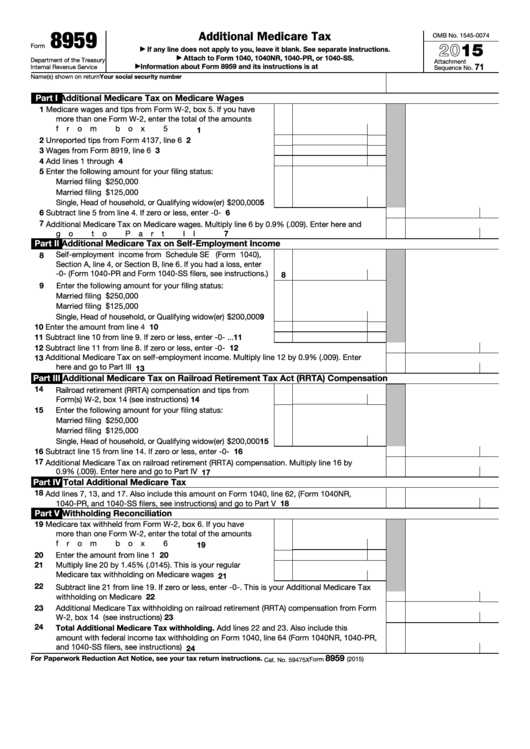

Form 8959 Pdf

Form 8959 Pdf - Use this form to figure the. Web form 8959 department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. The 8959 form is an application that is used to calculate additional medicare tax. The latest version available from the executive services directorate; Web basically, there are three types of income that count if a person asks whether they should file irs form 8959: Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Ad complete irs tax forms online or print government tax documents. • acft status information and status date is entered in part ii, block i. Try it for free now!

Web basically, there are three types of income that count if a person asks whether they should file irs form 8959: Fill out the military working dog handler certificate of commendation online and print it out. Web da form 1059 aer: Start by entering your personal information, including your name, rank, social security number, and contact information. Easily fill out pdf blank, edit, and sign them. The 8959 form is an application that is used to calculate additional medicare tax. Upload, modify or create forms. Save or instantly send your ready documents. Editable, printable, and free to use; Web up to $40 cash back how to fill out da form 1059:

Save or instantly send your ready documents. Web follow this straightforward guideline edit schedule 4 form 8959 in pdf format online free of charge: Ad complete irs tax forms online or print government tax documents. The latest version available from the executive services directorate; Utilize a check mark to point the choice wherever needed. Web basically, there are three types of income that count if a person asks whether they should file irs form 8959: Register for a free account, set a strong password, and proceed. Web form 8959 department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. Register for a free account, set a secure password, and. You will carry the amounts to.

Forms Needed To File Self Employment Employment Form

Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Ad download or email irs 8959 & more fillable forms, register and subscribe now! Web da form 1059 aer: Save or instantly send your ready documents. You will carry the amounts to.

Form 8959 Additional Medicare Tax (2014) Free Download

Use this form to figure the. Try it for free now! Utilize a check mark to point the choice wherever needed. Web da form 1059 aer: Ad complete irs tax forms online or print government tax documents.

1099 Misc Fillable Form Free amulette

Register for a free account, set a secure password, and. Editable, printable, and free to use; Web follow this straightforward guideline redact form 8959 in pdf format online free of charge: Web da form 1059 aer: Easily fill out pdf blank, edit, and sign them.

Fillable Form 8959 Additional Medicare Tax 2015 printable pdf download

Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Start by entering your personal information, including your name, rank, social security number, and.

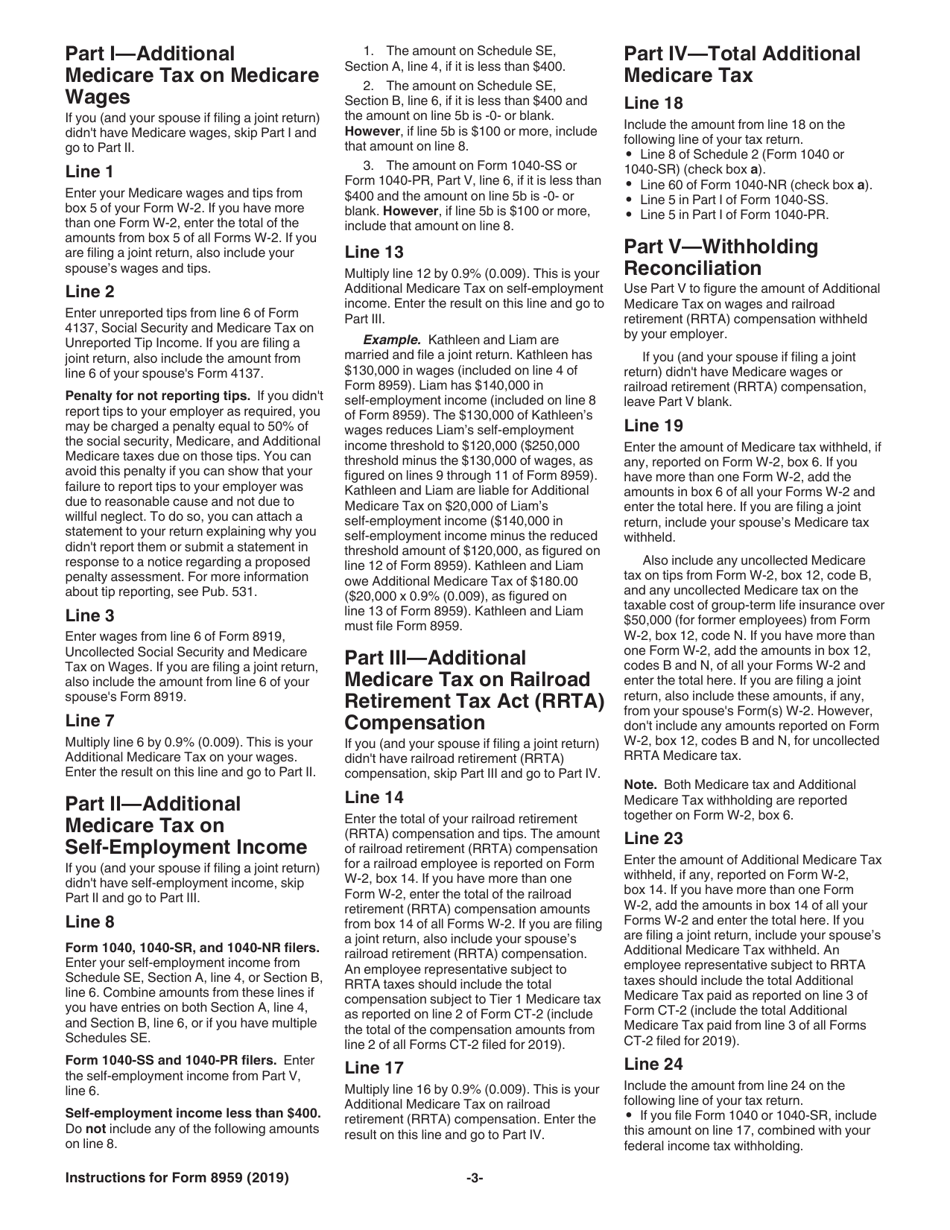

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Register for a free account, set a secure password, and. Web basically, there are three types of income that count if a person asks whether they should file irs form 8959: Web form 8959 department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. Web da form 1059 aer:.

Part 8959, Scotch® BiDirectional Filament Tape On Converters, Inc.

Web follow this straightforward guideline redact form 8959 in pdf format online free of charge: Save or instantly send your ready documents. Web form 8959 department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. You will carry the amounts to. Fill out the military working dog handler certificate.

8959 Stock Photos Free & RoyaltyFree Stock Photos from Dreamstime

Save or instantly send your ready documents. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Web form 8959 department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. Web basically, there are three types of income that count.

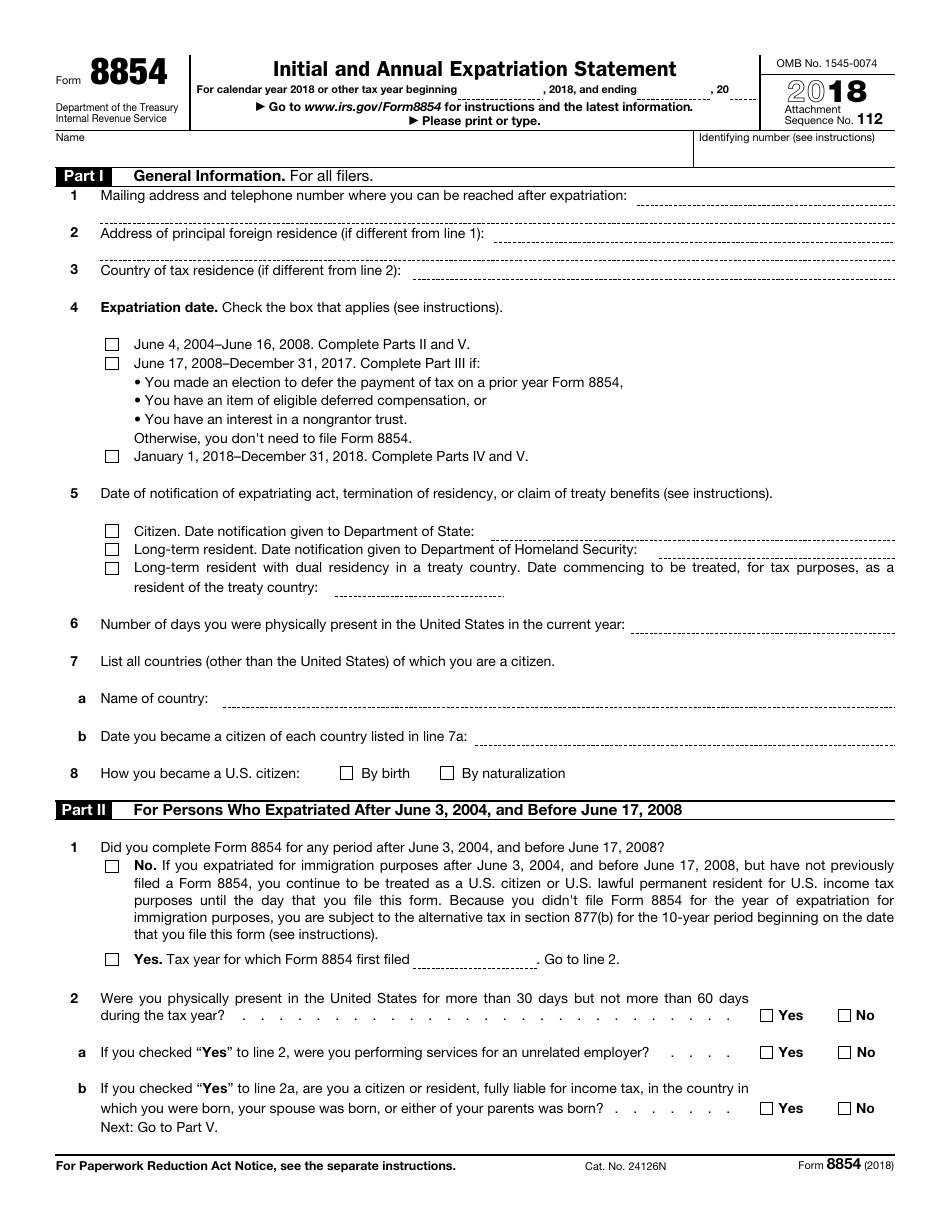

IRS Form 8854 Download Fillable PDF or Fill Online Initial and Annual

Web follow this straightforward guideline redact form 8959 in pdf format online free of charge: Web da form 1059 aer: Try it for free now! • acft status information and status date is entered in part ii, block i. Easily fill out pdf blank, edit, and sign them.

Completing Your 1040 EZ With your W2 Information

Start by entering your personal information, including your name, rank, social security number, and contact information. Double check all the fillable fields to ensure complete precision. Register for a free account, set a secure password, and. You will carry the amounts to. Web form 8959 department of the treasury internal revenue service additional medicare tax if any line does not.

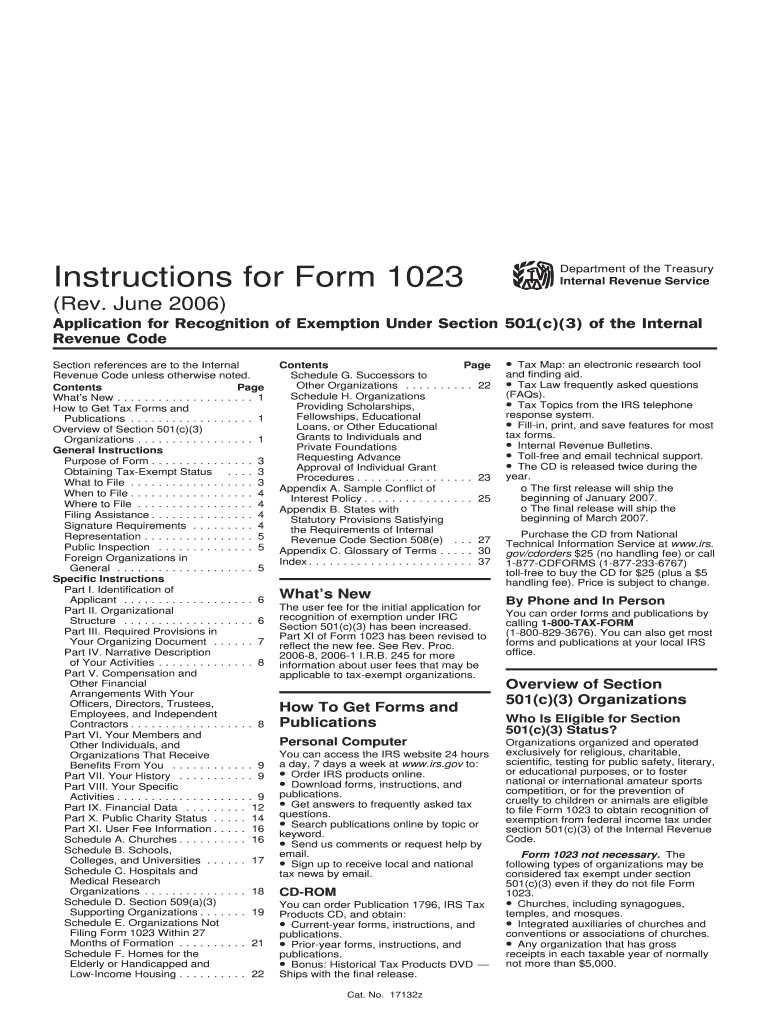

Irs Form 1023 Instructions Fill Out and Sign Printable PDF Template

Easily fill out pdf blank, edit, and sign them. Web follow this straightforward guideline redact form 8959 in pdf format online free of charge: Easily fill out pdf blank, edit, and sign them. You will carry the amounts to. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax.

Web Form 8959 Department Of The Treasury Internal Revenue Service Additional Medicare Tax If Any Line Does Not Apply To You, Leave It Blank.

Ad complete irs tax forms online or print government tax documents. Web up to $40 cash back how to fill out da form 1059: Try it for free now! Web follow this straightforward guideline edit schedule 4 form 8959 in pdf format online free of charge:

Web Da Form 1059 Aer:

Fill out the military working dog handler certificate of commendation online and print it out. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web basically, there are three types of income that count if a person asks whether they should file irs form 8959:

Double Check All The Fillable Fields To Ensure Complete Precision.

Web enter your official identification and contact details. Easily fill out pdf blank, edit, and sign them. Upload, modify or create forms. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any.

Utilize A Check Mark To Point The Choice Wherever Needed.

You will carry the amounts to. Easily fill out pdf blank, edit, and sign them. It needs to be completed only by those whose medicare wages are over. Editable, printable, and free to use;