Form 8954 Instructions

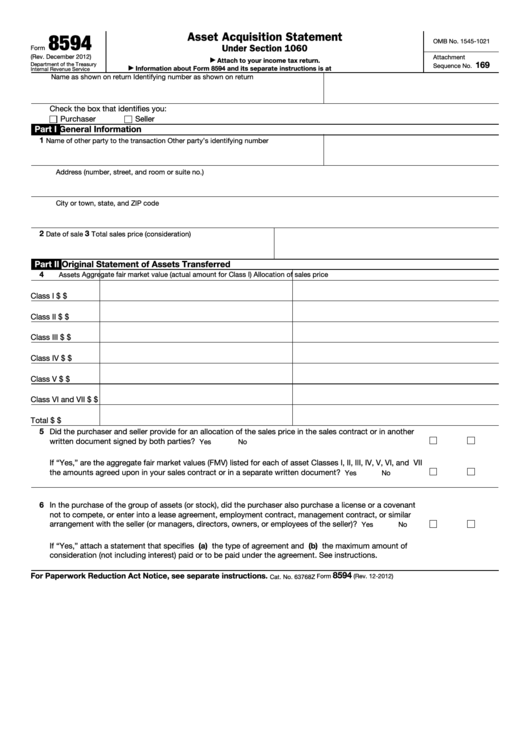

Form 8954 Instructions - Web help with form 8594 for inventory, equipement and goodwill. Web the irs instructs that both the buyer and seller must file the form and attach their income tax returns. Goodwill or going concern value. No repayment of the credit is required (see instructions). File form 15254 to request a section 754 revocation. You disposed of it in 2019. We purchased a business in march 2019 with inventory (independent valuation), equipment (value. Web you must file form 5405 with your 2019 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web if so, you may need to file irs form 8594 with your federal tax return. Web the form is required for the acquisition of a trade or business, which almost always would not include a rental property.

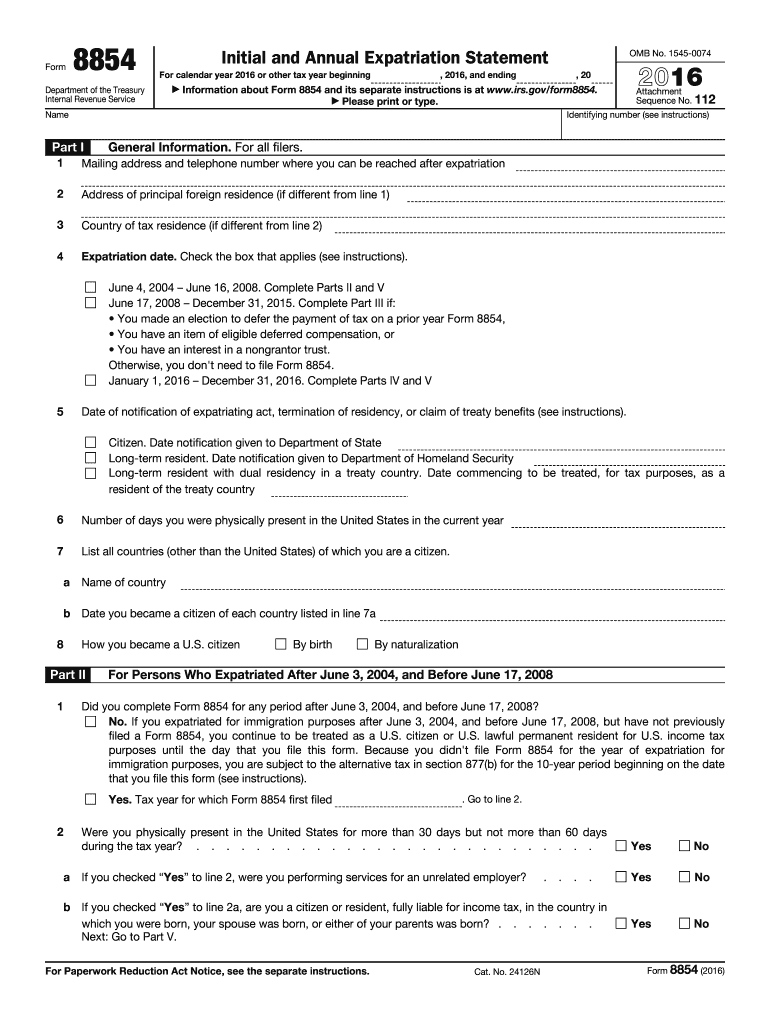

We purchased a business in march 2019 with inventory (independent valuation), equipment (value. See the instructions for the definition of. Web you must file your initial form 8854 (parts i and ii) if you relinquished your u.s. Web if so, you may need to file irs form 8594 with your federal tax return. Web help with form 8594 for inventory, equipement and goodwill. You disposed of it in 2022. Goodwill or going concern value. Web the irs instructs that both the buyer and seller must file the form and attach their income tax returns. The form must be filed when a group of assets were transferred (in a trade or. Web instructions for form 15254, request for section 754 revocation general instructions section references are to the internal revenue code unless otherwise noted.

We purchased a business in march 2019 with inventory (independent valuation), equipment (value. In a statement posted on its website for tax professionals, it said, “for the upcoming 2018 filing season, the irs will not accept. Web you must file form 5405 with your 2019 tax return if you purchased your home in 2008 and you meet either of the following conditions. Goodwill or going concern value. See the instructions for the definition of. Web now the irs backtracked again. Check the box below that applies to you. You disposed of it in 2022. Web partnerships, partners, or their representatives will use form 15254 to request a section 754 revocation. Web instructions for form 15254, request for section 754 revocation general instructions section references are to the internal revenue code unless otherwise noted.

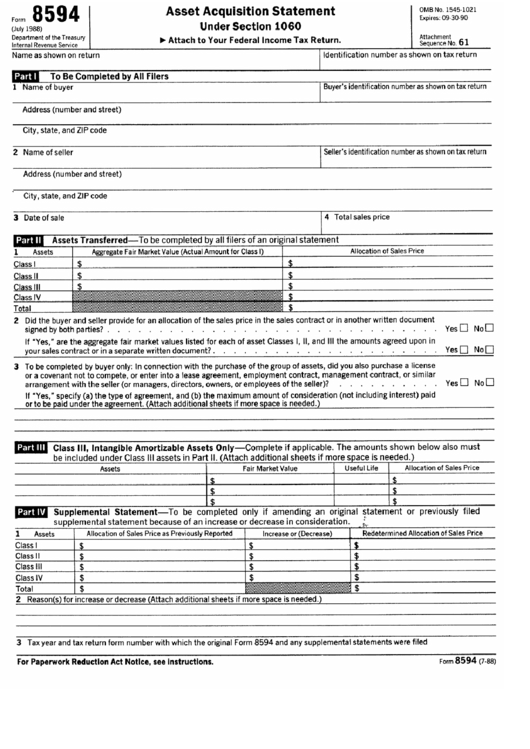

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

Check the box below that applies to you. The form must be filed when a group of assets were transferred (in a trade or. Web the irs instructs that both the buyer and seller must file the form and attach their income tax returns. Web irs form 8594 requires that both parties allocate the purchase price among the various assets.

IMG_8954

See the instructions for the definition of. Web if so, you may need to file irs form 8594 with your federal tax return. Web instructions to printers form 8594, page 1 of 2 margins: Web partnerships, partners, or their representatives will use form 15254 to request a section 754 revocation. Make sure to file this form to avoid irs penalties.

LEGO 8954 Mazeka Set Parts Inventory and Instructions LEGO Reference

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value. Web you must file your initial form 8854 (parts i and ii) if you relinquished your u.s. You disposed of it in 2019. Web help with form 8594.

IRS Instructions 8379 2016 2019 Fillable and Editable PDF Template

In a statement posted on its website for tax professionals, it said, “for the upcoming 2018 filing season, the irs will not accept. Web now the irs backtracked again. Web help with form 8594 for inventory, equipement and goodwill. We purchased a business in march 2019 with inventory (independent valuation), equipment (value. Web you must file your initial form 8854.

Form 8854 Initial and Annual Expatriation Statement Fill Out and Sign

We purchased a business in march 2019 with inventory (independent valuation), equipment (value. Web if so, you may need to file irs form 8594 with your federal tax return. In a statement posted on its website for tax professionals, it said, “for the upcoming 2018 filing season, the irs will not accept. Web partnerships, partners, or their representatives will use.

IRS Instructions 8938 2018 2019 Fillable and Editable PDF Template

We purchased a business in march 2019 with inventory (independent valuation), equipment (value. Web help with form 8594 for inventory, equipement and goodwill. Web now the irs backtracked again. Web partnerships, partners, or their representatives will use form 15254 to request a section 754 revocation. You disposed of it in 2022.

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

You disposed of it in 2022. Web now the irs backtracked again. Web you must file form 5405 with your 2019 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web help with form 8594 for inventory, equipement and goodwill. Web irs form 8594 requires that both parties allocate the purchase price.

LEGO instructions Bionicle 8954 Mazeka YouTube

Make sure to file this form to avoid irs penalties and a potential audit. Web irs form 8594 requires that both parties allocate the purchase price among the various assets of the business being purchased so the seller can calculate the taxes due upon. You disposed of it in 2022. No repayment of the credit is required (see instructions). Web.

Cms 1500 Claim Form Instructions 2016 Form Resume Examples XE8je6e3Oo

Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if: Web now the irs backtracked again. Web the irs instructs that both the buyer and seller must file the form and attach their income tax returns. You disposed of it in 2019..

Fillable Form 8594 Asset Acquisition Statement printable pdf download

Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. You disposed of it in 2019. Check the box below that applies to you. See the instructions for the definition of. Web the form is required for the acquisition of a trade or business,.

Make Sure To File This Form To Avoid Irs Penalties And A Potential Audit.

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value. Web you must file form 5405 with your 2019 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web instructions for form 15254, request for section 754 revocation general instructions section references are to the internal revenue code unless otherwise noted.

Web You Must File Your Initial Form 8854 (Parts I And Ii) If You Relinquished Your U.s.

Web help with form 8594 for inventory, equipement and goodwill. You disposed of it in 2022. Web the irs instructs that both the buyer and seller must file the form and attach their income tax returns. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if:

You Disposed Of It In 2019.

Check the box below that applies to you. Web now the irs backtracked again. File form 15254 to request a section 754 revocation. The form must be filed when a group of assets were transferred (in a trade or.

Web Irs Form 8594 Requires That Both Parties Allocate The Purchase Price Among The Various Assets Of The Business Being Purchased So The Seller Can Calculate The Taxes Due Upon.

See the instructions for the definition of. Web the form is required for the acquisition of a trade or business, which almost always would not include a rental property. We purchased a business in march 2019 with inventory (independent valuation), equipment (value. Web instructions to printers form 8594, page 1 of 2 margins: