Form 8880 Instructions

Form 8880 Instructions - Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. All you need to do is just to open it on pdfelement and fill the form accordingly. This form determines whether you qualify for the retirement saver's credit and how much money you can claim. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web see form 8880, credit for qualified retirement savings contributions, for more information. However, to complete the form successfully, the following step by step guide will be helpful. Web irs form 8880 reports contributions made to qualified retirement savings accounts. Web instructions for how to fill out irs form 8880.

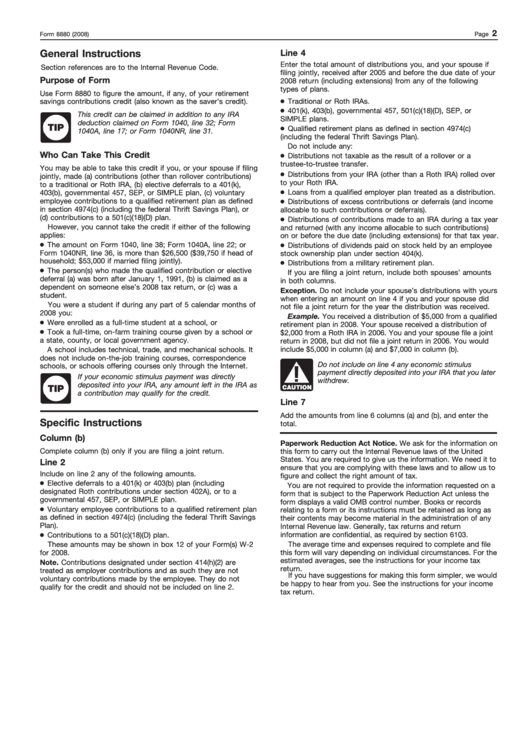

If you contribute to a retirement account, you might qualify for a tax credit. Two key pieces of information you need before preparing form 8880 is the agi you calculate on your income tax return and documentation that reports your total retirement account contributions for the year. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web see form 8880, credit for qualified retirement savings contributions, for more information. The irs form 8880 is a simple form which can be completed in just few minutes. Web for the latest information about developments related to form 8880 and its instructions, such as legislation enacted after they were published,. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web instructions for how to fill out irs form 8880. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit.

Web see form 8880, credit for qualified retirement savings contributions, for more information. All you need to do is just to open it on pdfelement and fill the form accordingly. Two key pieces of information you need before preparing form 8880 is the agi you calculate on your income tax return and documentation that reports your total retirement account contributions for the year. This form determines whether you qualify for the retirement saver's credit and how much money you can claim. This credit can be claimed in addition to any ira deduction. Or form 1040nr, line 32. Web to claim the credit, you must complete irs form 8880 and include it with your tax return. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web instructions for how to fill out irs form 8880. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit.

IRS Form 8880 Get it Filled the Right Way

Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Who can take this credit All you need to do is just to open it on pdfelement and fill the form accordingly. Two key pieces of information you need before preparing form 8880 is the agi you calculate.

Form 8880 Instructions Wallpaper Free Best Hd Wallpapers

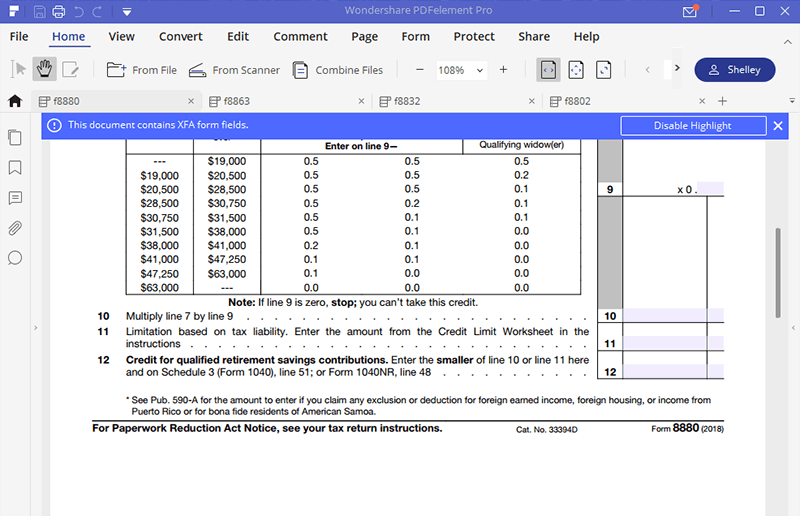

Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: This credit can be claimed in addition to any ira deduction claimed on form 1040, line 32; Web see form 8880, credit for qualified retirement savings contributions, for more information. Form 8880 is used by individuals.

4974 c retirement plan Early Retirement

Web see form 8880, credit for qualified retirement savings contributions, for more information. This credit can be claimed in addition to any ira deduction. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Use form 8880 to figure the amount, if any, of your retirement savings contributions credit.

Learn How to Fill the Form 8880 Credit for Qualified Retirement Savings

Web for the latest information about developments related to form 8880 and its instructions, such as legislation enacted after they were published,. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Or form 1040nr, line 32. All you need to do is just to open it on pdfelement and fill the.

IRS Form 8880 Instructions

Who can take this credit Web see form 8880, credit for qualified retirement savings contributions, for more information. Web to claim the credit, you must complete irs form 8880 and include it with your tax return. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web • form.

Form 8880 Edit, Fill, Sign Online Handypdf

Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: Two key pieces of information you need before preparing form 8880 is the agi you calculate on your income tax return and documentation that reports your total retirement account contributions for the year. Contributions you make.

2020 Form IRS 8880 Fill Online, Printable, Fillable, Blank pdfFiller

Web to claim the credit, you must complete irs form 8880 and include it with your tax return. However, to complete the form successfully, the following step by step guide will be helpful. Who can take this credit Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file..

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

Web to claim the credit, you must complete irs form 8880 and include it with your tax return. Who can take this credit This credit can be claimed in addition to any ira deduction. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Or form 1040nr, line 32.

Form 8880 Instructions Wallpaper Free Best Hd Wallpapers

Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web to claim the credit, you must complete irs form 8880 and include it with your tax return. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. The irs form 8880 is a simple form.

IRS Form 8880 Get it Filled the Right Way

This credit can be claimed in addition to any ira deduction claimed on form 1040, line 32; Web for the latest information about developments related to form 8880 and its instructions, such as legislation enacted after they were published,. Web see form 8880, credit for qualified retirement savings contributions, for more information. All you need to do is just to.

Two Key Pieces Of Information You Need Before Preparing Form 8880 Is The Agi You Calculate On Your Income Tax Return And Documentation That Reports Your Total Retirement Account Contributions For The Year.

Web see form 8880, credit for qualified retirement savings contributions, for more information. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web for the latest information about developments related to form 8880 and its instructions, such as legislation enacted after they were published,. This form determines whether you qualify for the retirement saver's credit and how much money you can claim.

Or Form 1040Nr, Line 32.

Web irs form 8880 reports contributions made to qualified retirement savings accounts. However, to complete the form successfully, the following step by step guide will be helpful. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web to claim the credit, you must complete irs form 8880 and include it with your tax return.

Contributions You Make To A Traditional Or Roth Ira,

The irs form 8880 is a simple form which can be completed in just few minutes. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: All you need to do is just to open it on pdfelement and fill the form accordingly.

This Credit Can Be Claimed In Addition To Any Ira Deduction Claimed On Form 1040, Line 32;

Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. If you contribute to a retirement account, you might qualify for a tax credit. Web instructions for how to fill out irs form 8880. Who can take this credit