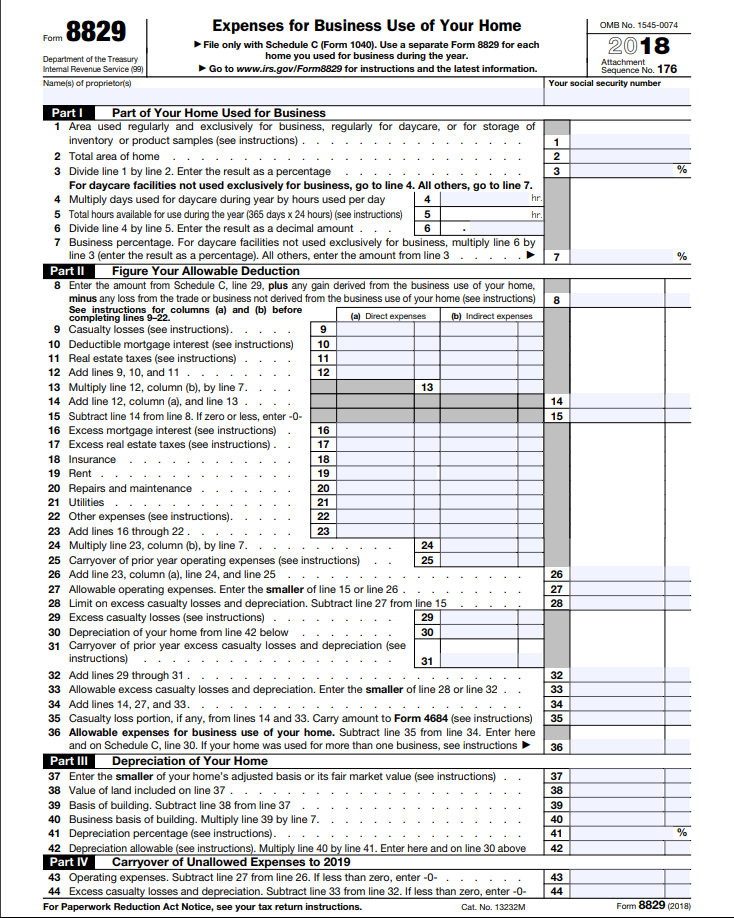

Form 8829 Example

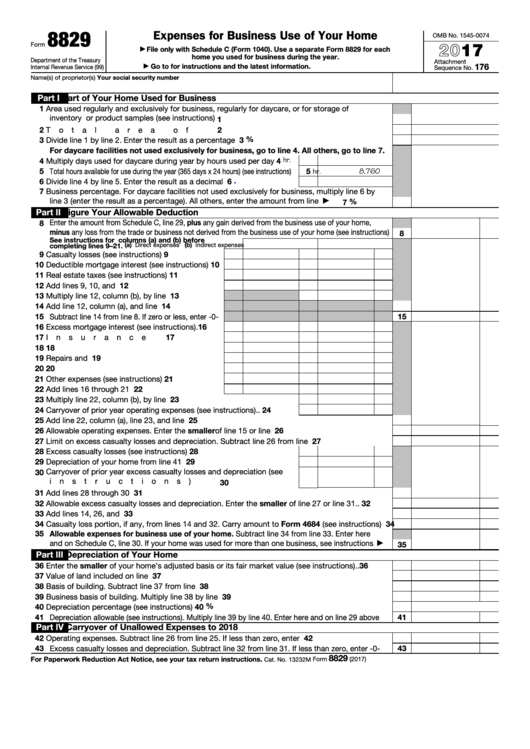

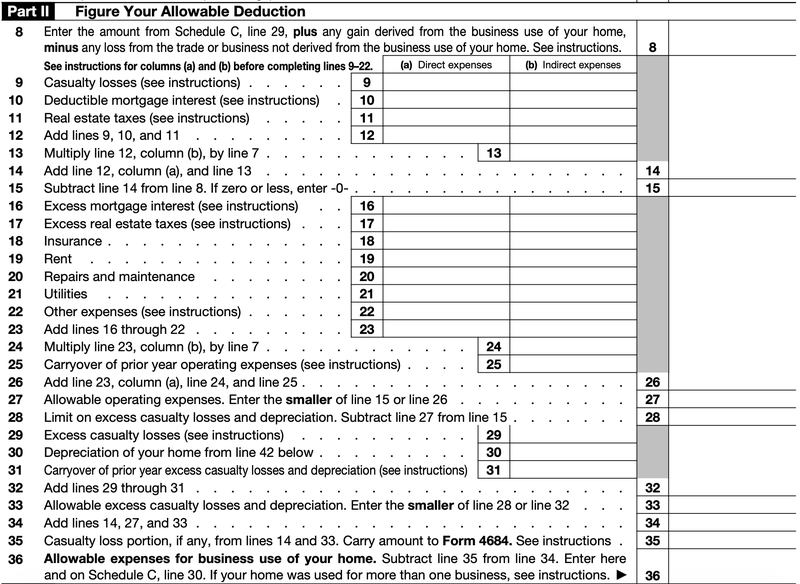

Form 8829 Example - It’s divided into four parts. 300 x (5/12) = 125. Web general instructions purpose of form use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. This follows the guidelines from publication 587, page 26 for part ii of the area adjustment worksheet. The form calculates the portion of expenses related to your home that you can claim as a tax deduction on schedule c. Then, subtract your total expenses (line 28 of your schedule c), from the gross income from your home office. Web irs form 8829 is made for individuals that want to deduct home office expenses. Some parts of the form can be complicated. Business use of your home on schedule c (form 1040) • keeping books and records. Web one way of figuring this out is to consider how much time you spend at each location.

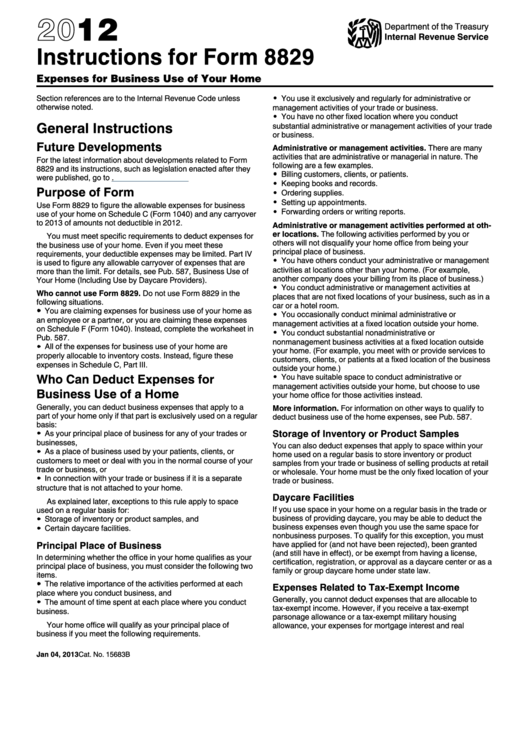

Table of contents how do i complete irs form 8829? Part of your home used for business part ii: The irs has published a comparison of the two home office deduction methods. Use form 8829 to figure the allowable expenses for • billing customers, clients, or patients. It’s divided into four parts. Web key takeaways irs form 8829 is the form used to deduct expenses for your home business space. Web form8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). If you reasonably estimate $300 of your electric bill is for lighting and you use 10% of your home for business, enter $30 on line 21 in column (a). Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file.

Web irs form 8829 is made for individuals that want to deduct home office expenses. Expenses for business use of your home keywords: Using irs form 8829 part i of form 8829: Web form8829 2022 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Some parts of the form can be complicated. The irs determines the eligibility of an allowable home business space using two criterion: Part of your home used for business part ii: Go to www.irs.gov/form8829 for instructions and the latest information. Web maintenance and repairs insurance depreciation of your home deductible mortgage interest remember that these deductions are scaled to the square footage of your home office or workspace, not the entire home. We’ll walk through each section and help you decode what certain lines are asking for.

U.S. Tax Form 8829—Expenses for Business Use of Your Home FreshBooks Blog

Table of contents how do i complete irs form 8829? Use a separate form 8829 for each home you used for business during the year. Web key takeaways irs form 8829 is the form used to deduct expenses for your home business space. Web purpose of form many activities that are administrative or managerial in nature. Go to www.irs.gov/form8829 for.

U.S. Tax Form 8829—Expenses for Business Use of Your Home FreshBooks Blog

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. It’s divided into four parts. Regular use of the space for business purposes and exclusivity—the space is used solely for business purposes. The form calculates the portion of expenses related to your home.

Instructions For Form 8829 Expenses For Business Use Of Your Home

This form helps you calculate the percentage of your home used for business, your business income versus expenses, the depreciation of your home, and any other expenses that are considered “. 300 x (5/12) = 125. How to complete form 8829 form 8829 helps you calculate the allowable deduction for home business expenses. Use a separate form 8829 for each.

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2018 of amounts not deductible in 2017. Web one way of figuring this out is to consider how much time you spend at each location. Use a separate form 8829 for each home you used for.

Home Office Tax Deductions for Small Business and Homeowner

If you face any difficulty while filling out form 8829, then you can even consult a tax. Use form 8829 to figure the allowable expenses for • billing customers, clients, or patients. The form calculates the portion of expenses related to your home that you can claim as a tax deduction on schedule c. Web form 8829, also called the.

Fillable Form 8829 Expenses For Business Use Of Your Home 2017

Business use of your home on schedule c (form 1040) • keeping books and records. Using irs form 8829 part i of form 8829: Go to www.irs.gov/form8829 for instructions and the latest information. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts..

Form 8829 Instructions Your Complete Guide to Expense Your Home Office

Part of your home used for business part ii: Web purpose of form many activities that are administrative or managerial in nature. Web for example, if your home office is 250 square feet, you’d claim a home office deduction of $1,250. Web one way of figuring this out is to consider how much time you spend at each location. We’ll.

How to Complete and File IRS Form 8829 The Blueprint

For example, if you work from home 50% of the time, 50% of your gross income is from your home office. Web general instructions purpose of form use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Part of your.

The New York Times > Business > Image > Form 8829

Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. How to complete form 8829 form 8829 helps you calculate the allowable deduction for home business expenses. Web information about form 8829, expenses for business use of your home, including recent updates, related.

How to Claim the Home Office Deduction with Form 8829 Ask Gusto

The form calculates the portion of expenses related to your home that you can claim as a tax deduction on schedule c. Go to www.irs.gov/form8829 for instructions and the latest information. Web home office deduction form 8829 is for taxpayers who submit form 1040 schedule c only. Some parts of the form can be complicated. Use a separate form 8829.

Filling Out Tax Form 8829.

The form calculates the portion of expenses related to your home that you can claim as a tax deduction on schedule c. Web for example, if your home is 1,000 square feet and your home office is 100 square feet, you use 10% of your home as part of your business. Web for example, in case your home is 4,000 square feet, and your home business space is 400 square feet, then the percentage will be 10%. How to complete form 8829 form 8829 helps you calculate the allowable deduction for home business expenses.

Part Of Your Home Used For Business Part Ii:

Web purpose of form many activities that are administrative or managerial in nature. Using irs form 8829 part i of form 8829: Web general instructions purpose of form use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Web for example, your electric bill is $800 for lighting, cooking, laundry, and television.

You Calculate The Part Of Your Home Used For Business.

Web for example, if your home office is 250 square feet, you’d claim a home office deduction of $1,250. For example, if you work from home 50% of the time, 50% of your gross income is from your home office. Web rent repairs and maintenance utilities depreciation on your home what does form 8829 look like? Web form 8829 department of the treasury internal revenue service (99) expenses for business use of your home.

It’s Divided Into Four Parts.

Web home office deduction form 8829 is for taxpayers who submit form 1040 schedule c only. If you reasonably estimate $300 of your electric bill is for lighting and you use 10% of your home for business, enter $30 on line 21 in column (a). Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. Web for example, if only 10% of the square footage of your house is reserved exclusively for business use, you can only use 10% of your home expenses as a business deduction.