Form 8986 Pdf

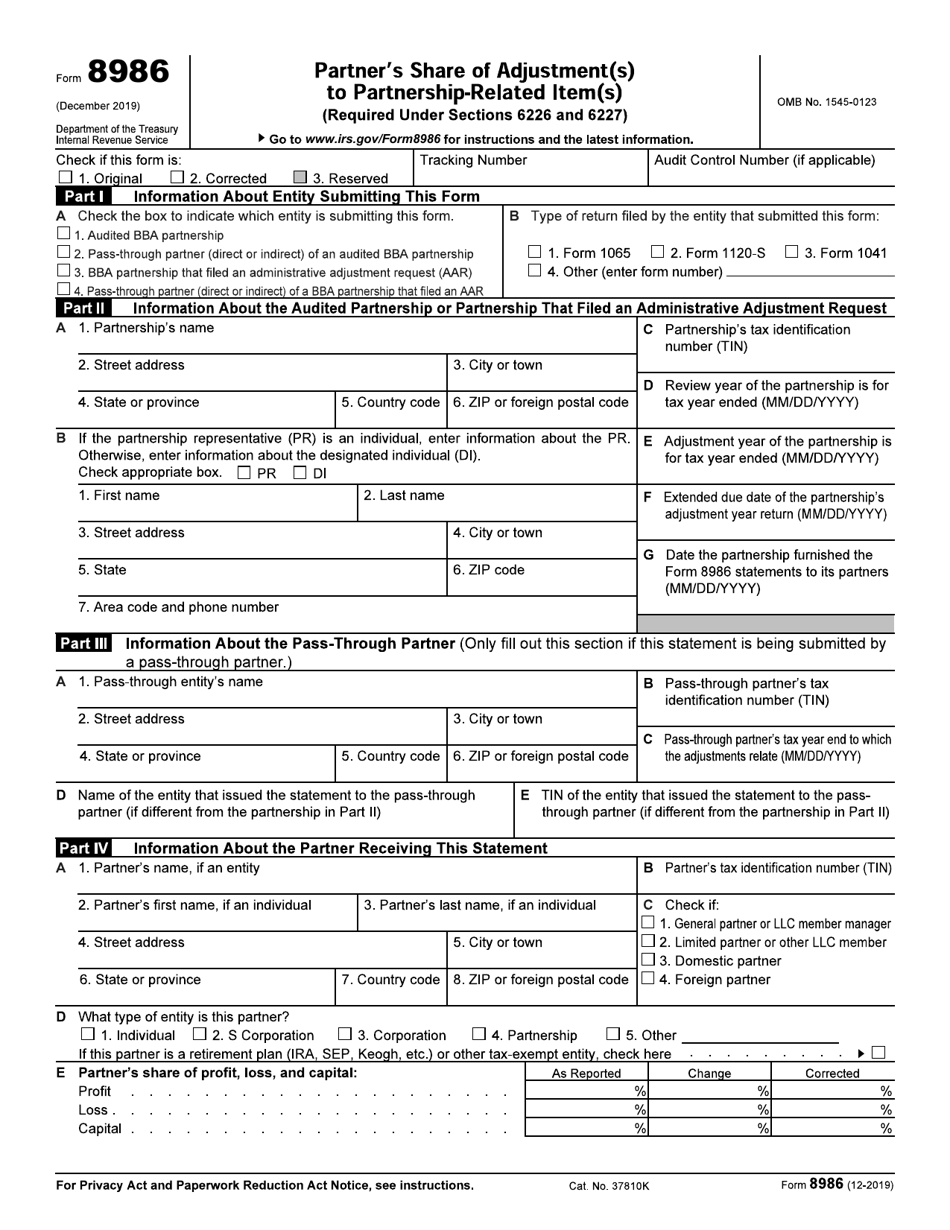

Form 8986 Pdf - Web the election absolves the partnership from any liability with respect to those adjustments. If you downloaded the instructions before november 2020, a cover sheet has been added to the file. Web form 8986, you will need to submit two corrected forms: The partnership must also complete a form 8985 with the forms 8986 that are filed with the irs. Web if this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to display this type of document. Additional information on filing form 8986. The irs released draft versions of the forms in september 2019. (1) a corrected form 8986 with the correct tin, and (2) a corrected form 8986 with the incorrect tin and zeros in part iv sections e through g, and in part v. Anytime a corrected form 8986 is submitted a corrected form 8985 must also be included. The updated file for instructions form 8986 pdf is available for download.

The final versions are consistent with the draft forms. Forms 8986 are filed with the irs and separately issued to the partners. Web according to the draft instructions, form 8986 was created for partnerships to show each partner’s share of adjustments to partnershiprelated items as a result of a bba audit or bba aar. The partnership must also complete a form 8985 with the forms 8986 that are filed with the irs. 3 audited partnership’s adjustment year Web the election absolves the partnership from any liability with respect to those adjustments. Anytime a corrected form 8986 is submitted a corrected form 8985 must also be included. The updated file for instructions form 8986 pdf is available for download. Web form 8986, you will need to submit two corrected forms: If you downloaded the instructions before november 2020, a cover sheet has been added to the file.

The final versions are consistent with the draft forms. 3 audited partnership’s adjustment year Web if this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to display this type of document. Forms 8986 are filed with the irs and separately issued to the partners. Web the election absolves the partnership from any liability with respect to those adjustments. Additional information on filing form 8986. Anytime a corrected form 8986 is submitted a corrected form 8985 must also be included. (1) a corrected form 8986 with the correct tin, and (2) a corrected form 8986 with the incorrect tin and zeros in part iv sections e through g, and in part v. The irs released draft versions of the forms in september 2019. Web form 8986, you will need to submit two corrected forms:

IRS Form 8986 Fill Out, Sign Online and Download Fillable PDF

Additional information on filing form 8986. 3 audited partnership’s adjustment year The irs released draft versions of the forms in september 2019. The partnership must also complete a form 8985 with the forms 8986 that are filed with the irs. Web if this message is not eventually replaced by the proper contents of the document, your pdf viewer may not.

Form 8986 Fillable Fill Online, Printable, Fillable, Blank pdfFiller

Web if this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to display this type of document. Additional information on filing form 8986. Web the election absolves the partnership from any liability with respect to those adjustments. The partnership must also complete a form 8985 with the forms 8986.

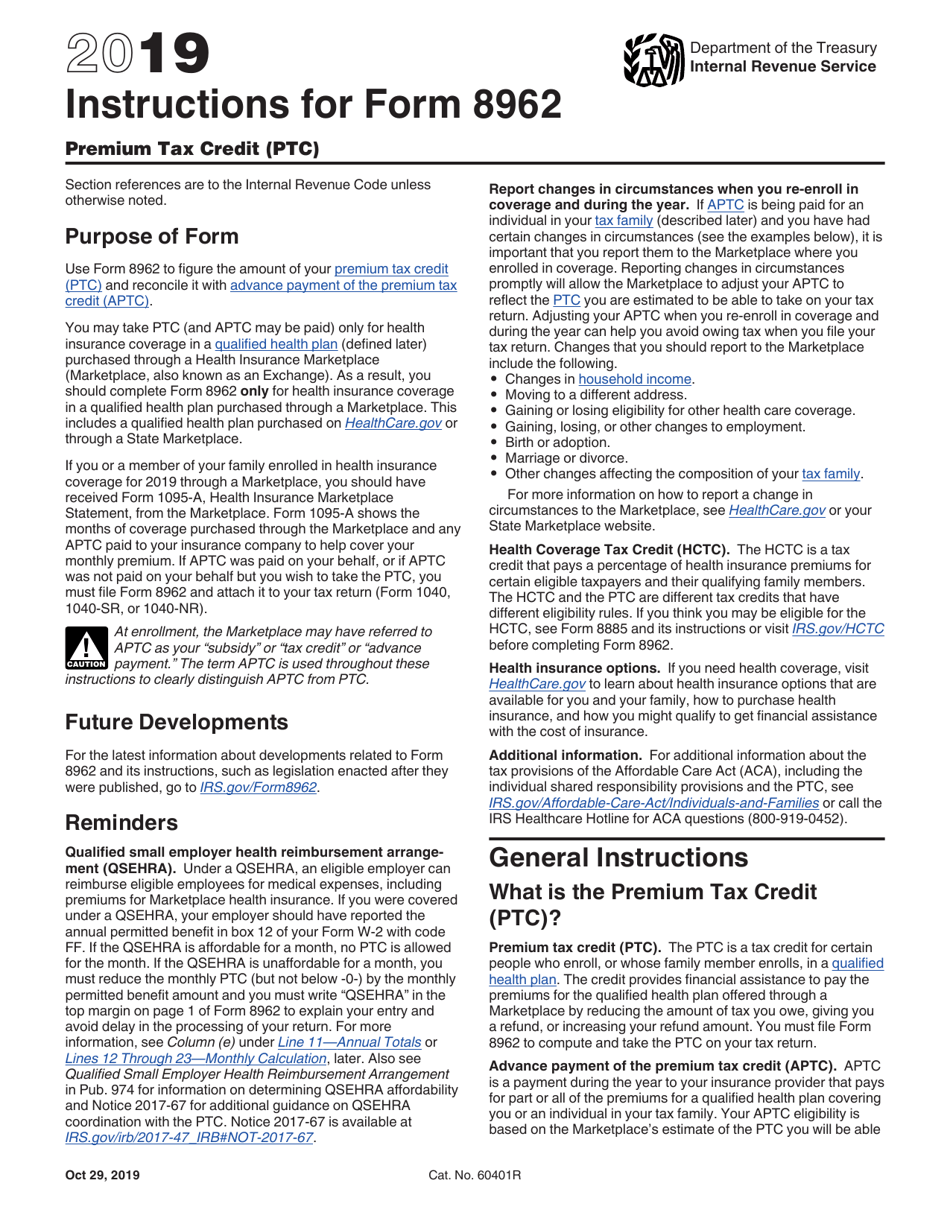

Download Instructions for IRS Form 8962 Premium Tax Credit (Ptc) PDF

Web form 8986, you will need to submit two corrected forms: 3 audited partnership’s adjustment year Web the election absolves the partnership from any liability with respect to those adjustments. The final versions are consistent with the draft forms. Web if this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be.

statement of account 中文 Kanbb

The irs released draft versions of the forms in september 2019. The partnership must also complete a form 8985 with the forms 8986 that are filed with the irs. Web the election absolves the partnership from any liability with respect to those adjustments. The final versions are consistent with the draft forms. Web form 8986, you will need to submit.

auditregime hashtag on Twitter

If you downloaded the instructions before november 2020, a cover sheet has been added to the file. The irs released draft versions of the forms in september 2019. The partnership must also complete a form 8985 with the forms 8986 that are filed with the irs. (1) a corrected form 8986 with the correct tin, and (2) a corrected form.

Additions and Alterations to Outbuilding at 76 Bartle Road, Durban SAHRA

Web the election absolves the partnership from any liability with respect to those adjustments. The final versions are consistent with the draft forms. Anytime a corrected form 8986 is submitted a corrected form 8985 must also be included. 3 audited partnership’s adjustment year Web form 8986, you will need to submit two corrected forms:

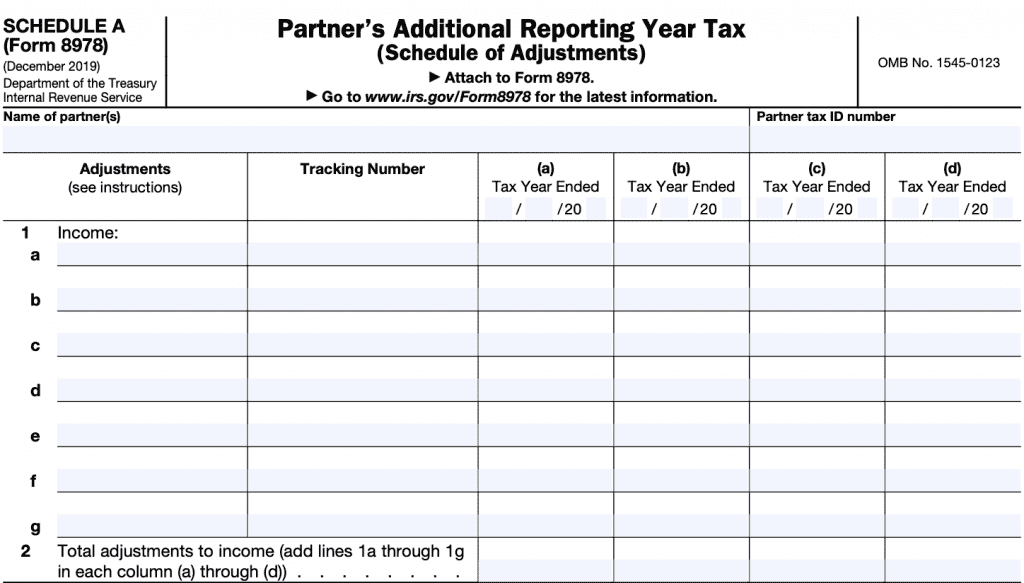

IRS Form 8978 A Guide to Partner's Additional Reporting Year Tax

(1) a corrected form 8986 with the correct tin, and (2) a corrected form 8986 with the incorrect tin and zeros in part iv sections e through g, and in part v. 3 audited partnership’s adjustment year Additional information on filing form 8986. The final versions are consistent with the draft forms. Web according to the draft instructions, form 8986.

Download Instructions for IRS Form 8986 Partner's Share of Adjustment(S

Additional information on filing form 8986. The final versions are consistent with the draft forms. Web according to the draft instructions, form 8986 was created for partnerships to show each partner’s share of adjustments to partnershiprelated items as a result of a bba audit or bba aar. Web if this message is not eventually replaced by the proper contents of.

IRS Form 8962 Premium Tax Cerdit PTC Blank Lies with Pen and Many

The updated file for instructions form 8986 pdf is available for download. 3 audited partnership’s adjustment year (1) a corrected form 8986 with the correct tin, and (2) a corrected form 8986 with the incorrect tin and zeros in part iv sections e through g, and in part v. The irs released draft versions of the forms in september 2019..

handle submit outside of HOC Form · Issue 8986 · antdesign/antdesign

Additional information on filing form 8986. The updated file for instructions form 8986 pdf is available for download. 3 audited partnership’s adjustment year The irs released draft versions of the forms in september 2019. (1) a corrected form 8986 with the correct tin, and (2) a corrected form 8986 with the incorrect tin and zeros in part iv sections e.

Web If This Message Is Not Eventually Replaced By The Proper Contents Of The Document, Your Pdf Viewer May Not Be Able To Display This Type Of Document.

Additional information on filing form 8986. 3 audited partnership’s adjustment year Web according to the draft instructions, form 8986 was created for partnerships to show each partner’s share of adjustments to partnershiprelated items as a result of a bba audit or bba aar. Web the election absolves the partnership from any liability with respect to those adjustments.

The Partnership Must Also Complete A Form 8985 With The Forms 8986 That Are Filed With The Irs.

The updated file for instructions form 8986 pdf is available for download. (1) a corrected form 8986 with the correct tin, and (2) a corrected form 8986 with the incorrect tin and zeros in part iv sections e through g, and in part v. The final versions are consistent with the draft forms. Web form 8986, you will need to submit two corrected forms:

Forms 8986 Are Filed With The Irs And Separately Issued To The Partners.

The irs released draft versions of the forms in september 2019. Anytime a corrected form 8986 is submitted a corrected form 8985 must also be included. If you downloaded the instructions before november 2020, a cover sheet has been added to the file.