Form 8915 D

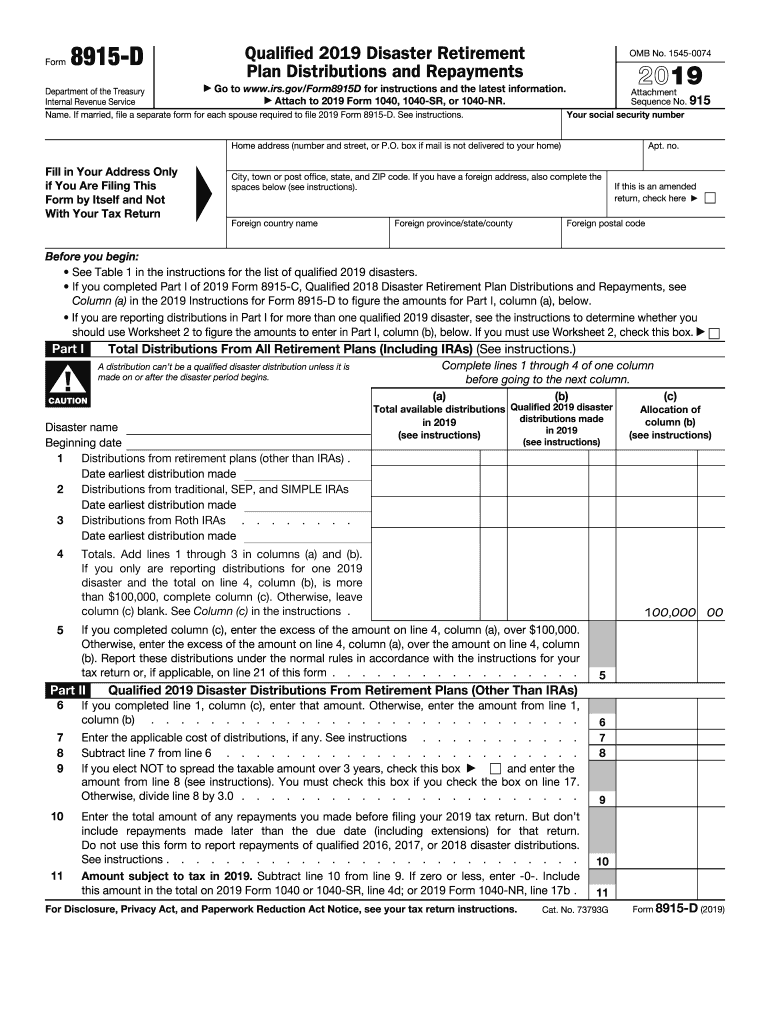

Form 8915 D - Go to www.irs.gov/form8915f for instructions and the latest information. Form 8994, employer credit for paid family and. Complete, edit or print tax forms instantly. Qualified 2019 disaster retirement plan distributions and repayments. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Qualified 2018 disaster distributions = $100,000 ; Qualified 2019 disaster retirement plan distributions and repayments.

Complete, edit or print tax forms instantly. Go to www.irs.gov/form8915f for instructions and the latest information. Qualified 2019 disaster retirement plan distributions and repayments. Qualified 2019 disaster retirement plan distributions and repayments. Qualified 2018 disaster distributions = $100,000 ; Department of the treasury internal revenue service. Form 8994, employer credit for paid family and. Complete, edit or print tax forms instantly.

Form 8994, employer credit for paid family and. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Qualified 2019 disaster retirement plan distributions and repayments. Go to www.irs.gov/form8915f for instructions and the latest information. Qualified 2019 disaster retirement plan distributions and repayments. Department of the treasury internal revenue service. Qualified 2018 disaster distributions = $100,000 ;

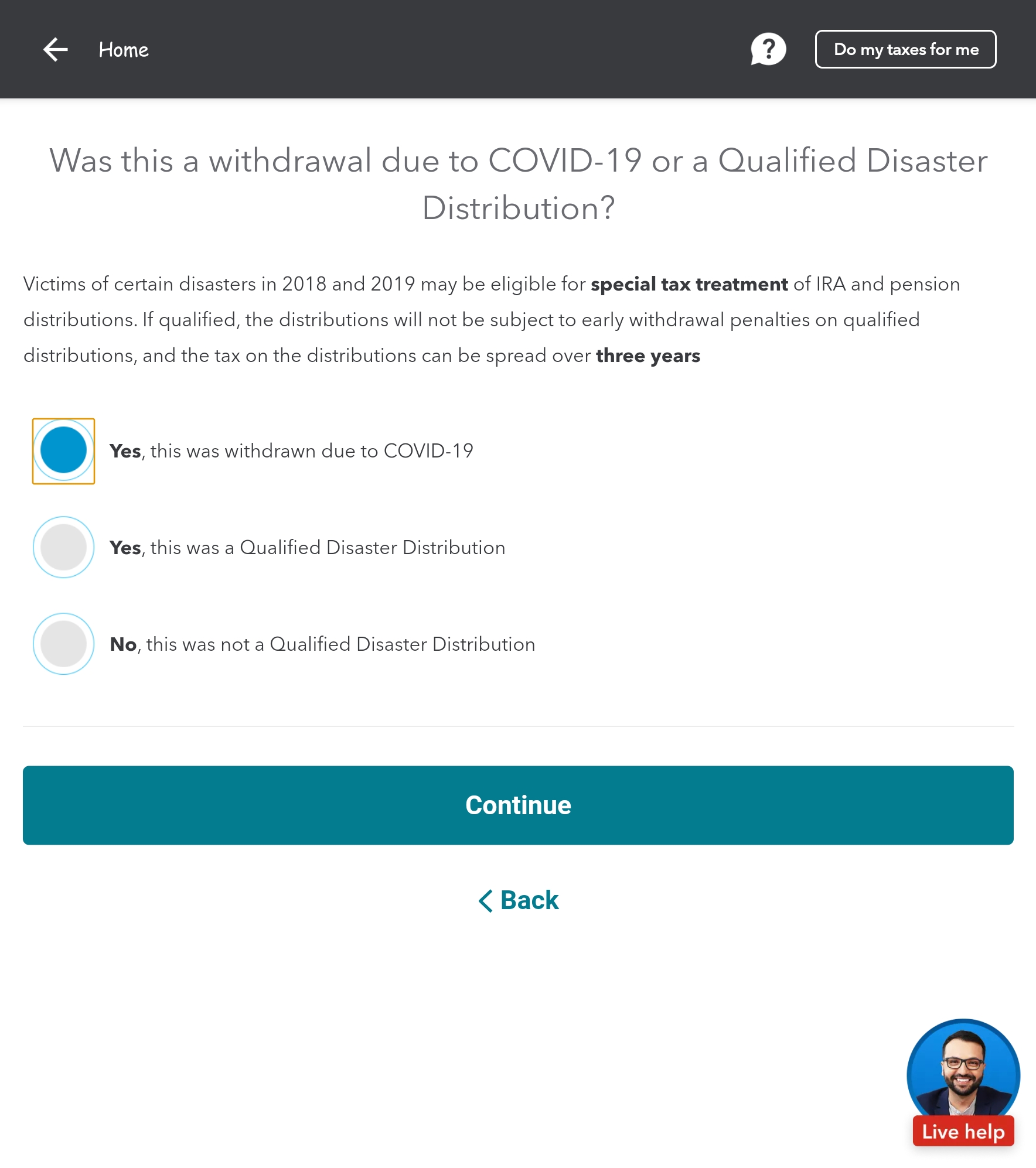

Use Form 8915E to report, repay COVIDrelated retirement account

Qualified 2018 disaster distributions = $100,000 ; Go to www.irs.gov/form8915f for instructions and the latest information. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Department of the treasury internal revenue service.

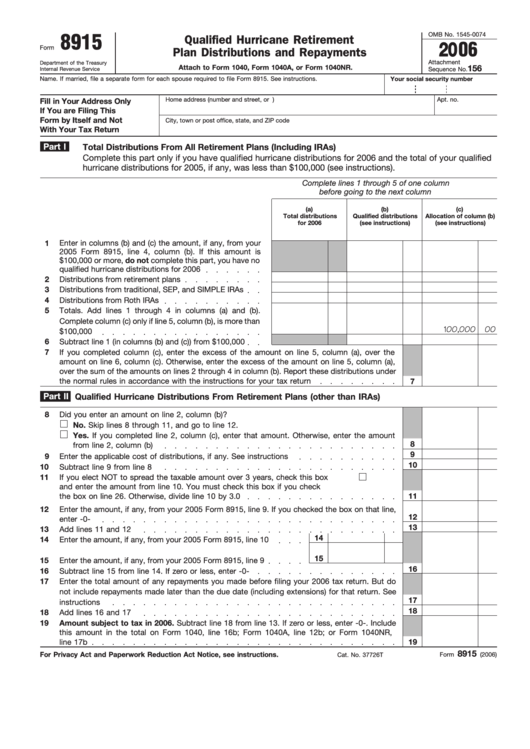

Fillable Form 8915 Qualified Hurricane Retirement Plan Distributions

Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. Go to www.irs.gov/form8915f for instructions and the latest information. Complete, edit or print tax forms instantly. Qualified 2019 disaster retirement plan distributions and repayments.

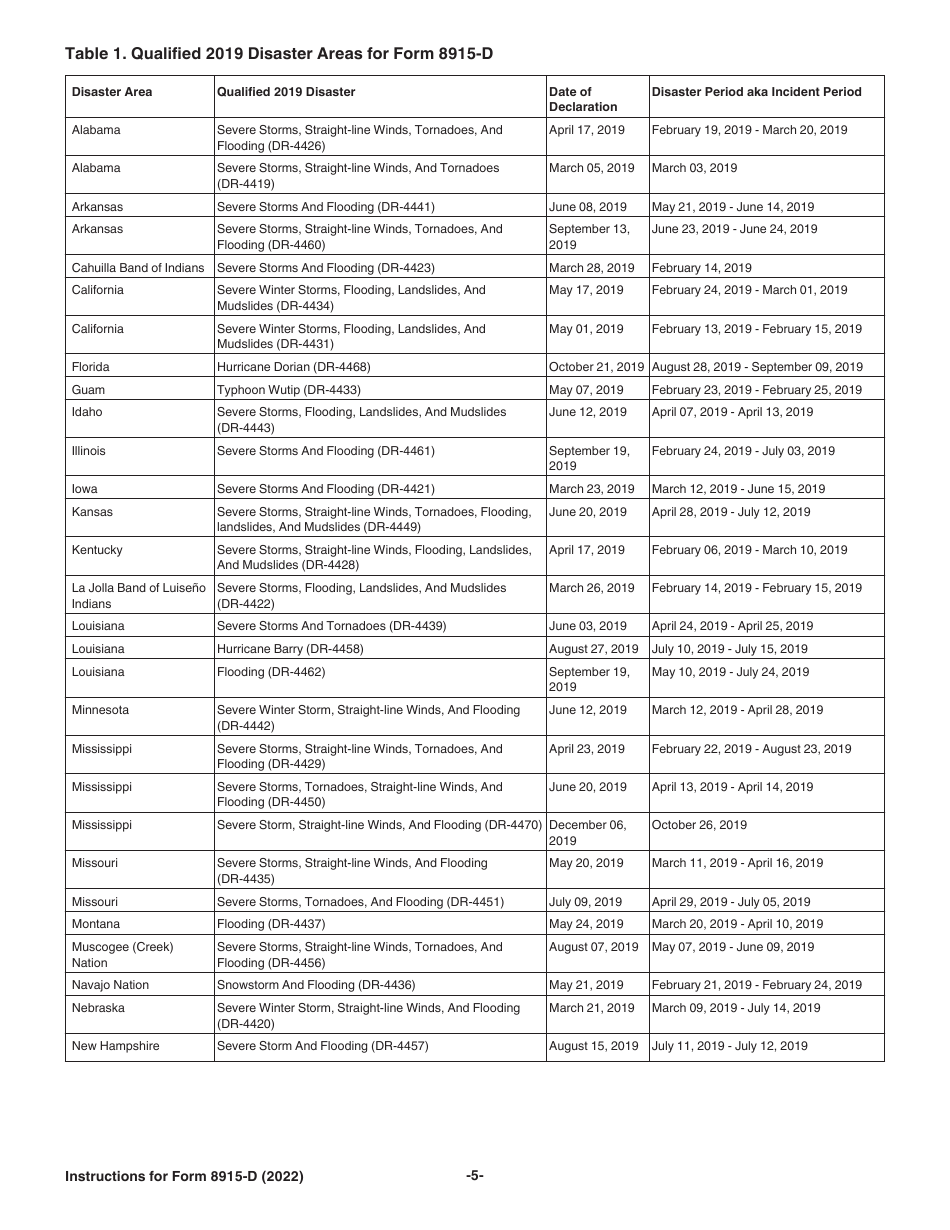

Download Instructions for IRS Form 8915D Qualified 2019 Disaster

Qualified 2019 disaster retirement plan distributions and repayments. Qualified 2019 disaster retirement plan distributions and repayments. Form 8994, employer credit for paid family and. Department of the treasury internal revenue service. Go to www.irs.gov/form8915f for instructions and the latest information.

Form 8915D Qualified 2019 Disaster Retirement Plan Distributions and

Go to www.irs.gov/form8915f for instructions and the latest information. Qualified 2019 disaster retirement plan distributions and repayments. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Qualified 2018 disaster distributions = $100,000 ;

8915e tax form turbotax Bailey Bach

Qualified 2019 disaster retirement plan distributions and repayments. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Form 8994, employer credit for paid family and. Qualified 2019 disaster retirement plan distributions and repayments.

Fill Free fillable Form 8915B Qualified Disaster Retirement Plan

Qualified 2019 disaster retirement plan distributions and repayments. Qualified 2018 disaster distributions = $100,000 ; Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

Fill Free fillable Form by Itself and Not 8915 D Qualified (IRS

Qualified 2018 disaster distributions = $100,000 ; Go to www.irs.gov/form8915f for instructions and the latest information. Form 8994, employer credit for paid family and. Department of the treasury internal revenue service. Qualified 2019 disaster retirement plan distributions and repayments.

8915 D Form Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Qualified 2018 disaster distributions = $100,000 ; Department of the treasury internal revenue service. Go to www.irs.gov/form8915f for instructions and the latest information. Form 8994, employer credit for paid family and.

Fill Free fillable Form 8915E Plan Distributions and Repayments

Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. Qualified 2019 disaster retirement plan distributions and repayments. Go to www.irs.gov/form8915f for instructions and the latest information. Complete, edit or print tax forms instantly.

When will form 8915E 2020 be available in turbo t... Page 23

Qualified 2019 disaster retirement plan distributions and repayments. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Go to www.irs.gov/form8915f for instructions and the latest information. Qualified 2019 disaster retirement plan distributions and repayments.

Qualified 2019 Disaster Retirement Plan Distributions And Repayments.

Department of the treasury internal revenue service. Form 8994, employer credit for paid family and. Qualified 2018 disaster distributions = $100,000 ; Complete, edit or print tax forms instantly.

Qualified 2019 Disaster Retirement Plan Distributions And Repayments.

Go to www.irs.gov/form8915f for instructions and the latest information. Complete, edit or print tax forms instantly.