Form 8958 Texas

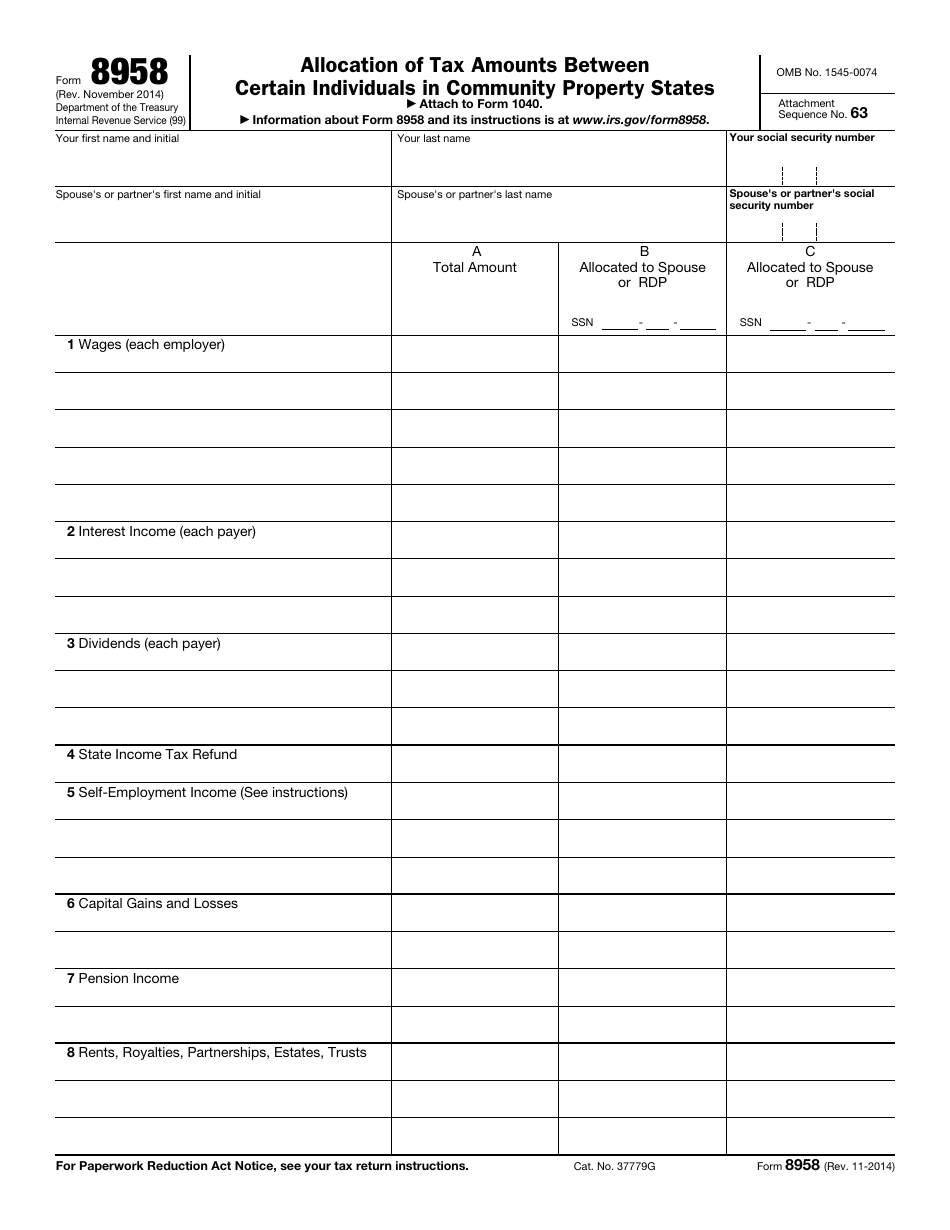

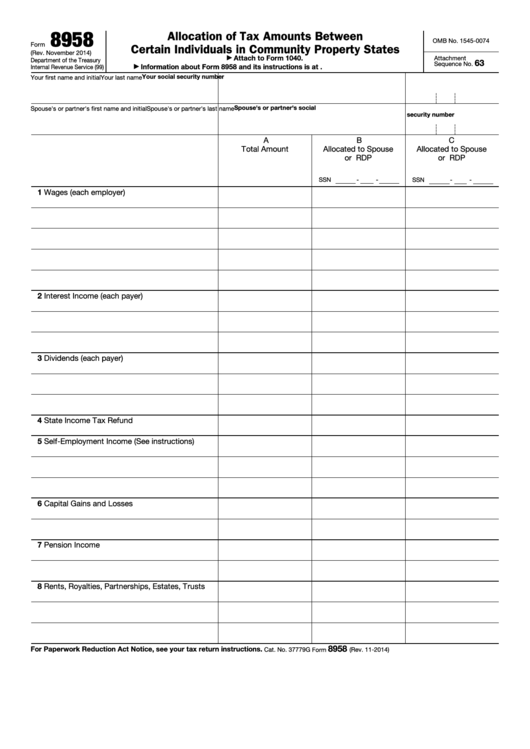

Form 8958 Texas - For federal tax purposes, the term spouse. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. I got married in nov 2021. My wife and i are filing married, filing. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web forms (and instructions) 8857 request for innocent spouse relief 8958 allocation of tax amounts between certain individuals in community property states. Form 8958 allocation of tax amounts. Use the appropriate community property law to determine what is. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return.

Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. I got married in nov 2021. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Form 8958 allocation of tax amounts. Web forms (and instructions) 8857 request for innocent spouse relief 8958 allocation of tax amounts between certain individuals in community property states. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. My wife and i are filing married, filing. Web income from sp's (or former spouse's) separate property (other than income described in (a), (b), or (c)). Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina.

Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state (arizona, california, idaho, louisiana, nevada, new. For federal tax purposes, the term spouse. I got married in nov 2021. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Use the appropriate community property law to determine what is. Form 8958 allocation of tax amounts. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web income from sp's (or former spouse's) separate property (other than income described in (a), (b), or (c)). Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or.

Form 8958 Fill Out and Sign Printable PDF Template signNow

My wife and i are filing married, filing. Web community property states include arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, and wisconsin. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web bought with separate funds..

Community Property Rules and Registered Domestic Partners

Form 8958 allocation of tax amounts. I got married in nov 2021. Web income from sp's (or former spouse's) separate property (other than income described in (a), (b), or (c)). Web bought with separate funds. Web community property states include arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, and wisconsin.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web bought with separate funds. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web income from sp's (or former spouse's) separate property (other than income described in (a), (b), or (c)). Web use form 8958 to determine.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Use the appropriate community property law to determine what is. Web community property states include arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, and wisconsin. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web for federal tax purposes, marriages of couples of the same sex are treated the same.

Form 8958 Fillable ≡ Fill Out Printable PDF Forms Online

Web bought with separate funds. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Form 8958 allocation of tax amounts. Web if your resident state is a community.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

The laws of your state govern whether you have community or separate property and income. I got married in nov 2021. Web bought with separate funds. Web for federal tax purposes, marriages of couples of the same sex are treated the same as marriages of couples of the opposite sex. Form 8958 allocation of tax amounts.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web for federal tax purposes, marriages of couples of the same sex are treated the same as marriages of couples of the opposite sex. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web income from sp's (or former spouse's) separate property (other than income described.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web community property states include arizona,.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web form 8958 is also needed.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web bought with separate funds. The laws of your state govern whether you have community or separate property and income. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Form 8958 allocation of tax amounts. I got married in nov 2021.

The Laws Of Your State Govern Whether You Have Community Or Separate Property And Income.

Web forms (and instructions) 8857 request for innocent spouse relief 8958 allocation of tax amounts between certain individuals in community property states. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. My wife and i are filing married, filing. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half.

Web Form 8958 Allocation Of Tax Amounts Between Certain Individuals In Community Property States Allocates Income Between Spouses/Partners When Filing A Separate Return.

Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web bought with separate funds. I got married in nov 2021.

Web Form 8958 Allocation Of Tax Amounts Between Certain Individuals In Community Property States Allocates Income Between Spouses/Partners When Filing A Separate Return.

Web income from sp's (or former spouse's) separate property (other than income described in (a), (b), or (c)). Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web community property states include arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, and wisconsin. For federal tax purposes, the term spouse.

Web If The Filing Status On An Individual Tax Return Is Married Filing Separately And The Taxpayer Lives In A Community Property State (Arizona, California, Idaho, Louisiana, Nevada, New.

Web for federal tax purposes, marriages of couples of the same sex are treated the same as marriages of couples of the opposite sex. Form 8958 allocation of tax amounts. Use the appropriate community property law to determine what is.