address or legal description and type of property.

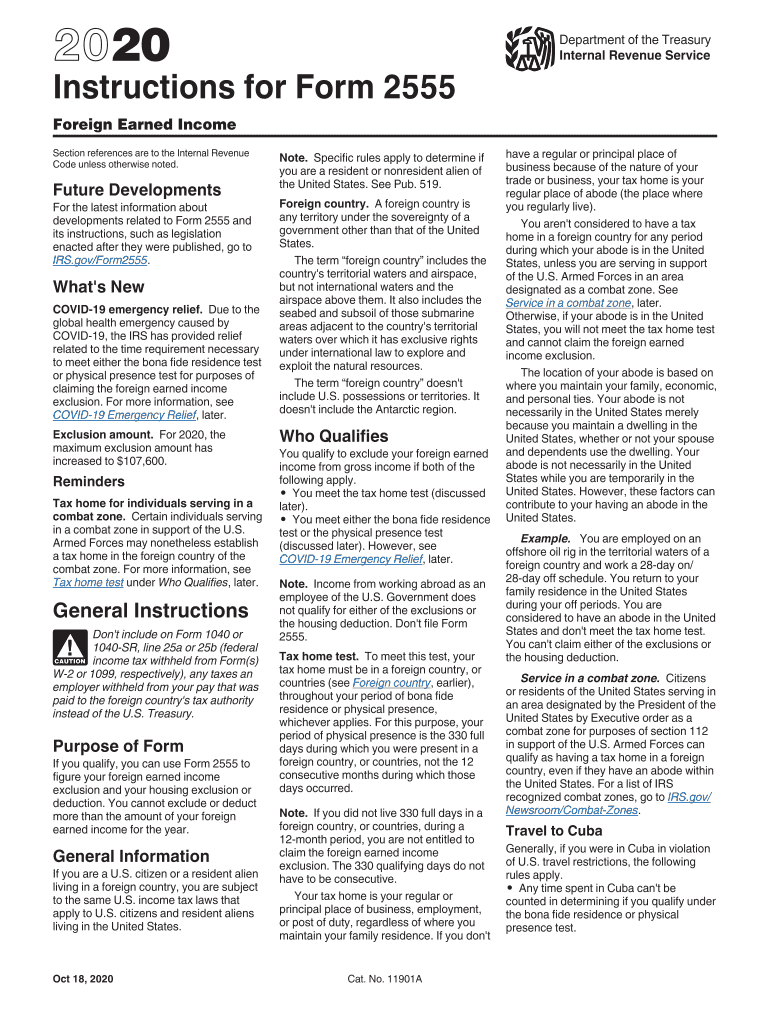

Instructions For Form 2555 Instructions For Form 2555, Foreign Earned

Certain exchanges of property are not. Special rules specific line instructions (also involuntary conversions and. See the instructions for exceptions. For the latest information about developments related to form 8824 and its instructions, such as legislation enacted after they were. Web general instructions future developments.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

For the latest information about developments related to form 8824 and its instructions, such as legislation enacted after they were. See the instructions for exceptions. There are two ways to handle a 1031 and turbotax can only use one method. Certain exchanges of property are not.

Ad Complete Irs Tax Forms Online Or Print Government Tax Documents.

Get ready for tax season deadlines by completing any required tax forms today. 8.5 draft ok to print. Web instructions for form 8824 ah xsl/xml page 1 of 4 userid: Click the link for more.

Web The Gain Or Loss, If Any, Will Instead Flow To Form 4797 From Form 8824.

The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other. List the address or legal description and type of property relinquished (sold). Web 1 & 4. Web form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information.

Purpose Of Form Use Parts I, Ii, And Iii Of Form 8824 To Report Each Exchange Of Business Or Investment Real Property For Real Property Of.

Here are the instructions for form 8824. See the form 8997 instructions. Web form 8824 worksheetworksheet 2 tax deferred exchanges under irc § 1031 analysis of cash boot received or paid sale of exchange property sale. Use parts i, ii, and iii of form.