Form 8863 2021

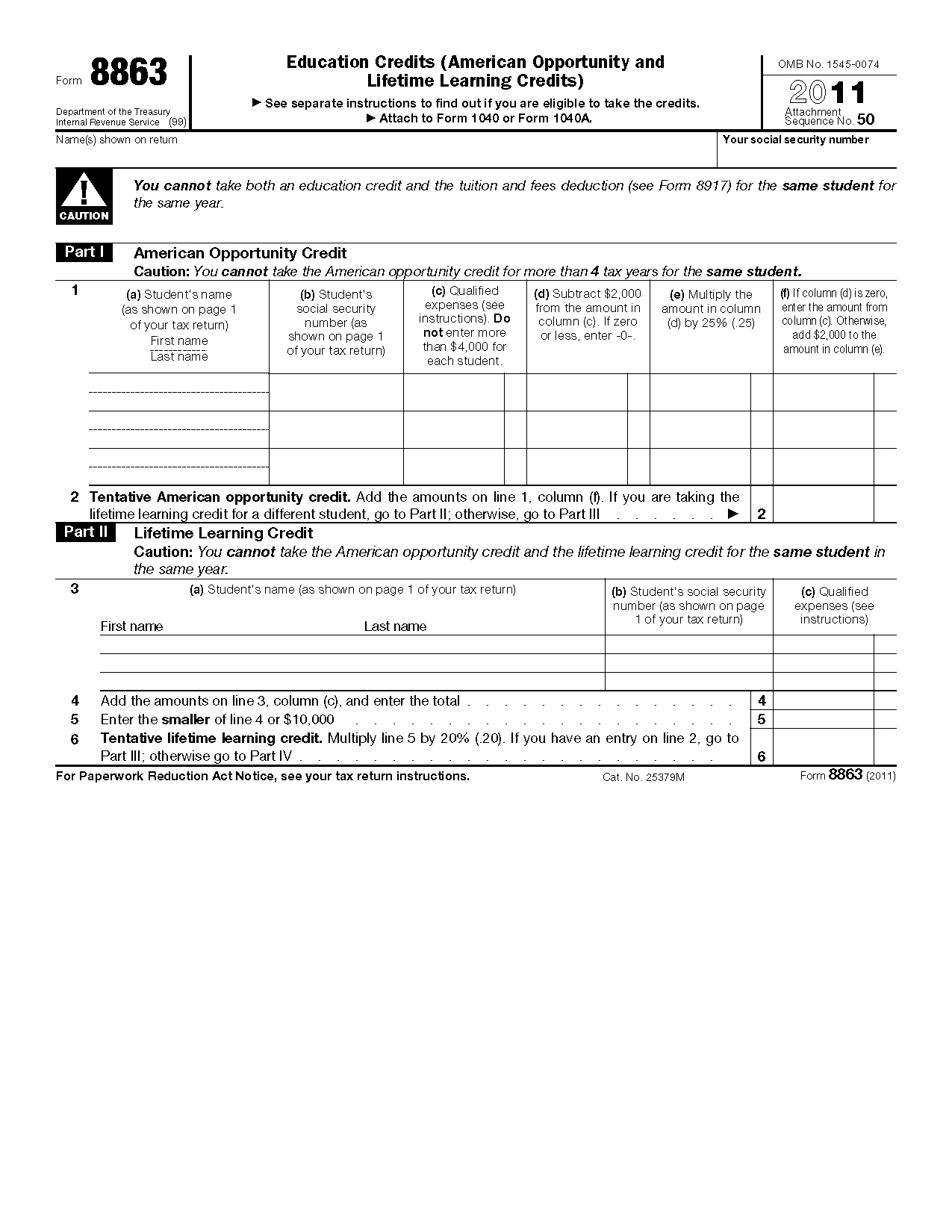

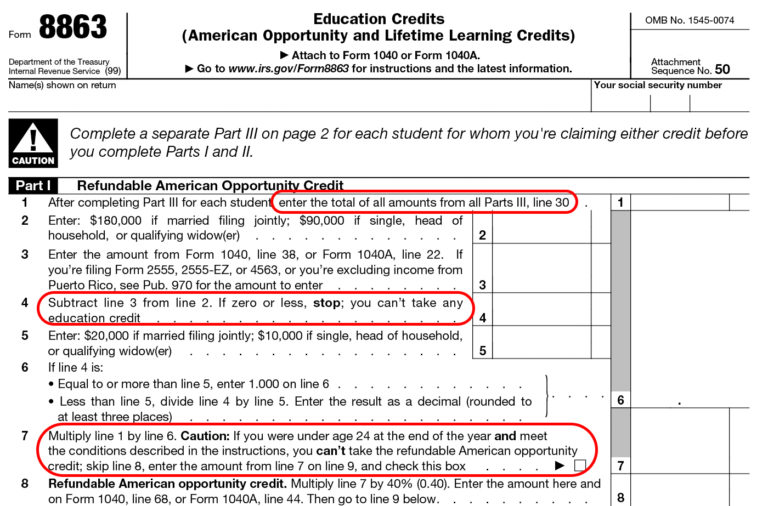

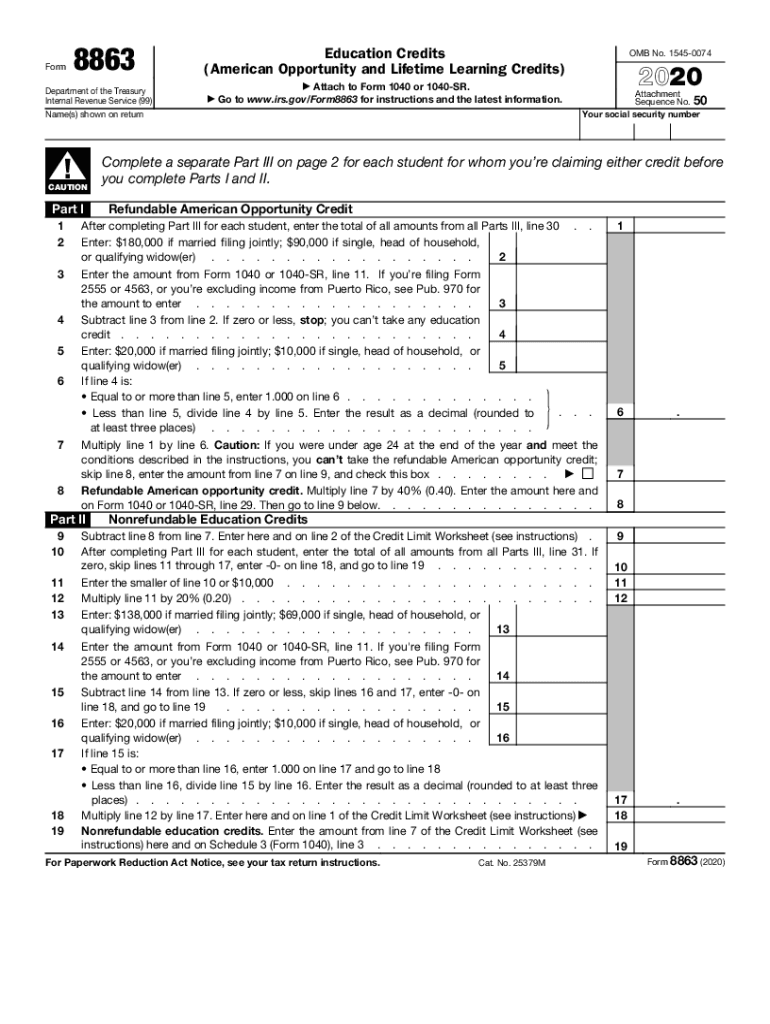

Form 8863 2021 - Go to www.irs.gov/form8863 for instructions and the latest information. Web the due date to file the 8863 tax form for 2022 is april 15, 2023. Choose the correct version of the editable pdf form from the list and get started filling it out. Web find and fill out the correct 2021 instruction 8863. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Before preparing the form, however, make sure that you. 50 name(s) shown on return You can claim up 20% of the first $10,000 of qualified education expenses in lifetime learning credit. Go to for instructions and the latest information. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on how to file.

Choose the correct version of the editable pdf form from the list and get started filling it out. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on how to file. At least one of your parents was alive at the end of 2021. You can claim up 20% of the first $10,000 of qualified education expenses in lifetime learning credit. Web the due date to file the 8863 tax form for 2022 is april 15, 2023. Go to for instructions and the latest information. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Taxpayers can obtain the blank template, instructions, and relevant samples from the irs or other reputable tax preparation websites. Form 8863 fillable can be completed online or printed out as a pdf and mailed to the irs.

Web find and fill out the correct 2021 instruction 8863. Taxpayers can obtain the blank template, instructions, and relevant samples from the irs or other reputable tax preparation websites. Before preparing the form, however, make sure that you. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on how to file. Web form 8863—education credits must be claimed if a taxpayer is going to claim lifetime learning credit on their federal income tax returns. 50 name(s) shown on return Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Choose the correct version of the editable pdf form from the list and get started filling it out. You can claim up 20% of the first $10,000 of qualified education expenses in lifetime learning credit. If you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return.

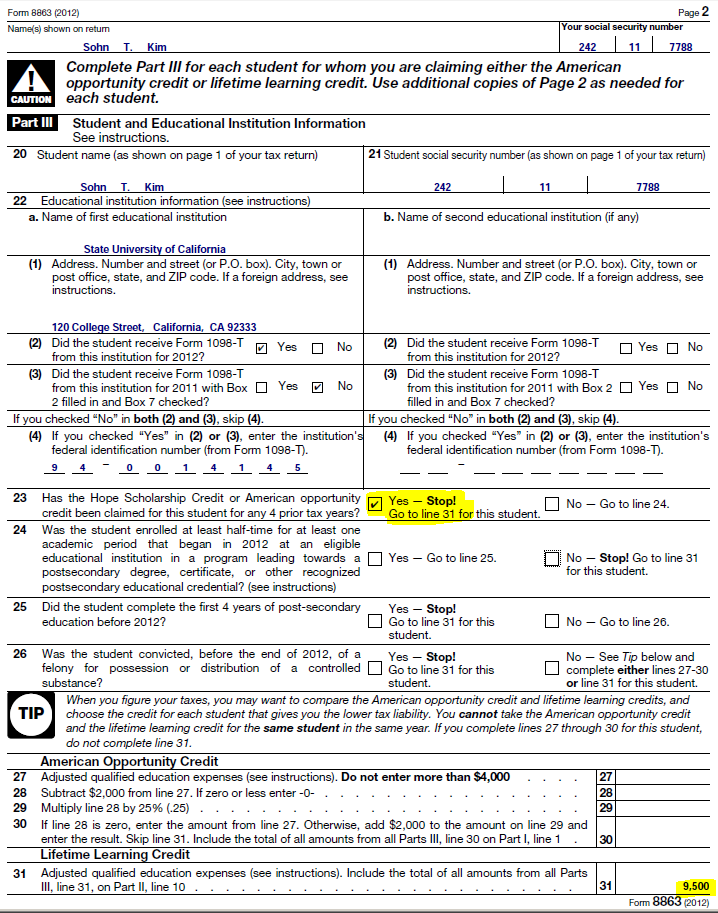

8863 Instructions Form Fill Out and Sign Printable PDF Template signNow

If you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Web the due date to file the 8863 tax form for 2022 is april 15, 2023. Form 8863 fillable can be completed online or printed out as a pdf and mailed to the.

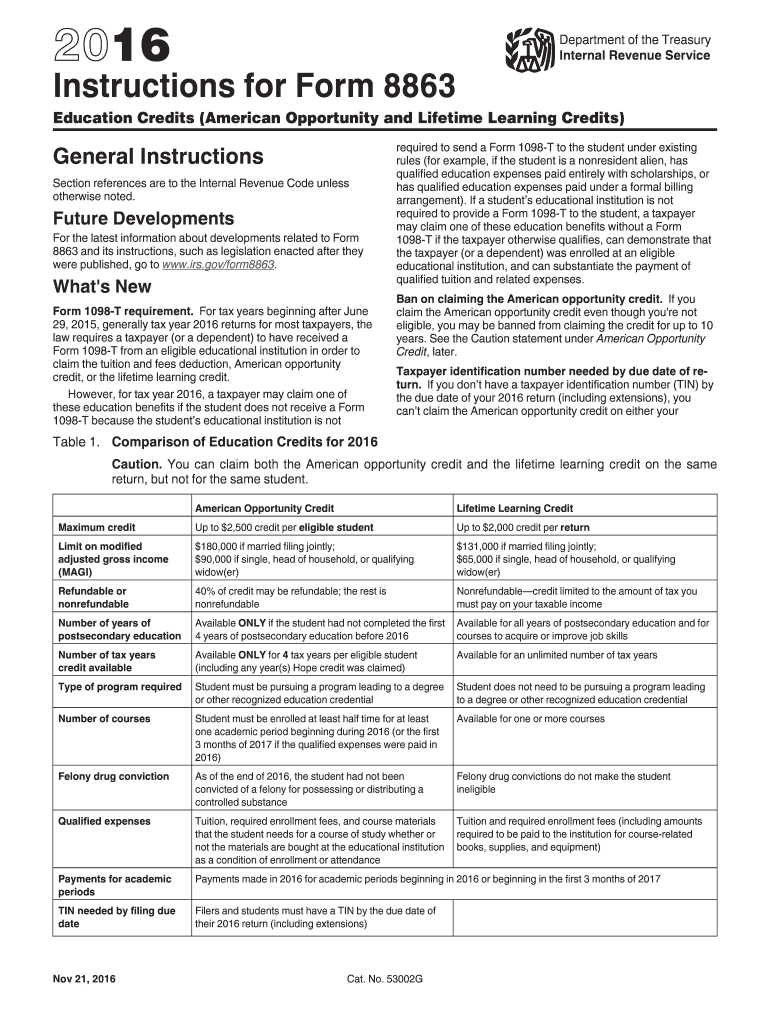

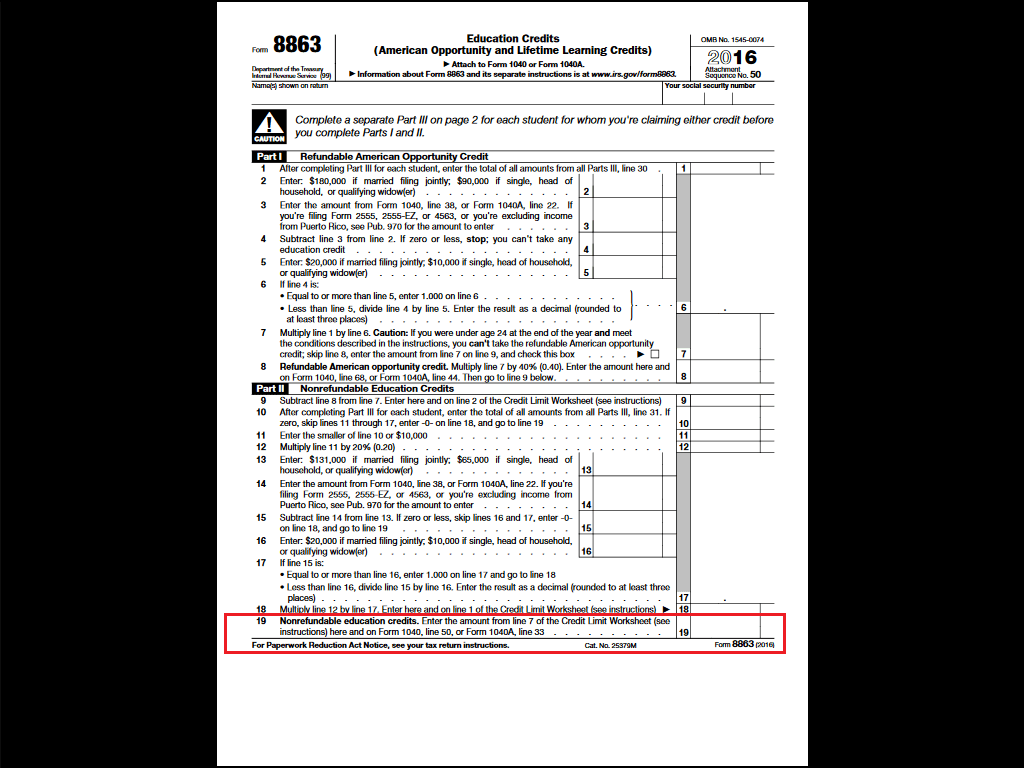

Tax Form 8863 Federal For 2016 Instructions 2015 2018 —

Go to www.irs.gov/form8863 for instructions and the latest information. Choose the correct version of the editable pdf form from the list and get started filling it out. Go to for instructions and the latest information. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on how to file. 50.

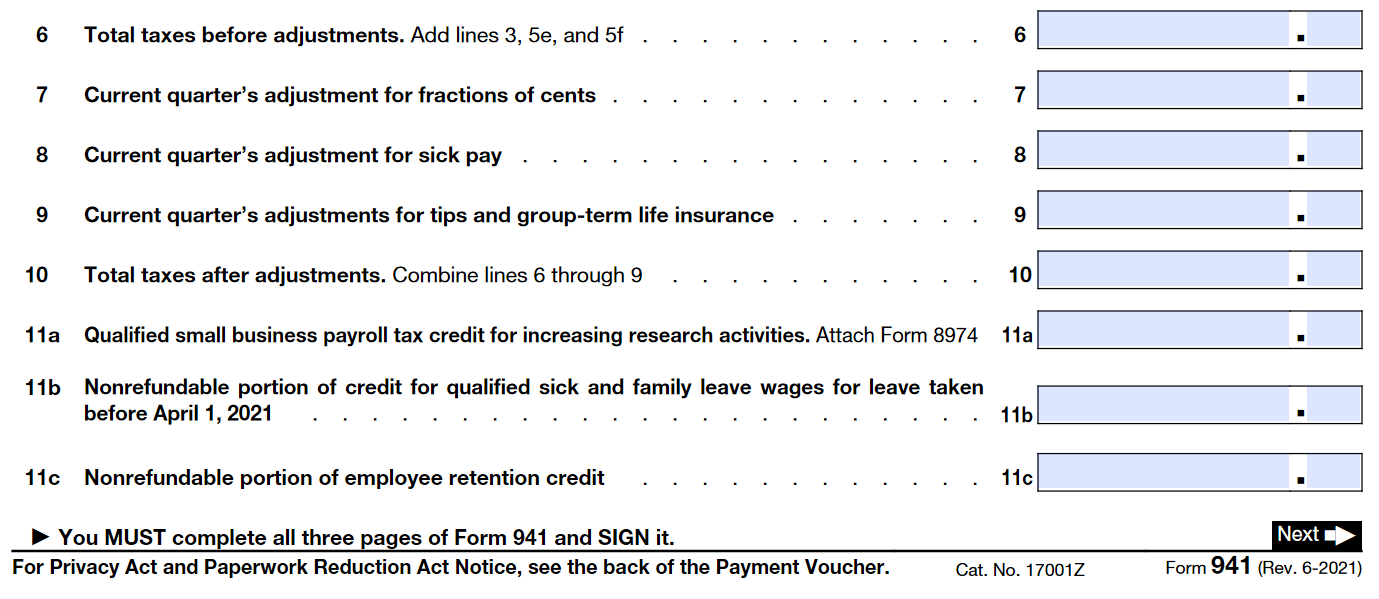

IRS Form 941 Instructions for 2021 How to fill out Form 941

Taxpayers can obtain the blank template, instructions, and relevant samples from the irs or other reputable tax preparation websites. Web the due date to file the 8863 tax form for 2022 is april 15, 2023. Web find and fill out the correct 2021 instruction 8863. You can claim up 20% of the first $10,000 of qualified education expenses in lifetime.

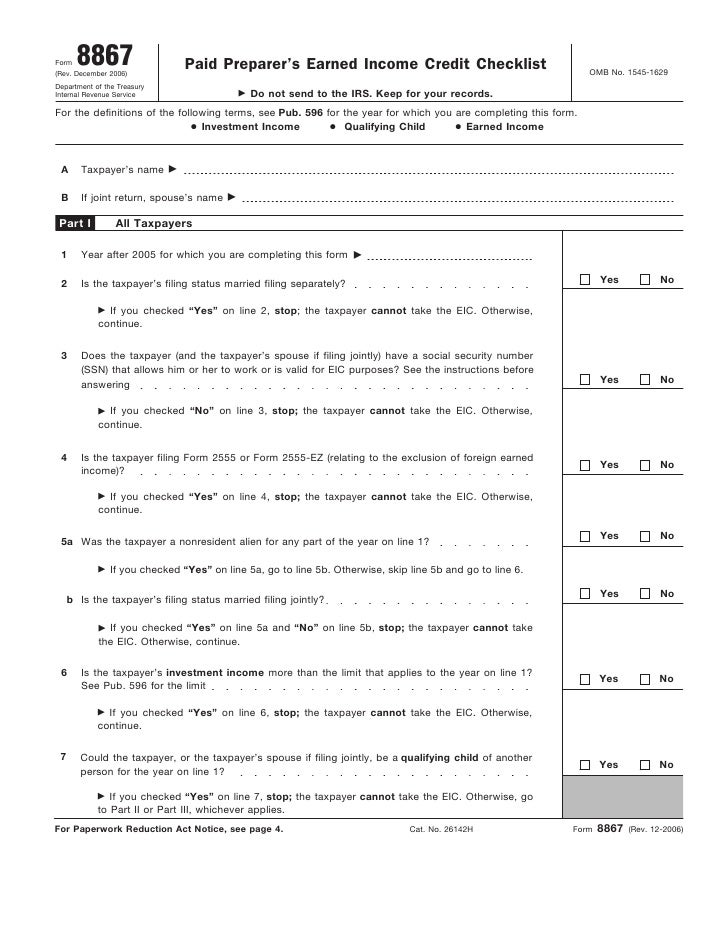

Earned Credit Worksheet 2022

Web find and fill out the correct 2021 instruction 8863. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on how to file. Go to for instructions and the latest information. Go to www.irs.gov/form8863 for instructions and the latest information. If you plan on claiming one of the irs.

Tax Time!

Web the due date to file the 8863 tax form for 2022 is april 15, 2023. Taxpayers can obtain the blank template, instructions, and relevant samples from the irs or other reputable tax preparation websites. Before preparing the form, however, make sure that you. Go to for instructions and the latest information. Web form 8863—education credits must be claimed if.

Form 8863 Instructions Information On The Education 1040 Form Printable

Before preparing the form, however, make sure that you. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on how to file. Web form 8863—education credits must be claimed if a taxpayer is going to claim lifetime learning credit on their federal income tax returns. Go to www.irs.gov/form8863 for.

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

Choose the correct version of the editable pdf form from the list and get started filling it out. Before preparing the form, however, make sure that you. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web find and fill out the correct.

form 8863 worksheet

Go to for instructions and the latest information. Form 8863 fillable can be completed online or printed out as a pdf and mailed to the irs. Choose the correct version of the editable pdf form from the list and get started filling it out. Before preparing the form, however, make sure that you. You can claim up 20% of the.

36 Irs Form 886 A Worksheet support worksheet

Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on how to file. Go to for instructions and the latest information. Before preparing the form, however, make sure that you. Web form 8863—education credits must be claimed if a taxpayer is going to claim lifetime learning credit on their.

Form 8863 Fill out & sign online DocHub

You can claim up 20% of the first $10,000 of qualified education expenses in lifetime learning credit. Form 8863 fillable can be completed online or printed out as a pdf and mailed to the irs. Choose the correct version of the editable pdf form from the list and get started filling it out. Web use form 8863 to figure and.

Go To For Instructions And The Latest Information.

50 name(s) shown on return Before preparing the form, however, make sure that you. Web the due date to file the 8863 tax form for 2022 is april 15, 2023. If you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return.

Form 8863 Is Used By Individuals To Figure And Claim Education Credits (Hope Credit, Lifetime Learning Credit, Etc.).

Taxpayers can obtain the blank template, instructions, and relevant samples from the irs or other reputable tax preparation websites. Web information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms and instructions on how to file. At least one of your parents was alive at the end of 2021. You can claim up 20% of the first $10,000 of qualified education expenses in lifetime learning credit.

Form 8863 Fillable Can Be Completed Online Or Printed Out As A Pdf And Mailed To The Irs.

Web form 8863—education credits must be claimed if a taxpayer is going to claim lifetime learning credit on their federal income tax returns. Choose the correct version of the editable pdf form from the list and get started filling it out. Web find and fill out the correct 2021 instruction 8863. Go to www.irs.gov/form8863 for instructions and the latest information.