Form 8839 Qualified Adoption Expenses

Form 8839 Qualified Adoption Expenses - Adoption credit if you paid. Web june 14, 2017 h&r block two tax benefits are available to adoptive parents: Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6. Web for adoptive families who incurred certain qualified expenses in the adoption of a child, the internal revenue service may allow a tax credit on your federal. Web how to generate form 8839 qualified adoption expenses in proconnect calculations and limitations addressed in this article may be impacted by inflation adjustments for the. The adoption credit and the adoption benefits exclusion. Web form 8839 is used to calculate the allowable credit of an eligible child based on the taxpayer's qualified expenses. Qualified adoption expenses qualified adoption. Web qualified adoption expenses include: Web to claim the adoption credit or exclusion, complete form 8839, qualified adoption expenses and attach the form to your form 1040, u.s.

The adoption credit and the adoption benefits exclusion. Web form 8839 is used to calculate the allowable credit of an eligible child based on the taxpayer's qualified expenses. Web follow these steps to enter the limited qualified adoption expenses: Additionally, there are separate rules to claim the credit on form 8839 if you adopt. You can claim both the exclusion and the. Web form 8839 qualified adoption expenses solved • by intuit • 7 • updated february 23, 2023 below are the most popular resources associated with form 8839:. Web june 14, 2017 h&r block two tax benefits are available to adoptive parents: Web qualified adoption expenses include: Web how to generate form 8839 qualified adoption expenses in proconnect calculations and limitations addressed in this article may be impacted by inflation adjustments for the. Web you may also qualify for the credit if you paid expenses to adopt a foreign child.

Web follow these steps to enter the limited qualified adoption expenses: Check box c on that line and enter “8839” in the space. You can claim both the exclusion and the. You can claim both the exclusion and the. Web qualified adoption expenses include: Web you may also qualify for the credit if you paid expenses to adopt a foreign child. Web how to generate form 8839 qualified adoption expenses in proconnect calculations and limitations addressed in this article may be impacted by inflation adjustments for the. Web you must submit irs form 8839 in order to report your qualifying adoption expenses. The adoption credit and the adoption benefits exclusion. Web for adoptive families who incurred certain qualified expenses in the adoption of a child, the internal revenue service may allow a tax credit on your federal.

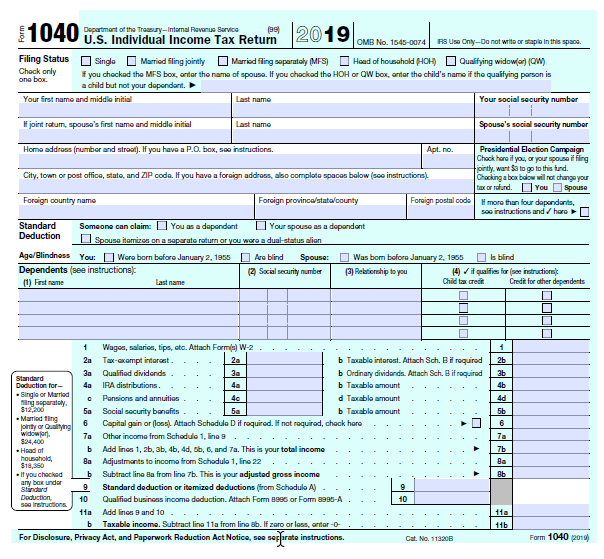

Example Of Filled Out 2022 1040 Calendar Template 2022

Web qualified adoption expenses include: Web you may also qualify for the credit if you paid expenses to adopt a foreign child. Adoption credit if you paid. You can claim both the exclusion and the. The adoption credit and the adoption benefits exclusion.

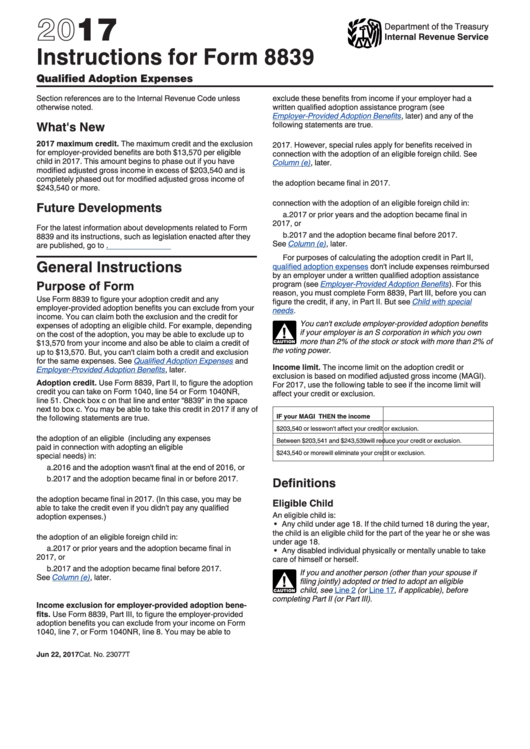

What Adoption Expenses Count? Qualified Adoption Expenses 2017

Web you must submit irs form 8839 in order to report your qualifying adoption expenses. You can claim both the credit and. Go to screen 37, adoption credit (8839). Web you may also qualify for the credit if you paid expenses to adopt a foreign child. Adoption credit if you paid.

Form 8839Qualified Adoption Expenses

Web you must submit irs form 8839 in order to report your qualifying adoption expenses. You can claim both the credit and. Adoption credit if you paid. Go to screen 37, adoption credit (8839). Enter “sne” on the dotted line next to the.

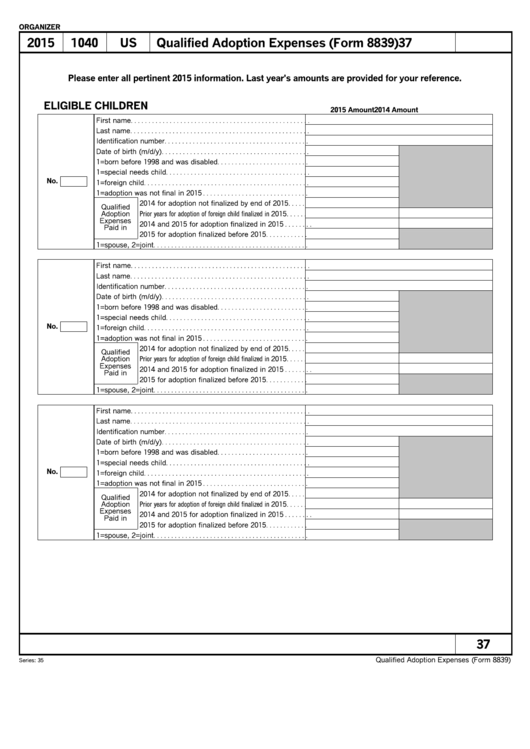

Form 8839 Qualified Adoption Expenses (2015) Free Download

Web how to generate form 8839 qualified adoption expenses in proconnect calculations and limitations addressed in this article may be impacted by inflation adjustments for the. Web for adoptive families who incurred certain qualified expenses in the adoption of a child, the internal revenue service may allow a tax credit on your federal. Qualified adoption expenses qualified adoption. Web form.

Fill Free fillable Form 8839 2019 Qualified Adoption Expenses PDF form

What is irs form 8839 as long as you meet certain qualifying standards, the. Web you may also qualify for the credit if you paid expenses to adopt a foreign child. Web form 8839 is used to calculate the allowable credit of an eligible child based on the taxpayer's qualified expenses. Additionally, there are separate rules to claim the credit.

Form 8839Qualified Adoption Expenses

Web for adoptive families who incurred certain qualified expenses in the adoption of a child, the internal revenue service may allow a tax credit on your federal. Additionally, there are separate rules to claim the credit on form 8839 if you adopt. Web you may also qualify for the credit if you paid expenses to adopt a foreign child. The.

Instructions For Form 8839 Qualified Adoption Expenses 2017

You can claim both the exclusion and the. Web for adoptive families who incurred certain qualified expenses in the adoption of a child, the internal revenue service may allow a tax credit on your federal. You can claim both the exclusion and the. Web form 8839 qualified adoption expenses solved • by intuit • 7 • updated february 23, 2023.

20 Form 8839 Templates free to download in PDF, Word and Excel

Qualified adoption expenses qualified adoption. Web follow these steps to enter the limited qualified adoption expenses: What is irs form 8839 as long as you meet certain qualifying standards, the. Enter “sne” on the dotted line next to the. Web you must submit irs form 8839 in order to report your qualifying adoption expenses.

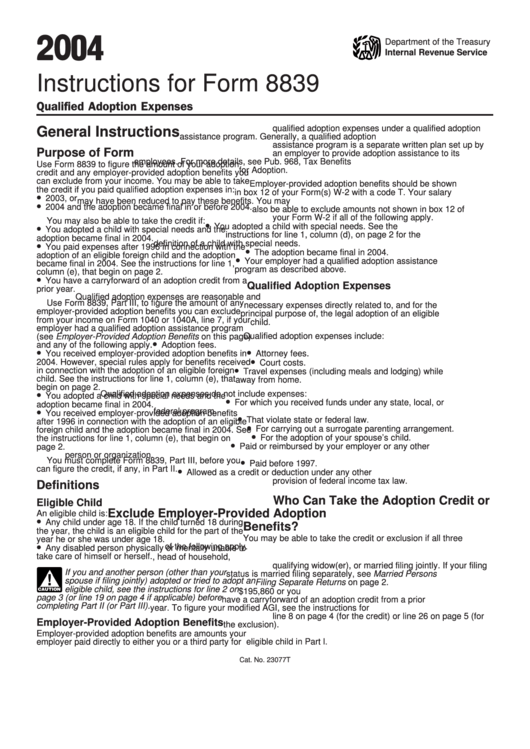

Instructions For Form 8839 Qualified Adoption Expenses 2004

Enter “sne” on the dotted line next to the. What is irs form 8839 as long as you meet certain qualifying standards, the. Go to screen 37, adoption credit (8839). Web to claim the adoption credit or exclusion, complete form 8839, qualified adoption expenses and attach the form to your form 1040, u.s. Web you must submit irs form 8839.

Form 8839 Qualified Adoption Expenses (2015) Free Download

Check box c on that line and enter “8839” in the space. Web form 8839 qualified adoption expenses solved • by intuit • 7 • updated february 23, 2023 below are the most popular resources associated with form 8839:. Go to screen 37, adoption credit (8839). Adoption credit if you paid. Web june 14, 2017 h&r block two tax benefits.

What Is Irs Form 8839 As Long As You Meet Certain Qualifying Standards, The.

Enter “sne” on the dotted line next to the. Web to claim the adoption credit or exclusion, complete form 8839, qualified adoption expenses and attach the form to your form 1040, u.s. Web form 8839 is used to calculate the allowable credit of an eligible child based on the taxpayer's qualified expenses. Web qualified adoption expenses include:

Go To Screen 37, Adoption Credit (8839).

Adoption credit if you paid. Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6. Check box c on that line and enter “8839” in the space. Additionally, there are separate rules to claim the credit on form 8839 if you adopt.

You Can Claim Both The Exclusion And The.

Qualified adoption expenses qualified adoption. Web how to generate form 8839 qualified adoption expenses in proconnect calculations and limitations addressed in this article may be impacted by inflation adjustments for the. Web follow these steps to enter the limited qualified adoption expenses: Web june 14, 2017 h&r block two tax benefits are available to adoptive parents:

Web You Must Submit Irs Form 8839 In Order To Report Your Qualifying Adoption Expenses.

Web for adoptive families who incurred certain qualified expenses in the adoption of a child, the internal revenue service may allow a tax credit on your federal. You can claim both the exclusion and the. Web you may also qualify for the credit if you paid expenses to adopt a foreign child. You can claim both the credit and.