Form 8839 Instructions

Form 8839 Instructions - Web for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after they are published, go to irs.gov/form8839. Web to generate form 8839 to receive the adoption credit: The instructions for form 8839 state: Web find answers adoption tax credit. You can download or print current. Child, combine the amounts you. Web about the latest developments on form not appointed, qualified, and acting, see united states person is any of the 8939 and its instructions, go to www.irs. Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code. Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c. Web how do i complete irs form 8839?

The instructions for form 8839 state: Web we last updated the qualified adoption expenses in december 2022, so this is the latest version of form 8839, fully updated for tax year 2022. Web tips on how to fill out the 2005 form 8839 instructions 2021 on the web: Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code. Enter the adopted child's personal information. Web this morning it was feb. Do not file draft forms. The internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain. You can download or print current. There are three parts to irs form 8839, qualified adoption expenses:

Information about your eligible child or. Go to input return ⮕ credits ⮕ adoption credit (8839) from the left menu. The internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain. Enter the adopted child's personal information. Web for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after they are published, go to www.irs.gov/form8839. You may be able to take this credit in 2022 if any of the. Go to www.irs.gov/form8839 for instructions. Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c. Web this morning it was feb. There are three parts to irs form 8839, qualified adoption expenses:

Form 8833 TreatyBased Return Position Disclosure Claiming a Treaty

Web to generate form 8839 to receive the adoption credit: Web tips on how to fill out the 2005 form 8839 instructions 2021 on the web: Go to input return ⮕ credits ⮕ adoption credit (8839) from the left menu. The instructions for form 8839 state: Go to www.irs.gov/form8839 for instructions.

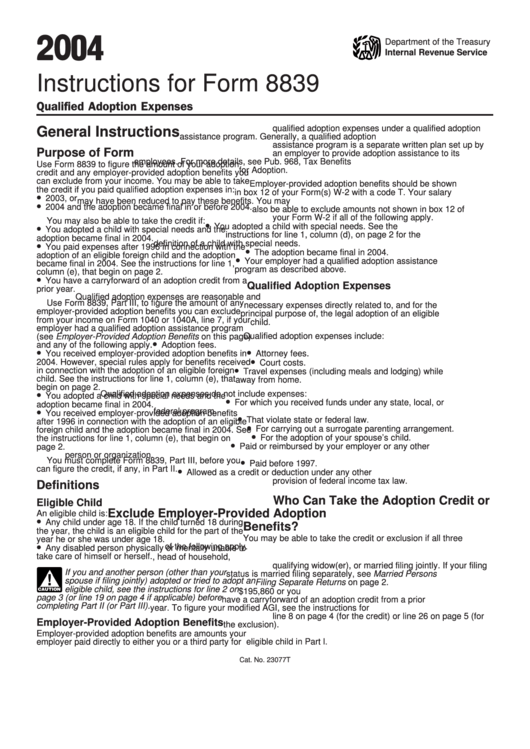

Instructions For Form 8839 Qualified Adoption Expenses 2004

Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c. Child, combine the amounts you. The internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain. Web tips on how to fill out the 2005 form.

Form 8839 Qualified Adoption Expenses (2015) Free Download

Web form 8839 department of the treasury internal revenue service (99) qualified adoption expenses attach to form 1040 or 1040nr. You can download or print current. Not sure exactly when it will be. Web find answers adoption tax credit. Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c.

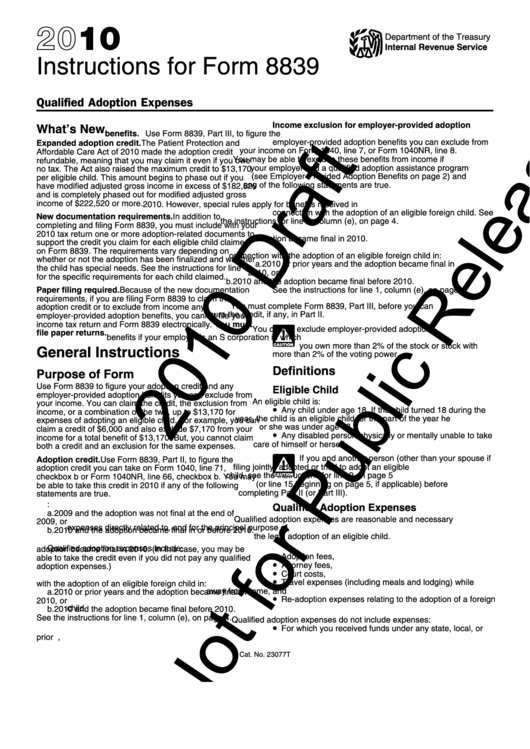

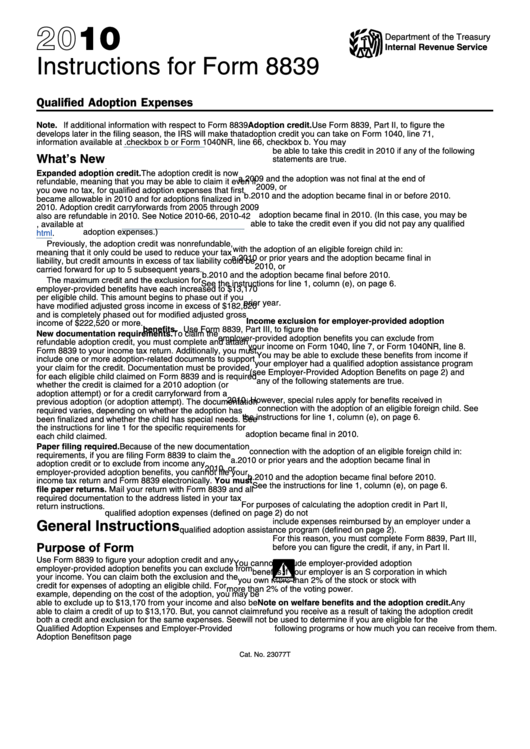

Draft Instructions For Form 8839 Qualified Adoption Expenses 2010

Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code. Web for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after they are published, go to www.irs.gov/form8839. I actually called 4 different tax preparer companies and they all said.

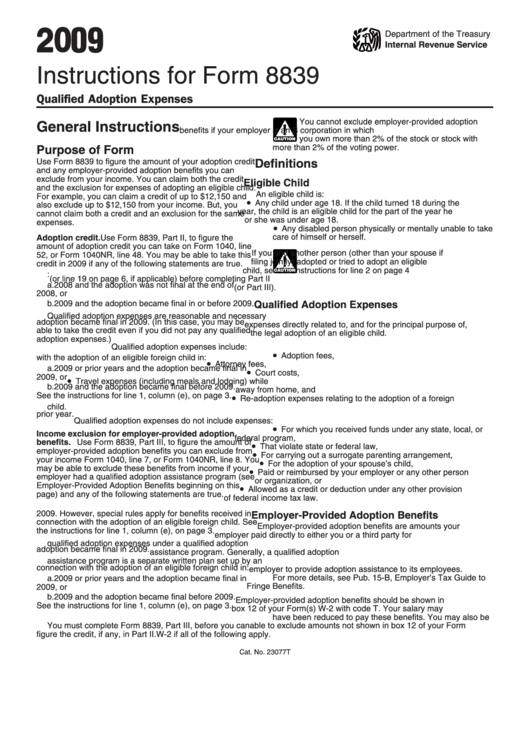

Instructions For Form 8839 2009 printable pdf download

Not sure exactly when it will be. Go to www.irs.gov/form8839 for instructions. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. The internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain..

LEGO instructions Technic 8839 Supply Ship YouTube

Web to generate form 8839 to receive the adoption credit: Enter the adopted child's personal information. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Sign online button or tick the preview image of the form. Go to www.irs.gov/form8839 for instructions.

Form 8839Qualified Adoption Expenses

Information about your eligible child or. Web before filing, taxpayers should review 2021 form 8839 instructions (also available at www.irs.gov) very carefully to be sure that they apply for the credit correctly and to see if. Web before filing, taxpayers should review 2022 form 8839 instructions (will also be available at www.irs.gov) very carefully to be sure that they apply.

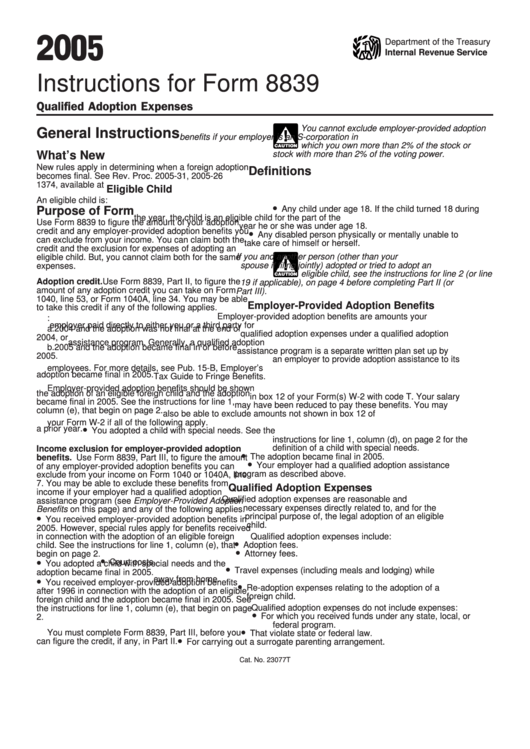

Instructions For Form 8839 2005 printable pdf download

Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web we last updated the qualified adoption expenses in december 2022, so this is.

Form 8839Qualified Adoption Expenses

Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code. Web to generate form 8839 to receive the adoption credit: Web before filing, taxpayers should review 2021 form 8839 instructions (also available at www.irs.gov) very carefully to be sure that they apply for the credit correctly and.

Instructions For Form 8839 2010 printable pdf download

The instructions for form 8839 state: Go to input return ⮕ credits ⮕ adoption credit (8839) from the left menu. Not sure exactly when it will be. Web about the latest developments on form not appointed, qualified, and acting, see united states person is any of the 8939 and its instructions, go to www.irs. Web before filing, taxpayers should review.

Not Sure Exactly When It Will Be.

To begin the blank, utilize the fill camp; I actually called 4 different tax preparer companies and they all said the form was not ready. Sign online button or tick the preview image of the form. Web how do i complete irs form 8839?

Web Before Filing, Taxpayers Should Review 2021 Form 8839 Instructions (Also Available At Www.irs.gov) Very Carefully To Be Sure That They Apply For The Credit Correctly And To See If.

You may be able to take this credit in 2022 if any of the. Web for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after they are published, go to www.irs.gov/form8839. You can download or print current. Web before filing, taxpayers should review 2022 form 8839 instructions (will also be available at www.irs.gov) very carefully to be sure that they apply for the credit correctly and to see.

Go To Input Return ⮕ Credits ⮕ Adoption Credit (8839) From The Left Menu.

Web we last updated the qualified adoption expenses in december 2022, so this is the latest version of form 8839, fully updated for tax year 2022. The internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain. Child, combine the amounts you. Web for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after they are published, go to irs.gov/form8839.

Web This Morning It Was Feb.

Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c. Web to generate form 8839 to receive the adoption credit: Web form 8839 department of the treasury internal revenue service (99) qualified adoption expenses attach to form 1040 or 1040nr. Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code.