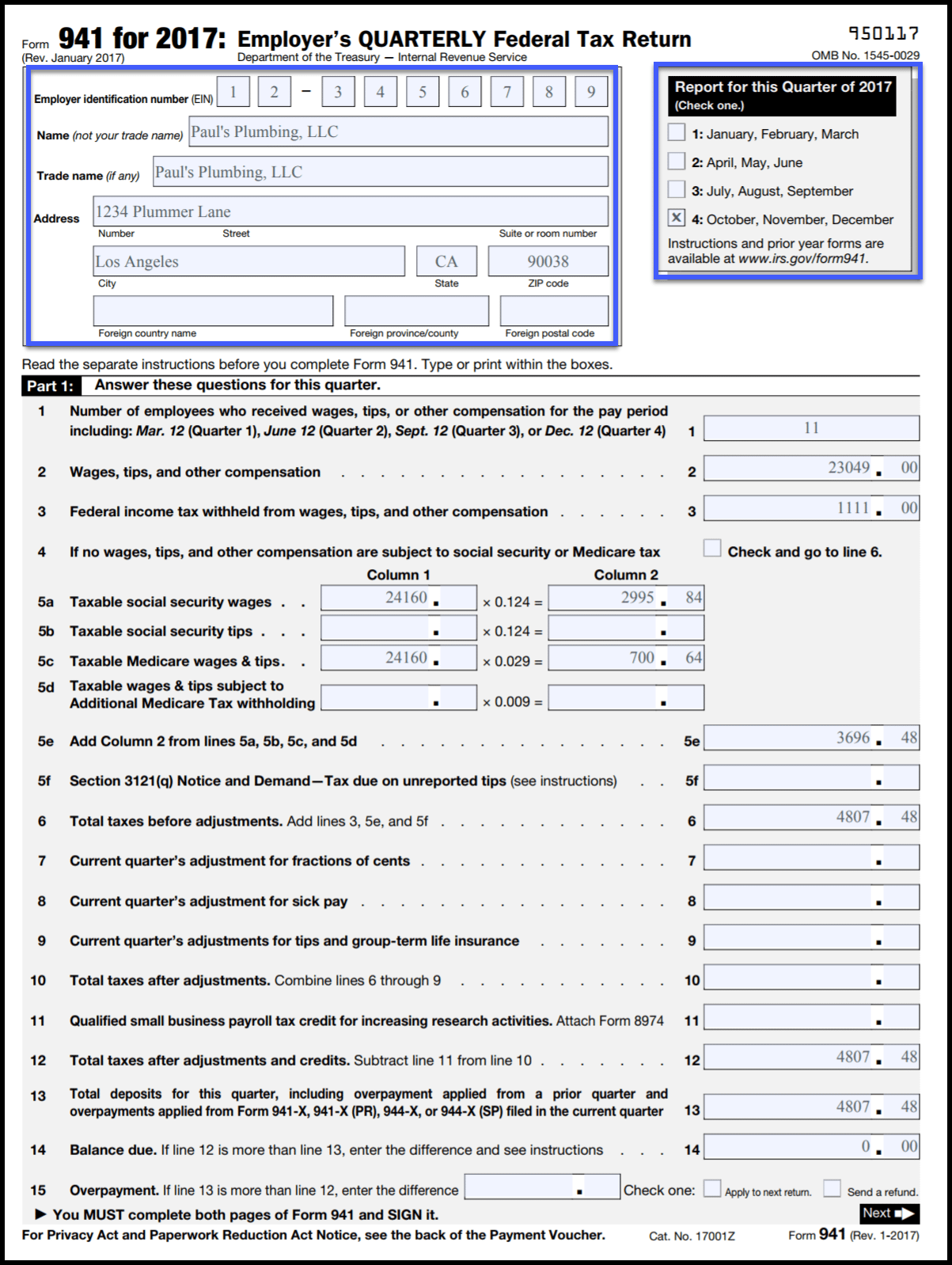

Form 941 Overpayment Refund

Form 941 Overpayment Refund - If you feel uncomfortable applying it to the july deposit required to be made by 8/15/17, you can call the irs and ask them to apply the overpayment to 3q2017 for you. Web what to do if you overpay 941 taxes: Web about form 941, employer's quarterly federal tax return employers use form 941 to: Web the claim process is used to request a refund or abatement of the overpayment. Pay the employer's portion of social security or medicare tax. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. A refund for anything should always be posted to same account where expense was originally posted. Web generally you can take this as a payment on the next quarter (3q) as long as you don't have any previous underpayments that exist on your 941 account. Most likely was employer if refund check came to company. Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments

Web if employer f does not request an advance payment of the credit, it may request that the $1,000 overpayment be credited or refunded when it files its second quarter form 941, employer's quarterly federal tax return. We have qb payroll, so i don't know what is going on, since i pay per the qb. If you feel uncomfortable applying it to the july deposit required to be made by 8/15/17, you can call the irs and ask them to apply the overpayment to 3q2017 for you. Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need to know who overpaid to determine who gets refund, employee or employer. Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments Web the claim process is used to request a refund or abatement of the overpayment. Most likely was employer if refund check came to company. Web what to do if you overpay 941 taxes: Stop and start dates for underpayment interest Web generally you can take this as a payment on the next quarter (3q) as long as you don't have any previous underpayments that exist on your 941 account.

Web if employer f does not request an advance payment of the credit, it may request that the $1,000 overpayment be credited or refunded when it files its second quarter form 941, employer's quarterly federal tax return. We charge interest when a taxpayer has an unpaid liability comprised of tax, penalties, additions to tax, or interest. Web generally you can take this as a payment on the next quarter (3q) as long as you don't have any previous underpayments that exist on your 941 account. If you feel uncomfortable applying it to the july deposit required to be made by 8/15/17, you can call the irs and ask them to apply the overpayment to 3q2017 for you. Pay the employer's portion of social security or medicare tax. Most likely was employer if refund check came to company. Web what to do if you overpay 941 taxes: Employers do not have to match the federal tax, but must on social security and medicare tax. We have qb payroll, so i don't know what is going on, since i pay per the qb. Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need to know who overpaid to determine who gets refund, employee or employer.

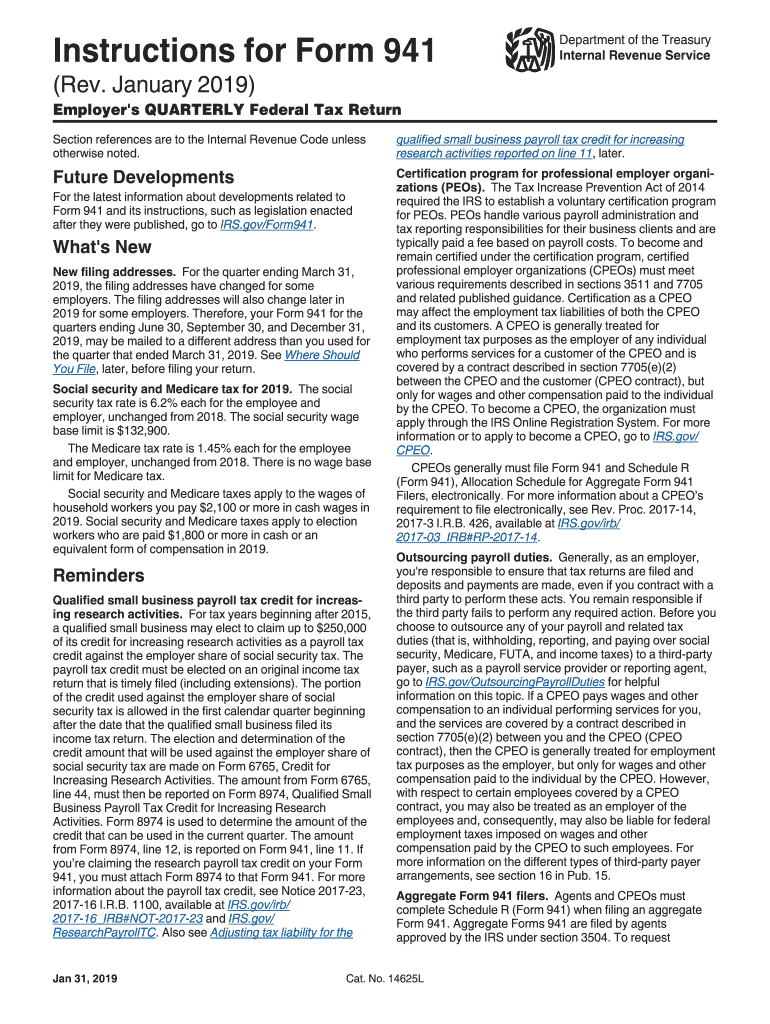

Form 941 Instructions & FICA Tax Rate 2018 (+ Mailing Address)

Web about form 941, employer's quarterly federal tax return employers use form 941 to: If you feel uncomfortable applying it to the july deposit required to be made by 8/15/17, you can call the irs and ask them to apply the overpayment to 3q2017 for you. Stop and start dates for underpayment interest Pay the employer's portion of social security.

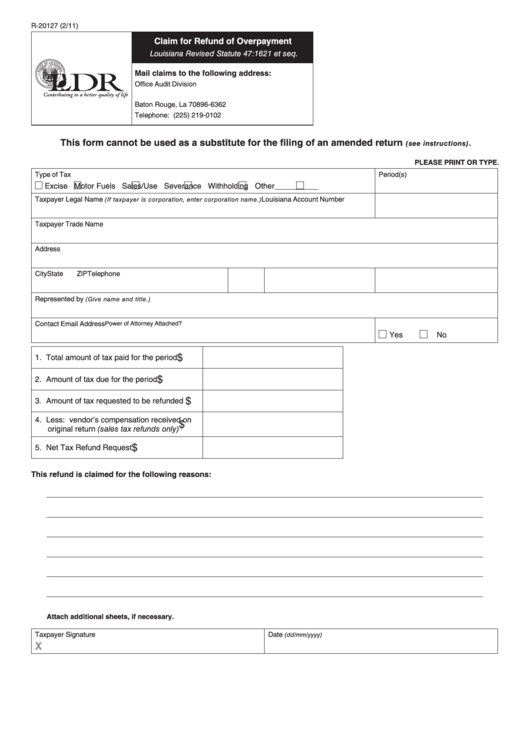

Fillable Form R20127 Claim For Refund Of Overpayment printable pdf

Employers do not have to match the federal tax, but must on social security and medicare tax. Stop and start dates for underpayment interest Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web the claim process is used to request a refund or abatement of the overpayment. Web about form 941, employer's quarterly federal tax.

2019 Form 941 Instructions Fill Out and Sign Printable PDF Template

Web the claim process is used to request a refund or abatement of the overpayment. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. It then explains how to check form 941 refund status. Web if employer f does not request an advance payment of the credit, it may request that the $1,000 overpayment be credited.

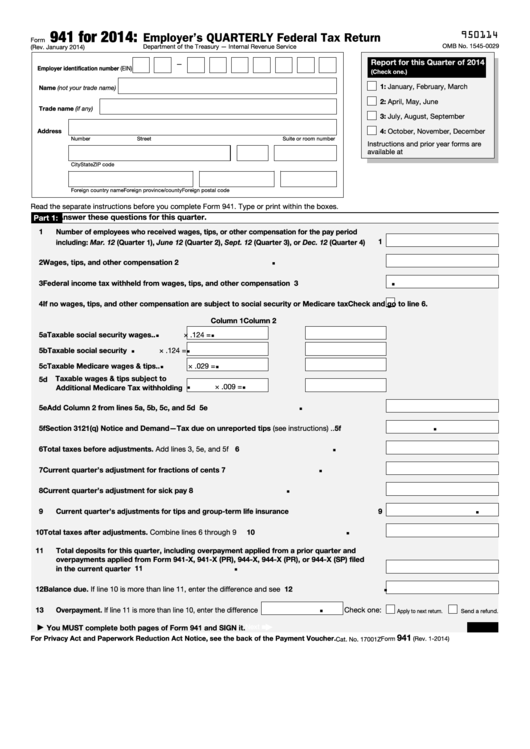

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments Web generally you can take this as a payment on the next quarter (3q) as long as you don't have any previous underpayments that exist on your 941 account. Web the claim process is used to request a refund or abatement of the overpayment. Web.

Solved Required Complete Form 941 for Prevosti Farms and

Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need to know who overpaid to determine who gets refund, employee or employer. A refund for anything should always be posted to same account where expense was originally posted. It then explains how to check form 941 refund status. If you feel uncomfortable.

Fill Free fillable Form 941 Employer’s Federal Tax Return PDF form

Pay the employer's portion of social security or medicare tax. Most likely was employer if refund check came to company. We charge interest when a taxpayer has an unpaid liability comprised of tax, penalties, additions to tax, or interest. Web generally you can take this as a payment on the next quarter (3q) as long as you don't have any.

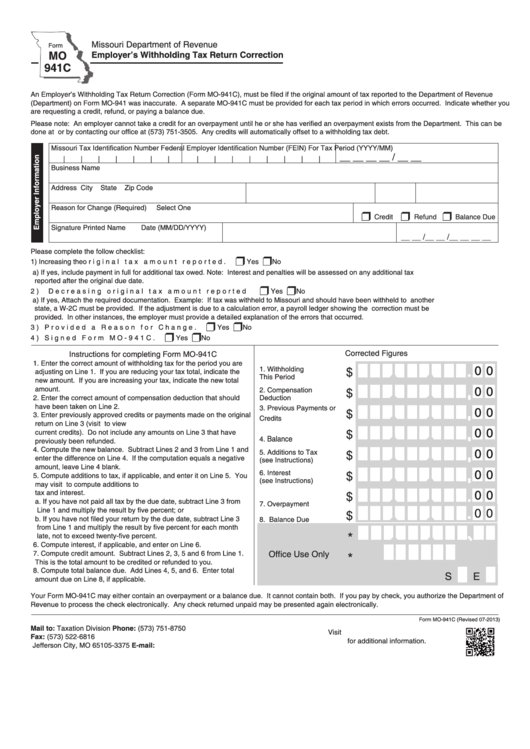

Fillable Form Mo 941c Employers Withholding Tax Return Correction

Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments It then explains how to check form 941 refund status. Employers do not have to match the federal tax, but must on social security and medicare tax. Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need.

IRS Notice CP42 Form 1040 Overpayment H&R Block

Web laws and regulations when does the irs charge interest? We have qb payroll, so i don't know what is going on, since i pay per the qb. Employers do not have to match the federal tax, but must on social security and medicare tax. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Pay the.

941 X Form Fill Out and Sign Printable PDF Template signNow

We charge interest when a taxpayer has an unpaid liability comprised of tax, penalties, additions to tax, or interest. Web what to do if you overpay 941 taxes: Web laws and regulations when does the irs charge interest? Most likely was employer if refund check came to company. Web the claim process is used to request a refund or abatement.

Download 2013 Form 941 for Free Page 2 FormTemplate

Most likely was employer if refund check came to company. Web the claim process is used to request a refund or abatement of the overpayment. Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need to know.

Pay The Employer's Portion Of Social Security Or Medicare Tax.

Stop and start dates for underpayment interest Web what to do if you overpay 941 taxes: Web about form 941, employer's quarterly federal tax return employers use form 941 to: We have qb payroll, so i don't know what is going on, since i pay per the qb.

Web Laws And Regulations When Does The Irs Charge Interest?

It then explains how to check form 941 refund status. If you feel uncomfortable applying it to the july deposit required to be made by 8/15/17, you can call the irs and ask them to apply the overpayment to 3q2017 for you. Web if employer f does not request an advance payment of the credit, it may request that the $1,000 overpayment be credited or refunded when it files its second quarter form 941, employer's quarterly federal tax return. Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need to know who overpaid to determine who gets refund, employee or employer.

Report Income Taxes, Social Security Tax, Or Medicare Tax Withheld From Employee's Paychecks.

Web generally you can take this as a payment on the next quarter (3q) as long as you don't have any previous underpayments that exist on your 941 account. Most likely was employer if refund check came to company. A refund for anything should always be posted to same account where expense was originally posted. Web the claim process is used to request a refund or abatement of the overpayment.

Employers Do Not Have To Match The Federal Tax, But Must On Social Security And Medicare Tax.

Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments We charge interest when a taxpayer has an unpaid liability comprised of tax, penalties, additions to tax, or interest.