Form 8915 F-S

Form 8915 F-S - This is the amount of early withdrawal. Create an 1040 file with any name. You can choose to use worksheet 1b even if you are not required to do so. Fill out the application below. Web when and where to file. Web f s d application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. For information about drake20 and prior, see. Web for instructions and the latest information. Web must be removed before printing. See worksheet 1b, later, to determine whether you must use worksheet 1b.

Web must be removed before printing. Web f s d application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. For information about drake20 and prior, see. This is the amount of early withdrawal. Web when and where to file. Fax form 10301 to irs: Web about form 8915, qualified disaster retirement plan distributions and repayments. Web for instructions and the latest information. You can choose to use worksheet 1b even if you are not required to do so. Web form 10301 is used to authorize a contact person to receive an encryption code required to read a compact disk.

Fax form 10301 to irs: Web must be removed before printing. Web f s d application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. You can choose to use worksheet 1b even if you are not required to do so. Web when and where to file. This is the amount of early withdrawal. Web about form 8915, qualified disaster retirement plan distributions and repayments. Web form 10301 is used to authorize a contact person to receive an encryption code required to read a compact disk. Web for instructions and the latest information. For information about drake20 and prior, see.

Generating Form 8915E in ProSeries Intuit Accountants Community

You can choose to use worksheet 1b even if you are not required to do so. Web about form 8915, qualified disaster retirement plan distributions and repayments. Fax form 10301 to irs: This is the amount of early withdrawal. If married, file a separate.

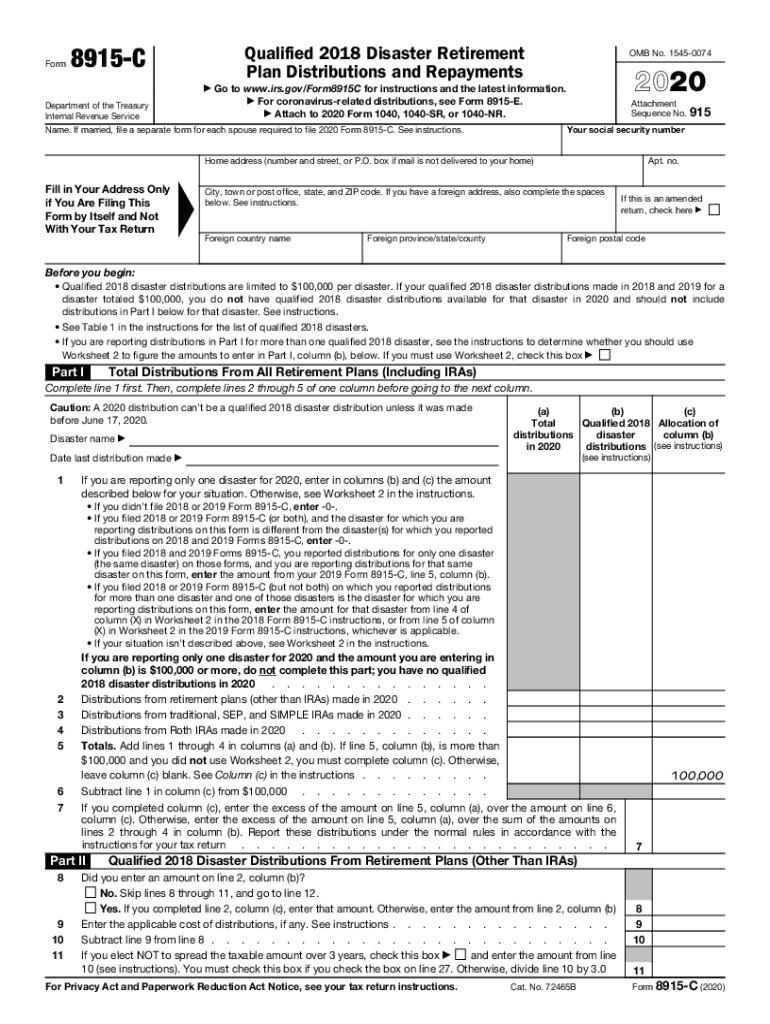

Fill Free fillable Form 8915E Plan Distributions and Repayments

Web f s d application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. Web must be removed before printing. You can choose to use worksheet 1b even if you are not required to do so. Web for instructions and the latest information. Fax form 10301 to.

2020 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

For information about drake20 and prior, see. Create an 1040 file with any name. Fax form 10301 to irs: Web f s d application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. If married, file a separate.

IRS Issues 'Forever' Form 8915F For Retirement Distributions The

Create an 1040 file with any name. Web must be removed before printing. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web form 10301 is used to authorize a contact person to receive an encryption code required to read a compact disk. Web for instructions and the latest information.

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

For information about drake20 and prior, see. Web for instructions and the latest information. Web f s d application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. Create an 1040 file with any name. Web when and where to file.

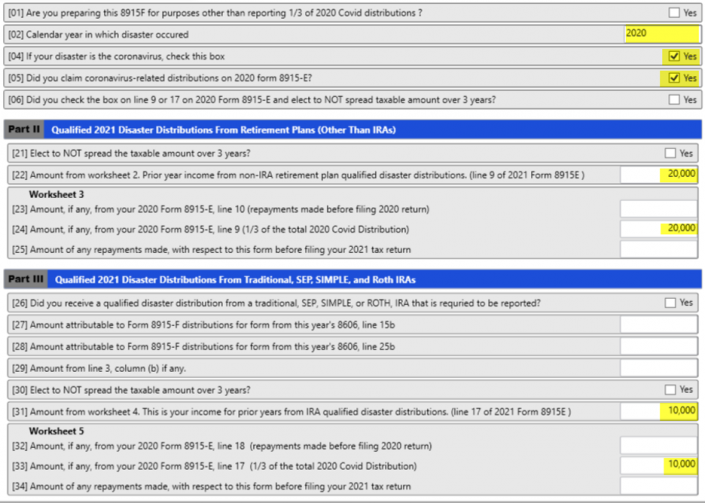

Basic 8915F Instructions for 2021 Taxware Systems

Web form 10301 is used to authorize a contact person to receive an encryption code required to read a compact disk. Web about form 8915, qualified disaster retirement plan distributions and repayments. Fax form 10301 to irs: If married, file a separate. This is the amount of early withdrawal.

Re When will form 8915E 2020 be available in tur... Page 19

Web form 10301 is used to authorize a contact person to receive an encryption code required to read a compact disk. If married, file a separate. You can choose to use worksheet 1b even if you are not required to do so. This is the amount of early withdrawal. For information about drake20 and prior, see.

8915 F 2020 Coronavirus Distributions for 2021 Tax Returns YouTube

For information about drake20 and prior, see. Web about form 8915, qualified disaster retirement plan distributions and repayments. Web when and where to file. Web form 10301 is used to authorize a contact person to receive an encryption code required to read a compact disk. Create an 1040 file with any name.

Fill Free fillable Form 8915F Qualified Disaster Retirement Plan

This is the amount of early withdrawal. You can choose to use worksheet 1b even if you are not required to do so. Web f s d application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. Fax form 10301 to irs: Web form 10301 is used.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

Create an 1040 file with any name. Web form 10301 is used to authorize a contact person to receive an encryption code required to read a compact disk. You can choose to use worksheet 1b even if you are not required to do so. Web for instructions and the latest information. Web f s d application for financial help to.

See Worksheet 1B, Later, To Determine Whether You Must Use Worksheet 1B.

For information about drake20 and prior, see. Web when and where to file. This is the amount of early withdrawal. If married, file a separate.

Web Form 10301 Is Used To Authorize A Contact Person To Receive An Encryption Code Required To Read A Compact Disk.

Create an 1040 file with any name. Web about form 8915, qualified disaster retirement plan distributions and repayments. Web must be removed before printing. Fill out the application below.

You Can Choose To Use Worksheet 1B Even If You Are Not Required To Do So.

Web for instructions and the latest information. Web f s d application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. Fax form 10301 to irs:

.jpeg)