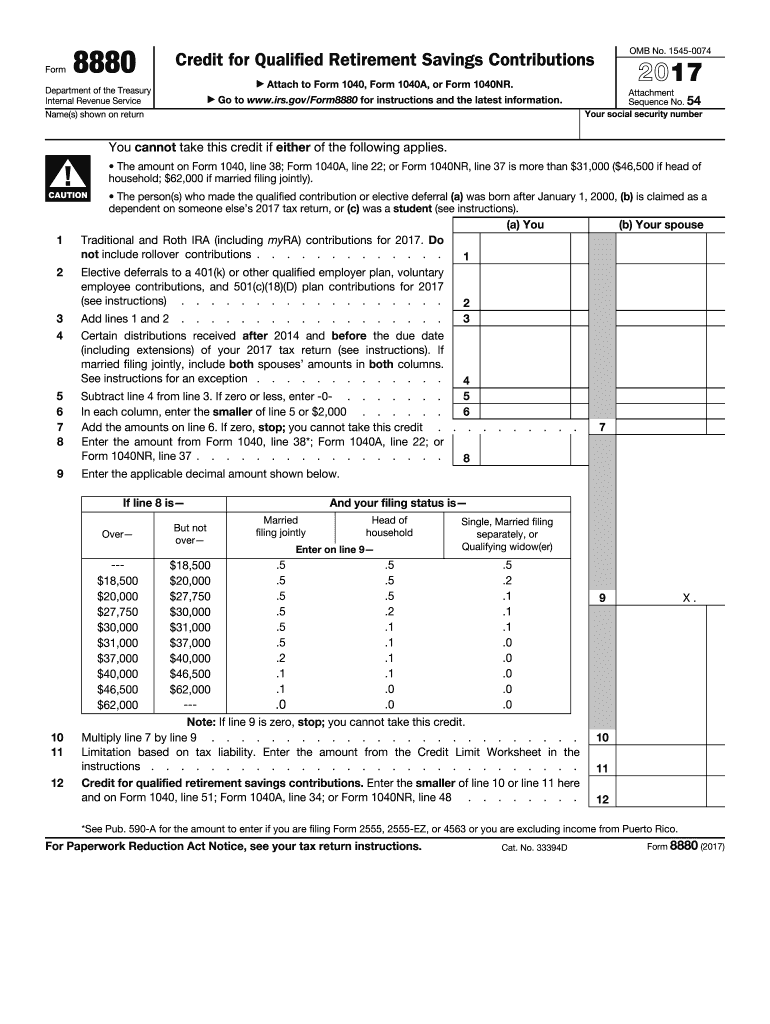

Form 8880 2021

Form 8880 2021 - Web see form 8880, credit for qualified retirement savings contributions, for more information. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Many people don’t take advantage of the credit simply because they don’t know anything about it. Upload, modify or create forms. Web 8880 you cannot take this credit if either of the following applies. Web you can’t file form 8880 using a 1040ez, so it’s important to consult an expert to make sure you are eligible for the credit. Must be removed before printing.

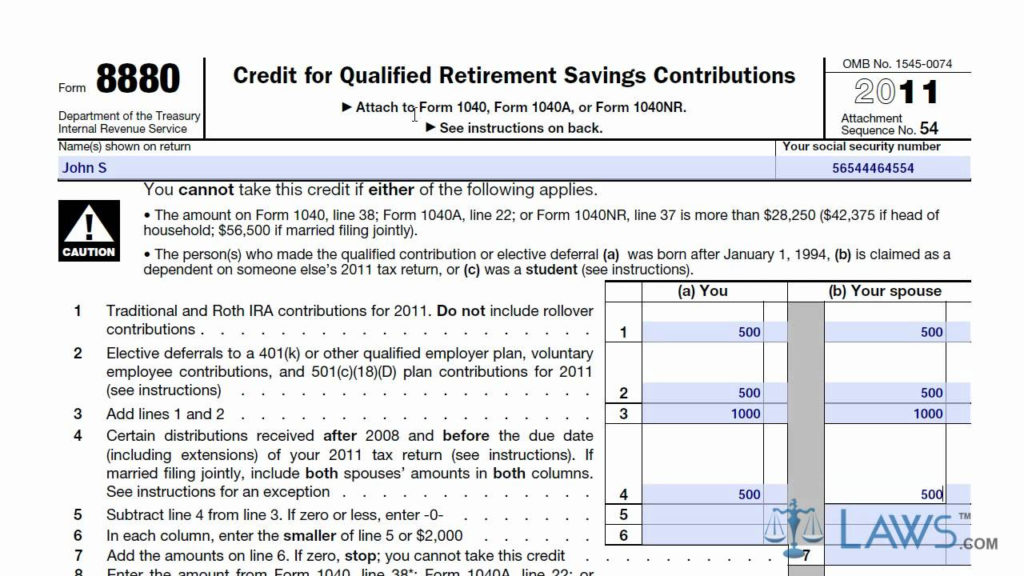

Irs form 8880 reports contributions made to qualified retirement savings accounts. Many people don’t take advantage of the credit simply because they don’t know anything about it. Web general instructions purpose of form use form 8889 to: Contributions you make to a traditional or roth ira, Irs form 8880 will help you determine if you are eligible this credit for retirement savings. $66,000 if married filing jointly). Uradu fact checked by yarilet perez what is irs form 8880? Try it for free now! Web 8880 you cannot take this credit if either of the following applies. Ad access irs tax forms.

Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. Ad complete irs tax forms online or print government tax documents. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: Get ready for tax season deadlines by completing any required tax forms today. Must be removed before printing. Try it for free now! To help determine eligibility, use the help of a tax professional at h&r block. Irs form 8880 reports contributions made to qualified retirement savings accounts. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web you can’t file form 8880 using a 1040ez, so it’s important to consult an expert to make sure you are eligible for the credit.

Credit Limit Worksheet 8880 —

Many people don’t take advantage of the credit simply because they don’t know anything about it. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • june 2, 2023 08:40 am overview are you eligible for the saver's credit? Table of contents saver's credit Irs form 8880 will help you determine if you.

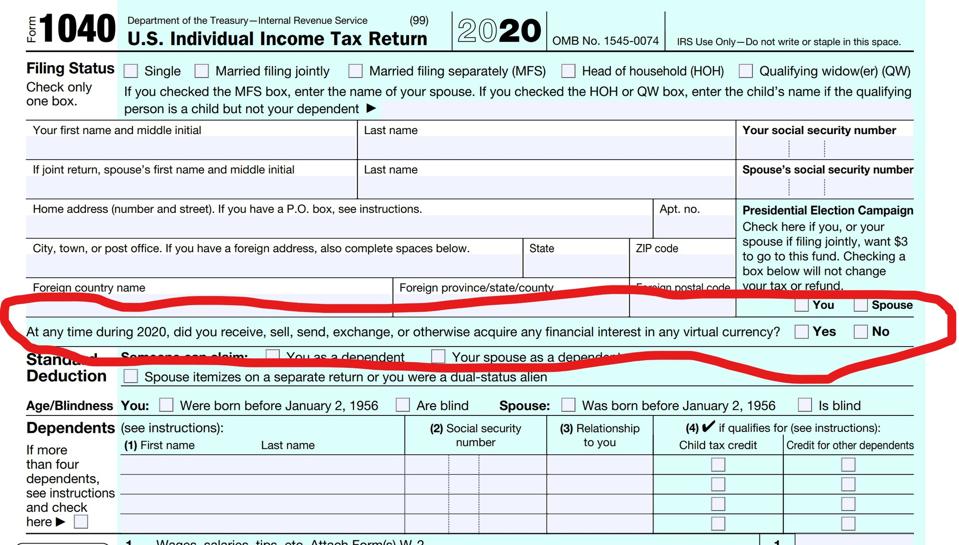

IRS Rules On Reporting Bitcoin And Other Crypto Just Got Even More

Ad complete irs tax forms online or print government tax documents. Web what is the irs form 8880? Many people don’t take advantage of the credit simply because they don’t know anything about it. Try it for free now! Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies.

8880 Form Fill Out and Sign Printable PDF Template signNow

Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • june 2, 2023 08:40 am overview are you eligible for the saver's credit? Uradu fact checked by yarilet perez what is irs form 8880? Web general instructions purpose.

Form 8880 Tax Incentives For Retirement Account —

Web 8880 you cannot take this credit if either of the following applies. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: Web you can’t file form 8880 using a 1040ez, so it’s important to consult an expert to make sure you are eligible for.

√100以上 1099 schedule c tax form 315657What is a schedule c 1099 form

Web what is the irs form 8880? Must be removed before printing. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file.

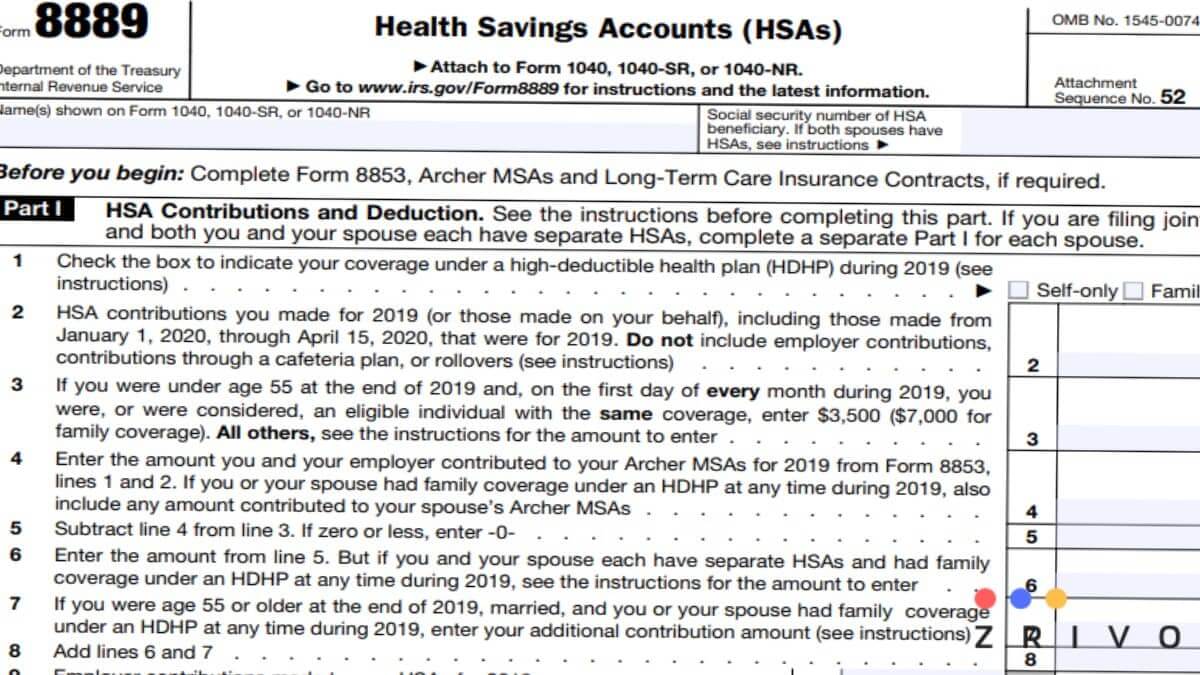

8889 Form 2022 2023

Irs form 8880 reports contributions made to qualified retirement savings accounts. Table of contents saver's credit Web see form 8880, credit for qualified retirement savings contributions, for more information. Ad complete irs tax forms online or print government tax documents. Web general instructions purpose of form use form 8889 to:

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

Web what is the irs form 8880? $66,000 if married filing jointly). Web 8880 you cannot take this credit if either of the following applies. Ad complete irs tax forms online or print government tax documents. Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies.

Taxable Social Security Worksheet 2021

Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report distributions from hsas, and figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. To help determine eligibility, use the help of a tax professional at h&r block. Irs.

Learn How To Fill The Form 8880 Credit For Qualified 2021 Tax Forms

Contributions you make to a traditional or roth ira, Web general instructions purpose of form use form 8889 to: Web see form 8880, credit for qualified retirement savings contributions, for more information. Get ready for tax season deadlines by completing any required tax forms today. Irs form 8880 will help you determine if you are eligible this credit for retirement.

SimpleTax Form 8880 YouTube

Ad access irs tax forms. Table of contents saver's credit Irs form 8880 will help you determine if you are eligible this credit for retirement savings. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. Try it for free now! Web see form 8880, credit for qualified retirement savings contributions, for more information. Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report distributions from hsas, and figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual.

Irs Form 8880 Reports Contributions Made To Qualified Retirement Savings Accounts.

Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents. Upload, modify or create forms. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • june 2, 2023 08:40 am overview are you eligible for the saver's credit?

Contributions You Make To A Traditional Or Roth Ira,

Web 8880 you cannot take this credit if either of the following applies. Many people don’t take advantage of the credit simply because they don’t know anything about it. Web you can’t file form 8880 using a 1040ez, so it’s important to consult an expert to make sure you are eligible for the credit. To help determine eligibility, use the help of a tax professional at h&r block.

Web Form 8880, Credit For Qualified Retirement Savings Contributions, Is Used To Claim This Credit.

Must be removed before printing. Ad access irs tax forms. Irs form 8880 will help you determine if you are eligible this credit for retirement savings. Table of contents saver's credit