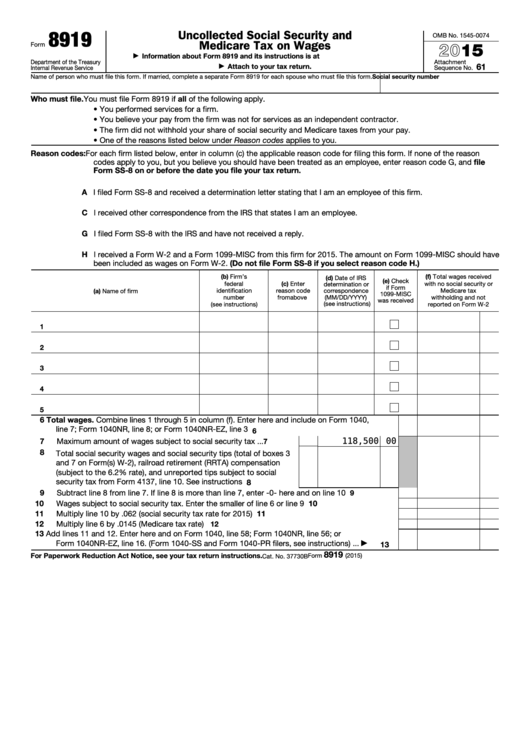

Form 8919 Tax

Form 8919 Tax - You performed services for a. The one you use depends on where you’re filing from and whether your return includes a payment. Per irs form 8919, you must file this form if all of the following apply. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. Web medicare tax on wages go to www.irs.gov/form8919 for the latest information. Books or records relating to a form or its instructions must. Web level 7 this information is entered in a different area of the program then regular w2s. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web form 8919, uncollected social security and medicare tax on wages ines zemelman, ea 22 march 2023 as a seasoned tax expert with years of experience, i've.

Web withhold federal income tax at ____% (20% or greater) i direct you to make the distribution in accordance with my election. You performed services for a. Employers engaged in a trade or business who. Here’s where to send yours,. Employee's withholding certificate form 941; Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of. Web there’s no single irs address. Web form 8919, uncollected social security and medicare tax on wages ines zemelman, ea 22 march 2023 as a seasoned tax expert with years of experience, i've. Web level 7 this information is entered in a different area of the program then regular w2s. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as.

Web withhold federal income tax at ____% (20% or greater) i direct you to make the distribution in accordance with my election. The taxpayer performed services for an individual or a. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web requested on a form that is subject to the paperwork reduction act unless the form displays a valid omb control number. Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes withheld from their. Per irs form 8919, you must file this form if all of the following apply. Employers engaged in a trade or business who. The one you use depends on where you’re filing from and whether your return includes a payment. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of.

When to Fill IRS Form 8919?

The one you use depends on where you’re filing from and whether your return includes a payment. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Employee's withholding certificate form 941; You performed services for a. Web irs form 8819, uncollected social security and medicare.

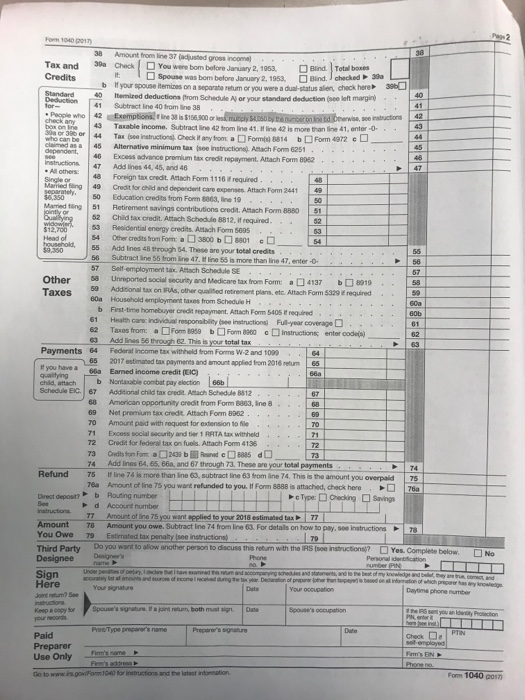

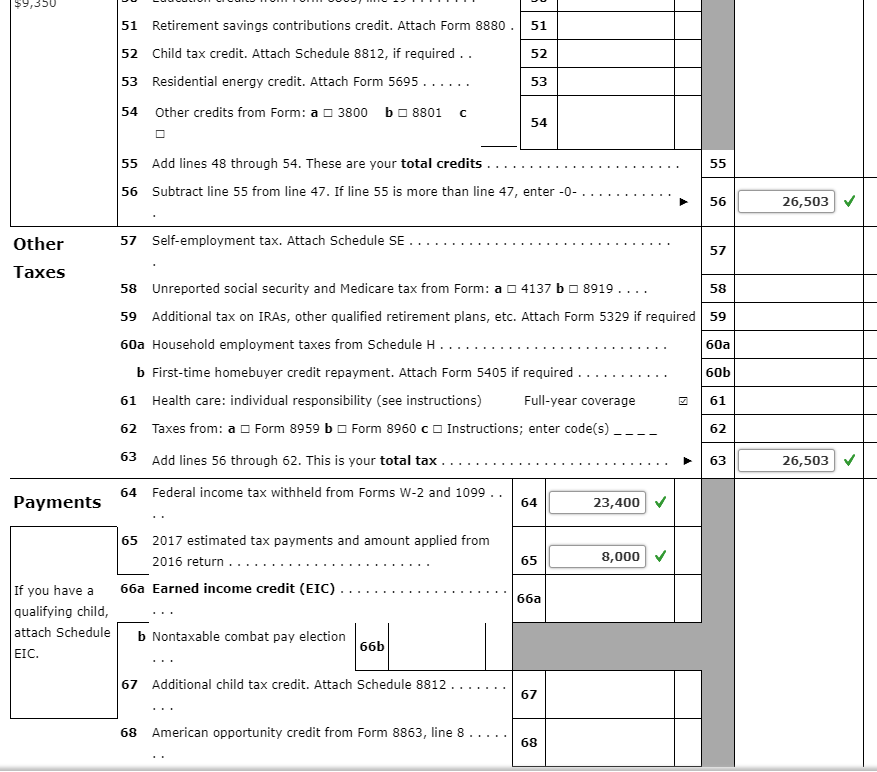

Solved I have a 2018 fillings, the objective is to transfer

I have read the “your rollover options” document. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Here’s where to send yours,. Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and.

Free tax filing offers and programs to help you through the process

Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of. Books or records relating to a form.

8919 Cobalt Glass Print Ltd.

Here’s where to send yours,. You performed services for a. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. The taxpayer performed services for an individual or a. Web form 8919 is the form for those who are.

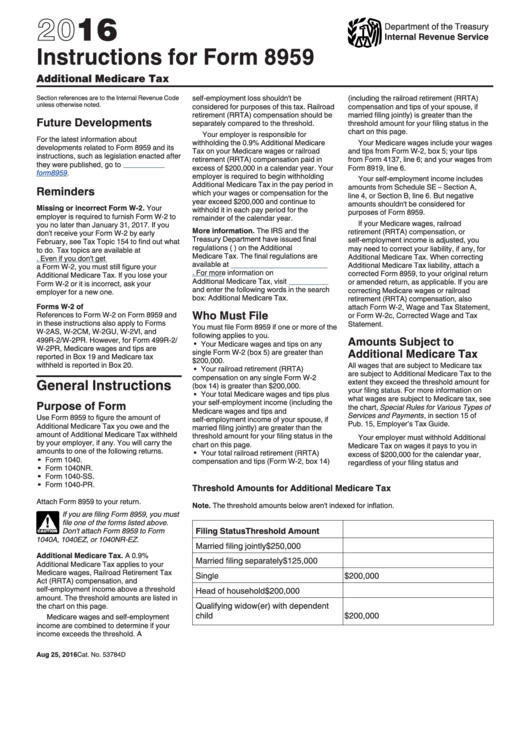

Instructions For Form 8959 2016 printable pdf download

I have read the “your rollover options” document. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Employee's withholding certificate form 941; Web there’s no single irs address. Here’s where to send yours,.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web withhold federal income tax at ____% (20% or greater) i direct you to make the distribution in accordance with my election. Attach to your tax return. Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes withheld from their. Web form 8919, uncollected social security.

How to Generate 2011 IRS Schedule D and Form 8949 using www.form8949

I have read the “your rollover options” document. Web medicare tax on wages go to www.irs.gov/form8919 for the latest information. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest. The one you use depends on where you’re filing from and whether your return includes.

I am sorry I don't know what you mean with "time"....

Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of..

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

The one you use depends on where you’re filing from and whether your return includes a payment. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest. Here’s where to send yours,. I have read the “your rollover options” document. Web withhold federal income tax.

Fillable Form 8919 Uncollected Social Security And Medicare Tax On

Web there’s no single irs address. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Employers engaged in a trade or business who. Employee's withholding certificate form 941; Web form 8919, uncollected social security and medicare tax on wages ines zemelman, ea 22 march 2023.

Web Medicare Tax On Wages Go To Www.irs.gov/Form8919 For The Latest Information.

Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web requested on a form that is subject to the paperwork reduction act unless the form displays a valid omb control number. Books or records relating to a form or its instructions must. Here’s where to send yours,.

Web Form 8919 Is A Solution For Independent Contractors Who Have Suffered From An Employer’s Misclassification And Now Face Uncollected Social Security And Medicare.

The taxpayer performed services for an individual or a. Web workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes withheld from their. Attach to your tax return. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages a go to www.irs.gov/form8919 for the latest.

The One You Use Depends On Where You’re Filing From And Whether Your Return Includes A Payment.

Employers engaged in a trade or business who. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true:

Web Use Form 8919 To Figure And Report Your Share Of The Uncollected Social Security And Medicare Taxes Due On Your Compensation If You Were An Employee But Were Treated As.

Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by. Employee's withholding certificate form 941; Web level 7 this information is entered in a different area of the program then regular w2s. I have read the “your rollover options” document.